Greenlight Kids App, have you heard about it?

If you want to raise money-smart kids, you can start by teaching them the value of earning, saving, budgeting, and investing. These are the fundamental four pillars or foundation of financial literacy.

And, with today’s technological advancement, this is not impossible to learn.

Probably your current financial provider already offers a kid or teen equivalent of a bank account or debit card. If you want to invest in your kid's future, you can open a joint or sub-bank account for them as young as he is.

Most financial institutions allow it as long as there’s parental consent. Furthermore, some enable the kids to turnover and handle the account once they hit legal age.

Another thing you could do to prepare for your kid's future is let them have a debit card for kids, teens, or minors.

The Greenlight Kids App is one of them. Essentially, it’s a prepaid debit card for kids, teens, or minors but with parental management and control.

Not only will kids learn how to budget and save, but they will also get paid to do chores and tasks assigned to them.

For parents, this is like hitting two birds with one stone. You impart financial wisdom while getting your house clean and clutter-free.

Therefore, let's talk about Greenlight Kids App and how it works in this post. Is it legit?

Moreover, is Greenlight Kids App the best debit card for your kid?

Read along to find out!

Related: How much does GoHenry Cost?- Is it a good debit card for kids?

Why should you teach kids about money matters?

Not all families are fortunate enough to have available resources and guides to help them raise financial-savvy kids.

Hence, if you’ve got the time and the means, make the most out of it. This is the concept most wealthy people pass on to their children.

At a very young age, they teach them the importance of saving money and the value of earning. They also ensure to raise their kids comfortable about money matters and that money talk.

More significantly, they teach their children how to acquire, create, and grow more money to work 10x harder and produce multiple money for them.

Most wealthy people don’t get the status they have now because of years of saving and working. Instead, they have learned how to build a business empire and a steady cash flow stream and assets that make more money.

Therefore, these businesses grow; they become their own boss and work as much as they want, whenever and wherever they want.

If we could teach the next younger generation about money matters, this is the time to do so. Most significantly, we should teach kids about money for them to:

1. Understand how money works and spend wisely,

2. Learn about how credit and loan works and how to manage finances,

3. They will become financially literate and learn the value of it,

4. Learn how to set saving goals, make their money grow, and instill a disciplined attitude,

5. They’ll become well-informed, responsible, and financial-savvy adults in the future.

These are just among the few reasons or examples of why you should teach kids about money. For some, this could be because they will inherit a large sum of money soon, or they’ll be managing a business in the future.

It all varies, but the key takeaway here is this. No matter your motivation in sharing financial education, we must do our part.

This is not just for our children. Now that we know better, we must act better.

Don’t pass down assets without knowledge. You can start teaching your kids how to manage money from a young age. For example, teach them to assign every dollar a job when they receive money.

And you can do this by assigning them a kid-friendly debit card like Greenlight Kids App.

What is Greenlight Debit Card?

App Store Rating: 4.8 out of 5 | Play Store Rating: 4.2 out of 5

Greenlight Debit Card is a prepaid debit card for kids with a mobile app. It lets parents efficiently manage and see where, when, and how much kids spend while helping them learn to handle their finances.

The Greenlight Kids App started in 2014; it has over 2 million parents and kids served and helped save money.

Since it's a prepaid debit card, parents need not worry because kids can’t spend an amount that is not there. Moreover, there is no minimum age for your kids to get started, plus no overdraft fees.

Greenlight Kids App also gives real-time alerts for parents so that they’ll get notified of their kid's transactions. This gives parents flexible parental control and a simple, easier overall view of their child’s account.

Above all, Greenlight Kids App lets parents do the ff:

- Transfer money instantly to kids

- Turn the card off via the app, if needed

- Receive alerts whenever the card is used

- Set store-level spend controls to help kids learn to budget

- Automate allowance payments

- Manage chores (and instantly reward a job well done)

All these and more Greenlight Kids App features are below!

How does it work?

For Parents

1. Sign-up by visiting the website or downloading the app.

If you sign-up from the website, you must enter your mobile number to get started. Once done, you’ll get redirected to a welcome page, and from there, you’ll choose the role of “parent or guardian.”

2. Parent Account setup.

Following the previous step, you will receive a verification code, and all you have to do is enter it. Then, Greenlight Kids App will prompt you to input your email address, social security number (no, it won’t affect your credit score, they don’t run a credit check!), a valid debit card or bank account, etc.

