When I first started to get my finances in order too and truly understand the basics, one of my biggest questions was what's the difference between saving and investing?

I hope this answer clears things up for you. Saving often involves you stashing up some money gradually and keeping it typically in a bank account. Whereas investing involves using your money to buy assets likely to increase in value to get a more significant return.

Another key difference between the two is the risk of losing money. With saving, your money is safe and guaranteed by a bank with little to no risk of losing it. However, with investing, the safety of your money is largely dependent on the value of the assets it's tied to.

Let's go into more detail on what each of these involves.

How is Saving Similar to Investing?

While “saving” and “investing” means different things technically, they both share a similar primary goal, which is to accumulate money. It's why people use both words interchangeably sometimes. So if your goal is to accumulate money, both saving and investing can get you there, however, investing does this faster (more on that later in this post).

To save or to invest, you will need an account from a financial institution most of the time. I can't say all of the time because some might consider keeping their money under the mattress saving too! Lol, I hope that's not you. Though the type of financial institution to use for saving is different from one for investing.

Also, people usually save or invest their money to use later. In the case of saving, you may need the money for a new car, the latest iPhone (or android, if that's more your speed), or a ton of other things. While the money that you invest could be for your retirement, wealth for your kids, or even college. Either way, the practice of saving or investing is always to have that money to use in the future.

Related Post: Questions about Saving money? Here are all the answers you need

More Key differences between Saving and Investing

To help you really understand how saving and investing are different, let's use our favorite tool from elementary school: Tables!

| Differing Factors | Saving | Investing |

|---|---|---|

| Financial Institution | Bank | Brokerage |

| Time Frame | Best for less than 5 years | long-term, more than 5 years |

| Risk | None. There's FDIC insurance by the bank | The level of risk depends on investment. it's possible to lose your capital |

| Types of Products | Savings accounts, Fixed deposits, CDs | Stock, ETFs, index funds |

| Skill Required | None. Very easy to save in an account | High skill level required |

| Return | Typically low depending on the bank's interest rate | There's a higher return potential |

| Access to Funds | Within minutes to a few days | It can take a few more days to get access to your funds |

When should you invest vs. save? How to decide?

Now, the next thing you may wonder as I did is when you should save vs. invest and vice versa. The short answer is based on time and when you'll need the money.

If you want to put some money away for future use, deciding between investing the money or saving it would depend largely on when you expect to use the money. For a goal that's less than five years away, you should save money. But if your goal for the money is more than five years away, it's best to invest it.

The main reason for this is the risk that comes with investing. The majority of investments are done through the stock market. The risk is that the stock market fluctuates a lot in the short term, but it has often increased overall in value over long periods.

So if you're saving for a car that you would like to buy within the next year, you can see why investing the money is an unnecessary risk to take. If the stock market is having a bad time when you're ready to use your money, you may have to sell your investment at a loss or wait longer than you planned to buy your car.

Related: Investing For Beginners With Little Money- 13 Easy Ways To Invest

Which is better? Saving or Investing?

So which one of the two is better? The short answer is “it depends”.

Well, we've already established that saving or investing will help you accumulate money and there are some key differences between the two. But deciding which is better will only be possible with the right context.

Going back to the point that the time you need the money compared to the risk would strongly influence whether it's better to save the money or invest it.

You can either focus on saving money, investing your money, or doing both at the same time.

However, that doesn't mean that you should strictly save your money for 30 years straight in a bank. That's just wrong. Mostly because you're actually losing out on growing your money substantially.

Just look at the example below to understand better.

Saving Vs. Investing Scenario

Assume I'm 25 years old and I want to put away $500 monthly towards my retirement. Automatically, it means I'm not planning to spend this money in the next 10, 20, or maybe even 30 years. Let's look at what saving this money would do first, then I would show what investing the money would do as well.

Saving for 30 years:

$500 per month in a year is $6000 per year

To be fair, I'm going to assume this money is put into a high yields savings account that returns 1.5% in interest. So over 30 years, saving $500 per month in a high-interest savings account will be $227, 557.

That's pretty decent, right? Well, let's see what investing the money would do.

Investing:

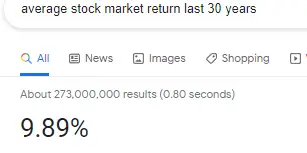

I'm going to use the average return of the stock market at 9.89%

I'm going to use $500 monthly to buy an investment that tracks the S&P 500 per month into an investment account. At 9.89%, after 30 years, that account will have $1,018,177.12

Whew! that's almost 5 times what a savings account would give you. In this case, investing is definitely better.

It's clear both saving and investing each has their role to play. If you need the money you're saving within the next 5 years, it's probably not worth the risk of potentially losing a big chunk of your money. So if you're putting away money for a short-term goal, saving is the better option.

So, neither is explicitly better than the other instead, they are both necessary and play separate roles to build wealth.

Summary

Hopefully, the difference between saving and investing is much clearer to you. The easiest way to think about it is around the risk and return of the two. With saving, you're hardly risking anything for very little return on your money, while investing comes with a risk of losing some or all of your capital for the potential of much higher returns.

I'm sure you know someone else that has these same questions. So be kind and share this post with them too!

0 Comments