Happy New Year everyone! This 2021 is the year you might want to review and plan once more for a better financial year ahead. Have you set up your financial goals yet?

If you're unsure how and where to get started, let's go back to basics.

Truly, the lucky ones have been taught about financial matters from a very young age, maybe through knowledge from their parents or whether they took a personal finance class.

However, learning it along the way as you grow older is just as good, especially now that you are more mature and able to grasp the information and skills needed to improve your finances.

This 2021, let us make it one of our goals to enhance our financial literacy.

Related Read:

SMART Financial Goals To Live By For 2021 and How To Stick To Them

What is Financial Literacy and why is it important?

Financial Literacy is a skill everyone should have. It involves understanding the basic financial principles that help you manage your money effectively and wisely.

Being financially literate supports many life goals. For instance, if you have a basic understanding of budgeting, it can make way for great progress with your savings goals, such as paying off debts, having money to invest, or having a good household budget plan.

It is important because it will allow you to control your money instead of having money control you. Ultimately, mismanaging money sets one on a path to financial disaster and struggle.

The opposite of this is being financially illiterate.

Think of someone who can't read or write, it's certainly more difficult for such person to navigate life. In the same vein, someone who has no understanding of their money would have difficulty navigating their finances.

That's why being financial literacy is a life skill for everyone who wants to optimize their finances fully.

Who is a Financial Literate?

When someone understands the concept of budgeting, saving money, debt management, making extra income, and investing, you're on your way to becoming more than just financially literate.

Moreover, there are essentially two parts to financial literacy: knowing how to manage money and actually doing it.

Anyone can learn the basic principles of money management, but taking it further to implement it in your daily life is more important.

According to the 2015 Standard & Poor’s Global Financial Literacy Survey, Americans fall short in financial literacy. It's time we teach our kids the dangers of too much debt and how to secure financial freedom in the future.

Let's Go Back To Basics

The following are basic financial terms to become familiar with that will guide you through financial decisions you make in your daily life.

Net worth

It may be a term you think only fits for celebrities or business folks, but no.

Net worth is the difference between your assets and liabilities. What does it mean?

Well, contrary to what you may think, your net worth is an integral part of your journey to personal financial literacy. And, it is equally important that you know what it is and how it is calculated.

An asset is anything that you own that can provide future monetary value. Assets are anything that, when you sell, is worth an amount of money you would get to keep.

For example, the money from your bank account, investments, or real estate you own outright.

On the other hand, Liabilities are anything that you owe to someone. Maybe to a bank, a cooperative, or an individual.

Examples of liabilities are student loan, credit card debt, mortgage, or personal loan. In simple words, if you owe money to anybody else, whether it bears interest or not, it is a liability.

To calculate your net worth, subtract your liabilities' monetary value from the monetary value of your assets. The equation looks like this.

Assets – Liabilities = Net Worth

| Assets | Value | Liabilities | Value |

|---|---|---|---|

| Home Value | $400,000 | Mortgage Principal Remaining | $230,000 |

| Savings Account | $8,000 | Total Credit Card Debt | $5,000 |

| 401K | $15,000 | Student Loan Debt | $30,000 |

| Car Value | $23,000 | Amount Owed on Car Loan | $20,000 |

| Total Assets | $446,000 | Total Liabilities | $285,000 |

From the example above, the total net worth is simply the difference between the total assets and total liabilities. That is,

$446,000 – $285,000 = $161,000 => Net worth

Take note that this is for example purposes only and that yes, you can have a negative net worth.

Yes, it is possible. To get rid of that negative net worth, reduce your liabilities. But, it may take some time depending on your income and how you handle money.

To learn more about how to get rid of debts fast, read below.

Related reads: 12 Smart Ways To Pay Off Debt Fast and Be Debt-Free

Income

Likewise, when it comes to personal finance, everything starts with your income. You must know the two types of income: Active and Passive Income.

Active Income is when you exchange money for your time, performing a service, or selling a product. It comes in the form of a salary, hourly wages, or commissions.

