Money investing for beginners- here are all the most common and comprehensive questions that we will answer for you, plus tips and tricks and advice in getting started to investing.

When you hear the word “invest,” what comes into mind?

Do you picture a group of people wearing suits, busy working on their desks with their computer screens filled with lines, graphs, and charts?

Mine was close to The Wolf of Wall Street. However, money investing is not just limited to computer screens and financial geeks.

Due to technological advancement, investing is made more accessible. You can start to invest with little money and even own fractional shares in a company.

Plus, you don't have to manually call your broker and ask to buy that stock for you and issue you a stock buy certificate.

Now, you can invest in the comfort of your home using your mobile devices.

It can feel intimidating at first, especially when you’re a novice starting your journey to taking charge of your finances. There seems to be a mountain of financial terms you must be familiar with, resources to check out, key points to remember, etc.

Hence, money investing for beginners can feel confusing, but when you know which investments to focus on, the process becomes more accessible.

In this post, let's talk about money investing for beginners, and let's get back to basics. We will try to explain each point in the most simple terms so you, as a newbie investor, will not get overwhelmed by waves of information shared here.

Without further ado, let’s get it on!

What is investing?

Don't let anybody fool you; investing is ridiculously easy. If you want it to be.

Investing means spending money on a venture with the expectation of profit.

So what’s all the fuss?

Unfortunately, there are two misconceptions:

- People confuse investing with trading, where you stare at four screens all day and are ready to hit BUY or SELL instantly.

- Thinking investing is a get-rich-quick path where you pick a few winning stocks and flip $100 to $10,000 in two months.

In other words, investing is where you park your money to grow and yield it.

Why should you invest?

Unfortunately, keeping your money in a savings account will lose its value over time. It is because inflation will suck your money.

Hence, you should invest your money to beat inflation.

Moreover, investing is a way for you to grow and make more of your money. You can then use it to fund your dream house, plan for your retirement, or use for your child’s education. Finally, investing long-term takes advantage of compound interest, which is a way to get the most out of your money's growth. As you save, the returns that you get pile up over the years.

Therefore, investing will help you achieve your financial goals in life and gain sustainable wealth.

How to start investing?

Before you throw yourself to the wolves, you must consider these first.

Well, first of all, when you start young, time is your best friend. So if you start investing as early as possible and you're ready, here's how to get it right from the beginning.

1. Create a budget for it.

Yes, it would help if you had a plan for investing. Furthermore, you must know how much you can afford? $20/month or $200/month? You must also set up your budget for investments. It helps you stay consistent and makes sure you're not spending your rent money on investments (that is a big NO!)

2. Secure your emergency fund.

More importantly, do not put your money into investments when you have 0 stashes of cash to fall back on if an unexpected expense comes up; you know life happens. It is because investments are typically volatile with various levels of risk. So they need time to stay in the market.

3. Pay off high-interest debt and avoid bad debts.

Interest works the same way on investment and debts. For example, paying off a debt with 18% interest yields more than investing with 8% returns. So if you've got high-interest debts like credit cards, the best thing to do financially is to pay those off first before investing your dollar elsewhere.

4. Get free money from your employer (401)k.

Does your employer offer a 401k plan with a match? Take that first! Here’s how it works. Company A says, “If you participate, I will match your contributions by 50% up to 4% of your salary.”

Now, if your salary is $50,000 and your contribution is $2,000, with your employer's contribution amounting to $1,000, you will get free $1,000 from your employer. Aside from that, these contributions are pre-tax, so who leaves free money on the table?

5. Start from your comfort zone.

With investing, it’s best to start from what you know and what you’re comfortable with. So think investing in:

- Yourself

- With spare change

- In building your network

- Companies that you love

- In a fraction of Apple stock over the latest Iphone

Investing is not just lines, chars, and markets. It’s whatever brings you value tomorrow and generates cash flow for you.

Therefore, investing doesn’t have to be complicated to be effective. Ignore the hype! Sometimes, the hardest thing to do is to JUST START. So let’s make STARTING INVESTING easier!

How much to invest?

This question is a matter of personal decision. However, there’s no defining point for it. It is one of the most common questions many beginner investors would most likely ask and often worry about. But you can invest as much as $1 or even $50 to get started officially. It has been made possible by fractional shares of stocks (more on this later)

Moreover, there’s no precisely written or set rule as to how much money investing for beginners. The truth is, you must invest as early and as much as you can.

