In this fast-paced world we live in, we often “subscribe” to a lot of things. While many of these are necessary expenses that are part of life, the amount you spend in those budget categories can significantly impact your overall financial health.

Moreover, you probably don't even use almost half of them or don't even remember why you initially signed up for some of them, right?

For instance- cable, streaming services, apps, memberships- these are part of your budget that may not cost much on their own but they add up.

Also, it's challenging to keep up with all of these sites and services. Besides, you may be overpaying for these services because you might have missed the promos and lower rates your provider offered at some point during your subscription.

And if you are like the amnesiac blue tang fish, Dory, who forgot all about these little money-eating products/services that are tearing down your finances, you don't have to worry about that anymore.

Thanks to Billshark that can do all the work and help you reduce your monthly bills!

Does this sound good? Or maybe too good? Let's find out in this Billshark Review.

What is Billshark?

Billshark is a service that helps you lower your recurring monthly bills by negotiating it on your behalf. The so-called team of “sharks” or agents will do all the legwork for you. Most importantly, Billshark is on a mission to help consumers manage their money the smart way. It can also help you end contracts for a vast array of popular services.

You register for free through their website or download the app via Android Play or iOs.

Besides, Mark Cuban, a renowned entrepreneur and one of the stars of “Shark Tank,” supports the app. (you may get the idea now how the name of the app is inspired, huh?)

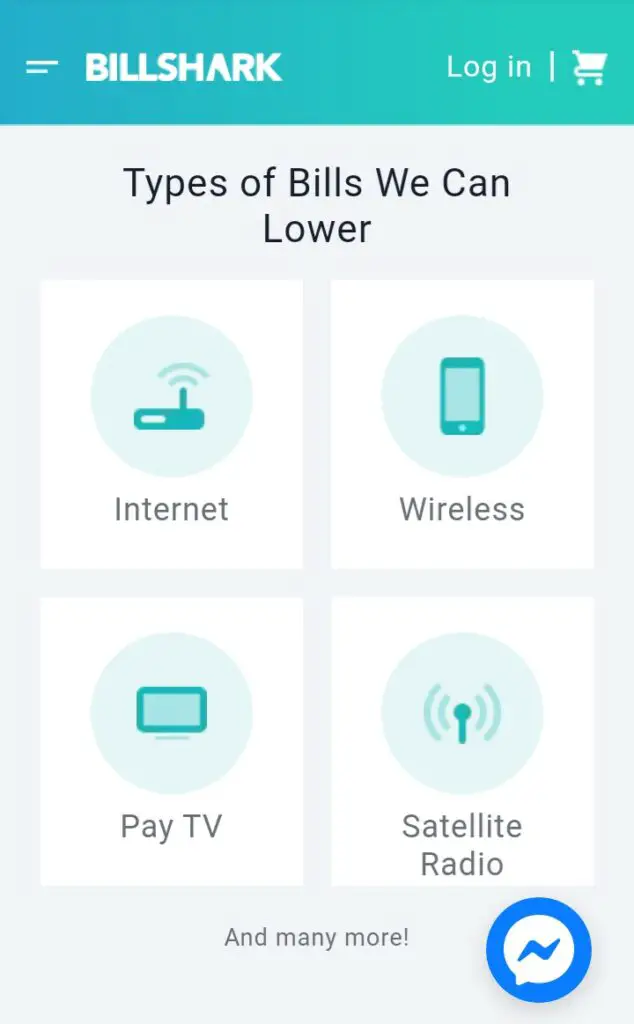

Further, the Billshark app aims to help Americans trying to figure out how to save money on cable, satellite TV, Internet service, home security, and even insurance.

However, despite its strong reputation, you have to know how the Billshark app works so that you can make a rational decision whether money-apps like these would work for you. To clarify, Billshark cuts 40% of the total amount it saved you but, no savings, no fee. (we'll cover more of that later!)

No Bill is safe

Price: FREE

Negotiates to lower monthly bills for individuals and businesses. It charges a 40% fee based on the amount successfully saved. If it can't save you money, you don't pay.

How does Billshark work?

Getting started through Billshark is straightforward. In other words, you can start saving money in less than a minute. Here's how to get started.

- You create an account.

- Select a service you want to negotiate.

- Send in your bills by uploading pictures through the app.

After that, you pay once the Billshark app successfully negotiates a deal for you.

Create your account.