Note: Greenlight will also notify you if you want to upgrade to Greenlight Max or Greenlight + Invest. We'll talk about more of that later!

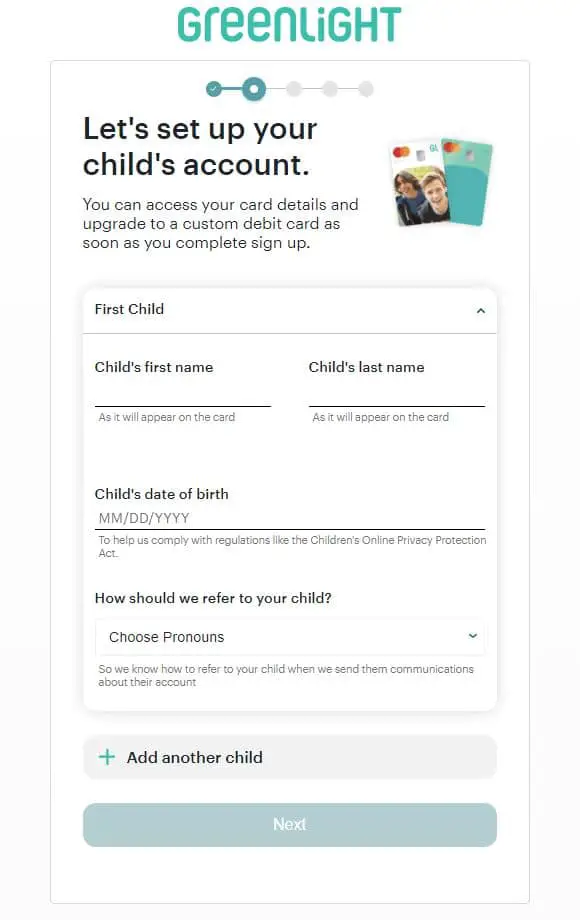

3. Set up your child’s account.

Now that you’ve finished creating your parent account, you will now set up your kid’s account. Enter your child’s name and mobile number. If you add another kid at a later point, just click “Add a child.” Furthermore, you can add up to 5 children.

To log in, parents can set up a username and password for their child with no phone number required.

4. Verify your identity.

Before you can open an account or any bank account, this is needed to confirm your identity.

This also includes basic information such as name, ZIP/Postal code, address, and more. Greenlight will mail the physical cards to the address you provided in the account setup, so make sure your address is correct.

5. Fund it!

In this step, you will now set up your parent’s wallet. You can load it with funds and transfer any amount to your child whenever, wherever, and for whatever.

Next is to add your funding source and choose your funding method so Greenlight Kids App can add the initial amount to your Parent’s Wallet. You can add other funding sources later.

Furthermore, Parents can link up to two bank accounts and two debit cards to their Greenlight Parent's Wallet at a time (as of this writing, Greenlight Kids App doesn’t support credit cards as a funding source)

Hence, you can add or connect your bank account instantly, manually, or set up auto funding (add money when the balance gets low or on the 1st of the month)

There is no fee for this process, but if you add your bank account instantly or manually, there is a $1 minimum transfer. For adding your debit card manually, a $20 minimum transfer after your initial loading of the card.

Greenlight Kids App uses Plaid to facilitate fund transfer.

6. Finish setting up.

Now you’re all set! For the physical card delivery, wait 7-10 business days. You can also customize it within the app but with added cost (more on this detail later!)

For Kids

This is how Greenlight Kids App works for kids.

1. Download the app.

Greenlight Kids App is compatible with Apple and Android phones and devices, even with Amazon kindle.

2. Log in to your account.

You can log in with your phone number or through a username and password your parent set up in your account.

