Full Disclosure: To start saving money by using the frugal ideas in this post, you must be ready to change your personal habits.

Whether it's cutting down on unnecessary spending, going for cheaper alternatives, or investing time in proper maintenance of your stuff to improve efficiency, you're bound to have to make some sacrifices to get the best bang for your bucks and save some money.

This is the whole point of money-saving, frugal spending!

1. Adjust Your Thermostat

Take a look at what the Department of Energy (DOE) has to say about this:

“You can save as much as 10% a year on heating and cooling by simply turning your thermostat back 7°-10°F for 8 hours a day from its normal setting.

You can easily save energy in the winter by setting the thermostat to 68°F while you're awake and setting it lower while you're asleep or away from home.

In the summer, you can follow the same strategy with central air conditioning by keeping your house warmer than normal when you are away, and setting the thermostat to 78°F (26°C) only when you are at home and need cooling”.

The simple principle is that the closer your house temperature is to the outside, the lower your heating and cooling costs will be. You can read more about it here: Department of Energy | Thermostat Operation. The DOE also has some cool infographics about energy saving on heating and cooling.

2. Reduce Vampire Loads and Save up to $100 a Year

Again, according to our friends at the Department of Energy (DOE), you can save up to $100 by using an advanced power strip. This would help to reduce “vampire loads,” which is electricity that's wasted by electronics that are not in use. You can find these in your computers, kitchen appliances, TVs, Stereos, and gaming consoles.

So you're better off unplugging all electronics and appliances that are not in use or put them on a power strip and turn the switch off from the strip.

3. Energy Saving = Cost-Saving = More $$$ in your pocket

I promise we're not going to go into the Math behind this. Basically, your utility charges you for the electricity you use, or rather, the electricity your house appliances and equipment “say” they use. However, inefficient appliances draw more energy than they need, and the rest is wasted as heat. What that means is that you paid for the energy that was wasted.

Use energy-efficient appliances and electronics such as LED lights (incandescent lights waste 90% of the energy).

“By replacing your home's five most frequently used light fixtures or bulbs with models that have earned the ENERGY STAR, you can save $45 each year” – DOE

Also, consider ENERGY STAR-labeled office equipment next time you need to buy one.

“It can provide dramatic energy savings—as much as 75% savings for some products” – DOE

4. DIY for Major Savings

Today, there are many resources available online and YouTube tutorials that offer DIY help with almost anything.

From taking care of some repair work in your house, changing your car's headlights, making your own chemical-reduced laundry detergents and cleaning products, there are several videos and step-by-step guides a search button away from you. Here are some resources to get you started

- Home Depot Ideas & How-to’s

- The Family Handyman

- Ask The Builder

- DoItYourself.com

- Better Homes & Garden Home Improvement

- DIY Natural Blog

5. Make a Grocery List in Advance

Lists, lists, lists. Create your grocery shopping by making a list by looking at your refrigerator and pantry before you go to the store. Grocery stores are arranged with their attractive, giant aisles and aisles of food to trigger your impulsive buying. Ever walked into the grocery store wanting to get a “few things” and end up leaving with a cart-load of food? Yeah, that's why you should make a list of the items you want to buy and stick to your list only.

6. Use Coupons and Coupon Apps

Naturally, coupons are a way to get items at a sale price. Your regular grocery stores will occasionally have coupons for sale items, which you can sometimes find in the newspapers or the store's coupons pages.

However, you should also definitely consider making use of coupon apps to make this process easier. Some of these apps allow you to upload your receipt and offer rewards and points, which you can then redeem for gift cards.

A note of caution: Don't go overboard with couponing. It's easy to start buying things you don't need or use just because you can get a deal. Doing this will only cost you more money eventually.

Here's a list of some of these coupon apps:

- Wikibuy

- Honey

- Ibotta

- Rakuten

- Fetch Rewards

- SnipSnap

- Coupons.com

- Target Circle

- Coupon Sherpa

- SavingStar

Learn More:

Wikibuy Review: Will it Save You Money?

Can the Honey Extension Really Save You Money? | Honey Review

7. Trade Big Brands for Store Brands

You can save up to an average of 25%, according to industry experts, by going for the store brand option of an item. According to a blind tasting test performed by consumer reports in 2012:

“Our sensory experts found that the store brand and name brand tied in 10 cases, the name brand won in eight cases, and the store brand won once”.

Many have said that the store brands measure up in quality to the name brands, so try out the store brands and rack up some savings.

8. Cook in Bulk

Make your dishes in bulk and freeze them up. Cooking in bulk is more efficient with time, effort, ingredients, and even electricity/gas (depending on your stove type). Go ahead and plan your meals for the week and tailor your grocery list to these meals. Also, when you have food always available in your refrigerator, it can save you from impulsive pizza buys and eating out. So next time you want to cook, plan to get enough groceries for bulk cooking.

9. Reduce Convenience Foods

Yes they're convenient but they also quickly rack up in costs. I'm talking about the prepackaged frozen foods you get at the grocery stores, or candy, soft drinks, juices, fruits, and vegetables in fresh or preserved states, processed meats and cheeses, and canned products like soups and pasta dishes.

You're better off getting the fresh produce yourself and following a recipe and save yourself some money.

10. Eat at Home & BYOL (Bring Your Own Lunch)

In 2017, statistics by Statista showed the average spending of consumers in the United States on eating out, by age. In that year, consumers in the U.S. aged 45 to 54 years spent an average of 4,157 U.S. dollars on eating out.