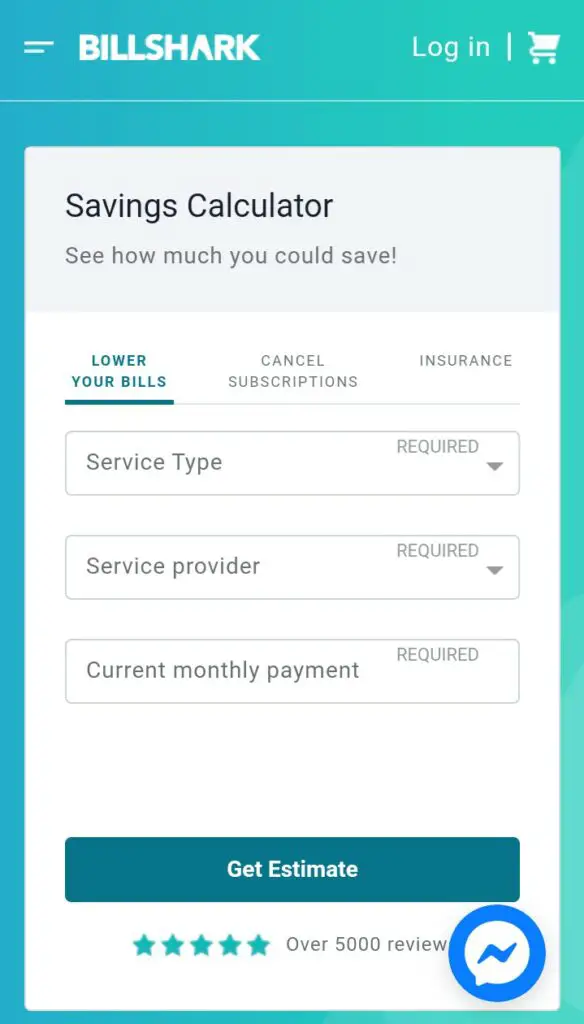

In creating an account, head over to the signup page and enter your email address, phone number, and other required personal information. Similarly, you can use your google account to sign up. Billshark also offers a free savings calculator to know how much you can save using the app, however, the results are just the amount estimated.

Select Bills you want to negotiate.

In selecting which negotiation service you'll use, Billshark offers options that include wireless internet, pay-TV, and satellite radio. Additionally, if you want to cancel multiple bills, you can go back through the process as many times as needed. As a result, you're increasing the chances Billshark can able to save you money.

Upload photos or digital copies of your bills

After that, you have to snap photos or digital copies of your bills, so the “shark” or team of “sharks” (your Billshark representative) will process to negotiate a reduction. Likewise, you can do this via the Android or iPhone app or through Billshark's website.

Consequently, you may need to include additional information about the services you use, such as PINs or passcodes. However, this may cause you to worry about security, but the “sharks” need this type of information to process the request.

Nevertheless, before confirming, make sure to mention any special requirements you have, like if you do not want to extend the contract's length, etc.

Pay Billshark and get your savings.

After a few days, you will receive a call from Billshark informing you of how the negotiation went and whether it could do so. Subsequently, the representative from Billshark will break down precisely the savings, so you got to know what has changed in your bill terms, your new rate, and when the savings will materialize.

Meanwhile, once Billshark had successfully managed to negotiate a lower rate for you, it will send an invoice, which you will have to pay on the due date. Furthermore, there's an option you can choose to arrange or split the payment over six months, but it comes with additional cost.

Features

| Free to Join | YES |

| Fees | 40% of savings on bill negotiations, $9 on each subscription cancellation, and $25 service provider cancellation. |

| Key Features | Bill negotiation, subscription cancellation, insurance rate comparison, service outages, lower business bills, rewards program, speed test, and refer-a-friend program. |

| Platform | Mobile app |

| Notifications | Alerts and notifications via Email and SMS |

| Support via | Email and live chat |

| Success rate | 90% |

| Paid or Premium Plan Features | NO |

| Security | 256-bit bank-level encryption |

Bill Negotiation

Negotiating your bill at a lower rate is where Billshark experts can assist you. You simply upload the information about the accounts you want to get a discount or negotiate for and let Billshark do the job for you. If Billshark is successful, it charges 40% of the amount you save. Otherwise, there's no charge to you.

Subscription Cancellation

The subscription cancellation feature will cost you a flat fee of $9. Moreover, the company says it can cancel around 100 different unwanted subscriptions for you.

Insurance Rate Comparison

Another worth mentioning feature of the Billshark app is its ability to let you compare your insurance provider with others who might offer a better deal. Although it won't help you switch providers, Billshark only provides you with the powerful knowledge that you can save more dollars out there just by checking other better deals. Furthermore, there is no cost to use this insurance comparison tool.

Service outages

Don't you know that you can claim a rebate when your provider didn't have a service? Billshark will contact these providers and help you claim that money for you!

Additional Billshark Features – What more can it do?

Lower Business Bills

Billshark has a nice feature that caters to consumers and individual users, and business owners alike. One is by helping lower business bills that are eating away businesses' revenues. It includes saving on company bills such as phone and internet, payroll, as well as those SaaS subscriptions, and more.

Rewards Program

Billshark reward is a program that gives new customers coupons that they can use. Consequently, it offers up to $100 vouchers, bonuses, and perks like travel and grocery rewards.

