How easy is it to start saving money? There are two answers to this based on my experience.

First of all, if you're not used to saving or haven't fully developed a habit of saving, then saving would seem like some elaborate, hard-to-understand activity.

However, with access to useful and relevant information, saving can be the easiest thing you do for your finances. And it can be fun too!

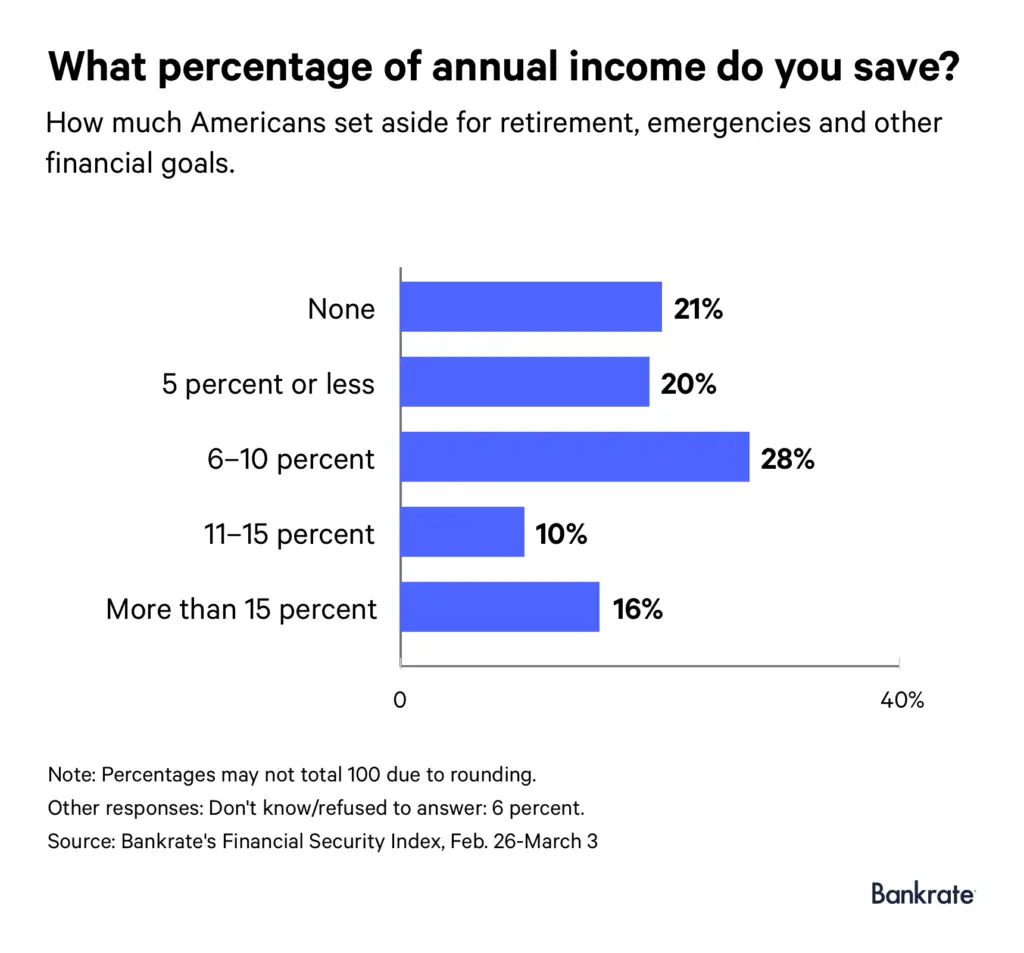

Americans aren't saving as much as they should, and 21% of Americans aren't even saving at all. The reason for this ranges from huge student loan debt, the lack of wage growth, and the increased cost of essentials.

I would also like to think that many just don't know how to. So…

Here are the 9 Simple Steps to Start Saving Money Every Month:

1. Create a Budget

It's not surprising that this is the first step on the list to help you save money every month. If you've been following my blog from the beginning, I always emphasize the importance of sticking to a budget. It doesn't have to be excessively detailed or time-consuming.

