Suppose you are minimizing debts, stashing enough money to hit your savings goal, or making extra money on the side. You're probably doing financially well.

However, if you have more significant financial goals such as financial independence, retiring early, or becoming the next billionaire, you probably need more than just saving money.

You must also know how much you are keeping and how long or fast you're going to achieve your financial goals. Isn't it makes sense when you know where you're heading to and how to get there?

Most people forgot the part of specificity. With vague goals came ambiguous results. If your goal is not clear to you from the very start, it would not be easy how you are going to get there and in which time frame.

This is also the part that I underestimated in the past. I was saving and keeping the money without a crystal clear reason or goal. So, I just set aside every money and then splurge it all in one. This is where I forgot to fill in the blanks- “I am saving money just because?”

From then on, I learned that every money that came into my hands should have a purpose. Each should have a job to fulfill because if not; it will be not long after it's gone, used in unworthy purchases, or wasted.

Therefore, let's talk about savings rate. What is it, and how would it help you in your savings journey?

Let's get it on!

Related: How to save 3000 in 3 months even in a low-income

What is savings rate and what does it mean?

First of all, there are two general categories of savings rates: The national and the personal.

The National Savings Rate

The National Savings Rate is the amount of income that households, businesses, and governments save. Think of it on a macroeconomic level.

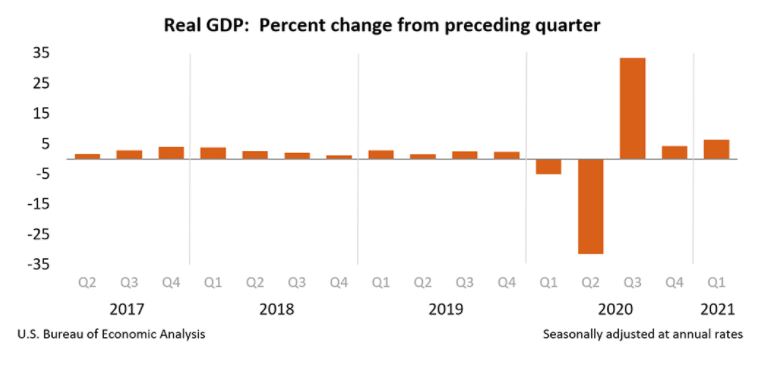

It is also a healthy economic indicator as it shows trends in overall savings, which can bloom investments. In contrast to GDP (Gross Domestic Product), which is the measurement of income earned from the production of goods and services in a country during a specific period, or the total amount spent on final goods and services (less the imports)

National Saving Rate is the GDP that is saved rather than spent on a nation's level.

The Personal Savings Rate

The second savings rate, a personal savings rate or simply a savings rate, is micro-level.

The personal savings rate is the percentage rate of an individual's savings. It is the ratio of personal savings to disposable personal income; it can be calculated for an economy as a whole or at the individual level.

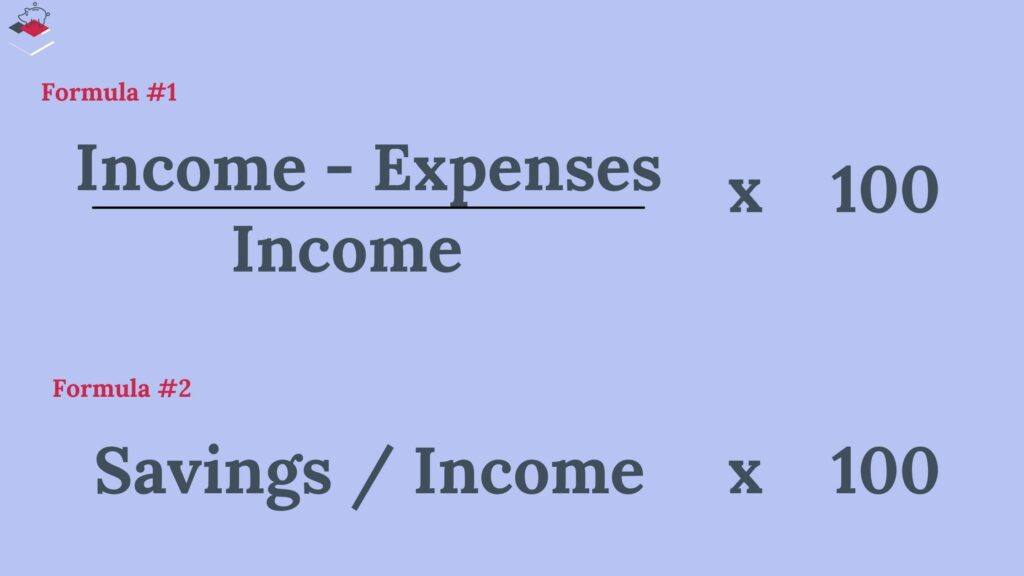

For instance, if you have $30,000 disposable income (left after taxes) and spend $25,000 in expenditures, your savings rate is 16%. Assuming you keep the $5,000 savings, of course. Here's a simple computation.

