Automation may be one of the greatest innovations in the history of technological developments. It streamlines business processes, reduces redundancy and human errors, and can process transactions in real-time.

Nowadays, several budgeting tools are powered by artificial intelligence (AI) or advanced technology to help its users thrive in terms of their finances.

One of them is Trim, also known as AskTrim. Trim is a financial service that helps you save money up to 30% by canceling unwanted subscriptions, negotiating your bills, automating your credit card payments and savings, and more.

To clarify, Trim is not an app. You cannot find it on Google Play nor in the App store. Instead, to get started, you should directly go to their website.

After signing up, you will begin by communicating with a chatbot through SMS text message or your Facebook messenger.

Therefore, if are you looking for a budgeting tool, assistance to haggle your subscriptions, and want to “trim” down some expenses here and there, read on to learn more from our full Trim review, and let's find out if it will actually “trim” the fat in your budget.

Related:

List of Budgeting Apps

What is Trim?

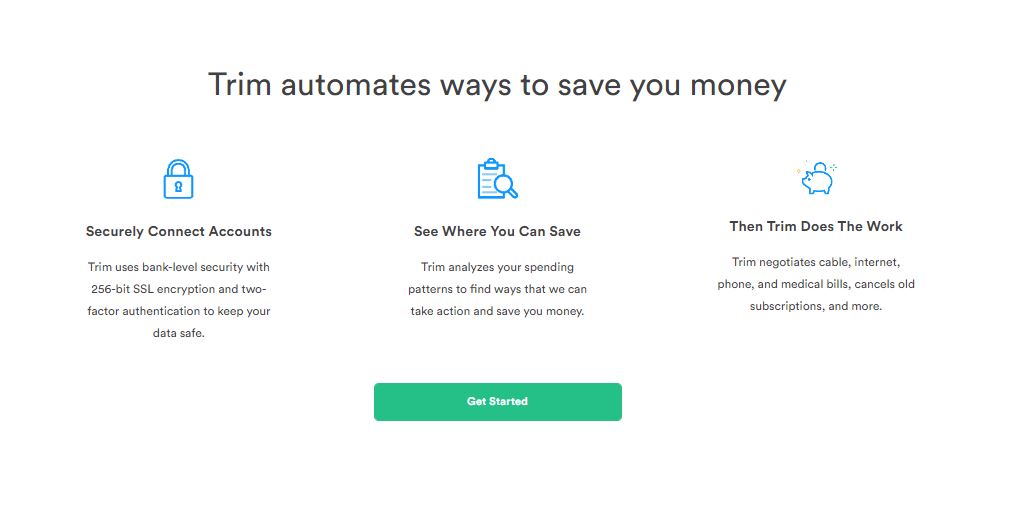

Trim is a financial service backup by AI to identify and manage your recurring subscriptions, find savings with your daily expenses, and even renegotiate your bills to save you money each month.

Before anything else, you might ask, “I can easily do this on my own,”; but mind you, users of this service choose to utilize Trim probably because they don't have the time to negotiate on their own.

Also, they probably don't want to deal with the headache of negotiating with their provider.

Now, isn't that a good deal?

Further, there are free and premium services that Trim offer. Let's see how Trim works.

How does Trim work?

Getting started with Trim is a no brainer. Here's how it works.

1. Sign-up for Trim through its website using your Facebook account, Google account or an email address.

2. Next, link your bank and credit card accounts.

3. Then, Trim will analyze your bank statements and identify any recurring subscriptions that you might not use anymore or have long forgotten.

4. After that, Trim will show you recurring subscriptions, and you can either agree to cancel or decide to keep paying if you still want to keep it.

On the other hand, if you agree to let Trim cancel the subscription, it will automatically do all the work for you.

FYI: Occasionally, Trim will not be able to cancel a contract. In this case, you'll have to end it manually. However, Trim can still be of value to you because it highlights the unnecessary cost that is adding up to your end, and you'll get notified by it.

Moreover, according to Trim, it reports a 70% success rate in lowering customer's bills.

Features

Trim has several features that will potentially help you save money. Some of it is free, while for others, Trim will charge you a commission on any money it successfully saves.