For sure, there are many golden rules to investing or investing calculators you more likely have heard about or encountered, telling you this is the amount you should invest bah blah blah. However, it may or may not work for you.

Like budgeting for saving, you must also set aside a budget for investing. Therefore, your budget will tell you how much money to invest. So, it depends on how comfortable you are with the amount willing to commit to investing and would more likely not be used in the next five to ten years (disposable income)

Lastly, we suggest that after you account for your budget- taking away savings, essential expenses, etc., make it a habit to set aside money for your investments. For instance, $50 or $150 will do.

But if you can’t do that, remember that the most important thing is to get started right now and build the habit of putting that money in any investment vehicle every month, no matter what.

Whether it’s $250 a month or 25 bucks, once you build that habit, then you can worry about whether you’re investing enough to meet your goals and make adjustments from there.

Getting ready to invest

Before I officially throw you into the lion’s den, let’s finalize your preparation for money investing for beginners. Then, let me share some insights and investing starter packs you should tick off your checklist.

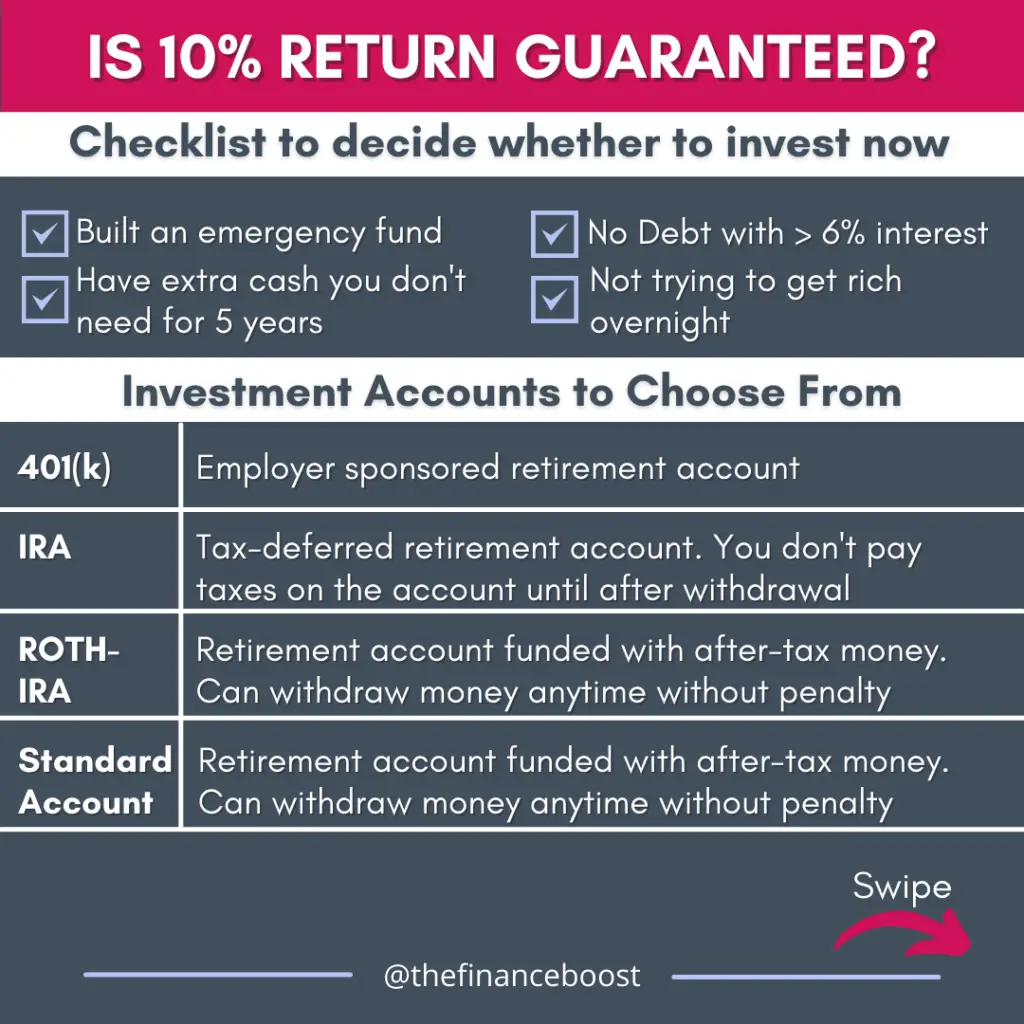

Make sure you meet the criteria on the checklist by having an emergency fund, and having proper debt management first. Choose the type of investment account you want to open. 401ks are typically provided by your employer but you can open any of the other three yourself.

