There are deliberate actions you can take to build excellent credit as a young adult. These actions will directly help you achieve a great credit score from scratch. You can also rebuild bad credit by following this guide.

Lenders always want to make sure you can pay back before they approve you for a credit account. This includes getting a mortgage for a house, a car loan, or a personal loan.

They determine this based on your credit history and credit. Also, they look at whether you've been making regular payments to other lenders on time.

You're probably wondering how you can prove all of that when you've never had a chance to use credit.

This article would explain everything you need to know about building credit and getting a great credit score.

You'll learn how you can start to build credit and how to boost your credit score fast. You'll also see how long it can take to build great credit based on my experience.

Finally, you'll know how to maintain an excellent credit score and how good credit can work for you.

If you aren't keen on reading a long article, there is a “Key Takeaways” portion at the end of the article just for you 🙂

What Affects Your Credit Score?

Before you can build your credit score, you have to first understand the factors that affect a credit score. There are 3 major credit scoring companies/credit bureaus in the United States:

- TransUnion

- Equifax

- Experian

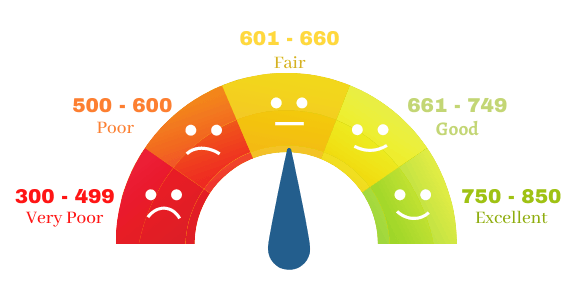

Credit Score Ranges

750 – 850: Excellent

661 – 749: Good

601 – 660: Fair

500 – 600: Poor

300 – 499: Very Poor

Your score may vary slightly depending on the model used by the credit reporting companies, but the following factors are typically considered:

1. Payment History – 35% to 40% (High Impact)

Your payment history has the largest impact on your credit score. This constitutes making timely payments and avoiding missed payments.

Paying less than your lender's minimum required amount is considered a violation of the agreement and will negatively impact your score. If you can't pay the minimum amount, call your credit issuer as soon as possible to find out what your options are.

Strive towards a 100% on-time payment history as this contributes about 35 to 40% of your score.

Payment history doesn't apply to just credit card bills and loans. It applies to other bills such as utilities, rent, phone bills, hospital bills, etc.

Technically, the companies in charge of these bills do not report to the credit bureaus. However, if your unpaid bills get sent to a debt collector, the debt collector reports the account to the credit bureaus.

Unpaid bills and missed payment reports can stay on your credit file for about 7 to 10 years. This will greatly affect your credit score and lenders' decision to approve your loan and/or credit applications.

2. Credit Card Utilization – 20% to 30% (High Impact)

This measures how much you owe relative to your total credit limit. In other words, it's the percentage of how much credit you use relative to how much total credit you have.

According to lenders, carrying a high balance or a high fraction of your total available credit is considered risky behavior.

Generally, it's advised to keep credit utilization below 30% of your total available credit. You can do this by using your credit cards infrequently and by keeping your balances low.

3. Average Age of Credit History – 15% to 21% (Medium Impact)

The longer your credit history, the higher the average age of your credit, and the better your credit score will be. It factors in your longest credit account to your newest credit account.

It basically shows how long you've been responsible with your credit. Adding new credit accounts will lower the average age of your credit history.

4. Number of Accounts and Credit Mix – 10% (Low Impact)

The number and variety of accounts you have also has an impact on your credit score. Credit mix refers to having credit cards, mortgage, auto loans, and other types of credit accounts to your name.

Essentially, there are two main types of credit: Installment and Revolving credit.

An installment credit account is usually in the form of a loan with a set loan term and monthly payment amount. You typically make the same payment amount every month. Examples of this credit type are mortgages, student loans, and auto loans.

