Need help saving, budgeting, and investing? Qapital takes off the work from you and helps you do all these and more. Read our full Qapital review.

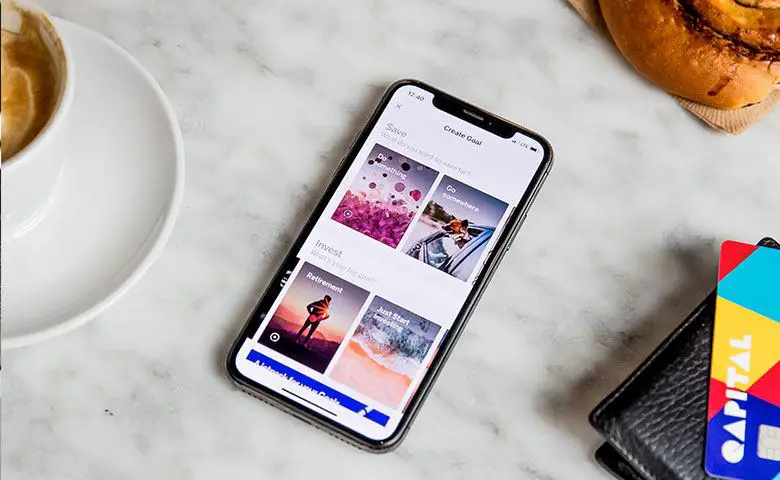

Qapital is a mobile money app that helps you save money based on the rules you set, your spending habits, and automatically saves and/or invests money towards your savings goals or expenses you plan for.

It's an app that takes the stress of micromanaging your money off you by allowing you to set rules once and doing the rest for you.

It also encourages saving as little as possible with rules that save the change every time you spend. Also, there is the 52-week rule that saves very small amounts of $1, $2, $3 to $52 for every week in a year.

You can also enjoy the features of a budget without having to budget for every single category by setting a weekly budget for discretionary spending.

Essentially Qapital is very useful to people who have a hard time saving on their own and keeping a close eye on their spending.

Qapital has a rating of 4.1/5 on google play based on 19,000 reviews and 4.8/5 on apple play based on 71,000 reviews.

I decided to try Qapital in July 2020, and as of this writing in July 2021, 1 year later, I saved $20,958 with Qapital.

Jump straight to My Qapital Experience, or keep reading to learn about Qapital's features and how it works first.

How Qapital Works

After you've downloaded the app to your phone from either the Apps store or Play Store, you'll link your checking account to the app.