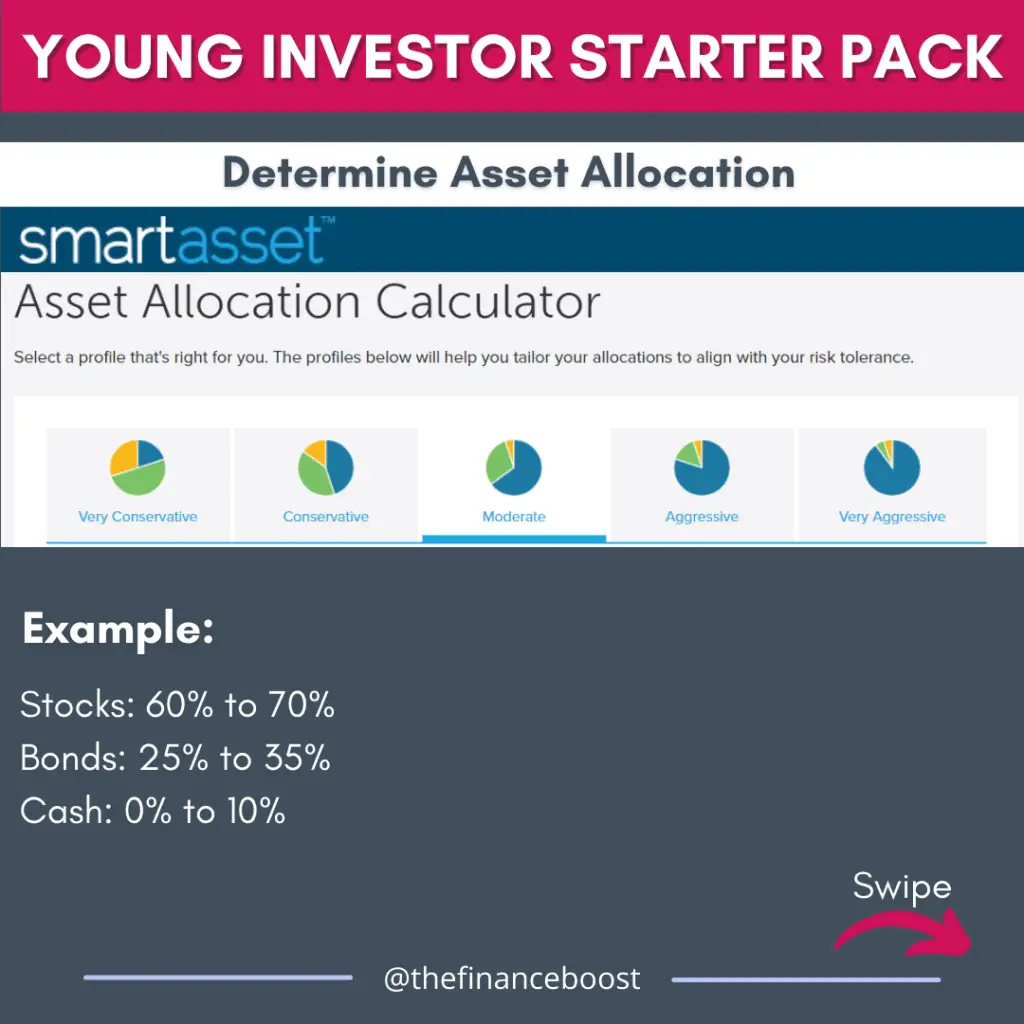

Determine how you want to distribute your investment. 80% stocks? 90% stocks? 5% crypto? It's up to you based on your risk appetite and time horizon.