A revolving credit account is a form of credit that lets you borrow money repeatedly up to a set amount and pay it back over time. Examples of revolving credit are credit cards, personal line of credits, and home equity lines of credit.

Revolving credit typically boosts credit score faster than installment credit. Making a payment towards your credit card's balance can increase your credit score by up to 10 points or more.

I've had instances where my credit report showed a decrease in my mortgage balance and auto loans. But, there was no change to my credit score. However, when I pay off the balances on my credit cards, my credit score can have over a 10-point increase.

5. Hard Inquiries/New Credit – 4% to 10% (Low Impact)

This considers any recent credit application activity, such as applying for a mortgage, credit card, or auto loan. When a lender pulls your credit report, your report registers that as a hard inquiry.

Opening too many accounts simultaneously would show up on your report as too many new hard inquiries, which raises a concern with lenders.

It could signal a very risky behavior, such as a tendency to overspend or trouble paying bills, and will ultimately hurt your score. Hard inquiries typically stay on your report for up to 2 years.

The general rule of thumb is to have at least a 6-month gap between new account applications.

Where Should You Start From?

Building credit from scratch doesn't have to be a daunting task, and you can start building credit right away with the methods below.

1. Get a Starter Credit Card

A starter credit card is just as its name implies. It's a credit card for people who have no credit history and are looking to start building credit.

As a young adult looking to build excellent credit, you can easily get approved for a starter card without any prior credit experience or history.

There are three types of starter credit cards: student credit cards, secured credit cards, and unsecured credit cards for bad or no credit.

Related Read:

Budgeting Tips for Young Adults: How to be the Master of your Finances

Student Credit Cards

These are credit cards for college students. If you're a college student, you have a good chance of qualifying for one of these.

Some credit cards may require you to have fair credit, but most student credit cards don't require you to have established credit already.

Some student credit cards may allow you to earn cash back on purchases and have some other perks. You can also upgrade from a student credit card after graduation. Student credit cards typically have:

- No annual fee

- No deposit

- High-interest rate

- Limited or no rewards

- Low credit limit

See the Best Student Credit Cards to Start Building Credit

Secured Credit Cards

Remember how lenders like to see you've been financially responsible in the past? Well, a secured card is a way for you to put your money where your mouth is. To get a secured credit card, you're required to make a deposit, usually in the amount of the credit limit.

With some secured credit card issuers, you can get your deposit back after a couple of months or years of demonstrated responsibility. Some will give your deposit back to you when you close the account.

(I got my deposit back after two years of using a Wells Fargo secured credit card).

The secured deposit is a way for issuers to take transfer some of the risks to you. Secured credit cards typically have:

- Annual fee (not all secured credit cards)

- Deposit (credit limit amount)

- High-interest rate

- Not a lot of perks

- Low credit limit

Unsecured credit cards for bad or no credit

Unsecured credit cards are for people who have poor credit or limited credit history. It's a regular credit card that doesn't require a deposit to qualify for. However, it has a couple of downsides.

Poor credit is generally identified at or below a credit score of 579. People with poor credit and limited credit history are considered high-risk borrowers. With that score range, it becomes difficult to get approved for credit cards with good deals.

An unsecured credit card for bad credit may require you to pay a one-time entry fee, an annual fee, and a very high interest upward of 25% APR.

Yes, the unsecured credit card is scary. The high interest is there because of the high risk to the issuers and to keep you cautious.

The great thing is that you never have to pay interest on any credit card if you pay off your balance in full every month. Unsecured credit cards for poor credit typically have:

- High-Interest Rate

- Annual fee

- One-time processing fee (not all of them)

- Limited rewards and perks

Store Cards

“Would you like to take 15% off your purchase today and 3% off online purchases with our XYZ card?”

Sound familiar? Yes, those are store credit cards, and they can help you quickly build credit.

Store credit cards usually have very high-interest rates and low credit limits. Applicants with limited credit history typically get approved easily.