3. Access to Tabs.

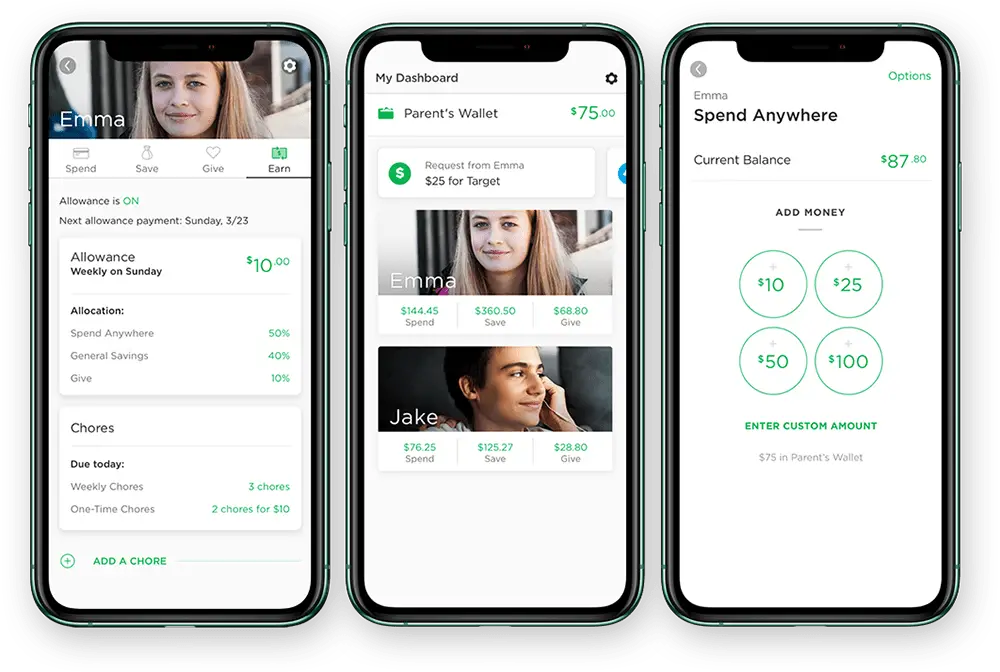

There are generally four lists of tabs options: the spend, save, give, and earn.

The Spend tab allows you to spend wherever (following the limits your parents initially set up). You can also see your spending history.

Then you can have access to the built-in Savings Tracker and account.

The Give tab is dedicated to charity. You can choose a category from the list provided or pick a charity on your own.

Lastly, the Earn tab is where you will see your amount for every chores and task finished.

Greenlight Kids App: Summary of Features

Greenlight Kids App: Features | ||

Details | Rating | |

Core Features | Prepaid debit card for kids and teens, Parental Controls, Interest-bearing savings account, Instant money transfer, Automatic chore allowance, Roundups, Customized Cards, Direct deposit, Greenlight + Invest, | |

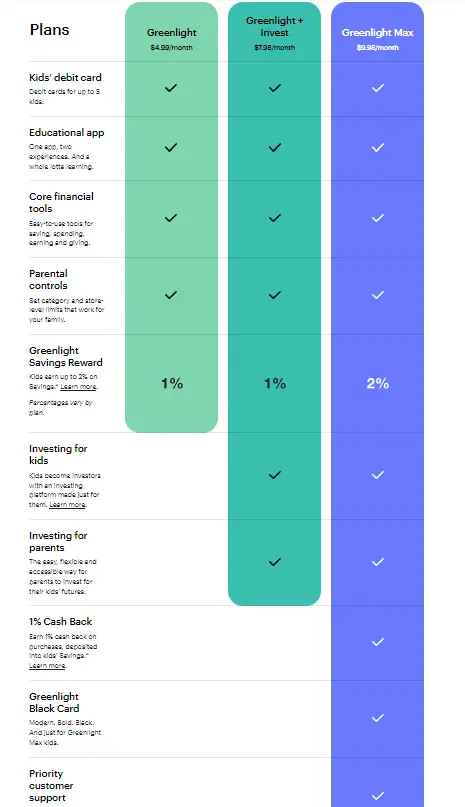

Pricing | $4.99 per month, per family (up to five kids) Greenlight + Invest- $7.98 per month, per family (up to five kids) Greenlight Max $9.98 per month, per family (up to five kids) | |

Fees | No fee to make cash withdrawals with your Card at any ATM. ATM operator fees may apply. First replacement is free; subsequent replacements are $3.50 per Card. | |

Free Trial | One month free trial can cancel anytime. After that, the plan starts at $4.99 per month | |

Platform Availability | Website, Apple and Android devices, Ipad, Kindle, works even with Apple Pay and Google Pay | |

Security | FDIC-insured for up to $250,000 per individual through the card’s partner bank, Community Federal Savings Bank (CFSB). Also comes with an EMV chip and parent-controlled PIN. Greenlight also blocks unsafe locations on spend categories. Moreover, it lets you select where and how much your kids spend their funds. Parents can immediately turn off or deactivate card if lose or stolen (Mastercard’s Zero Liability Protection.) | |

