Kids don’t magically learn how to understand money or manage finances. Hence, as the older and more woke generations, we have to teach them.

Do you have that moment when you wish you knew something about money when you were a bit younger? What difference would it make if you were educated and informed about basic financial literacy or personal finance 101?

Dang! All those years of wasteful spending money. Wouldn’t it be better if you placed in an investment fund or savings account? And what about budgeting? Would you be rich by now?

Indeed, we all have that money mistakes or money lessons we wish we knew when we were younger.

Out with the old, In with the New!

The overall system is still founded on the traditional and more secured end. For example, we were taught about quadratic equations, the science behind gravity, or that a triangle can’t have two right angles in school.

They told us that to succeed in life, we must get a good education, get a high-paying job, build a family, and die.

There's a missing link here. Unfortunately, we didn't learn about compounding, how a credit card works, or even how to purchase a home.

All these essential financial literacies weren’t a secret anymore. These are what the wealthy ones teach their youngsters.

What if you can have the power to teach your kids about personal finance at an early age?

In this post, we will share one of the best debit cards for kids, the GoHenry. But ultimately, how much does GoHenry cost? And, will it help your kid learn how to handle their finances?

So, whether you’re a parent looking for an affordable bank account for your child or an older relative concerned about teaching kids to become financially savvy adults, this post is for you.

To my single friends out there, don’t worry. You can still benefit from the deets here that you can use a reference once you have your kid someday!

Are you ready? Let’s build the groundwork for generational and exponential wealth starting from our little ones.

Start them young!

Related: Jobs That Kids Can Do To Boost Their Allowance (For Kids 12 and Up)

How to teach kids about money?

Money matters are an essential aspect of living. Therefore, parents often keep the issues relating to money and saving with them.

And the children remain unaware of how their needs and wishes are met and from where the money comes.

As a result, the kids cannot learn about some hard aspects of their life; firstly, the hardships suffered by the parents to provide a happy life and secondly, the importance of money management.

Teaching money matters may seem to be a difficult task for parents. But it is not so. You can introduce the concept of money to a child as soon as she learns to count!

Furthermore, research shows that it’s good to start learning about money early; kids form attitudes and habits as young as seven, and it’s their parents' responsibility to shape those attitudes, beliefs, and habits.

For example, here are some tips on how to teach kids about money in every age group.

Age 4-7

- Counting coins and bills

- Allow them to pay at the grocery store

- Teach them about chores and an allowance

- Don’t argue about money

Age 8-12

- Save for something they want to buy

- Open a bank account

- Allocate allowance towards savings

- Create grocery list with budget

Age 13-15

- Budgeting income vs. expenses

- Understand the costs of buying a car

- Understanding wants vs. needs

- Teach how to use a debit card

Age 16-18

- ROI of college

- Store-valued cards

- Basics of investing and accounts

- Household expenses for living on their own

These are some fun tips and ideas to encourage your kid and make learning money fun. Essentially, it must not be taboo that only adults can converse with. Involve them as early as now!

One way to do that is by opening a joint or sub-bank account. Or you could let them have a debit card for kids, teens, or minors. Enter, The GoHenry card.

What is GoHenry?

App Store Rating: 4.6 out of 5 | Play Store Rating: 4.4 out of 5

GoHenry is a prepaid debit card/bank account designed with kids and teens in mind. Originally from London, U.K, and founded in 2012, its members have rocketed to over two million users today. It recently launched its U.S version with equivalent offerings and features.

An idea and a solution inspired the GoHenry concept. It would be easier for parents and practical for kids to learn about money and how to manage it confidently, simply by experience.

We all know that basic financial literacy is a crucial life skill. Just like learning to read or ride a bike, learning about money by giving kids practical experience at an early age and how it works can go a long way in becoming a money-smart adult.

Furthermore, GoHenry is passionate about offering the right tools to inspire a lifetime of financial wellbeing. Hence, they are on a mission to help kids learn about money in the most practical, fun way and for parents to instill in their children good financial habits plus have peace of mind.