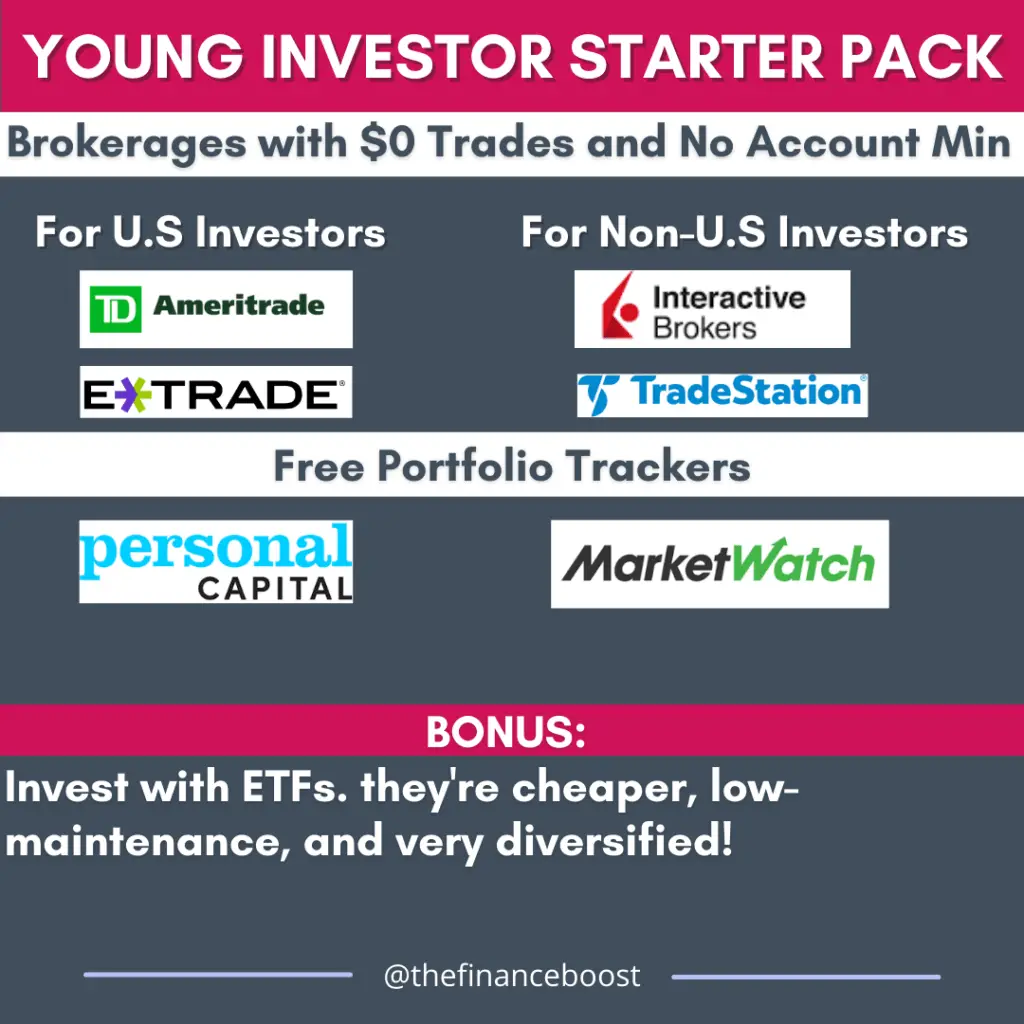

Lastly, use a no-fee brokerage for your account.

Money investing for beginners: Active vs. Passive Investing Approach.

If you’re an active investor (direct investing), you are more likely hands-on to your investment portfolio, doing all the buying and selling, managing, rebalancing, and can dedicate time to research and study. You are close to becoming a “trader” who is more concerned about the short highs and dips of every stock movement and benefits from there.

| PROS: | With the right skill, one can take advantage of the high gains and can quickly exit if risks increase in a specific sector or stock. |

| CONS: | High-fees, less tax efficient. |

On the other hand, if you're more on the fundamental and value side, you are a passive investor (indirect investing).

It is because you have a more long-term investment horizon, buy and hold stocks, and don't constantly check nor care about every volatile stock movement.

Furthermore, you are also a passive investor if you have a trust fund manager who works on your behalf.

| PROS: | Lower fees so cost-effective, buy and hold strategy leads to potential high returns in the long term. |

| CONS: | May get trapped when the market declines. |

Therefore, decide whether you will become an active or a passive investor.