Note of caution: Be careful not to spend more than you can afford with a store credit card! It's very easy just to go berserk while shopping at your favorite store with a store card and be left with unwanted debt.

The same rules apply here: pay off your balances, make payments on time, and don't miss any payments.

2. Apply for a Credit Builder Loan

A credit builder loan is basically like a savings account with negative interest. It's a loan that's just to build credit and increase your credit score.

The process involves you taking out a loan and funding that loan yourself. Here's how it works.

- You apply for a loan amount, for example – $1000

- You're given a loan term at an interest rate – say 12 months @ 12% interest.

- The lender deposits $1000 into a “savings account” that you cannot access until the loan is paid in full.

- You make monthly payments of ~$94 on time for 12 months to build a credit history.

- The service provider sends positive credit report to the credit bureaus.

- At the end of 12 months, you would have paid off your credit builder loan in full.

- Then your savings account would be unlocked, and you get the $1000 you applied for.

At the end of 12 months, you would have paid ~$120 in interest to the service provider. But you would have also proved credit responsibility through timely payments.

With an established 12-month credit history, your credit score would most likely increase.

Typically, you can get a credit builder loan from small lenders such as local community banks, credit unions, and online lenders.

3. Become an Authorized User

As a young adult, you can “piggyback” off someone else's excellent credit to build yours. This is done by getting a relative or significant other (or anyone that trusts you) with a great and long credit history to add you as an authorized user on their credit card account.

This will add that card's payment history to your credit info and help boost your credit score. You don't have to use the card at all to benefit from it.

This is also a way for someone under 18 to start building credit. You can be added as an authorized user to your parent's credit card.

Usually, banks have a minimum age requirement for adding a minor as an authorized user. So, the primary cardholder has to check with the bank to find out the age requirement.

You also want to check to ensure that the credit card issuer reports authorized user activity to the credit bureaus. If that's not the case, being an authorized user won't impact your credit score.

Lastly, your credit score and credit history are tied to the primary cardholder. So, make sure that you do this with someone with a history of paying on time. You want to do this to avoid hurting your score any further.

4. Cosign a Loan

If you need a loan, for example, to buy a car, then you can get someone with great credit to cosign the loan. A cosigner with excellent credit can help you get approved for a loan. They can also help you get a better rate than you would have gotten without them.

You're also able to build your credit this way and boost your credit score with on-time monthly payments.

The cosigner's credit will be affected negatively if you don't make payments on time. The cosigner would also be held responsible and required to pay your debt if you default on your payments.

So typically, your cosigner would have to trust you enough to take the risk and cosign a loan with you.

Note: Do not get a loan just to build credit. If you don't need a loan, use another credit building method to establish credit.

5. Be Responsible with Your Student Loan

By managing your student loan properly – making regular payments, not missing any payments – you can establish credit. Student loans get reported to the credit bureaus; therefore, defaulting on student loans would hurt your credit.

However, just student loans wouldn't a huge impact on raising your credit score quickly. That is why you should also use additional methods to build your credit.

Related Read:

12 Smart Ways to Pay Off Debt Fast and be Debt-Free

How to Build Your Credit Score Fast

Now, you understand the factors that affect a credit score and how to establish and build credit. It's easier to understand how you can increase your credit score quickly.

1. Get a Credit Card

Apply for a credit card that gets reported to the credit bureaus. Credit cards have more credit score-increasing influence than loans.

2. Pay Bills on time

Pay all your bills on time every month. Payment history takes the highest chunk of impact (at 35-40%) on your credit score.

Missing a payment can lead to a derogatory mark that can stay on your credit for about 7-10 years on your credit report.

You can utilize your lender or bank's online services and apps to schedule auto-pay for your bills, so you don't accidentally miss a payment.

There are also a couple of budgeting apps that provide you with a bills calendar and send you a reminder for your bill payments.

3. Make Use of Your Credit Card and Pay off the Balances Monthly

Use your credit cards and pay off 100% of your balances before the statement (closing) date. As long as you make a purchase with your credit card and pay it off, you're golden. Your credit score would thank you.