There is also a service called Trim Premium, which costs $99 per year.

| Price | Free to join (some premium features are not, will cover more later) |

| Fees | 33% of the total savings |

| Paid Plans | $99 annually |

| Free (Basic Features) | Subscription Monitoring, Bill Negotiation, Spending, and Budget Tracking |

| Premium (Paid Features) | Bank negotiation, Trim Pay, Medical Bill Negotiation, Simple Savings, Financial Coaching, Partner Offers, Subscription Cancellation, Debt Calculator |

| Alerts and Notifications, Support | Facebook Messenger and SMS, Support via Email |

| Security | Bank-level 256-bit encryption |

Free Basic Features

Subscription Monitoring

One of Trim's core feature is its ability to monitor your subscriptions. All you have to do is link your bank account and let Trim take care of the rest. It then analyzes your statement and finds any recurring subscriptions.

These recurring subscriptions or also known as “gray charges,” are often overlooked. Certainly, it may be an insignificant amount at the time you give in, but it eventually adds up.

It may include membership sites, software, video games, etc. Also, free trial periods you forgot to cancel.

Take note that in this free feature, you are still responsible for canceling your subscriptions. If you like Trim to cancel it on your behalf, you'll have to sign up for Trim Premium.

Additionally, this feature puts all of your recurring subscriptions in one easy-to-read dashboard for you to review and make an informed decision.

Bill Negotiation

Another popular service Trim caters to is where they negotiate lower bills on your behalf. Trim reported that it had saved users over $40M on their cable, internet, and phone bills. That's $250 annually in average savings for each user!

On the other hand, Trim charges you a 33% fee of the annual savings it successfully saves you. In other words, you don't pay anything if Trim doesn't save you anything.

How Trim Bill Negotiation Works?

In four easy steps, this is how Trim Bill Negotiation Works.

- Select your provider

- Send Trim a copy of your bill.

- Trim negotiates your bill with the provider on your behalf.

- You will get notified if Trim can save you money.

Afterwards, you can then select your payment method, and Trim will only charge you if it saves you money.

Typically, Trim charges 33% of the one-year savings (no savings, no payment). And, you pay that upfront.

In other words, if Trim can save you $20 a month, say, on your mobile plan, or $240 over one year, you would pay Trim $79.

If this doesn't sound good to you, remember that you can always negotiate your bills independently.

Spending and Budget Tracking

Lastly, Trim also offers a fundamental budgeting platform to track your spending. Trim helps you identify places to spend less. If you want to improve your budgeting skills or learn how to start from scratch, you may check our articles below.

Learn More:

How to Budget and Save Money to Transform your Finances

How to Budget Money on Low Income.

Trim Premium

You have to pay for the following Trim Premium features since they're not part of the free version. However, you can try the 14-day free trial to assess whether this is something that might work for you. Keep in mind that it will costs you $99 yearly. See our Trim review on its premium features.

Bank negotiation

If you are utilizing your credit cards month after month, it may be hard to keep up with your other bills, plus the interest rate and APR. Trim, will help you lower your bank fees and APRs. What they will do is that someone from Trim's team will call your bank and see if they can find any savings for you.

According to Trim, on average, they save users over $1,100 by bringing down APR and other costs like overdraft fees.

Trim Pay

Want to pay your debt faster? You can now do that with Trim Pay. With this premium feature, you can now automatically set your credit card payment. It is a debt payoff plan service based on your budget.

Firstly, you have to pick which credit card you want to pay off. Secondly, set up an automated weekly bank transfer to your Trim Pay account (this is a savings account). Further, you got to pick a day of the month for the total in your Trim Pay account to transfer to your credit card company.

For now, Trim works with one credit card at a time, and you can withdraw the cash from your Trim Pay account anytime.

Mind you, this is just an additional credit card payment. You are still responsible for making the minimum monthly payments of your credit card debt.

Medical Bill Negotiation

Aside from Trim's free bill negotiation service with the likes of cable, internet, and phone bills, Trim Premium, can handle your medical bills as well. If you think this is something of value to you, you can always upgrade your account to include this feature.