While Passive Income does not need much active work. Think of it as income you can generate while you're sleeping.

Passive income is one form of making extra money. It may come from revenue from investments, dividends, rental income, or royalty income.

Budgeting

Of course, budgeting is a familiar term and is the backbone of personal financial literacy. It is a defined plan to guide how you spend your money and itt gives you a clear picture of how you're doing financially.

Therefore, a budget influences your financial decisions and behavior to keep you away from financial havoc. It is why budgeting is so crucial for you to understand.

For a complete, in-depth guide on budgeting, check out our post:

Related reads: How to Budget and Save Money to Transform your Finances.

Saving Money

This is Financial Literacy 101

Saving money is the process of setting aside extra cash for whatever future financial goals you are preparing for.

It may be for a large purchase, vacation, or paying down debt. Essentially, having extra money saved acts as a buffer between your current circumstances and future uncertainty.

It is smart to have money saved especially on “rainy days” or whenever you least expect an expense. Likewise, it is wise to save money for an emergency fund (3-6 months worth of your living expenses), a down payment for a home, car purchases, medical expenses, and the like.

Learn More:

Questions About Saving Money? Here are all the Answers You Need

32 Realistic Ways to Save Money Very Easily Without Giving up Too Much

Investing

Investing is an essential part of personal finance and is a direct path to build wealth. The idea is simple. You allocate a portion of your money to a lucrative asset that will make your money grow over, and in turn, increase your net worth.

Some examples of investments are real estate, mutual funds, stocks, ETFs, and index funds.

Investing is not just for the super rich. It's for anyone, and everyone should invest.

Compounding

Compounding is a real deal when it comes to building wealth. It works like magic and is one of the main benefits of learning how to invest.

The idea is your money earns money that then also earns money. Try to visualize it this way, you deposit money, and the bank pays you interest on your deposit.

For example, an initial deposit of $100 earns 5% interest, or $5, bringing your balance to $105. Then, in the second year, your $105 makes 5% interest, or $5.25; your balance is now $110.25. Afterward, in the third year, your balance of $110.25 earns 5% interest, or $5.51, so your balance is currently $115.76.

It's the same way with an investment in the financial markets. But instead of interests, it's dividends and returns that keep earning more money on your behalf.

See? That's the magic of compounding. However, compounding can also work against you if you're paying interest on a loan.

Compounding over a long time is how people become very wealthy and why investing is essential for you to learn and understand.

Learn More:

How to Start Investing Your Money Like a Pro – The beginner’s guide

Debt

We certainly cannot exclude the debt from the list of financial literacy terminologies as this a major topic many people struggle with.

Debt is any amount of money that you owe to someone. Therefore, you must understand how borrowing money works and how it can affect your overall financial health.

Here are basic debt terminologies you should be familiar with:

‣ Principal

It is the original amount of money borrowed or the remaining amount of money owed at any point during the loan term, not including interest.

For example, if you took out a $10,000 personal loan, your principal would be $10,000. Then, if you paid off $3,000 of the original loan amount (not including interest payments), your principal would be $7,000.

Remember, each monthly payment you make on a loan includes interest, so only a portion of your monthly payments counts toward the principal.

‣ Interest Rate

Express in percentage, (%) it is the amount of money in addition to the principal that you must pay. It can be a fixed or variable interest rate. From the word itself, a fixed interest rate is a guaranteed fixed amount while variable interest rate chanages throughout time.

‣ Collateral

Collateral is an item of economic value that serves as a means for a lender to retrieve the amount of money borrowed if the borrower fails to pay back per the agreed-upon terms.

For instance, if you take out a loan to buy a car and fail to make the payments, the lender can reclaim the vehicle you purchased and sell it to somebody else to make back the money you borrowed and didn't payback.

‣ Loan Term

The loan term is the agreed timeline and structure to which you should pay the debt. For example, if you take out a loan to purchase a home appliance and agree to pay back a lender in 12 months, the loan term would be 12 months.