Related:

32-realistic-ways-to-save-money-very-easily

4. Keep Credit Card Utilization Below 30% – 10% is Even Better

Use your card sparingly and strive to keep your credit usage below 30%, or even below 10% if you can. Your credit card utilization has the second-highest impact (20%-30%) on your credit score.

Especially if you're just building your credit, you should use a credit card only to improve your credit score.

What that means is, you should aim to only use your credit card for an amount that you can afford to pay off right away (below 30% credit utilization, of course).

That way, you're not stuck with a balance that you cannot afford to pay off completely at the end of the month.

5. Increase your Credit Limit

If you've established some credit history and demonstrated continuous credit responsibility with on-time payments and keeping your balances low, then you can always ask your credit card company to increase your credit limit. However, it's up to the company to approve or decline your request.

By increasing your credit limit, your credit card utilization drops as long as you maintain the same level of credit card usage you had before the limit increase. This would also lead to a boost in your credit score.

6. Pay More Than the Minimum Payment Required

I'm an advocate for paying off your entire balance on a credit card, so you don't have to pay any interest on it.

However, if you have to carry a balance on your credit card, try to pay more than the minimum payment required by your lender or credit card issuer every month. This way, you can pay down your debt faster and have a lower credit utilization as well.

7. Check Credit Report at Least Once a Year and Fix Issues

Make a habit of checking your credit report regularly to make sure that there are no issues with the information.

If you find any issues, you should immediately dispute it with the credit bureau. You're also able to quickly identify if there's an identity theft issue relating to your credit.

You are allowed a free credit report from each of the 3 nationwide credit reporting companies once a year, and you can order the reports from each company at the same time or at different times.

You also have access to several other free credit monitoring companies such as credit karma, credit sesame, nerd wallet, and a couple of financial apps such as Mint and Clarity money.

My bank (Wells Fargo) also provides a free credit score monitoring service through the bank app, so your bank may be doing that as well.

8. Apply for Credit Cards and Loans Only as Needed

Don't apply for any credit account just for the sake of building credit. You don't have to go into debt to boost your score. However, if you apply for multiple accounts, try to ensure there's a 6-month gap between new accounts.

9. Become an Authorized User

You can quickly add a couple of points to your score by getting added as an authorized user to a credit card of someone with excellent credit because that card payment history gets added to your file

How Long Does it Take to Build Excellent Credit?

There's no definitive answer for how long it takes to build great credit because it depends on many individual factors, but I can say what my personal experience has been.

Generally, it takes 3-6 months to establish a credit history with the major credit bureaus. However, some industry experts say that you need about 7 years to have good credit.

Let's take a look:

- My first credit account was a secured credit card with Wells Fargo in February 2017(3 years ago) with a $300 credit limit.

- Over time, I got more credit cards, cosigned a car loan, and got a mortgage (all before Dec 2018)

- As of December 2018 (that's how far back I can see my score history), I was at a score of 723 (using the VantageScore 3.0 model)

- As of today, I have a FICO score of 783 and a VantageScore of 768

- My average age of credit history is 2 years, 4 months.

I hit the 700+ credit score in less than 2 years, and all I did was follow the credit building methods and good credit habits discussed in this article.

So yes, it can take a long time to build good credit, but it can also take a very short time, too, depending on your financial situation and how well you manage your credit.

How to Maintain an Excellent Credit Score

“To whom much is given, much would be required” – The Bible [Luke 12:48]

Awesome! You built your credit to a 750+ score; now you have to make sure to keep it in that range. One thing to note is that the higher your credit score, the higher the score drop if you get a negative report on your credit file.

- A single missed payment can cause up to a 100 point drop for a score of 700+, so avoid that at all costs.

- You have to make sure to stick to the good credit habits that helped you achieve a great credit score in the first place and just keep polishing your credit.

- Strive to never carry a balance on your credit cards and pay in full every month because high credit scores are very sensitive to negative reports.

