We all know we should be saving money, but there are common questions relating to money-saving specifics.

The answers to these questions would help you maximize your savings, get yourself on the right track, and help foster better saving habits.

In this post, we'll answer questions about when to start saving money, where to save the money, how much savings you really need, and how investing can boost your savings exponentially as a result of compound interest.

So, let's jump right into it.

When Should I Start Saving Money?

Start now if you haven't already! Technically, the best time to start saving money is as soon as you start earning money. For most people, this is in their 20s after getting a paying job after school.

Saving money as early as possible allows you more time to grow your money. The earlier you start saving, the lesser the amount of money you need to save enough for retirement.

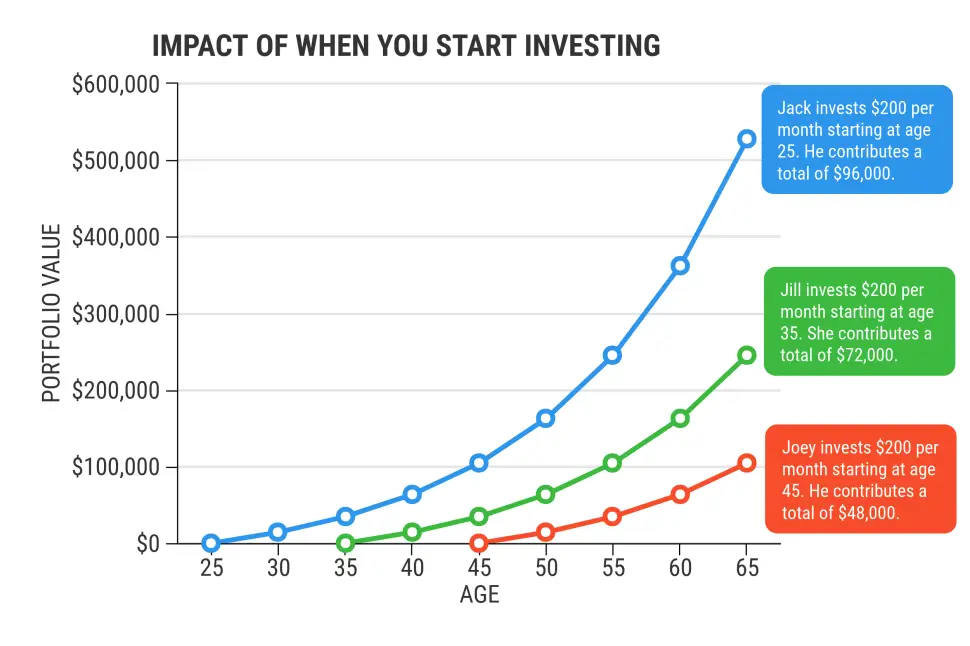

Let's take a quick look:

If you start saving $400 monthly at age 25 with a 7% return, by age $65, you would have saved $1,057,681.07.

However, if you don't start saving till you're 40 and you start saving $1000 with the same return of 7%, by age 65, you would have saved $815,369.65.

So while you're making larger contributions from age 40, you still won't be able to save up as much as someone who started in their 20s with less than half the amount.

That's the beauty of compound interest.

Compound interest allows you to earn, not just on your actual investments but also on the dividends and interests you accumulate on your assets.

It's why your money can grow faster with the more time you give it.

So, no matter how little you're able to put aside to save, go ahead and save it to build a saving habit.

Besides, saving $1 every day will give you $365 at the end of the year in your savings instead of $0.

Recommended Reading:

32 Realistic Ways to Save Money Very Easily Without Giving up Too Much

Where Should I Save My Money?

The answer to this question depends on when you need the money you're saving. In another post, I talk about classifying your savings by specific goals.

So if you're want to save for a downpayment on a house, retirement, travel, education, and such, then those would be separate saving goals.

Where you save your money would depend on the time horizon of your saving goals.

For example, Let's assume you're saving for a house downpayment, and you're going to need the money in the next 1-2 years.

You should save the money in a low-risk account like a high-yield savings account so that it's liquid and readily accessible to you.