Customer Service | Help section in the Greenlight Kids app. Email at support@greenlight.com, call them by phone at (888) 483-2645 or by text at (404) 974-3024. | |

Funding Options | Load parent wallet by ACH transfer from your checking account or debit card. There is no fee to load your parent wallet. For loading your child’s prepaid account, you can transfer form the parent account or direct deposit through your child’s employer (if they are working or have a job, again with 0 fee) | |

Who is it best for? | Parents who want to teach their child to become financially savvy. Those parents who also wants to control their kid’s spending and manage allowance. Bigger families for key financial insight in one place and in one go. | |

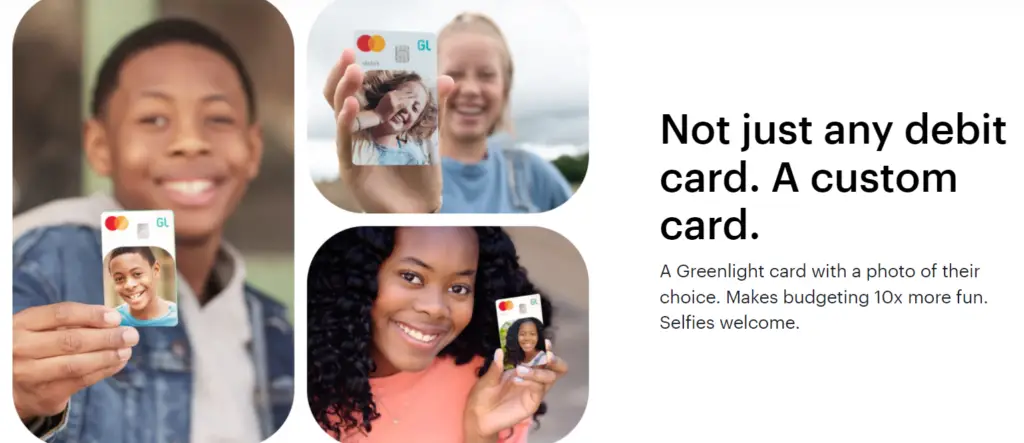

Debit Card

Greenlight Kids App core feature is its prepaid Debit Card. Moreover, you can customize it (card with your kid’s selfie or personalized name)

With the Greenlight debit card and app, kids can earn money through chores, set savings goals, monitor their balances, spend wisely, and invest.

On the other hand, parents can set flexible controls and get instant notifications every time their kids spend money.

Hence, it’s like a debit card for kids in mind but managed by parents.

The Greenlight card can be used almost anywhere Mastercard is accepted, online and in-store (per parent’s approval). It also works internationally with no foreign transaction fees.

However, there are some places and transactions where Greenlight cards are prohibited. These are:

- Wires or money orders

- Lotteries

- Online casinos or online gambling

- Cashback at the point of sale

- Dating/escort services

- And more

Ultimately, parents can add other establishments that will decline transactions through the Spend Control feature.

Parental Controls

Greenlight has a permission-based spending rules system, allowing parents to establish rules for specific stores and spending categories. When parents set these spending controls, they can place their preferred spending limitations on their child's spending at a particular retailer or within a specific spending category.

- Store-level Spend Control– allows parents to select each store where kids can use their Greenlight debit card. Parents will still receive real-time alerts anytime kids use their Greenlight debit card online or offline, even with approved spending.

- Spending Categories– ATMs, Groceries, Restaurants, Online Gaming, etc.

- In-app approvals– Kids can request real-time for additional funds or permission if they go to a new store without prior approval or if in case, the card doesn’t carry a high enough balance.

- Freeze the card– if the card got lost or stolen, turn on or off the card within the app.

Furthermore, the Greenlight Kids app will tell parents when a card gets declined for any reason. This kind of flexible control and insight is where the Greenlight Kids app shines the most.