From there you have 3 options of what to do next

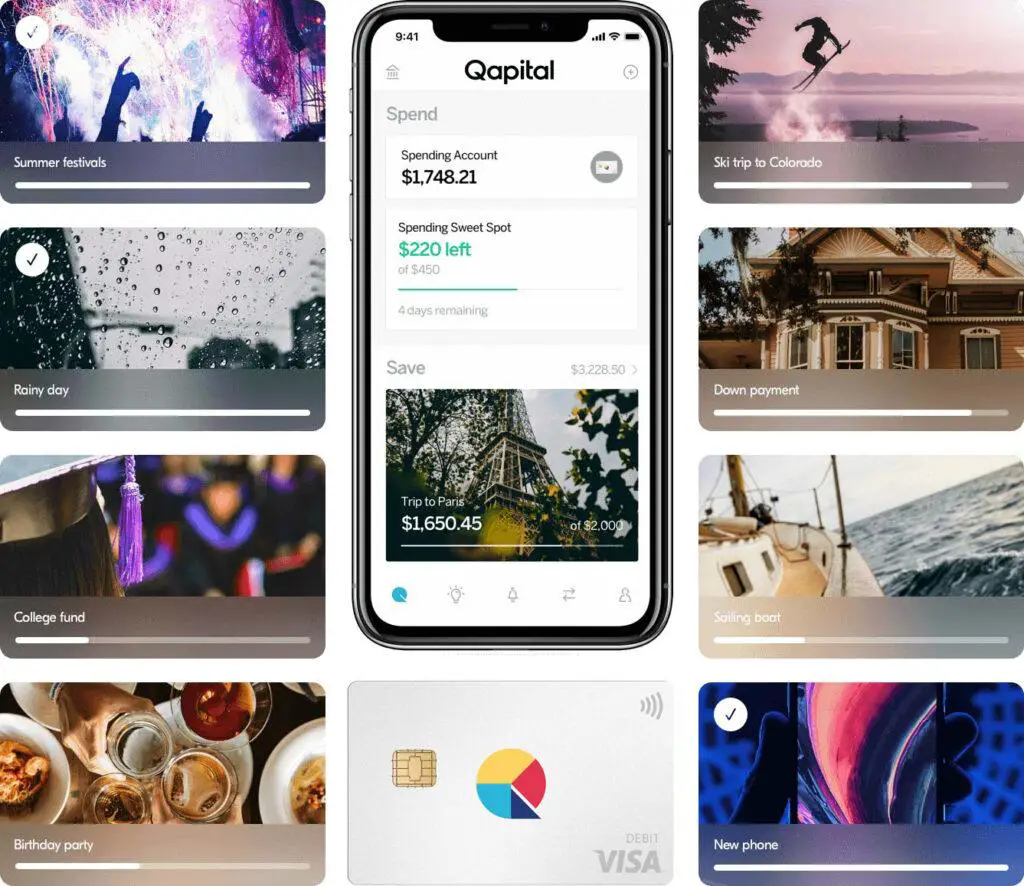

1. Create a Savings Goal Account

A Qapital savings goal account is FDIC insured and held in one of Qapital's partner banks.

You can create a goal from one of the options already on the app, such as Emergency Fund, Vacation, Wedding, Debt Freedom, and more.

Then all you have to do is set one or more rules that would automatically save money toward your goal

2. Create an Invest Goal Account

Qapital invest account is more suitable for your long-term saving goals such as retirement, down payment for a house, college fund, or wealth building.

Your money for your investment goal is held in an ETF portfolio based on your level of risk tolerance (they have 5 different risk levels).

The same concept applies here. You set one or more rules that'll automate saving money toward your investment account

3. Create a Qapital Spending Account

When you open a Qapital spending account, you're given a Qapital Visa® Debit Card that's linked to it. You can also set up Apple Pay or Google Pay with it.

This account earns 0.1% interest compounded monthly. Your spending account helps you to keep track of your weekly spending.

No need to worry about overdraft fees or transfer limits on this account. You can also set up a recurring weekly transfer from your fund account to your Qapital Spending Account.

What are the Qapital Rules?

Set & Forget Rule

Use this rule to set an amount of money to move into your account automatically either daily, weekly or monthly

Payday Rule

Save a percentage of your paycheck every payday with this rule. Just tell the app the goal you want to save towards, the percentage to save, and how much to deposit towards your savings.

RoundUp Rule

Every time you make a purchase with your linked account, Qapital would round up cents to dollars on each transaction and saves the change. You can choose to round up to the next $1, $2, up to $5.

Let's say you set your rule to round up to the next $1. If you make a transaction of 3.10, the nearest dollar is $4.00, so Qapital would save $0.9.

Guilty Pleasure Rule

I couldn't hold back laughter when I first learned of this rule. Every time you buy something you’re trying to resist, you get to save.

On the one hand, you're trying to curb impulsive spending, and on the other hand, you save money whenever you give in. It’s a Win-Win.

Spend Less Rule

For budget lovers, here's a rule you'll love. Set a weekly budget for something, and if you spend less on it, Qapital will save the difference.

It's a fun way to stick to a budget and get rewarded for coming in under.

Freelance Rule

Did you think taxes could get easier? Qapital has an interesting way to help you set aside your tax immediately receive payment for freelance work.

Assuming you have a separate account for your side hustle or freelance work, once money comes in, a percentage of it is automatically set towards your tax goal.

52 Week Rule

Save $1 in week 1, $2 in week 2 up to $52 in week 52, the last week of the year. With this rule, you will save $1378 in a year, and you probably won't feel it.