Types of Debt

The following are the two basic types of debt.

Secured Debt

In general, a secured debt is a debt incurred to purchase a particular item that will, in most cases, serve as the loan's collateral.

For example, when you take out a loan to buy a house, the house itself will serve as collateral. That way, if you ever fail to pay back the loan, the lender can take back the house and sell it to recoup the money you borrowed.

Unsecured Debt

Unsecured Debt is a debt without collateral.

A great example of unsecured debt is an unsecured credit card. You are given access to a limited amount of money to borrow and spend without any collateral to protect the lender.

It is for this exact reason that credit cards carry such high-interest rates. Think of it like this, no collateral means more risk for lenders, and more risk for lenders leads to higher interest rates.

Credit Score

A Credit Score is a number used to determine someone's ability to manage debt. It helps lenders assess your creditworthiness and likelihood to pay back a loan. To learn more about credit and credit scores, read below.

Related reads: How to Build Excellent Credit Score – 9 Proven Ways.

Taxes

For basic personal financial literacy, it's a huge mistake to leave out taxes. Here are the three types of taxes you need to understand in personal finance.

- Income Tax – these are the taxes that are pulled out from your paycheck and imposed by federal, state, and local governments on individuals and businesses' income.

- Property Tax– taxes imposed by local governments on real estate. The amount you have to pay is based on the value of the property you own and is therefore subject to change over time.

- Sales Tax– Imposed on the sale of any goods or services, these taxes are imposed by state and local governments so that the actual tax percentage can vary greatly. Many states don't impose a sales tax at all.

How does Financial Literacy affect individuals?

There are more benefits of becoming financially literate, just as you reap the rewards of success and hard work. For starters, being financially literate allows individuals to increase their net worth.

Because you know how to budget the right way and understand how much money goes in and out, it gives you the ability to make reasonable financial decisions that reflect your current financial position.

There's also less financial struggle on your part because improving your knowledge of personal finance will increase your chances of experiencing success with money.

Additionally, when you are equipped with sound financial knowledge, you make wise decisions, pay bills on time, and better manage your household budget.

The more financially literate you are, the better your financial decisions will be, and you're more likely to avoid many financial hardships.

Who needs Financial Literacy?

EVERYONE! As I mentioned earlier, Financial Literacy should be for everyone. Regardless of your age, gender, race, or life situation, financial literacy is for everyone.

We must teach our youth and incorporate simple math skills that will surely go a long way.

Today, with many resources that you can access, learning to become financially literate is easy. There's no excuse because you can watch a financial vlog on Youtube or ask Google your questions.

Even better, you can check out TheFinanceBoost blog daily and get financial tips and updates that are tailored to you. We listen, and we care.

Get more financial insights delivered directly to you by subscribing to our newsletter. We'll bring you actionable money tips and insights that fit your lifestyle and experiences.