Divide your savings by your disposable income and multiply by 100. ($5,000/$30,000 x 100)

Or you can also use this long-cut formula: Income less your expenses, divided by your income, and then multiply by 100. Do the math, and you get the same result!

The 2021 U.S Savings Rate

Let me throw you some stats.

According to the Bureau of Economic Analysis (BEA), the GDP increased at an annual rate of 6.4 percent in the first quarter of 2021 (advanced estimate). This reflects the continued economic recovery from the pandemic, the reopening of various establishments for business, and continued government response related to the Covid-19 pandemic.

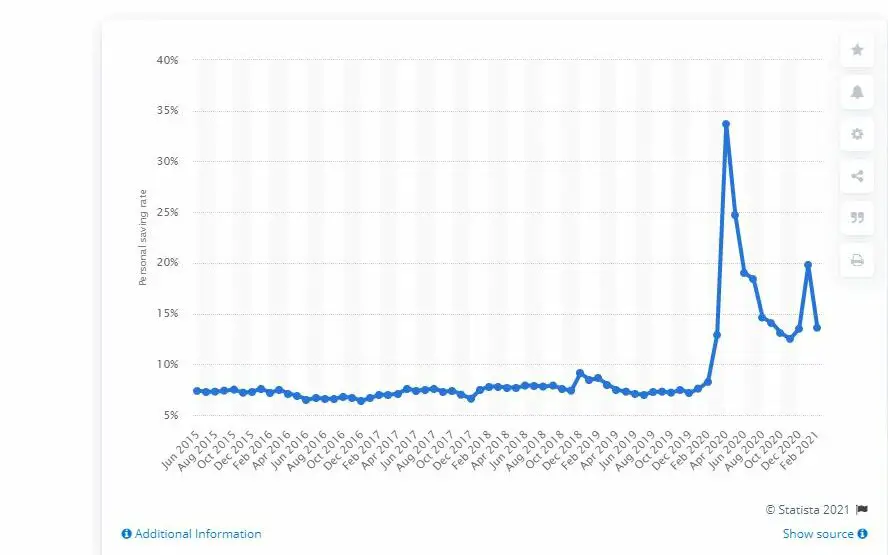

On the other hand, since the Federal Reserve started tracking the savings rate in the U.S., the highest rate was 33% in April 2020, but most likely, that figure was impacted by the COVID-19 pandemic.

However, in February 2021, the personal saving rate in the United States amounted to 13.6 percent, down from 19.8 percent in January.

You may ask, what factors affect personal savings rate and what is an ideal one?

What is a high savings rate?

Essentially, the higher your savings rate means the more money you are saving per month. And the more money you are saving each month, the more you can accumulate towards personal financial goals such as retirement, a down payment for your dream house, debt payments, emergency fund, and any other financial goals you have in mind.

The ideal savings rate is 20%. It is recommended that you keep at least 20% from your paycheck and save it every month. Does it ring a bell to you?

Well, following the 50-30-20 budget rule, it would be easier to remember saving 20% of the money from your income every paycheck.

Furthermore, financial planners suggest specific savings rates depending on an individual's time frame when saving for retirement.

For example, if you start in your early 20s or before you turn 30, your savings rate should be higher or half of your income. The key here is that the fewer years you have left to save for retirement while working, the more you have to keep.

| Working Years Until Retirement | Savings Rate |

| 66 | 5% |

| 51 | 10% |

| 43 | 15% |

| 37 | 20% |

| 32 | 25% |

| 28 | 30% |

| 25 | 35% |

| 22 | 40% |

| 19 | 45% |

| 17 | 50% |

Factors affecting your savings rate.

For example, economic uncertainty such as recessions and economic shocks tends to influence the personal savings rate. More people would rather keep their money or defer spending to prepare for an uncertain financial future. That explains why there's a surge in savings rate when the Covid-19 pandemic hit last year.