Speed Test

The speed of your internet is crucial as the faster your connections, the better your browser can support services like VoIP (voice over IP), video streaming, and gaming. Similarly, Billshark allows its users to check speeds for ISPs such as Comcast, Xfinity, Time Warner Cable, Charter, Sprint, T Mobile, Suddenlink, AT&T, Verizon, CenturyLink, Frontier, DirecTv, Dish, Optimum, MediaCom, and Cox. Besides, the speed test feature is for free!

Refer-a-friend program

Of course, like many other bill reduction apps, Billshark also gives you a $10 Amazon Gift Card every time someone signs up by using your unique referral link while the newly signed up receives a $10 discount on their invoice.

Alternatives to Billshark

Aside from Billshark, you may check out similar apps that offer the same services, such as:

PROS and CONS

The following are the Billshark Review of the strong points and drawbacks the app can offer. Let's dive in.

PROS

- Easy and fast to sign up. It will take less than a minute to get started.

- Risk-free guaranteed as it only charges you if it gets you savings.

- Using Billshark can save you time and the hassle out of making phone calls and negotiating bills yourself.

CONS

- Higher fee (40%) compared to its competitor Trim, which only charges for 33%, and this may eat up your savings.

- The cost will be charged upfront, or you can arrange to split it over six months. In other words, it may take some time before you start seeing the silver lining of your savings.

- Billshark will not allow you to refuse or deny any savings it can find for you. It means that you need to think carefully about which bills you want them to negotiate. Make sure also to include any requirements you have beforehand.

- Only available in the U.S and Canada.

- Bills negotiation does not include insurance, credit card, or utility bills.

Frequently Asked Questions (FAQs)

Who is Billshark for and not for?

As you probably know, Billshark is a tool that will help you save money by lowering your monthly recurring expenses. If you are a busy person and don't have the time to do this by yourself, Billshark will be a good fit. Thus, it takes the hassle out of negotiating bills. It claims to have saved customers up to 25% and, if you spend a lot on bills every month, this could be a significant amount. However, the 40% fee may be shocking and can eat up your savings, so if you have the time and expertise to go through loops of negotiating your bill, then you can do it all by yourself instead.

Is Billshark safe?

Apps like Billshark usually require users to input some personal details, which might pose a security warning to you. But, Billshark, like other money-saving tools, does not store, share, or sell your data and always ask for permission and confirmation for any request its user asked. Also, it uses a payment processing service with the highest level of PCI certification available when taking your payments. Moreover, it uses a 256-bit level, the same encryption level used by most banks. Billshark has a good reputation, having backed up by Mark Cuban (Shark Tank, anyone?)

In case you're wondering, Billshark makes a profit with the fees it collected for any savings they can negotiate. However, if it isn't able to save you money, you don't pay for anything; thus, they get no profit. Additionally, Billshark may negotiate one-year or two-year contracts.

Can I cancel Billshark?

If you think Billshark is not for you, you can always negotiate bills on your own. Additionally, you can shoot an email through their website if you wish to terminate services with them. Besides, they have active customer support direct email and even live chat.

How does Billshark negotiate?

Billshark has a team of experts called “Sharks” who will contact your providers and do all the negotiation ins and outs. These “sharks” will then get you after a few days and explain how the negotiation went and what to expect. It also finds better deals for you through its other features such as an insurance rate checker and rewards program. In doing so, you'll know if you're getting the best deal thus, saving money!

Is Billshark worth it?

The only real way to know is if you give the app a chance. Billshark is a promising app, and it doesn't hurt to try and let it do the job for you. Therefore, if you don't want to go through the stress of negotiation and stuff, it may be worth saving money and sharing it with an app that does all the legwork for you. And, if it does save you money, you're good to go. Many other apps offer the same service for a lower fee; however, this may be a personal decision.

How much money can I save using Billshark?

You can use the app's savings calculator to get an estimated amount. On the other hand, according to Billshark's website, their most massive savings to date is almost $10,000. As a reference, it average between $300-$500 per bill. Most importantly, you should know that every customer and account varies, so until the negotiation has been completed, you'll never know how much you can save.

Final Thoughts

No more than ever, every dollar counts. Therefore, if you need to cut costs and want to give your budget a chance to breathe, Billshark is what you need to shave a few zeroes off your bills every year.

On the other hand, make sure to read the terms before using apps like Billshark carefully. If you have special requirements or additional information needed, include it during your bill enrollment so that Billshark can do its job for you. And, remember, if it doesn't save you money, you don't have to pay for anything.

If security is your concern and the fee is intimidating for you, you better off negotiating your bills on your own. Otherwise, take advantage of services offered by free mobile apps like Billshark.

To sum up, Billshark is a safe and legit app. Indeed, you can save a bit of money and can rest assured that you're not overpaying anymore.

So, that's it! I hope you learned from this Billshark Review.

How about you? Have you used the Billshark app before? What are your experiences in using the app?

Please share it in the comment section below.

0 Comments