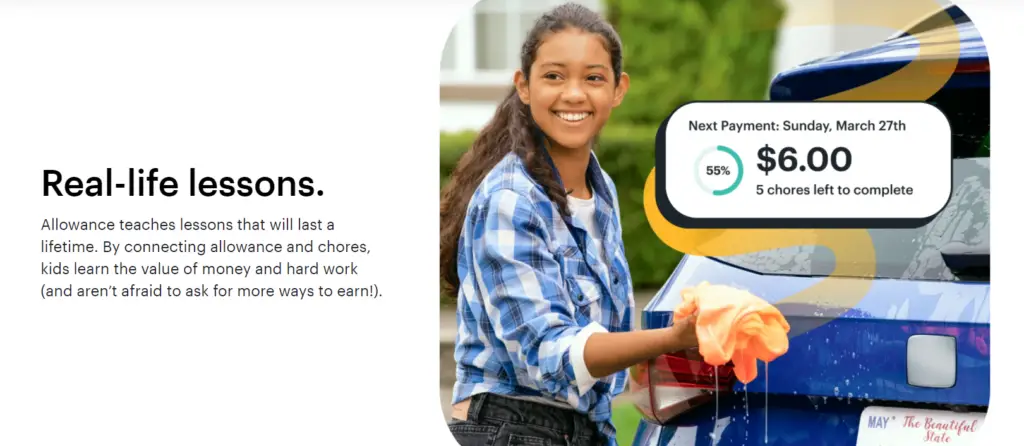

Chores and Allowance

By connecting allowance and chores, kids learn the value of money and hard work. As a result of incentivizing your kids for a job well done, kids can appreciate the reward of hard work.

With Greenlight Kids App, parents can set chores according to frequency.

- Routine chores– are tasks that repeat weekly or multiple times per week.

- One-time chores– single-time chores or for bigger tasks

Parents can manage and track these chores and place money transfers automatically (if they choose to pay their kid in exchange for completing a chore or task)

Another cool feature of Greenlight Kids App is an allowance on autopilot. Parents can set an allowance to pay out weekly, biweekly, or monthly.

- Fixed or Partial Payment- Parents can choose to pay a consistent allowance to their kid (not tied to chores) or only a percentage of it.

- Get paid to do chores– Or, parents can only pay their kids allowance if they successfully finished all their tasks.

On the other hand, if your child is a teen and is working, Greenlight Kids App allows direct deposit. So they can have their paychecks sent straight to their Greenlight account.

Lastly, if there’s a Spend Control function, there’s also a Spend Anywhere feature. With the Spend Anywhere feature, kids can spend their money where they want, and parents can have even more flexibility through the control they put in place.

Your child can spend money from the Spend Anywhere category at any merchant that takes Mastercard, whether online or offline.

You should also be able to link your child's individual Spend Controls to their Spend Anywhere fund, allowing them to pool cash for a specific purchase- this helps in avoiding purchases to get declined if the kid’s balance is low.

Investing

The most notable feature of Greenlight Kids App is its investment account for kids (they use brokerage accounts in the parent's name that the child can use).

Through their upgraded version, Greenlight + Invest, or their premium plan, Greenlight Max.

With an additional $2.99 ($7.98/monthly Greenlight + Invest) or ($9.98/monthly Greenlight Max,) families can now afford everything under the basic Greenlight Kids App with an investing platform add-on.

It’s common knowledge that investing is a key to building long-term wealth. So whether you plan for your kid’s education or major purchases for them someday, investing in your kid's future is the key.

Now with the upgraded version of Greenlight Kids App, kids and teens can use it to research stocks, watch videos, explore, and hands-on learn more about the world of investing. On the contrary, parents must approve all individual stock and ETF investments.

Furthermore, here’s what you can do with Greenlight + Invest.

- Fractional shares– buy fractional shares of stocks or companies your children adore (kid-friendly stocks). You can also start with as little as $1.

- Parent approval– parents approve every trade right within the app.

- No hidden fees– Fee-free trade and zero commissions.

If the kid is too young, parents can open and invest for the child. But, of course, it is still best to have adult parents' guidance when kids start investing. Therefore, they can learn more and expand their skills and knowledge.

Related: 11 Best Investments for Teens- How to start investing as a teenager.

Savings Rewards

Greenlight may have used a different term, but for their Savings feature, it offers up to 1% interest (per annum) on the average monthly balance up to $5,000.

Moreover, for their premium plan (Greenlight Max), kids can earn up to 2% as their savings grow.

Greenlight rewards kids for smart money management. With that, they offer more ways to save. One is through round-ups. Hence, kids can round up purchases to the next dollar and automatically add the change to their savings.

They can also set specific savings goals and track them within the Greenlight Kids App. On the other side, parents can help by setting a percentage of their allowance to go toward savings then placing them on autopilot (parent-paid interest)

Greenlight Kids App- Financial Literacy

What’s best about Greenlight Kids App is that it offers a bunch of educational content. All these can be found right within the app from videos, games, quizzes, and blogs. In addition, Greenlight made it engaging and more fun so that kids could enjoy learning.