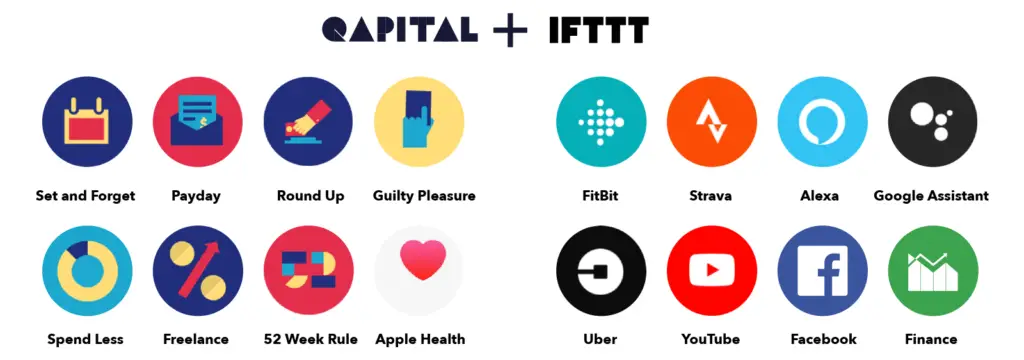

IFTTT Rules

IFTTT stands for “If This, Then That”. The rules in this category save money for your goals when you perform a specific activity— like completing fitness goals, like a video on YouTube, or taking an Uber.

The most interesting of these rules to me is the Finance Rule, which is triggered when the S&P 500 index drops a percentage. I mean, you just have to give points to Qapital for creativity.

Take a look at some of the IFTTT rules:

Apple Health, Strava and Fitbit

Want to add more fun to your fitness goals? With Qapital, you can reward yourself when you complete your fitness goals by saving a few dollars. The more fitness goals you hit, the more you save towards your saving goals.

Amazon Alexa and Google Assistant

You can set up your voice assistants to save some money whenever you say a preset phrase like, “Alexa, Save me some..” If you preset $5, you get $5 to get towards a savings goal of your choice.

Budgeting with Qapital

Qapital has 2 main budgeting features; Payday Divvy and Sweet Spending Spot. It also has 2 rules closely tied to budgeting, which were discussed earlier; the Spend Less rule and the Guilty Pleasure rule

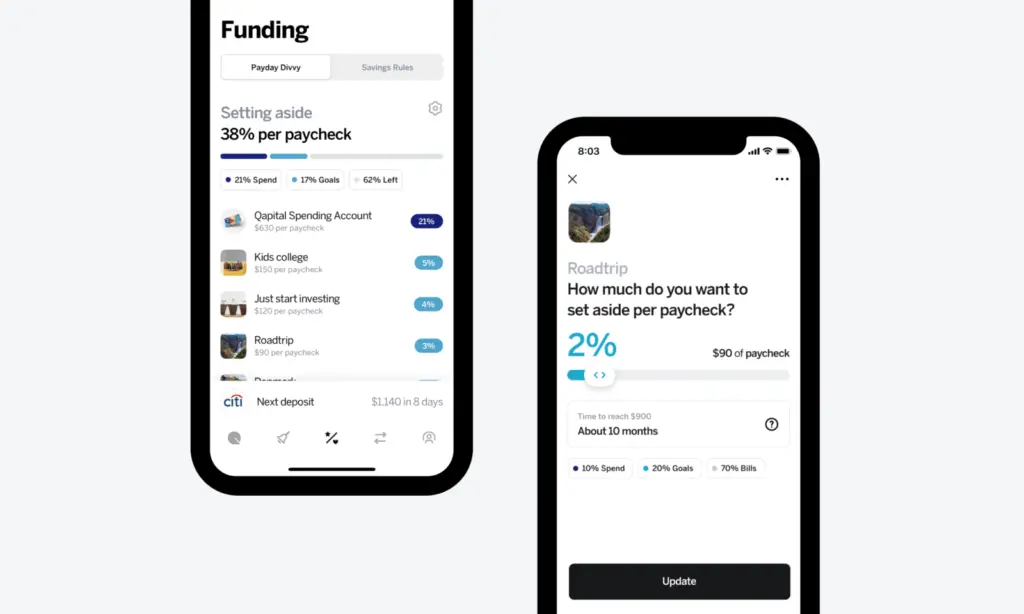

Payday Divvy

The Payday Divvy feature is Qapital's way of making budgeting easier for you, especially if you're not a fan of detailed budgeting.

How do you use Payday Divvy?

Tell the app how to divvy up your paycheck by percentages to different expenses. Simply assign percentages for savings, investments, and everyday expenses.