With the medical bill negotiation, Trim will look to install a 0% payment plan on your behalf and even ask for available discounts when possible.

Simple Savings

An additional competitive offer of Trim is its high-yield savings account that will grow you up to 4% on your first $2,000 saved. It is FDIC insured bank account and you can transfer from this fund automatically and start saving right away.

Financial Coaching

Premium users will get unlimited access to Trim's Financial Coaching feature. So, users can ask questions and get 1-on-1 advice from Trim's certified financial advisors/planners. It is worth mentioning since, with the help of this fantastic feature, you can start to get back on track of your financial journey or get useful tips in managing your finance to achieve your financial goals.

Partner Offers

Trim has direct partnerships with more than 15,000 U.S. financial institutions that will give you exclusive deals to help you save even more money.

Subscription Cancellation

Ultimately, Trim will not only help you identify subscriptions, but they will most likely cancel any unwanted subscriptions for you.

Debt Calculator

Once you have successfully linked your account, Trim will help you set up a payoff plan for your current debts. It will enable you to minimize interest, therefore, getting you ahead of your financial goals.

Trim

Trim will help cancel unnecessary subscriptions and negotiate your bills; therefore, saving you money.

Alternatives to Trim (Trim vs. Truebill vs. Billshark)

| Trim | Truebill (see full review) | Billshark (see full review) | |

|---|---|---|---|

| Signing-up | Email or Facebook account, then log in to your bank and credit card accounts. | Email or Facebook, then connect your credit and bank accounts. | Google, or Facebook. Then, start uploading your latest bills. |

| Main Feature | Subscription management and bill savings | Managing bills and subscriptions, the “True Protect” feature | Cost-saving on bills and subscription cancellations |

| Charges | 33% | 40% | 40% |

| Security | Plaid encryption services, two-factor authentication | Bank-level 256 bit SSL encryption security, read-only access data | 256-bit encryption, no third party access. |

| Platform Availability | Personal AI “assistant”; chatbot on SMS and Facebook messenger | iOS and Android mobile | Android and iOS mobile |

All of these three financial assistant programs can help give you a clearer picture of your financial standings. Almost all of them offer the same features, but as you can see, Trim charges only 33% on overall savings, as opposed to Truebill and Billshark's 40%.

Related: Truebill Review

However, the last two are convenient in terms of availability as you can easily access it on a mobile app. At the same time, Trim works as a bot, and you can chat via text messages or Facebook messenger only.

It's just a matter of preference for which of these three apps you think can help you achieve your financial goals.

PROS AND CONS

Trim has a promising potential of keeping down your costly bills, however, there's also a downside to using it. Check out the pros and cons of Trim below.

PROS

- Negotiating bills on your behalf.

- Free to use the basic features.

- Trim won't charge you unless they save you money.

- It helps to track and cancel unwanted subscriptions.

- Able to send you alerts to track your expenses and spending.

CONS

- No mobile app; only works through text or Facebook Messenger, but the website is site-friendly.

- Have to link your credit or debit card, which may cause unease.

- Trim Premium is a paid service.

- You will have to pay 33% of the annual amount it successfully saved for you, but you have to pay this fee upfront in one lump sum; before the actual savings roll out over time.

- You can do everything Trim does on your own if you dedicate time.

FAQs (Frequently Asked Questions)

Is the Trim app safe?

Trim takes its user's security very seriously. For instance, it uses bank-level security with 256-bit SSL encryption, two-factor authentication, and read-only access to ensure its user's sensitive account information is safe.

In addition, Trim also never stores account credentials on their servers.

Does Trim charge a fee?

There is a percentage Trim takes out for lowering your bills. However, the catch is that Trim charges a 33% fee of the annual savings they can attain. Furthermore, you have to pay for it upfront in one lump sum.

Can Trim save money on my other utilities?

No. Trim won't negotiate with public utilities such as your water, power, or gas bill. For reference, the following are the cable companies and internet providers Trim can deal with: AT&T, Comcast, Verizon, Spectrum, and most leading cable TV and internet providers.

How does Trim make money?