Generally, we can breakdown saving options, based on when you need the money, into short-term and long-term savings.

Short-Term Saving Options (0-5years)

| When the money is needed | Saving Options | Risk vs. Return |

|---|---|---|

| less than 2 years | High-Yield Savings account Money market account | Low risk, 0.4% to 0.7% |

| 2-3 years | Short-term bond funds | Moderate risk, 1% to 2% |

| 5 years | Certificate of Deposits (CD) Peer-to-peer lending | Low risk, 0.75% to 1% Moderate risk, 5% or higher |

Long-Term Saving Options ( greater than 5years)

| Saving Options | Risk vs. Return |

|---|---|

| Individual Retirement Account (IRA) | Risk depends on asset allocation, Annual average return is 5% to 8% |

| Employee-Sponsored Retirement Account: 401(K) or 403(b) | Risk depends on asset allocation, Annual average return is 5% to 8% |

| 529 College Savings Plan Account | Risk depends on asset allocation, Annual average return is 5% to 8% |

| Taxable Brokerage Account | Risk depends on asset allocation, Annual average return is 5% to 8% |

Essentially, your goal, time horizon, and risk tolerance all play into where you save your money. For money needed in the short term, it's not advisable to put it into high-risk accounts.

That's because there might not be enough time for your money to recover if a financial downturn should occur.

How Much Money Should I Have in an Emergency Fund?

If you're just starting to save, you should first save $1000 as a primary emergency fund for unexpected expenses.

You should then build your emergency fund to 6 months of living expenses to take care of any unforeseen emergency expenses that might come up.

The idea is that 6 months is enough time for you to bounce back from a job loss, illness, home repair, or any other emergency.

In the meantime, your basic needs (utilities, food, shelter, insurance, transportation) are covered during this period.

You can save more in your emergency fund, up to 9-12 months if you want to err on the side of caution and make sure you're covered for a full year.

But I won't recommend adding more money to your emergency fund anything beyond 1 year or living expenses.

Instead, start putting the rest of your money to work by investing it for higher returns.

How Much is Too Much Savings?

In this context, ‘savings' refers to regular cash, money in a savings account (even high-yield ones). You should invest any amount you save beyond an emergency fund of 6 months of living expenses.

Why? Because the annual inflation rate is about 2% and savings accounts these days return only 0.4% to 0.7%.

That means that $10,000 would only be able to buy $8,959 worth of goods in 5 years.

As such, stashing money without putting it in high-interest yielding assets would cost you money in the long-term.

Look towards investing your money in the financial market, which has a historical average return of 7% after inflation.

See the long-term savings options we talked about earlier to save any money after fully funding your emergency fund.

What is the Difference Between Saving and Investing?

We've used the words saving and investing somewhat interchangeably, but they are fundamentally different.

Saving is putting aside money with the intent to accumulate enough for future use, such as an emergency or a planned expense.

Investing is using your money to grow your income. It's also an accumulation of money for future use, but with the goal of earning interest and returns in exchange for taking on risk.

In practice, saving for the long-term is actually investing. It involves buying stocks, bonds, ETFs, mutual funds, real estate, and other security assets to achieve long-term money goals.

Savings are usually put into low-risk, low return, FDIC insured accounts. They're very liquid and can be accessed at any time. While investments typically carry more risk, especially short-term investments.

If you have money that you're not going to need in the next 3-5 years, it's best to invest it in the financial market with the hope of getting higher returns.

Moreso, because of the risk associated with investing, only invest money you won't need within 2 years.