Your budget just needs to map out a plan for your money. Your budget should show your total monthly income, your monthly expenses, both fixed and variable, and what's leftover.

Here's what you do:

‣ Calculate your monthly income

Get all your pay stubs and documents for all other income sources and use them to calculate your total monthly income. Your estimated monthly income should be your take-home pay after all taxes, and other deductions have been accounted for.

‣ Identify all monthly expenses

Use receipts, bank statements, past bills, and invoices to estimate how much spending you do monthly. There's an easier way to do this without doing everything manually.

Budgeting apps like Clarity Money, Truebill, and Trim can import all transactions associated with linked bank accounts and cards and even help identify forgotten and unwanted subscriptions.

‣ Allocate money to your needs

Your needs include rent/mortgage, utility bills (excluding phone and internet), food, and transportation (gas, car payment, or public transport).

Don't panic. I'm not saying these are the only things you need in life; they're just the bare minimum essential to your survival. We want to make sure that your basic needs are taken care of regardless of what happens. Depending on your income level, you can take some burden off significantly when budgeting for these essentials.

‣ Next up are wants, savings, and debts

Ok, so this is where you can be flexible. There are several techniques to budgeting, where you can be as detailed as you want or not. Whatever approach you choose to take, I recommend that you prioritize setting aside money for your savings and debts above your wants.

I'll explain. Every month, you can put aside some money towards your savings, such as a retirement account, emergency fund, high-interest savings account, or other investment accounts. For debt, add extra payments to cover your debt so you can save on interest payments and pay-off debt faster.

“Mosun, but I want to be able to have fun, get nice clothes, and eat out.” By all means, allocate some money to that, after putting some money aside for savings and debt.

Your wants are the most negotiable part of your budget. If you think you don't have enough money left for your wants, you have to look for other means to cover those costs, like cutting expenses, taking up a side hustle, a freelance job, or doing short tasks for quick money.

Learn More:

How to Budget and Save Money to Transform your Finances

Household Budget Worksheet- 7 Realistic, Simple, Easy Ways To Budget

2. Track and Record Your Expenses

I know this is kind of implied under the create a budget section, but it deserves its own bullet. There's something about consciously seeing how much you're spending on different items that just makes you want to be conscious about your spending.

Let's use my favorite example – coffee, one of America's favorite breakfast beverages. It's easy to buy a $4 cup of coffee here and there, and if you're the Cappuccino/Frappuccino type, you're spending almost $6 on a cup of coffee. Moreso because it's a prevalent habit to grab one on your way to work without even thinking much of it.

However, a poll by Amerisleep found that millennials (age group of 25-34) spend a shocking $2,008 on coffee per year, and the age group of 35-44 spend $1,420 on coffee per year. Surprised? Well, small costs also add up.

By recording and tracking your expenses regularly, you can quickly catch areas where you might be overspending every month and start saving money on such costs.

Don't just look at the individual prices; look at the amount you spend on an everyday item over a more extended period, say 6-12 months. That way, you can identify things that are eating into your budget unnecessarily.

3. Cut Spending

It's much easier to reduce your spending when you're tracking your expenses. You're able to see areas in which you can save money monthly easily.

You can also incorporate some money habits and challenges that can help you cut your spendings, such as waiting for 30 days before making a purchase, having a no-spend day, and setting a daily or weekly spending limit.

You can also save a lot on groceries by creating a list before every grocery run or shopping activity, limiting your grocery runs to one day in a week, and using cashback apps to get the best deals on prices.

Learn More:

23 Best Money Saving Apps that Will Fast Track Your Savings

Also, be responsible with your credit cards, do not save your cards online, and do not put more money on a credit card than you can afford to pay off right away, except in very dire circumstances.

Learn More:

How to Build Excellent Credit Score – 9 Proven Ways

4. Budget for Savings

Make it a conscious thing to always include a budget for savings every month. The 50-30-20 rule suggests that you save 20% of your income.