Once you get paid, money gets automatically transferred to those accounts.

The rest of your paycheck stays in your linked bank account to take care of the rest of your expenses and bill that aren't within Qapital.

Sweet Spending Spot

Think of all the things you buy at least once a week, like groceries. Those are the expenses that you put within your sweet spending spot.

It's a feature that focuses on weekly budgeting your daily expenses. It helps you monitor your day-to-day spending.

The idea is that it's easier to stick to weekly budgets for things you buy every day compared to a monthly budget.

Also, a weekly budget would probably be easier to follow than one for the entire month.

You can adjust your sweet spending spot each week until you find the right amount that keeps you on track with your goals.

Learn More:

How to Budget and Save Money

Free Budget Templates and Spreadsheets

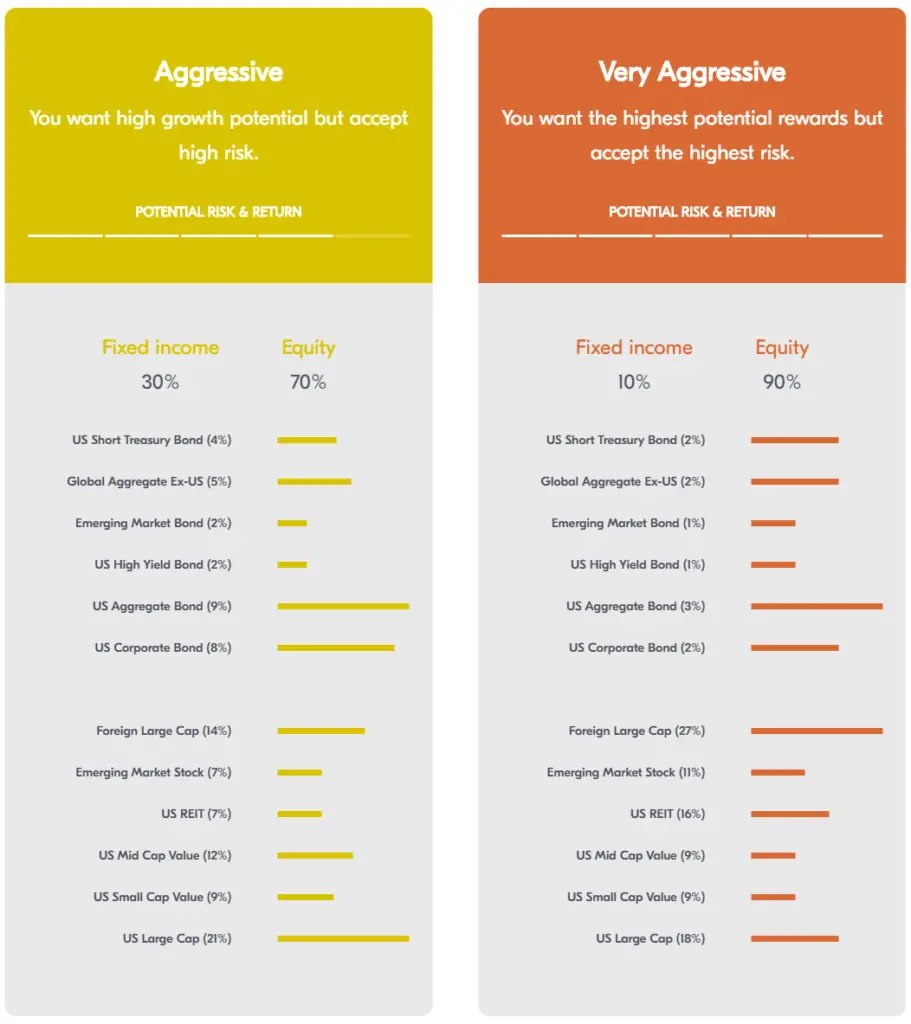

Qapital Invest

Qapital created an investment platform that's designed to appeal to both experienced and beginner investors.

Your investment goal funds are placed in an ETF-based portfolio that suits your expected time horizon and the level of risk you're comfortable with.

There are 5 different portfolios based on risk vs return and invests in 12 different asset classes.

How does it work?

You start by naming your goal and stating how much you want to save. Then, pick a timeline for when you want to save it.