There are also the prevailing market interest rates. The relationship between income and wealth (lower-income earner tends to spend more on necessities while the wealthy spends on luxury items while saving more), government policies, and an individual's characteristics- all these play a role in influencing your savings rate.

If a person is frugal, he will tend to save more.

What is the personal savings rate?

Now before you care about the national savings rate of the whole state of America, it's essential to know first your personal savings rate.

Let's start with ourselves first!

As mentioned earlier, the personal savings rate is the percentage rate a person keeps as savings. You can get this ratio amount by subtracting your spending from your income, dividing this number by your income, and multiplying it by 100.

Take note that in calculating your income, it should be a net income or income after taxes. It's easier to deal with it than gross income since you may encounter various amounts with differing governing taxes in every state.

Why is personal savings rate important?

Savings rate is probably the one you can have the most control over in terms of your financial plans.

If you know how much you need to save in x period, you'll be motivated even more to do so. As you know your savings rate, you can control money towards savings, generating extra income, and managing your expenses.

The savings rate is one of the essential components of your financial plan and goals. It has a huge impact that will determine your success.

You cannot control the future, the market rate, even how long you will live. But you have control over how much your savings rate should be to fulfill your goals.

For example, if your goal is financial independence and early retirement (FIRE), your savings rate will determine if you have enough money to last you throughout your retirement years.

Moreover, the higher your savings rate towards retirement, the better your financial progress will be. In other words, you’ll either be able to retire earlier or have more money during your retirement. Maybe even both!

Steps on how to calculate your savings rate

To know your savings rate, follow the steps below. You can also indicate your ideal savings rate if you have a specific percentage rate or amount in mind, but if you have no idea so far, you can start from scratch by knowing the percentage of what you are keeping every month.

Let's break down each step.

- Calculate your after-tax income and choose from which period you will cover.

- Compute for your overall expenses of the same period.

- Subtract your spending from your income to figure how much you’re saving, then divide this number by your income.

- Multiply by 100.

And that's it! You're all set. Thinks it's too hard? Think again!

When calculating your savings rate, you will get a sense of how close you are to your financial goals, whether it's for retirement, big purchase, or financial independence.

You should include other source of income you may have, such as freelance or side-gigs.

While on the spending side, be sure to include any expenses you may have, even the variable or recurring ones.

On the other hand, if you've got no time to check your overall savings rate manually, you can use the savings rate calculator instead. From there, make a decision and see for yourself how well you are saving or how much you should contribute more.

How to increase and improve your savings rate?

Trim your expenses

Go over your budget and see which categories you can free up. But, make sure not to oversee big expenses too.

Most people only trim on their discretionary expenses. Remember, every dollar counts. Have an expense tracker and see which part of your budget you can trim or completely cut back on. Little coins and dimes add up as well, so better yet, keep track of every ins and out of your budget.

Find ways to save money on your big expenses too, such as a vehicle or home expense.

Increase your cash flow

Making more money is a great way to save money! With this, you can have more room for savings or investment and even have more money to suit your needs and wants.

However, make sure not to trap into a lifestyle creep. Lifestyle creeps or lifestyle inflation is when you are spending more as more money comes in. It won't be long until you realized you're broke.

Lifestyle inflation will keep you at the same level or take you lower, even with more money. It's why many “rich” athletes, celebrities, and stars go broke when they retire. Therefore, be sure to still spend at a reasonable cost or intentionally. Having more money doesn't mean you can spend it all the way to the moon!

To increase your cash flow, you can seek other sources of income like a side-hustle or freelance work. You may also ask for a raise from your current job or negotiate your pay.

These are all smart ways to increase your income. Remember, your ability to earn is your most important asset. If you are constantly finding ways to earn more, you should have no problems getting to a healthy savings rate.

Pay yourself first

Most significantly, is to pay yourself first. Meaning, save first before you spend and not save what is left. Instead, pay yourself, save money for your goals and future, and then live on the rest of your money.

You can easily do this by setting up an automatic transfer of savings from your checking to your savings account. That way, you won't forget to save every payday. Plus, it would be quick for you to reach your goals and dreams.

Wrapping Up

The summary of our money journeys is to live comfortably today and save enough for tomorrow. But, you can do both simultaneously!

At the end of the day, this is what we all want from money- enough to last us throughout our lifetime.

Remember the formula: Trim or cut back on expenses> Increase your earning ability> Pay yourself and save more as much as you can!

What is your savings rate? Are you saving enough money to fund your goals? How long are you going to achieve that?

Tell us more in the comment section below! And, if you have more tips on saving more money, feel free to reach out!

0 Comments