However, depending on your financial situation or personal preference, you can make that percentage higher or lower than 20%. The main idea is to develop the habit of saving deliberately with a plan.

Personally, I calculate all my necessary expenses for the month, allocate a small amount to discretionary and fun spending, and then save the rest.

Sometimes, depending on my expenses that month, I'm able to save and invest more than 45% of my take-home income.

This is a sure way to keep you from living paycheck to paycheck because you always have money saved for emergencies and your future.

5. Create Savings Goals

My mum always says that she likes to give every money a name. That means she likes to say ‘this money is for a new paint job', or ‘that's the carpet money‘. Doing this takes away the vagueness out of handling money.

In the same vein, classifying your savings by goals would help you save better. Make everything you want to do with your money a saving goal and put money towards it every month. It could be for a goal as small as “Christmas gifts for the kids” or as large as “downpayment for a house.”

Whether it's for short-term goals to be achieved with the next few months or years or long-term goals like retirement, always have it written down.

Qapital is a great app to help with this. With Qapital, you can create goals for the short term, which would be kept in a secured FDIC savings account, and also create goals for the long-term, which will be invested in a portfolio that matches your risk and goals,

6. Automate your Savings

Out of sight, out of mind doesn't have to be true when it comes to your savings. Your savings can be out of sight but also very well taken care of. Put your savings on autopilot by setting recurring deposits to a savings account.

Automatically saving money without your knowledge can significantly boost how much you save every month because you don't have to worry about forgetting.

You can automatically deposit large chunks of money or spare change using apps like Qapital, Digit, and Acorns.

7. Start Investing your Savings

Once you've taken care of your emergency fund and saved money for up to 3-6 months of monthly expenses in a high-yield savings account, the next thing is to save in higher-return entities by investing in securities and assets.

While investing always takes on some level of risk, you can stack up a fair amount of savings over time with compound interest.

Let's look at how compound interest works and how a small amount of money can make a huge difference:

| Amount | $100/ Month | $100/Month | $150/Month |

| Annual interest rate | 0% | 7% | 7% |

| Length of time | Ten years | 10 years | 10 years |

| Total Amount Saved | $12,000 | $16,776 | $25,165 |

Saving $100 in a 0% interest savings account for 10 years can make you leave almost $7,000 on the table than if you had invested that same amount in assets that yield a combined 7% return (Average rate of return on the stock market is 10%, not including inflation)

Additionally, adding just $50 more monthly would multiply your savings even more, with an $8400 higher return than a $100 monthly deposit @ 7% interest.

Now, I know how difficult it is to get into investing when you're a beginner, especially because you don't know where to start. That's why I created this guide to help you figure it out.

8. Choose the Right Tools

We've covered a lot so far, and I know you're probably wondering; “is there a way to make all these processes easier”? or you're thinking; “I don't think I can keep up with all these because it seems like a lot of work.” Well, you're going to learn all about that in this section.

Give us the tools, and we will finish the job.

~ Winston Churchill

We're not short of technological innovations today when it comes to keeping up with our finances. FinTech (financial technology) has taken significant strides in the last decade, and there are so many personal finance apps and software to help you control your money.

So, to help you optimize your savings, what tools should you be using?

Let's break it down into 5 main categories and see the tools recommended for each of them:

1. Cost-Cutting Tools

We often believe that product and service prices are set in stone, but there's always room for negotiation, deals, and promotions to be snagged and savings to be made.

Also, keep up with your subscriptions, filter out the ones you don't really need, and save that money every month.

Here are the apps that can do these for you:

- Truebill – Lower your bills, get rid of unwanted subscriptions, get refunds on service outages

Read our full review - Trim – Bill Negotiation, cancel unwanted subscriptions,

Read our full review - Clarity Money – Find and cancel unwanted subscriptions, budget and expense tracking

Read our full review

2. Saving on Expenses Tools

Save money on your regular shopping activities. Whether you're buying groceries, a new TV on Amazon, or getting clothes for the winter, you can get some money back on your expenses.

So yes, while you need to spend on something worthwhile, you also get to save some money on it. Now that's how you shop smart.