Trim makes money with the amount it charges you, which is 33% of the total amount it saved you. Moreover, Trim also makes money with the Premium version that costs $99 yearly or $10/month (estimate).

Why does Trim need my bank account?

By linking your bank account, Trim can analyze your spending habits and recurring charges to suggest ways to free up your money. Without accessing your checking account, Trim can't do its job.

How much does Trim cost?

Even though there is a free version, the paid premium version of Trim costs $99 yearly. However, if this is not an issue for you, it may be useful to avail of this service.

Does Trim work?

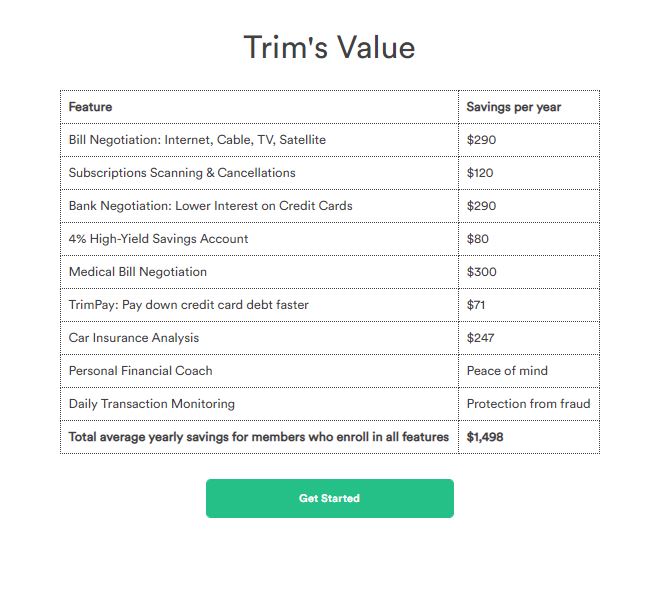

Yes, it does. It enables you to save your money. According to the asktrim website, the total average yearly savings for members who enroll in all features is $1,498. On Bill negotiation: Internet, Cable, TV, Satellite, savings per year will be $290.

Similarly, subscription scanning and cancellations will save you $120 per year, as per Trim's Value.

Is the Trim app legit?

Trim began in 2015 and, subsequently, has been improving its services. Therefore, Trim is a safe and legit finance tool that claims to save up its members to $645/year.

Is it Trim worth it?

Overall, Trim is a secure and legitimate program that saves you money by tracking down your long-unused subscriptions, negotiate your bills, and automate your savings. Therefore, its central core free features are worth the try, but you can also arrange on your own beforehand.

On the other side, if you have credit card debts, you may opt for Trim's premium features and get the most out of its Trim Pay and Savings account.

Final Thoughts

For the most part, Trim has a good industry reputation, as it tells you precisely what you are spending your money on, without ever needing to look through your credit card and bank statements. It saves you time and makes it easy for you to look at what expenses you can trim off and where you may be able to potentially bargain a lower service charge from your providers.

Furthermore, it is worth signing up with Trim to take advantage of its free subscription monitoring and bill negotiation services; to know what things you pay for every month. Then, for any more specific situations, Trim's Premium offerings could potentially help you.

Another thing worth mentioning is that Trim will monitor when there is a reported outage of a service you subscribe to and automatically start chatting with the service's customer service department to request a discount prorated for the number of days the service was unavailable. Although this doesn't happen all the time, it's nice to know that Trim goes the extra mile.

Most importantly, if you live with too many subscriptions, and you can't afford the time to scan through all of your past transactions, then Trim is for you.

Personally, what I like is the automation feature it presents and how you barely have to do much for Trim to find savings for you.

Above all, it only charges you for any successful negotiation it does for you—no savings, no payment.

However, keep in mind that you can always do these things first on your own. Trim is only one useful tool to help you get better in your financial life. So, be mindful of personal details you share with services like this and be responsible for your own financial business.

To sum up, I hope this Trim review has helped you learn about Trim and decide whether to give it a shot.

Have you used Trim? If so, what are your experiences with it? Share them down below. If you plan to use Trim, also let us know what you think!

0 Comments