GoHenry also comes with a mobile app that makes it more accessible and convenient for families to empower their kids and help them gain money skills for life.

(Curious about where the name comes from? Essentially, the company is named after GoHenry’s first customer, an 11-year old boy named Henry.)

How does GoHenry works?

For Parents

With the GoHenry prepaid card and app, you can now raise a disciplined and money-smart kid. Moreover, as parents, you can encourage your kid to become financially independent and learn and appreciate that money doesn’t grow on trees.

Here are how GoHenry works and its features that give parents ease in family financial management.

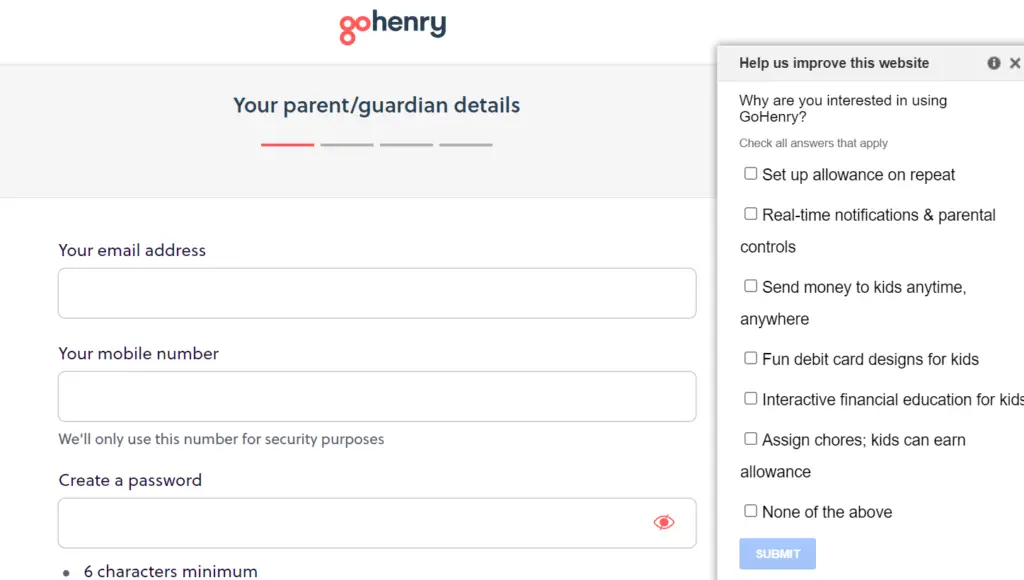

1. Sign-up by visiting the website or downloading the app.

From there, GoHenry will ask for your basic information, such as email address, mobile number, etc., to create your parent account.

2. Activate it and follow prompts to set up your account.

This will include how to manage pocket money payments, set up tasks, and monitor your child’s spending.

3. Once activated, you’ll be given your child’s log-in details for their app, along with their card PIN.

If your kid forgets their password, you can change it through your parent account. Additionally, if they forget their PIN, they can always view it within the app by clicking ‘card’ then ‘pin’ at the bottom page.

4. Activate your child’s card.

Your child’s GoHenry physical card will arrive within seven business days upon signing up. Before your child can use the card, you must activate it first. Then, all you have to do is enter the last four digits of the card number.

5. Add funds.

Of course, before your child can use their card, you need to top up money to the parent account. You can also automatically transfer money to your parent account when your balance is running low.

6. Complete account set-up.

Now, you can set up a weekly pocket money payment, customize spending limits and choose where your child can use the card.

For example, you don’t want them to overspend above $50 in one transaction, or perhaps you want them to use the card only for in-store purchases and ATMs and not online.

You can modify all these spending rules at any time.

7. Add money to your child’s card.

Hence, you can seamlessly transfer funds from your parent account to your child’s card.

It will help them get started, or maybe you want to add a little extra. Usually, your child's card will be funded by their weekly pocket money payment.