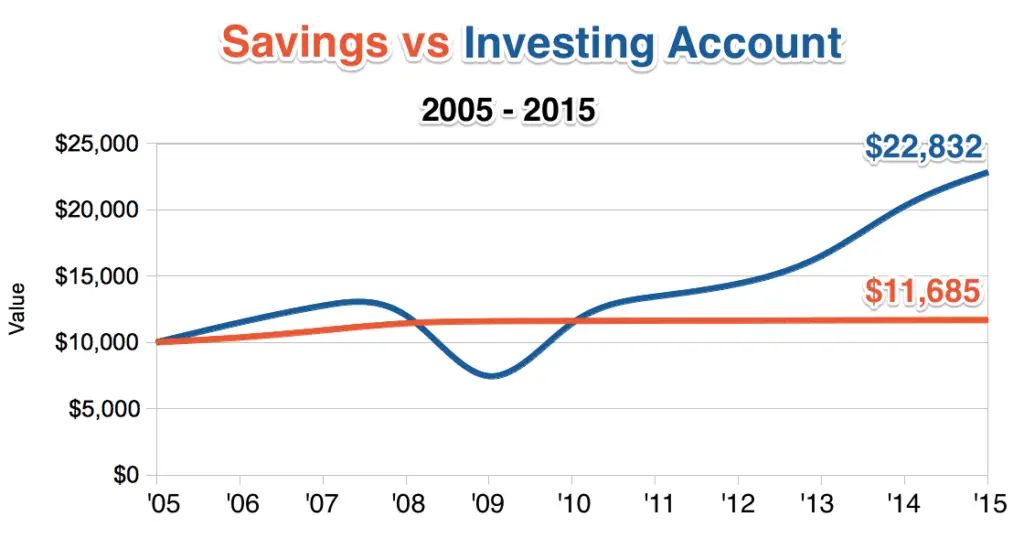

A quick illustration of saving vs. investing $10,000 between 2005 to 2015 shows that a saving account yields $1,685. While an investment account yields $12,832 with a return on investment of 8.56%.

Learn how to start investing your money here: How to Start Investing Your Money Like a Pro – The beginner’s guide

Should I Save or Invest?

It would be best if you did both. For near-term goals, you want your money to be liquid and accessible, so the ideal thing is to save the money.

This can be in high-interest savings accounts, certificate of deposits, or a money market account. By doing this, your money is both insured and protected from the fluctuations and illiquidity of an investment.

However, for money that you're saving for the future, it will do you no good to save it in the accounts mentioned above.

It would be best for you to capitalize on the time and compound interest potential for your money for such long periods.

That money should be invested in high-return assets like stocks, mutual funds, real estate, and such. 401(k)s, Investment Retirement Accounts (IRAs), and brokerage accounts can be used to achieve this.

Moreover, there's a right way to do all this.

To start with, save money towards your emergency fund, which is up to 6 months of living expenses. You want to make sure you can handle an emergency if it comes up.

Then, pay off high-interest debts with over 6% interest. Either tackle the debts in the order of highest interest to the lowest or the order of lowest debt to the largest.

Finally, you can start funding your future by investing in the financial markets and/or real estate.

However, you do not have to wait till you pay off the debt completely to get started with this. We'll cover more on this further in this post.

What is a Certificate of Deposit (CD)?

A certificate of deposit (CD) is a savings account offered by banks and credit unions in which you invest money and cannot access it for an agreed period.

However, this account has a higher interest than a regular savings account.

A CD is a low-risk investment that is FDIC insured up to $250,000. The longer the term of the deposit, the higher the interest received.

For example, let's say you have $10,000 that you would like to invest, but you want a low-risk investment. You apply for a 2-year term CD with a 2% interest rate.

At the end of 2 years, your investment would have matured to $10,404.

While the returns on a CD are low compared to investing in the financial market, CDs are low-risk, low-effort investments you can use for the money you want to grow but would be needed in the short term.

What is a 401(K)?

A 401K is a retirement saving and investment account that is sponsored by an employer. An employer will match your contributions up to a certain percentage of your income.

This account is tax-advantaged, which means that your contributions to the account are pre-tax dollars, saving you a lot of money.

As with other retirement accounts, the funds in it are not to be withdrawn until you're 65 years old. If you take out the money before this time, you'll be subject to huge penalties.

The IRS doesn't tax you for all gains made on your money in your 401(k) until you withdraw your money from the account.

Many employers offer 401(k) plans as part of the employment benefits, and I highly recommend you contribute at least the maximum amount of money your employer would match.