11. Make Your Coffee Yourself

A cup of coffee here and there every day can eat very deeply into the average person's pocket. A poll by Amerisleep suggests that millennials (age group of 25-34) spend a shocking $2,008 per year, and the age group of 35-44 spend $1,420 on coffee per year.

Imagine spending this amount on coffee and then still eating out for lunch, whew!

Go ahead and get your own coffee maker and brew your coffee at home in the morning.

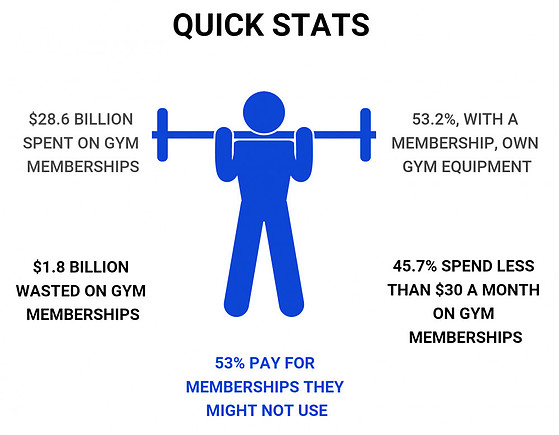

12. Cancel Your Gym Membership

Yeah, we all start the year with our new year resolutions of hitting the gym consistently, but if you're at the point where you don't use your gym membership at least twice a week, then you're better off without it. As a matter of fact, there are many fitness apps out there that you can get for free.

Statistics by finders.com

13. Skip the Car Wash Membership

You don't really need that unlimited monthly car wash. You can always take advantage of the free vacuum machines at the gas stations if your kids mess up your car with their cookies and fruit snacks. If you're not keen on washing your car yourself at home, then sure, you can occasionally do a basic drive-through wash, but it's not worth getting a membership for.

Let's face it, most of your time and effort is spent cleaning the inside of the car, so should you really be paying $10 monthly to wash the exterior of your car when you end up cleaning the inside yourself?

14. Take Care of Your Clothes Yourself

Whether it's taking your clothes to the dry cleaners or an alterations store, taking care of your clothes can quickly become expensive.

Yes, I know some clothes actually say “dry clean only,” and some clothing requires extra care. But this basically means you're not to machine wash and machine dry.

You can dry clean your own clothes by yourself at home. Now, I know you might be one of the frugal money-saving ideas on this list that you might stay away from, but all I'll say is to give it a try.

Also, there are tutorials on the internet on how to mend your own clothes. You can get a sewing kit and mend your clothes and your kids' clothes by yourself.

15. Create and Follow a Budget

This is the best way to plan out your money and expenses in advance. By creating a budget, you're consciously putting a limit on your spending habits and planning out your expenses in order of importance. Depending on the type of budgeting method you use, you can restrict the money allotted to as many categories as you want. This way, you can curb your impulsive spending, save money, and maximize your finances.

Most of these frugal ideas for saving money discussed are based on your normal day-to-day activities. You can pick a few to start working with right away. The bottom line is that you can save as much money as possible, depending on how committed you are to make a few changes and embrace frugal living.

I'd love to hear about the creative ways you save money. You can also leave a question in the comment box and I'd be happy to help!

Saving is the first step of Personal Finance. Wealth creation process begins only when we start saving. Saving is the first process which bring us to Financial Freedom. Saving always begins in your mind first then you start it in reality. Many individual always find it very difficult to give up their current enjoyment for the future which is uncertain. They always want to live today and take the day as it comes which is quite not good and that’s the reason more i should share this with friends and family too.

It’s very thoughtful of you to share this article, many people don’t know how to save money ans this affects them in a lot of ways because there are many ways you xan save money and have extra cash in your pocket and you’ve mentioned the best ones here, they’ll be of great help.

Being able to save money is very good and sharing this beautiful ideas is nice too. I like how you can give as many as 15 ideas on how I would be able to save money. It’s really good stuff. I thi k everyone wants to save money and that’s more reason why I should share this with my friends and family too. Thanks!

Hello Suz,

Glad you found some good ideas to start using. Go ahead and let more people in on it 😉

Given the current circumstances in the world, these really are some awesome frugal money saving ideas to use. Fortunately for my family, it seems we’re already following most of the ideas in this list. In our experience, pretty much all of the ideas involving food/groceries goes hand-in-hand with each other and works wonders with saving money.

Gladeno, that’s great that you already follow some of these. Yeah, sometimes food can eat up a big chunk of our money and we can save a lot from food alone.

Thanks for your comment!

During this difficult time, I am sure that we all need all the tips and tricks to save money. Hopefully, I cn go back to work soon. You are absolutely right. It is time for me to change my personal habits so I can save more money. I am guilty of the vampire loads myself, It is just so easy to just se it right away but I am going to make an effort to just switch it off fom now on. Thanks for the list of the DIYs, not only that this will save money but it can be a new hobby as well 🙂 The coupon ads is neat as well I am going to download the apps on my phone. Phew! Thank god that I have been listening to David Bach and also Dave Ramsey, I have been ditching my latte ever since. Thanks for sharing these awesome tips.

You’re right Nuttanee, we do need all the tips we can get. We’ll be better off in the long run by improving our spending and saving habits today.

I’m glad you found the coupon apps useful!