- Don't open new applications except you have to because a high credit score is susceptible to higher point-cuts if there's any negative credit activity.

- Create a budget, and stick with it to help you manage your spending habits, keep track of your bills and take control of your finances.

Learn More:

How to Budget and Save Money

15 Awesome Frugal Money Saving Ideas to Use Today

Free Budget Apps

Why Do You Need to Build Credit?

“I will prepare and some day my chance will come.” – Abraham Lincoln

If you someday want to buy a house with a mortgage, get a car loan, a personal loan, or even rent an apartment (for which most landlords require good credit), you need to build credit.

Whether any of these endeavors is on the horizon or still far away, building credit prepares you. Sure, cash is king, but great credit is leverage.

“Better to have, and not need, than to need, and not have.” – Franz Kafka

Your credit also determines how low of an interest rate you can get. If you're classified as a high-risk borrower, lenders tend to approve you for very high-interest rates.

For example,

Let's say you apply for a $20,000 auto loan and want to pay it off over 6 years.

If you have excellent credit (above 749), you may qualify for a 3.5% annual percentage rate (APR)

You will have a monthly payment of $308.

You'd pay $2,202 in interest over 6 years.

However,

If you have fair credit (low 600s), you may qualify for a pricier 8% APR.

Your monthly payment increases to $350

You'd end up paying $5,248 in interest over the life of the loan.

In this scenario, having great credit would save you $3,046.

You're also able to get the best reward credit cards. The best credit cards offer travel miles, introductory offers, or cash back every time you use them. Lenders typically approve only people with good or excellent credit for these cards.

In some cases, you may also be able to get a better insurance rate for your car or homeowner's policy because, in most states, insurance companies can use your credit information to create a credit-based insurance score.

Key Takeaways

As a young adult, it might seem like a daunting task to navigate credit building and figure out how you can build an excellent credit score.

Luckily, if you've had no prior credit history, here are the main keys to start building great credit as a young adult and beyond that.

- To get started with building credit, you can get a starter credit card. It can be a secured credit card, student credit card, unsecured credit card for poor/no credit, or a store credit card.

- You can also ask someone with great and long credit history to add you as an authorized user to their credit card, which would help your credit history.

- You can take out a credit builder loan, where you make monthly payments to a savings account until the loan amount is paid in full. After the loan term is complete, then you can access the loan.

- Properly managing your student loans can positively impact your credit file.

- Payment history and credit card utilization have the highest impact on your credit score.

- Pay all bills on time, don't miss payments, and avoid letting any debt go into collection. Derogatory marks are a huge points-dropper and can stay up to your score for 7-10 years.

- Keep your credit utilization below 30% every month. Strive to keep it below 10% if you can.

- Pay off your balances on your credit cards every month before the statement date to avoid paying any interest.

- Pay off more than the minimum required amount on your credit card balances to keep credit utilization low and pay debt faster.

- Have a good mix of revolving and installment credits.

- Apply for credit cards and loans only as needed.

- Try to keep a 6-month gap between new credit applications to reduce the number of hard inquiries. Hard inquiries can stay on your credit file for up to 2 years.

- Remember that the higher your score gets, the larger the point-drop for negative reports.

- Check your free credit report at least once a year from each credit bureau and regularly monitor your credit with free credit monitoring apps.

Feel free to leave a comment on any questions you might have or your insights and opinion about credit building. I would love to hear from you.

I found your article very valuable. You explained this whole subject of credit in easy to understand terms. Nearly every one of the scenarios you detailed resonated with me as I have experienced them myself. From starting out as a student with no credit, Attaining a great credit rating and then falling from grace because of bad credit habits.

The lowest level was when we had to declare bankruptcy. What I found amazing in your article was the steps to build up ones credit rating. Those were the steps we followed without realizing it to once again have a good credit score.

There was one point you made that made me pause – someone with a great credit credit score of 800 could have it fall to 700 just by being late with one payment. I thought that was a bum deal.