That's free money from your employer that can boost your retirement funds.

What is the Rule of 72?

The rule of 72 applies to investing, and it estimates the number of years it'll take to double your investment at a given annual interest rate.

We've talked about compound interest and how it can grow your money exponentially over time. With the rule of 72, you can know approximately when your investment doubles.

Here's the formula for the rule of 72:

Number of years to double investment = 72/interest rate

For example, if you invest $10,000 at an interest rate of 6%, it will take around 12 years (72/6) for your money to double to about $20,000.

You can use Bankrate's simple savings calculator to try it out and see the difference between the estimate using the rule of 72 and the actual numbers.

The rule of 72 can give you perspective into how your money grows, most especially when you compare investing options.

If I save $10,000 in a regular bank account that yields about 0.1%, it'll take about 720 years to double the money. Whereas, if I save the money in an IRA with cumulative returns of 6%, it'll take 12 years to double it.

That is why there's a point you reach with saving money where your savings can be accelerated by investing instead of leaving it in a bank account.

What is the 30-Day Saving Rule?

The 30-day saving rule is a saving technique to help curb impulsive buying. It involves waiting for 30-days before you purchase something that's not an emergency.

We've all experienced a certain level of buyer's remorse at some point. When you buy something you didn't plan to buy and then later feel guilty for buying it.

With the 30-day saving rule, you're allowing yourself to have more time to really think about the purchase you want to make before going ahead.

So, in essence, you're saving money by delaying a purchase hoping not to feel the need to buy an item anymore after the 30 days are up.

Here's how it works in 5 steps:

- About to make a purchase you don't really need? Pause, rethink, and choose to wait.

- Put the amount that item costs into a separate savings account.

- Make a note of that date and the projected 30-day date from then.

- Put that note somewhere you can see it.

- 30 days are up. Make your decision. Do you still need it? If yes, buy it. If not, the money stays in your savings account.

By denying yourself the instant gratification from buying something you probably don't even need, you're also developing a conscious spending habit that can positively affect your finances.

Learn More:

The 30-Day Savings Rule – Easy Step by Step Guide to Save More Money

Which Money-Saving App is the Best?

There are several money-saving apps for a variety of things. There are apps for saving on shopping, cutting costs, expense tracking, automated saving, and investing.

The best money-saving app has to help you save money effortlessly and also be easy to use.

You should have at least one app for each category in your money-saving toolbox to maximize saving in every area.

Here are the apps I recommend:

- Automated Saving and Investing Apps: Qapital and Acorns

- Budgeting and Expense Tracking: Personal Capital

- Cost-Cutting: Billshark or Truebill

- Saving on expenses: Honey or Capital One Shopping

- Investing: M1 Finance

Check out more money apps and their reviews here.

Should I Save or Pay Off Debt?

Depending on how much room you have in your budget, the ideal thing is to pay off debt and save at the same time.

If you have high-interest debts over 6%, then you want to take action to pay off those debts fast because high-interest debts can do significant damage to your finances.

For example, let's say Jack has a $10,000 debt on a credit card with an APR of 20%. It would be more beneficial for Jack to pay off the 20% interest debt than to save his money in a market that may return 10% at best.

At the same time, you don't want to leave your savings tank on empty just to solely pay-off debt because that's a recipe for disaster. You want to make sure you at least save up for emergencies.

It would also be best if you took advantage of your employer's 401(k) plan, so you're not leaving completely free money on the table. 401(k) essentially doubles your savings with free money from your employer.

So, if you have high-interest debts, fund your emergency fund first, match your employer's contribution to your 401(k), and focus on paying debts first.

But if your debts are low-interest, you can give saving greater weight in your budget while still paying off debt.

More realistically, if there's only room for one of them in your budget, here's how to go about it:

- Only pay the minimum required amount on your debts at first.

- Save towards your emergency fund first.

- Then, create a debt repayment plan.

- Focus on paying off the high-interest debts first because this is better for your finances. However, you may choose to pay off the smallest debts first to gain some quick wins.