Qapital would calculate how much you should save a week on average based on an estimated 5% growth rate.

Next, you'll be asked a few financial questions that will generate a risk profile based on your answers. Qapital will then recommend a portfolio for you based on your risk tolerance and the timeline to reach your goal.

Now, you can go ahead and fund your investment account with a deposit or set rules to add money directly to your goals.

My Qapital Experience – I Saved $20,000 in 1 Year Without Thinking

So here's the thing, I wanted to boost my savings and found out about an app that automatically saves money for you based on rules you set. I knew of Acorns and Digit (which I used for a while), but I was intrigued by the features of Qapital, so I decided to try it out with the 30-day trial.

Meanwhile, I was already contributing money monthly to my retirement account and regular investment account, so I thought I could just use Qapital to save some petty cash for fun money or other things I like.

Besides, Qapital would be saving in bits and pieces anyway and not in chunks, so I figured it wouldn't hurt.

Well, I created different saving goals just to test drive the app. I set up a couple of rules for the saving goals and used Qapital invest for one of the goals.

I was excited when I saw how easily Qapital helped me save extra money and decided to stick to it after the first month.

Fast-forward to 1 year later, and I'd saved $20,958 in total with Qapital, net total after a couple of withdrawals along the way.

Here's a breakdown of the goals and rules I used:

| Savings & Invest Goals | Rules I Used | Return Rate | Time Period |

|---|---|---|---|

| Travel Life | Round-Up Rule Payday Rule: 4% of deposits over $50 | 0.10% | 2 months |

| Emergency Fund | Round-Up Rule 52 Week Rule | 0.10% | 12 months |

| Education | Set and Forget: $50/week 52 Week rule Round-Up | 0.10% | 12 months |

| Build Wealth (Qapital Invest) | Payday Rule: 10% of deposits over $50 | 10.73% | 8 month |

| Build Wealth (Qapital Invest) | Set and forget: $56/week | 22.1% | 12 months |

So, I intend to keep using Qapital and add more rules to help supercharge my savings. I'll be sure to keep you all updated, but I recommend taking it for a spin yourself.

Qapital

Save, Budget, and Invest easily with Qapital. It takes off the work from you and helps you do all these and more.

Qapital's Other Features

Dream Team

This is a great feature for couples to manage money together and create shared saving goals. With Dream Team, you both get one overview of both your finances. You can decide which balances you'd like the other person to see.

With payday divvy, you can also choose how both paychecks should be divided to cover your shared expenses. Notifications also let you stay on the same page with each other's spending and transactions.

You're also able to make instant transfers between each other's spending accounts while also keeping each other motivated to achieving your financial goals together.

Money Missions

With this feature, Qapital provides fun challenges that help you learn about how to use your money better.

It provides insights into how you use your money for two reasons: to learn about yourself and to help you spend in new ways optimized for your happiness.

One of the missions is “Cancel a subscription and put the money toward a goal”.

The mission is there to make you reflect on which subscriptions make you happy and which ones you can do without. Then you can cancel one of them and save the money toward a goal.

Give $5, Get 5 Referral Program

Qapital has a referral program that allows you to get $5, and your referred person also gets $5. You'll be given a referral link that should be used by your referred person to sign up.

To get your bonus, they must sign up with your link and make a deposit towards a Qapital goal. Their account must also be in good standing for 45 days. After that, both parties will receive a $5 bonus.

Deposits and Withdrawals

When you initiate a deposit from your funding account, it'll take 1-2 business days to become available in your Qapital account.

Automatic transfers funded through rules set are deposited in batches into your goals accounts up to 4 times a week.

To transfer a recent deposit from your Qapital goals account back to your funding account, the deposit has to settle in the goals account for 4 days before it can be transferred back.

Withdrawals take 1-2 business days to be available in your funding account. Your Qapital Visa card can also be used for transactions or to withdraw funds from an ATM.

Whenever you initiate a withdrawal, there's no cost to you.