Many will find this article helpful besides young adults. Thanks for writing it.

Cheers.

Edwin

Great comment Edwin!

And Yeah, the higher scores get penalized the most. That’s why good credit habits are needed to maintain excellent credit even after you attain a high credit score.

Hello there Mosun, thank you for sharing this compelling and in my opinion, much needed article about young adults keeping an excellent credit score. Without a doubt, this article will be insurmountably helpful to those who have a problem with their credit score and just in general, managing their finances. Unfortunately this is not something taught in all aspects of schooling.

Thanks Beesan. You’re right, it’s appalling that a topic this vital to day-to-day living is missing from the school curriculum.

Financial literacy is one of the misunderstood topics and one can look back and trace why such is happening. The education system itself does not touch on the topic. Many people use credit for leisure and non-necessary lifestyle choices and in no time they end up not being able to settle bills and result in a poor score rate. On the other hand, a great way to improve one’s credit score is to use it for investments or assets. like making a property purchase with a credit card that brings monthly proceeds. Great article. Easy to read.

Great Insight Ezra. Thanks for your feedback

Your content is extremely helpful and thorough. Even though it was a long read I got some very good answers.

I wish all young people would read this and understand it! Too many have debt and don’t understand the consequences. I hope you can somehow target the younger generation.

I really get upset when my credit score lowers just because my life style does not warrant shopping at a variety of stores. As soon I limit my shopping to groceries, my score drops as much as 15 points. That seems very unfair. What do you think?.

Thanks again for your great educational blog.

Hi, I’m really glad you got your answers!

Your credit score doesn’t depend on where you shop or what you buy with your credit card. It could be that your’re not using your credit card for a while and it shows no activity. Sometimes that can cause a slight drop but not something so major. Or it could be some other reason.

I would suggest you get a credit monitoring app like credit karma. If there’s a score change, the app would always tell you what caused it, most of the time for me, it’s due to a balance increase. With the app, you can know exactly what cause the drop and adjust accordingly.

This is VERY helpful. I wish I’d had access to this information when I was a young adult. Honestly, it would’ve saved me from what eventually turned into a bankruptcy in my 20s. As someone approaching 50 now, I can look back at that time in my life with renewed clarity and sometimes I wonder how I got sucked into it all. My priorities were clearly backward and I kept telling myself that there was no reason I couldn’t pay it all back. What I wasn’t realizing was that even factors like my credit utilization habits themselves were already working against me. I definitely know some youngsters who could benefit from this and I intend to share it with them. Thanks for putting this out there!

Thanks a lot for your comment Mark, I hope more young adults can learn from your reflection

Hello Mosun, thank you for this really nice information. I have to say it means a lot to me. Because I have been meaning to learn about this for a while now but I haven’t really seen any good article that helps out with it. I have been really happy about this article generally and I’ve just shared with my wife so can learn too

Hi Justin, I’m glad you found the information useful. Hope your wife loves it too!

This is a really big thing. To be able to build a good credit score because it has its own very many benefits in the long run. I have been learning this from my dad but there’s no knowledge that’s a waste so it is good that you can tell me about this here on your website. Thank you so much for this information.

Thanks Suz, glad you found it useful.

This is really helpful, it is very Important for everyone to get across this kind of articles because it is going to help on a very good way and the mistakes almost people made won’t be yours to repeat again. It is true that you need to prove that you’re financially responsible before you can get a mortgage or loan, this article is really resourceful.

Thanks Bruce! Glad you agree.

Thank you so much for sharing this information here. Often, a major problem encountered by many is not having enough to manage their credit scores not to talk of boosting it. Hence, it becomes Paramount to know the tips to actually ensuring there is balance maintenance and in trying to maintain it all. Surely worthy to see here is the information here. Besides, would love to share this out to more people, with your permission.

Very true Nath. It’s always very good to start from the basics and understand the general concepts and factors affecting credit before it all starts to make sense on how to improve the credit score. Thank you for your feedback and of course, feel free to share as you so please.