Greenlight also has sweepstakes, contests, and more where families can participate, bond, and have fun. Thus, Greenlight partnered with Kahoot! for their daily dose of financial education content.

Security and Control

Greenlight Kids App offers spending notifications in real-time for your peace of mind. Plus, you can activate or deactivate your kid’s card in an instant when it gets lost or stolen.

There’s also the spend and ATM controls. Moreover, Greenlight debit cards are FDIC-insured up to $250,000 and come with Mastercard’s Zero Liability Protection.

Greenlight has a face or fingerprint recognition for logging in to the app for an additional layer of protection.

Additionally, the premium subscription plan (Greenlight Max) offers identity theft, phone, and purchase protection for up to five children.

No Hidden Fees

Say yes to NO hidden fees because Greenlight Kids App offers no, 0, without, NADA:

- ATM Fees.

- Overdraft fees.

- Minimum spend.

- Trading fees.

- Commissions.

- International fees (when traveling abroad)

To test the water, you can try out their free one-month trial period (again, with no commitment, you can cancel anytime), but after that, the price starts at $4.99 per month.

Greenlight Kids App Plans and Fees

Refer friends, get $30

Greenlight offers cash rewards of up to $150 for every successful referral. To learn more about it, read here.

Greenlight Gift

This feature allows kids to receive gift funds on their Greenlight Cards for birthdays, holidays, and other special occasions.

Anyone can send a Greenlight Gift (relatives, friends, etc.) no need for the giver to create a Greenlight account, but the recipient must have one.

This step outlines the process on how to give a Greenlight Gift.

Greenlight Kids App: FAQs

Is Greenlight app good?

Greenlight Kids app is a legit prepaid debit card for kids with a mobile app. A prepaid debit card means you load or put a fund into the card before you can spend whatever amount there is. You cannot spend what’s not there.

It’s one of the best debit cards for kids because of its wider functions, plus add-on features such as investing and interest-bearing savings accounts.

Kids learn to have hands-on experience of mobile banking and savings, investing, budgeting, and earning. What’s best is that kids earn money to complete chores while parents have peace of mind that the house is clutter-free and control their child’s financial management.

What apps does Greenlight work with?

Apple Pay, Google Pay, Amazon, and Samsung Pay works with Greenlight. You can use these apps as soon as you add your Greenlight card to your wallet on your smartphone.

How do you set up Greenlight app for kids?

First, parents must create their parent account. Next is to set up your kid’s account.

You must enter your child’s name and mobile number. Then, if you add another kid at a later point, click “Add a child.” Furthermore, you can add up to 5 children.

Parents can set up a username and password for their child to log in. No phone number is required.

The steps here lay down the process on the Greenlight Kids App experience.

Is Greenlight app free?

Greenlight Kids App is a subscription-based plan. The basic plan’s price is $4.99/month.

The Greenlight + Invest is priced at $7.98/month, while the Greenlight Max is priced at $9.98/month.

Greenlight Kids App: Pros and Cons

| PROS | CONS |

| Automates allowance | No lending options (apps like Famzoo and BusyKid allows parents to lend money to their kids, this can help kids to learn about credit) |

| Encourages kids to save and budget | Can’t reload cash directly from participating retailers nationwide. |

| Offers a physical debit card (which can be added to Apple and Google Pay) | Investing feature is not free, has a monthly subscription upgrade plan. |

| Has an Investment Platform | Limited in some countries. |

| Interest on savings | |

| Real-time alerts and notifications for spending and ATM wit | |

| Automated chore and allowance management |

Greenlight Kids App: Alternatives

The Greenlight Kids App is hardly the prepaid debit card out there. You can also check out other options such as:

Greenlight Kids App- Final thoughts

If your parents, grandparents, and great-grandparents knew investing a small amount of money each week for a long time would make them very wealthy, then you’d be rich. But they didn’t.

And now it’s your responsibility for all of your future generations.

Stop blaming the government or the faulty, outdated educational system. The next best thing you can do today is to start.

Part of passing down generational wealth is passing down a financial education.

With fintech apps such as Greenlight Kids App, you and your kid's future are off to a brighter start.

What do you think of Greenlight Kids App? Have you used it? What are your experiences in using the app?

If you haven’t already, are you considering a starter debit card for your child?

Share your thoughts below, and see you in our next posts!

0 Comments