Customer Support

To contact the support team, you can reach out directly through the app or by emailing them. However there's no phone support

Plans, Fees and Pricing

Qapital offers a free 30-day trial to let you figure out if the app works for you. How much does Qapital cost after the trial period? There are 3 different plans with different features and pricing.

| Features | Basic $3/mo | Complete $6/mo | Master $12/mo |

|---|---|---|---|

| Create unlimited, personalized saving goals | ✔️ | ✔️ | ✔️ |

| Make fun rules to trigger automatic saving | ✔️ | ✔️ | ✔️ |

| Transfer money between goals easily | ✔️ | ✔️ | ✔️ |

| FDIC-insured up to $250,000 | ✔️ | ✔️ | ✔️ |

| Swipe and save with a VISA® debit card | ❌ | ✔️ | ✔️ |

| Pay yourself first with Payday Divvy | ❌ | ✔️ | ✔️ |

| Track cash weekly with Spending Sweet Spot | ❌ | ✔️ | ✔️ |

| Qapital Invest | ❌ | ✔️ | ✔️ |

| Money Missions | ❌ | ❌ | ✔️ |

| First Look at new features | ❌ | ❌ | ✔️ |

So, Is Qapital Legit and Safe?

Qapital is partnered with Lincoln Bank where all your savings are kept in FDIC insured accounts with insurance on up to $250,000.

Qapital makes use of the latest and strongest SSL (Security Sockets Layer) and TLS (Transport Layer Security) encryption standards.

Your login information and Social Security number are never stored on Qapital servers, so you can rest assured your personal information is safe.

To ensure that only you have access to your account at any time, Qapital allows Passcode Access, Face ID, Fingerprint ID, and Remote Lock for you to choose from to login securely to your account.

Pros & Cons

PROS

- Makes it easy to develop a saving habit for money-saving newbies

- Allows you to set multiple saving goals at the same time

- Allows recurring deposits in addition to the saving rules

- Provides the opportunity to save often and regularly by tying saving triggers to routine activities

- Makes budgeting stress free for laid back budgeters

- Easy to get started with Investing for beginners

- Provides different investment portfolios that match your goals timeline and risk tolerance

- Low maintenance fees for large investment accounts

- It automatically pauses transfers from your fund account once your balance drops below $100

- No Transfer fees

- Comes with a Visa debit card

- Can use the app without having a Qapital bank account

- Funds are FDIC Insured.

- No minimum amount to open an account

CONS

- No web or PC version of the app can only use on a mobile phone

- Charges a fee for International transactions

- High maintenance fees for small investment accounts

- Customer service can only be reached through email or message in the app. No phone support

- The master plan features don't justify the higher cost

- Transfers take a long time to settle into the accounts

Use the Qapital Money App…

> If you want to get into the habit of saving money very easily. Qapital makes saving painless by allowing you to save money in minimal amounts while living your life normally.

> Also, if you're a fan of the percentage budgeting method, or you just don't want to bother about how much $$$ to budget to every single category of your expenses, then give Qapital a try. You're also able to easily see how much you have to play with each week using the sweet spending spot feature.

> If Investing is difficult for you and you don't know where to start. However, if you have a small investment account, a cost of $72 a year ($6/month) for maintenance is too high.

For instance, a $500 investment account with a $72/year fee equates to 1.44% maintenance cost. Whereas, a robo-advisor like wealthfront that also automatically invests your money based on risk assessment has a 0.25% maintenance cost. Besides, wealthfront accounts with $5000 or less have no maintenance cost.

> However, if you're an investor with a large account over $28,000 and you don't want to get actively involved in investing in individual securities by yourself, then this is a very cheap option for you with lo maintenance fees.

> Also, if you're a freelancer, this app is great to help you put aside money for your taxes and save you the hassle of figuring out how much to pay the IRS during tax season.

Look Elsewhere if…

> You're already an expert saver and Qapital's fee of $3 for the basic saving plan won't give you any new value.

> You have a small amount of money to invest, and you're looking for where to start from. Check out Wealthfront instead, though you need a minimum of $500 to open an account

Bottom line

Qapital offers a great chance to get started with money-saving without putting too much thought into it. The different sets of rules help to supercharge your savings and reach your goals faster.

It makes saving fun, budgeting easy, and investing stress-free. Overall, it's a money app that does everything your money needs to work well for you.

I would like to thank you for this article, I never knew that there was an app that could save you money. This is very interesting. However, I do not think that this is for me. I do not beleive in paying for something that is supposed to help me save money. Defeats the purpose for me. I would like to ask a question, how were youable to box your affiliate disclosure the way that you did?