Here are the apps that would find you savings, give you cashback, and alert you when there's a price drop on items you want:

- Honey – For cashback from online retailers including Amazon

Read our full review - Wikibuy/Capital One Shopping – For cash back from online shopping and local restaurants

Read our full review - Ibotta – For cash back on groceries, online shopping, in-store shopping, and subscription and delivery

Read our full review

3. Budgeting and Expense Tracking Tools

Like I said, creating and tracking a budget shouldn't make your life more difficult. It's meant to make your life much more comfortable and help you manage your money better.

Now, while some may prefer to stick to pen and paper, it's much easier to use an app to track your expenses and monitor your budget. Many apps will import your transactions from your connected accounts for free and categorize them.

Here are my best picks of budgeting apps:

- Personal Capital – Best for expense tracking and bird's eye view of finances

- Charlie – Best for budgeting help and debt-payoff plans. It also comes with a friendly virtual chat buddy.

- YNAB (You Need a Budget) – Best for in-depth budgeting

4. Investing Tools

I know investing can seem like a daunting task if you've never had any experience with it. However, you can invest very easily and without hassle if you have the right tools.

Some platforms will do the heavy lifting for you and invest in a portfolio that matches your risk tolerance and goals, while others can help you on your journey if you choose to be hands-on with investing.

See my top picks of investing apps below:

- Wealthfront – Robo-advisor with 529 college savings accounts, IRAs, and high-yield savings accounts. Free management of $5,000.

- Betterment – Robo-advisor with IRAs and high-yield savings accounts. Up to 1 year of free management with a qualifying deposit. Access to human financial advisors.

- Fundrise – Best for crowdfunding real estate investing. Offers eREITs and eFUNDS

- M1 Finance – Best for Robo-advisor and brokerage hybrid

5. Saving and Investing Automation Apps

If you want to supercharge your saving and investing process, these apps will be great to start with. You can set rules that trigger your money to be saved and invested based on your spending patterns, lifestyle, and income every month.

If you have had trouble saving in the past, these apps can help you kickstart your savings by accumulating savings passively and without any effort on your part.

- Qapital – Triggers savings with rules; set-and-forget rule, 52-week rule, guilty pleasure rule, round-up rule, and more. It also has a budgeting and investing side to it.

Read our full Qapital review - Acorns – Invest your spare change automatically.

- Digit – Saves money in bits and pieces from your checking account without you feeling the impact.

With access to the right tools, you're on a better path to fast-tracking your savings

9. Keep Learning

Develop a habit of always wanting to improve your financial knowledge. Yes, financial literacy wasn't on the standard school curriculum, but it's on the agenda of real life.

Be willing to seek out the knowledge for yourself to help transform your finances and set you on a path to financial freedom.

Keep reading online materials and resources like The Finance Boost for more tips and hacks on handling your money.

How Much to Save Every Month

Essentially, how much you save every month boils down to your income level and financial goals. You can choose to have an outright amount you want to save or a percentage of your income.

One approach I take to manage my money is to treat my finances like a company's annual financial report. Hold on; it's not that deep. I just mean I take a quarterly review of my money.

Basically, I realized that setting short term goals and tracking my progress periodically works better for me.

See How I Determine How Much to Save Every Month

So, assuming my saving goal for the year is $10,000, that means my quarterly saving amount should be $2500. Basically, every 3 months, I should save $2,500.

Then, I'll break that down further to how much I should save per paycheck. Two paychecks per month mean 6 paychecks per quarter. Eventually, I'll arrive at $417 to save per paycheck or $833 per month.

Here's a table if you like visuals:

| Annual Saving Goal | $10,000 |

| Quarterly Saving Amount | $2500 |

| Monthly Saving Amount | $833 |

| Savings per paycheck | $417 |

I typically use the amount to save per paycheck as a rule of thumb, but I mostly focus on how much I can save per month. This is because my expenses aren't evenly distributed across the month.

My expenses in the first half of the month can outweigh my expenses in the second half. So I make sure to account for that when setting my automatic saving deposits.