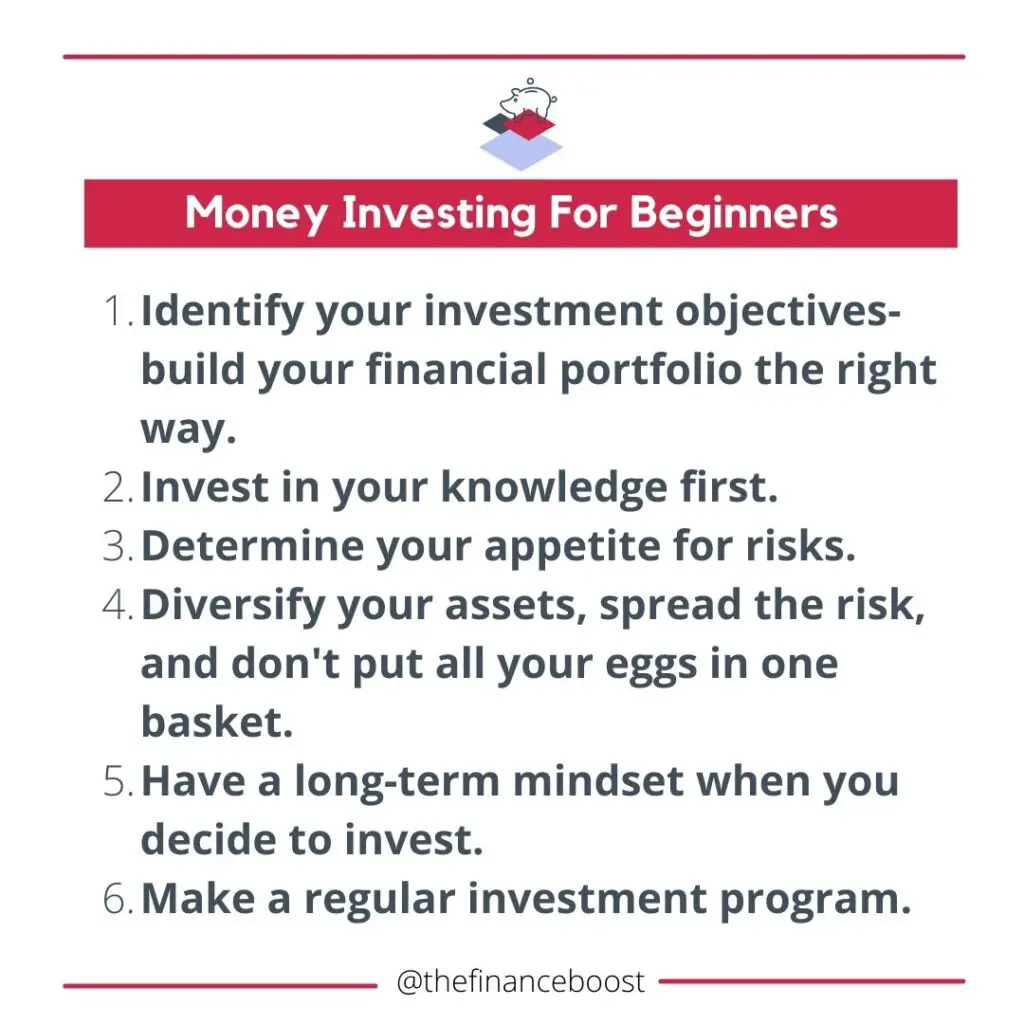

Aside from that, you must also identify your investment objectives and determine your appetite for risks.

Every asset has its risks; so you must gauge how much money you are willing to lose if you invest. For instance, here are general classifications:

| Aggressive Investor | High risk, high gain. Invests in single assets like 100% equities or stocks. |

| Conservative Investor | Low risk, low gain. Go to 100% single asset, e.g., bonds have a low return on investment but are guaranteed. |

| Balanced | If you want others to manage it, you can do a mix of bonds and stocks. |

| Multi-Asset | Investing portfolio with a combination of bonds, stocks, and other assets. |