Yeah, that’s can be a put-off for some, especially when you don’t have any trouble saving already. As for the box, all I did was give the text a background color.

First I would like to thank you for this article, I never knew that there was an app that can help you to save money. I can see how the whole concept can be very helpful. Second, I do not beleive in paying for something that is supposed help me save money. Kind of defeats the whole purppose for me any ways. I would like to ask you how you were able to box your affiliate disclosure like you did.

This is literally what I needed! I have a friend who has been struggling to save money and he’s tried EVERYTHING aro start saving money and his toxic spending behavior is just too much… I decided to do my own research for him and o think I found the perfect article for him to read because this app seems to do wonders! Thank you so much for this!

That’s awesome Misael! I’m glad you found this helpful. Hope your friend finds the app useful as well.

Nice site and nice post.

Do you know that setting rules and goals in savings and implementing them can be some how difficult in a world like ours with limited earnings and higher spendings. Now, Mosun, its really nice to see an app that can help one save and it’s really not easy saving from just outside a means of saving like having such app to help you with it. I would love to have this app so I can check in from time to time and see how much I’ve saved From my little earnings, at list saving will be stress free. At times, people fail to reach a set goal because of the absence of a guide. But now, with such app like Qapital you’ll have a lot to save and it will help you manage your spending. Great work and more ideas man.

Wow what a great article on the Qapital app. I have never heard about this application and sounds very interesting. We all actually need something or someone to help us save money (in case we all are like me 🙂 ) Savings are always more than welcomed! I like the programs they offer.

Now if you will allow me to ask.. I saw in your cons that you have written that the maintenance fees are a bit high. Do you still think it’s worth?

Haha Sunny, we are many like you.

Yes, the cost is relatively high if you’re looking to use it for investing and you have a small account, because there are cheaper services like wealthfront that also automate investing for you.

However, anyone that needs help saving can benefit from the rules feature. Also, with Qapital, using the rules for investing can also help you invest more easily. So, it’s worth it based on the value you expect to get from it.

Nice site and nice post.

Do you know that setting rules and goals in savings and implementing them can be somehow difficult in a world like ours with limited earnings and higher spendings? Now, Mosun, it’s really nice to see an app that can help one save and it’s really not easy saving from just outside. A means of saving like having such an app will help you with it. I would love to have this app so I can check in from time to time and see how much I’ve saved From my little earnings, at list saving will be stress-free. At times, people fail to reach a set goal because of the absence of a guide. But now, with such app like Qapital you’ll have a lot to save and it will help you manage your spending. Great work and more ideas man.

Godspower, You’re absolutely right about saving stress-free. I’d like to know how using Qapital helps you save better. Feel free to drop by with an update anytime 🙂

Thanks!

The habit of saving isn’t in all of us and in fact some people are better than others when it comes to saving and on the other hand, we all have different expenses to handle. Nonetheless, with an app that helps you have no how, you’ll have something to call a savings and it will be all good. I still would love go learn more about Qapital investments

Thank you for this review on Qapital. I like the dynamics of the app. And it has many cool features. I like the approach they gave it with Guilty Pleasure Rule. It’s cool you get to save when you actually give in.

I like its referral program. And it’s affordable. I’ll give it a try. Thank you!

Interesting app for sure. I am always looking for ways to make saving and budgeting less stressful. This sounds like it may be a solution for that. The one thing I didn’t like was the fact that there is no phone support and that you have to do it on a phone. I would certainly prefer to be able to use it on a PC.

I do like the many options for saving though. It may be worth trying it for the 30 day trial period.

Thank you for sharing this, I had not heard of this app before now. Do yse this app and if so, how has it worked for you?

Yeah not having other versions of the app is a bummer especially if you like to see things on a bigger screens. Yes, I have the app and I’ve been using it for about 6 months.

I set all the rules and goals that i wanted several months ago. I just love how I’m able to check in from time to time and see how much I’ve saved without even feeling the impact. It really makes saving stress free.

Hello Mosun, its really nice to see an app that can help you have and it’s really not easy saving from just outside a means of saving like having such app to help you with it. Most people fail to reach a set goal because no guides to it and with such app like Qapital you’ll have a lot to save and it will help you manage your spending. Clever idea