For instance, they’ve finished a chore. Or, your kid has completed regular tasks that you set like pet walking, tidying their room, doing the dishes, and more. Within the GoHenry app, parents can set tasks like that, and your kids can even see the amount they’ll get paid for completing them.

These tasks setting is optional, and you can schedule them accordingly whenever you want to have them completed—for example, weekly.

For Kids

GoHenry app makes it simple and easier for kids to use. It got all you need to see, and every detail you need, closer to a regular digital bank app.

1. Getting Started with GoHenry.

Download the GoHenry app. It is compatible with cellphones, iPad, or tablets. Then, log in to the GoHenry app using your account password or PIN (provided by your parent, so ask for your account credentials and details).

2. Account Summary and Dashboard

Once you successfully log in, you'll see at the dashboard your account summary, such as details about your available money to spend, your weekly limit, your next allowance date, etc.

You can also see your spending account, saving account, and your total bank balance all-in-one place.

3. Tasks Management

GoHenry app will also tell you all your tasks- what you’ve completed and when it’s done. These tasks will help you earn money from your parent once you’ve completed them.

For every completed task, tick them off. Then you will receive your actual money depending on when it is due on the app, based on your parent’s set tasks and schedule.

4. Save money

You can also set a savings goal. From the savings tab, input the goal amount you want to save, and GoHenry will show you how much you’ve saved and how much more is needed to achieve your savings goal.

Note that you can quickly transfer any amount from your savings to your actual available balance and vice versa. You can even transfer money to your parent’s account.

5. Useful Tabs and Card Customization

The Spending tab will show you all your expenses or where you spent your money.

There is also a Statement tab like an overall picture of your financial statement. It will show the summary of your earnings and spending.

The Limits tab will show you details of your card status (is it activated, deactivated, or blocked?), your spending limits (weekly, single spend limit, cash machine limit), and where you can use your card (ATMs, in-store, online).

Moreover, if you forgot your card PIN, you can easily access it within the app.

Lastly, one of the best features of GoHenry is that you can even design another card.

How much does GoHenry Cost? GoHenry Features: A Quick Glance

GoHenry Summary of Features | ||

Features | Detail | Rating |

Core Features | Prepaid debit cards, Instant money transfers, Bank account for kids, Parent monitoring of kid’s account, Savings, Budgeting, Earning app for kids and teens, A money management tool. | |

Pricing | $3.99/monthly, per child | |

Fees | No overdraft and transfer fees. | |

Platform Availablity | Website, Mobile App | |

Security | FDIC-insured for up to $250,000 through the card’s partner bank, Community Federal Savings Bank (CFSB), comes with EMV chip and parent-controlled PIN | |

Customer Support | Phone, LiveChat and email support, 7 days a week from 9am - 5pm EST | |

Funding Options | Top up the parent account by debit card or bank transfer without fee | |

Who is it best for? |

| |

Wow! What cool features! Ever wonder how much does GoHenry cost? Read on to find out if it’s worth it!

Prepaid Debit Card

GoHenry’s main feature is its prepaid debit card for kids. A prepaid card is a card that you load or reload in advance and can purchase stuff. Think of a typical prepaid debit card.

When you buy goods and services through this prepaid debit card, it’s like you withdraw money from the funds in it.

Essentially, GoHenry’s prepaid debit cards allow kids to only spend up to the amount that they have. Hence, it won’t bear overdraft fees or non-sufficient charges.

Parental Management and Control

This feature is probably one of the most sought-after for most parents looking for their kid's primary bank account/card.

With GoHenry, parents can set spending limits, block specific payment channels (ATM withdrawals, in-store, or online), and even stop and unblock the card instantly from the app. It is for when the card gets lost or stolen.

Parents can also receive real-time spending notifications, set up the automatic allowance, and quick transfer in sending money.

Tip: Asking kids about their account balance does two things: 1.) Encourages them to do mental math, 2.) Keeps their money goals in check

Ask your kids about their account balance at random times. They should always know it.