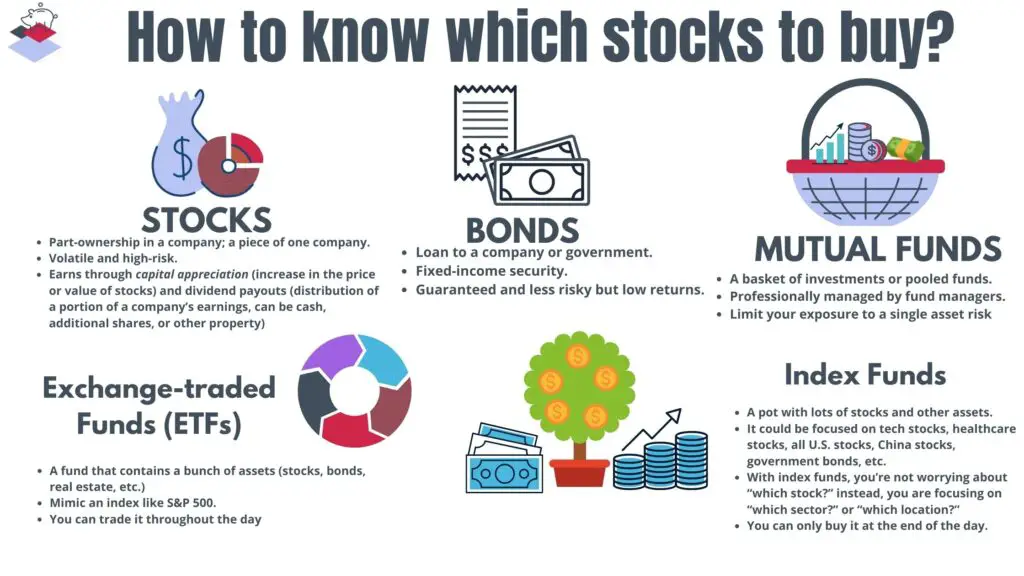

Types of asset investment

Where to buy stocks?

Now that you know various asset types and investment vehicles to park your money on, the next question is where to buy those stocks?

Which is the best online platform for money investing for beginners?

There are bunches of investing platforms out there; however, they work pretty much all the same.

Here are three points you should consider:

1. No fees

Look for brokerage or any investing site that won’t charge you to buy or sell stocks. Fortunately, many investing platforms and apps are fee-free and charge 0% commission for buying and selling transactions.

For U.S Investors– Ameritrade, ETrade,

For Non-U.S Investors– Interactive Brokers, TradeStation

2. Fractional shares

It means that you can invest any amount of money in stock regardless of the stock price. So, for example, you can invest $50 in shares of Google instead of buying a total allocation of $3,000.

Essentially, fractional shares of stocks will split it up, and you will only get $50 worth of it.

3. Investor Knowledge

Seek an investing site that offers free tools and research that you need for money investing for beginners. Moreover, investing doesn’t have to be complicated, and you are free to open many investing accounts for your different investing goals.

How to start a portfolio?

So you now have the money to invest, you have an idea of the stocks and funds you want to buy, plus investing sites, you will use. The next question is how to start an investment portfolio?

There are two defining points: To buy them all at once or invest everything in one stock every month.

The principle of diversification comes into play here. As mentioned, every asset has a certain degree of risk. What’s good is that you are free to customize and set your portfolio in a DIY or do-it-yourself fashion or let an app do it for you.

When building your investing portfolio, take in your goals and investing timeline horizon. What do you want to see in your portfolio? Will it be long-term-oriented?

How many stocks do you want to own and other types of investments?

Remember that there is also a danger in owning a few stocks, so don’t put all your eggs in one basket. Diversify and Balance!

You can split your first month or deposit across your entire portfolio of 10-15 stocks and funds. Then, invest across at least 5-10 of these or a handful of new stocks each month.

For instance, with a six-stocks portfolio, you’ve got 17% of your money in each. If two of those stocks fall by a third (33%), then your wealth just took an 11% hit, and that is if all the other stocks are holding steady.

But let’s say you started your portfolio with 15 stocks, each only accounts for 7% of the total. So if the same two stocks drop (33%), it only sets you back 4% total, which is hurt but something you can recover from.

Hence, fractional shares and rebalancing come in handy.

How to buy a stock?

The process of buying a stock is surprisingly easy and almost identical to any online brokerage out there.

First, you go to your online brokerage website—next, log in your credentials. Then start quoting stocks. Once you pick a specific stock, you may see the bid price and the ask price.

The bid price of the shares is the highest price an investor in the market is offering to buy the stock. While the asking price is the lowest, investors are willing to sell their shares in the market.

Furthermore, the bid and ask price is valuable for traders, especially if they do options trading, while for investors, it will only be a few price differences.

So once you settle, you can now place orders. Click buy if you will buy shares, then input the quantity or how many shares you want. If you’re buying fractional shares, you will input the dollar amount- how much you want to invest instead of picking the number of shares you want.

Most investing platforms will automatically display the cost of trades, including vat or charges (if any), then it will display a notification stating you have now successfully bought x shares.

How many stocks to own?