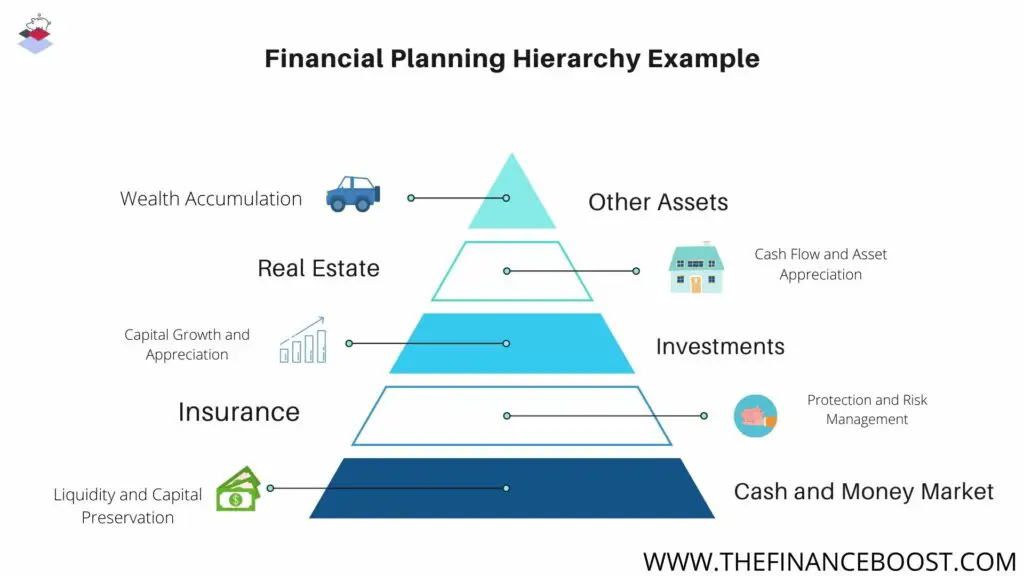

Are you familiar with Maslow's Hierarchy of Needs? Well, in finance, there's something also called the Basic Hierarchy of Personal Finance Planning.

Like how the bottom should be fulfilled first, for instance, liquidity and capital preservation – this is where you save up cash for, say, emergency fund or towards any savings goals you currently have.

Next, you can move on to protecting your income and then proceeding to grow it through investments.

Penultimate is asset accumulation and, finally, wealth. This is just a simple guide you can use when planning for your finances.

More Tools and Resources to Improve Financial Literacy

Books

1. Why Didn’t They Teach Me This in School? – Cary Siegel

Overview:

The author, Cary, realized that many subjects were taught in schools except the very one people needed to know how to manage their money.

This book was written to provide uncomplicated tips and important lessons on personal money management.

There are 99 principles discussed in this book, which sounds like a lot, but they are very straight to the point and very easy to understand and recall.

It's a great book for high school students, recent grads, and anyone looking to learn the basics of personal finance.

2. The Millionaire Next Door: The Surprising Secrets of America’s Wealthy – Thomas J. Stanley Ph.D. and William D. Danko Ph.D

Overview:

This book was born out of tons of research done on America's millionaires and how they acquired their wealth.

The millionaire next door might not look like what you were expecting, may not drive flashy cars, or live in mansions, but they all have some things in common.

In this book, you'll find out how you can become one of them.

3. Rich Dad Poor Dad – Robert Kiyosaki

Overview:

Did you think you need to have a high-paying job to become rich? Well this book would have you think again.

Robert talks about having two dads while growing up – his real dad (poor) and his best friend's dad (rich) – and how both of them influenced his views about money.

This book basically shifts your mindset from looking to work to earn more money to having your money work for you.

4. Your Money or Your Life – Vicki Robin and Joe Dominguez

Overview:

This book forces you to reexamine your priorities and have you question what part of your life you're giving up for the money you have.

It teaches you the basics of money and helps you develop a relationship with money where you don't have to sacrifice the things that matter to you for excess in your life.

At the end of the day, your money and life becomes one integrated whole.

Podcasts

Today, when we're all busy with something and always on the go, podcasts are the perfect way to get the information we need while we do other things.

You can listen to a podcast while in the car, on a jog, at the gym, or during your alone time. This makes it a great resource to learn about money and also get some entertainment in the process.

Here are 5 Podcasts I recommend to learn about financial literacy:

Final Thoughts on Financial Literacy

Remember, Knowledge is Power. Now that you have a basic idea of what and how personal finance works and what financial literacy is, it should drive you to start taking the time to look at how yours is going.

Yes, there's still a lot to learn. Besides, learning should be for life. But don't forget to share what you've learned as well.

At TheFinanceBoost, we genuinely want to see you, our dear readers and subscribers, become the ultimate bosses of your money and thrive financially. Together, let us hope for a better financial year this 2021.

Moreover, it should be ingrained in our children to learn something that will help them in life and improve our future generation's financial literacy.

Indeed, early preparation for personal finance will help them prepare for a better future.

What do you think of this article? Comment down below and share your thoughts. We'd love to hear from you about your financial journey for 2021.

0 Comments