By default, GoHenry blocked a few merchants, so your child can't make purchases. For example, these are from:

- Dating websites

- Tobacco shops

- Pornography (adult entertainment and websites)

- Gambling

- Bars and nightclubs

You can further control where your child uses their card. Thus, complete visibility and control feature!

What’s new in GoHenry? Updated feature: You can now add a co-parent or guardian to help manage your child’s GoHery account. You’ll both be able to manage spending rules and limits, receive real-time updates, and manage tasks.

Earning money by completing household chores

This feature is a simple way for your child to appreciate the value of hard work and money.

With every chore you set, and your child completes it, they will earn allowance money. Moreover, as a parent, you can schedule and automate it. It is useful for routine tasks or those chores that repeat weekly or daily.

Parents can manage and track these recurring chores from the app and place money transfers automatically. But, it is still your choice whether you want to pay them or not.

Savings Goal

GoHenry offers a savings account through its Savings Goal feature. However, unlike some savings accounts, these don’t pay interest.

Still, it’s an excellent tool your kid can use for them to learn how to budget and save money. They know how to keep buying things they need or want.

Both parents and children can set it up themselves. In the parent’s view, they can also oversee progress charts, if their child is contributing and how much. Moreover, parents can help by transferring extra money or through gifts.

TIP: To raise money-savvy kids, challenge your child to save a certain amount each month. If they accomplish, reward them by taking them to dinner or contributing to buying their favorite items to keep them motivated.

Related: 17 Money-Saving Challenges to Definitely Help Save More than Before.

Giftlinks

Giftlinks is a unique link that parents can provide to friends or relatives to send money to the child. There’s no need to download the app, and it’s completely free.

This can be an alternative way for your kid to receive money on special occasions. Ideally, if you’re a family living in a mobile-first or cashless transfer and transactions.

It is safe as these Giftlinks are accessed through a secure web page, and from there, the gifter can now send money to that child’s GoHenry card.

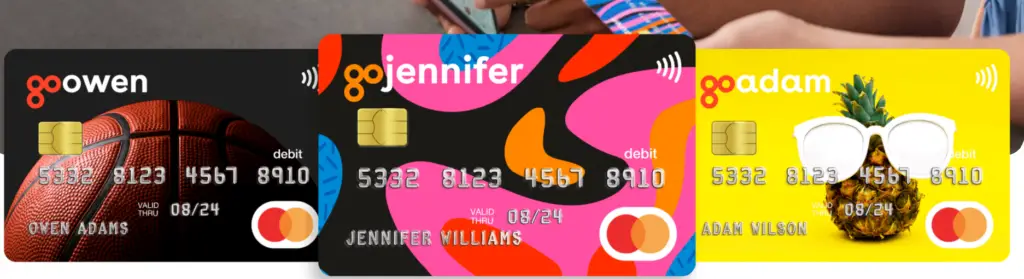

Customized Cards

This is optional but a great feature. GoHenry allows you to customize your child’s card. However, there’s an extra fee of $4.99.

You can choose what should be the name on the card, plus you can pick from many design themes from the GoHenry website that will match your child’s interests, hobbies, or personality.

Security and Customer Support

GoHenry account is FDIC-insured for up to $250,000 through the card’s partner bank, Community Federal Savings Bank (CFSB). Furthermore, it comes with an EMV chip and parent-controlled PIN.

For customer support, they are only available through email and phone. You can shoot a message at help@gohenrycard.com or call them by phone at 1 (877) 372-6466 every day of the week between 9 AM and 5 PM EST for any additional queries.

Donate to Charity

Another notable feature of GoHenry is teaching your kids how to share. This is through their donations to charity or giving features.

GoHenry has partnered with Boys and Girls Clubs of America for this project.