I break it down this way so that, at any given time, I can use any of these smaller metrics to check in with my overall goal.

Now, you may be wondering, how do I decide what my saving goal amount should be?

Basically, I start from my monthly expenses and work my way up to how much I can save after my expenses every month.

First, outline all your mandatory expenses, which would include housing, utilities, food, transportation. Also include any recurring bills such as minimum credit card payments, phone bills, cable bills, and such. Mind you, some apps and services such as Trim and Truebill can lower such bills.

Reasons For Saving Money and Why It's Important to Save Money

‣ Emergency Cushion

Saving for emergencies is essential because no one really knows the future, so you want to have some funds ready to go in case you need money for something unexpected.

‣ Peace of Mind and a Sense of Security

We all think about how our money is doing and whether we have enough to take care of any financial responsibilities. It's challenging to always worry about where the funds to take care of all your expenses every month will come from.

Saving money will take some of this anxiety off you and help your sleep better at night

‣ Retirement

For one, I know how vague the term ‘retirement' can be, especially when you're in your 20s and you're being told to plan your financial life for 40+ years down the line. It's mostly because people don't understand what retirement really is and why you should bother about it early.

Retirement is just when you stop actively working for money. So you're saving for either when you're old, don't want to work too much anymore, or when you want to decrease your workload.

And you can retire at whatever age you choose. Just take a look at Grant Sabatier, who retired at 30.

PS: you don't have to retire when you're old. It's just that most people do because they don't have enough money to sustain them for the rest of their lives early enough.

‣ High Average Life Expectancy

There's a high possibility you're going to be around for a really long time because today's average life expectancy is higher than what it used to be 60 years ago.

If you're in your 20s and you feel like you've lived for a really long time, try 50-to 70 more years for you to potentially still be around. So, you want to make sure that your sustenance throughout your lifetime is guaranteed.

‣ Volatility of Social Security

Again this is related closely to today's average life expectancy. The social security program was developed in 1935 and was designed to provide workers or retirees with benefits after age 65.

Well, let's look at what the average life expectancy was at that time. Life expectancy at birth in 1935 was only 60 for men and 64 for women.

According to Statista 2019 report, life expectancy for men is 78 while for women, it's 81. That's about 18 years more than was expected at the inception of social security.

So I understand why many are skeptical of social security being around when they're actually ready to retire; it's also why many people save money.

‣ High Education Costs

Going to school to get education costs so much these days with the average student debt being $40,000.

So yeah, you can save to either cover a full portion of their school costs or some portion of it, so you're not bogged down by huge debt when you're ready for college.

Also, 529 college savings plans allow you to start saving for your kid's college fees before they even set foot in the school system.

‣ To Build Wealth

I'm sure you've heard the phrase: “the rich keep getting richer.” It's because of the ability to grow money and make it multiply.

Saving money so you can invest is very crucial. We covered how compound interest and time can fast track your savings and compound your wealth.

Once you start investing your savings, your saving rate becomes exponential and can help you build huge financial muscle over time.

Wrapping Up – Key Takeaways

Sometimes, lack of information is the main culprit that keeps us from succeeding. Saving money can be as easy for you as you want it to be just by following everything discussed in this guide.

Take charge of your finances by increasing your capacity to save more money every month. Everyone can do it, especially you!

To recap, let's look at the most important things to take away from this piece:

- Create a Budget to map out a plan for your money

- Keep Track of your Expenses to curb bad spending habits

- Cut your spending to create more room in your budget

- Deliberately include “savings” as a line item in your budget

- Break down your savings into specific goals to keep you engaged and committed

- Put your savings on autopilot and make saving a no-brainer

- Invest your savings once you save enough for emergencies

- Use the right tools to help you on your journey and improve your effectiveness

- Never stop learning to keep boosting your finances

And on that note, I hope you've gotten some useful tips to help you save more money every month. Please feel free to leave a comment about how you're saving or ask any questions you may have. I would love to hear from you

Here's to Acing Money!

0 Comments

Trackbacks/Pingbacks