- Reevaluate your finances again and see how you can start saving more.

Can Saving Money Make You Rich?

A rich habits research that interviewed 233 millionaires with $3.2million net assets shows that almost half of them got their wealth the same way: living below their means, saving consistently, and investing those savings over time. It's called the “Saver-Investor” path.

So yes, saving and investing money can make you rich. From what we've seen in this post, the earlier you start saving, the faster your path to wealth accumulation.

While you may not get rich instantly by saving $200 a month or $5 a day, you would have accumulated a decent amount of money with compound interest and time.

Now, you may be wondering, “I don't want to wait till I'm old to get rich.” Well, then you need to decide what amount of money you'll consider to be rich and by what age you expect to have that net worth.

Then go ahead to calculate the savings rate you'll need to achieve that. Next, proceed to increase your income by asking for a raise at your current job, acquiring more skills to get a better paying job, getting a side hustle, or starting a business.

To illustrate, let's say I want to be a millionaire by 45, and I have 20 years to go. I will need to save about $2300 a month with a 6% APY return to hit the $1,000,000 mark by age 45. Note that this is purely monthly contributions alone.

Your earning potential can also increase if you acquire income-producing assets such as real estate. So, on your path to becoming wealthy, it starts with you clearly identifying your goals and thinking like the rich

Saving money to get rich isn't going to work in a vacuum except with proper financial planning and a clear path to reach your goals.

Wrapping up

Saving money can seem challenging, especially when you don't know the answers to all your questions. However, saving is actually pretty easy once you have the right systems in place.

There are basically 4 things to keep in mind for proper financial planning and a long-term saving lifestyle:

- Build Your Emergency Fund

- Contribute fully to your 401(k)

- Pay off debts

- Invest your money for your future

Now, there is one final thing that brings all of this together and ensures you stay on track to reach your goals: A Budget. Plan out your entire financial journey with a budget.

Lastly, if you're struggling to make ends meet as it is and are wondering how to find ways to save and get out of living paycheck to paycheck, here are the posts I recommend you read next.

- How to Save More Money Every Month – 9 Simple Steps to Start Saving

- How to Budget Money on Low Income – Top 4 Essentials

- 12 Smart Ways to Pay Off Debt Fast and be Debt Free

- How To Stop Living Paycheck to Paycheck – 10 Realistic Tips

- How to Save $1000 Fast- The ABC of Ultimate Savings Goals

I hope you found this post useful and have gotten most of your questions about saving money answered? If there are any more questions you have about saving money, please leave a comment below.

What questions on this list did you want answers to the most? We would love to hear from you.

Hi Mosun,

What a great article. Simplified a lot of the jargon that I hear in the press and online without being too simplistic. Thanks so much for clearing a lot of things up.

Its clear that a combination of saving and investing is the way forward. I think I’ve missed the boat when you suggest starting at age 20, but its never too late, right?

Thanks and I’ll be signing up for your newsletter to see what your discussing next.

Thanks, Robs. Yes, it’s never too late, just start and be consistent with it.

Thanks for signing up. Feel free to download my free guide on how to get started with investing.

This is a very thorough and comprehensive post on saving money and I fully agree with you that one should start saving money as soon as you start earning money. You can even start saving a percentage of pocket money that you might be getting. The power of compound interest is indeed a great way to grow your savings.

I have bought some ETFs for long term investment and it is already growing nicely. I love your tip on the 30-day savings rule and will implement it.

Thanks for your comment. That’s a good tip to save some of your pocket money, even if you’re not yet earning from a job.

Hello there! This is a really helpful article! It’s only been more recently that I had to think of ways to make or save more money due to a large school debt and for emergencies especially when COVID hit just last year. You provided some really helpful ways to save money. What bank or company would you recommend for a high savings account?

Hi Mike, I’m glad you found the article helpful.

Synchrony Bank currently has 0.55% APY and offers its customers a lot of perks. It also doesn’t require a minimum balance to earn the APY. You can check them out to make sure they meet all your banking needs.