How much does GoHenry cost? On Pricing and Fees

Here’s a table that summarizes how much does GoHenry cost.

| Monthly Fee/Per Child | $3.99 (per month, per child) |

| Card Replacement | $0 |

| Different Design Card Replacement & Custom Card Fee (optional) | $4.99 |

| Cash Reload Fee | $0 |

| ATM Balance Inquiry | $0 |

| Inactivity (After 12 months of no movement or transaction) | $0 |

| Online and Offline Card Transaction | $0 |

| ATM Withdrawal | $1.50 (in and out of network ATM withdrawals. Some owners of ATMs or ATM networks charge an additional fee.) |

| International Transaction | $0 |

| International ATM Withdrawal | International ATM Withdrawal- $1.50 (plus fees charged by international ATM operator) |

Read here to learn more.

Funding Options

The only way to deposit funds to the parent account is through a debit card. So you have to provide your banking information.

There is no fee if you load your child's prepaid debit card. Unfortunately, as of now, GoHenry doesn't support direct deposit.

Moreover, GoHenry doesn't offer to reload cash directly onto participating retailers' cards. Therefore, it should always be linked to a debit or credit card.

However, this can be looked forward to in the future.

How much does GoHenry cost per month?

Now we’re talking money. Great! So GoHenry is based on a subscription basis. It starts at $3.99 per month per child. However, parents can only manage up to four child accounts under the same parent account.

You might wonder, is there a free version of GoHenry? Well, you can try their free trial for one month (no upfront payment and can cancel anytime), and after that, only $3.99/month per child or (13 cents per day!)

Can GoHenry be used when traveling abroad?

You can only set up a GoHenry account in the U.S., but you can use the GoHenry cards in other countries where Mastercard is accepted. Moreover, GoHenry does not charge any fees for foreign currency transactions.

Read here to learn more.

What we like about GoHenry

- More than just a kid-friendly app but also educational (they have tons of resources and educational finance tools on the blog page of their website)

- Great money tool for beginners

- It is good that it has no cashback feature since it will defeat the saving and spending control function.

- There is a Spending Limits feature and Blocked merchants.

- Instant notification for spending and ATM withdrawals- provides insight into your children’s money activity.

- Customizable card

- Free trial

- There is no overdraft fees and non-sufficient fund fees- a standard prepaid or debit card function.

- Automated allowance payment, quick transfer, and chore or task management.

What GoHenry could improve

- No investment option

- Additional fee for a customized card

- No interest on savings

- It doesn’t offer parent/child loans (some apps do, and this helps in teaching kids about how credit works)

- Limited direct deposit feature- to add funds to a child's account, you must link a debit or credit card.

- Account cancellation- must contact GoHenry to end your subscription, which can be a bit of a hassle.

Related: 11 Best Investments for Teens- How to start investing as a teenager.

Services similar to GoHenry

What better way for kids to learn about money? Teach them through experience!

While GoHenry seems like it could offer the best of the world, other similar apps can also provide even more flexible features for parents and kids.

- Greenlight

- Famzoo

- BusyKid

- Current Debit Card

- Copper

- Capital One MONEY Teen Checking

- Step Banking for Teens

How much does GoHenry cost?- Final thoughts

We teach reading, writing, and math functions, both at school and at home. But, let's not forget that financial literacy is just as critical, if not more so.

Teach your teen how not to get into toxic debt rather than wait and watch them struggle to try to get out of toxic debt.

Model how to be a lifelong learner. Let your kids see you continue to learn about money and other topics outside of school.

Normalizing learning is a lifelong journey and can do independently from various sources.

How much does GoHenry cost? Our final verdict is that it’s worth it to use, but don’t forget other flexible apps that may be better suit you and your child’s needs.

However, overall, GoHenry is worth it, legit, and safe to use by families. Perfect for those who are slowly transitioning or starting their financial journey together.

Have you used GoHenry? What was your experience in using the GoHenry app? Now that you know how much GoHenry cost, will you and your family use it?

We can’t wait to see your thought on the comment box! See you there!

0 Comments