This question is probably one of the most common that money investing for beginners and even seasoned investors encounter.

Moreover, you most likely get all these great investing tips and ideas of how easy to build a portfolio of hundreds of stocks. You just keep investing and so on.

However, you really don’t need to. Research shows that once you get to 20 or 30 stocks in your portfolio, your overall return starts to look like the average market return because you’re so well-diversified- getting a little bit of everything in your portfolio.

Hence having only 3-5 funds gives you all the diversification you need in those asset classes, then you can pick 10-15 stocks of companies you like or support.

This strategy spreads your risks around those funds that will give you the market return, but since you've got a little bit more in those small handfuls of stocks, you get the opportunity for higher returns.

Therefore just 10 or 15 stocks are good enough to propel your investing journey- especially if a few of those take off to the moon.

How to know when to sell?

Eventually, this will be what money investing for beginners have to worry about. When is the right time to sell? If you’re investing every month, when do you take those profits and run?

First and foremost, when you’re investing, set aside your emotions. Don't let it get the best of you. Instead, invest in companies and assets you believe in and invest only an amount you can afford to lose.

The best thing to do is never sell. Well, try to hold those three funds and then the 10-20 stocks that you really like until you retire and start living off your investments.

It’s not as easy as you think because even long-term investors don't hold that long. But eventually, you have to sell, and you must know better when is the perfect time to do so.

Now there are a few reasons that might trigger you to let go of your shares.

Company issue or scandal

If there is no accountability by the management, rethink if it’s still worth it to own shares of that company's stocks. Even though problems are inevitable and even the best companies run into some issues, as an investor, you must know what the companies are doing to resolve their issues and how they step up.

Too much borrowing money

Watch out for companies that are in too much debt. It is not a good company to invest in, significantly if the dividends are cut, and shares plummet. When the debt becomes unsustainable, you better be out early.

No longer valuable

Do your assessment of what stocks should be worth. Then, define your target price and adjust. For example, would you sell once you hit your target price or wait to increase and receive higher returns?

How much money should a beginner invest for the first time?

Depending on your investment budget, you can start with any amount. Know that money investing for beginners has no set limits as to which amount you should begin to or can invest. You can even invest with little or no money at all!

Where should I invest my money as a beginner?

Invest in different asset classes that will generate wealth that can last your existence. However, know your appetite for risks first.

For beginners, we suggest investing your money in knowledge and skills first. Then, once you have acquired enough wisdom, move on to mutual funds as they are professionally managed, bonds, high-yield savings accounts, CDs, 401(k), insurance, or build your business.

Once comfortable, you can jump into stocks, crypto, index funds, or ETFs.

What kind of investment should a beginner have?

As mentioned, depending on the beginners' risks, they could have invested in these best types of investment for money investing for beginners:

- High-yield savings account

- Retirement accounts such as 401(k), IRA, Roth IRA, and Traditional IRA

- Bonds

- Exchange-Traded Funds (ETFs)

- Mutual funds

- Certificate of Deposits (CDs) or Time Deposit Accounts

What should I invest $1000 in?

If money to invest is not an issue, invest the easy way.

You can proceed with an ETF. Essentially, ETF is a fund containing many assets such as stocks, bonds, real estate, etc. ETFs mimic an index like the S&P 500.

An index is just a list of assets, e.g., stocks, that track the collective performance of the assets on the list.

For example, the S&P 500 index tracks the largest 500 U.S. companies. So, if I buy an ETF that mimics the S&P 500, that makes me a shareholder of those 500 companies too!

How do beginners invest in stocks with little money?

Money investing for beginners with little money is never an issue. Through fractional shares, you can now earn a fractional part of a company’s stocks. Then, you can add funds later on.

It takes money to make money, right? With very little money, you can have a stake in thousands of companies and share their profits.

Moreover, one practical tip is this: If you can automate your bills, why not your investments? It’s just as easy. So, invest the easy and right way.

Read more: How to Start Investing Your Money Like a Pro- The beginner's guide

Key Takeaways

Investing isn’t too big of a deal, and everyone should be doing it. It is now even more available and affordable for everyone.

So, stop letting your mind deceive you. There’s too much to lose not to TRY to overcome these obstacles and self-limiting beliefs to investing.

What’s your biggest question about investing?

What’s keeping you unsure, and what are those things that are keeping you from getting started?

Tell us in the comments below.

0 Comments