Money Lover App Review: Are you still struggling to track every ins and outs of your money?

If you’re not a fan of traditional budgeting or excel, there’s an alternative mobile app for you!

Money Lover is a personal finance app that can help you keep track of your cash flow. It’s an expense and budget tracker all-in-one!

Now more than ever, budgeting should tailor-fit to your unique current life situation. That is why it is called personal finance. Nonetheless, it should be personal.

Suppose you have been into your financial awakening recently; congratulations! This money lover app review is for you.

Plus, smart financial managing is definitely a life skill, especially for those in their early 20s, transitioning into adulthood.

Even if you’re a beginner or not, money lover offers a comprehensive budget tracker and reporting that can ultimately help you in your financial awakening journey.

So, let’s get right into it!

Read more: How to Save Money Every Month- 9 Simple Steps to Start Saving.

What is Money Lover?

App Store Rating: 4.6 out of 5 | Play Store Rating: 4.3 out of 5

Money lover is an expense manager and budget tracker app. It’s a simple finance app to manage personal finance, well, because money matters.

The app’s name may suggest a different vibe, but come to think of it. Who else doesn’t love money?

If you’re a money lover, this money lover app review is perfect for you!

You can seamlessly download the money lover app both on android and iOs devices. They have over a million users and downloads.

The money lover app is user-friendly plus it gives you an overall picture of understanding where your money or budget goes.

However, will it help you never to overspend again? Let’s see the app’s excellent features.

Money Lover App Review: Features

Money Lover App Features | ||

Details | Rating | |

Core Features | Budgeting tool and expense tracker, user-friendly interface filled with functional icons. Has reporting for visual and chart displays. | |

Platform Availability | Website and mobile app devices (play store and google store compatible) | |

Security | Data encrypted, username and password are stored in a secure and isolated multi-layered database, the app only stores the data needed to sync and update transactions automatically. | |

Fees | $34 for lifetime premium version upgrade or subscription plus in-app purchases for selected icons | |

Customer Support | In-app Help and Support, and email only at contact@moneylover.me | |

Free Trial | None, but you can try their free version (with limited features) and upgrade after. | |

Best For | Beginner budgeter, moms, students, young professionals, and busy person for on-the-go and comprehensive, interactive budgeting financial tool. | |

First of all, there are basic and paid features for the money lover app (as of this writing, they are on sale, with purchasing money lover premium lifetime for half of the original price, $15 only)

As the app is a money tracker, yes, it can ultimately help you never to overspend again. With its notification features and a budget and savings set-up, you can get an overview of how well you’re doing financially.

Let’s dive deep into the different unique features of the money lover app.

Basic Features

Money tracker

The money lover app helps you keep track of your cash. It’s now easier to see where every dollar goes; Not to mention the high-level categories with their cute icons, suited for every financial transaction.

Budget set-up

With the money lover app, you can now set up limits on how you would like to spend your money. It’s easier to stay on track, and the app will remind and show you whether you’re over the budget.

The budget set-up is similar to the envelope budgeting method, where you set and fill up each amount you dedicated for a specific budget or expense envelope.

Overall reports

The app comes with built-in graphs and pie chart reports where from there, you can make a sound decision and get a clear picture of how well you’re holding financially.

Money Lover Premium Paid Features

Unlimited number of Wallets, Budget, Saving, and Event

Users can only have one wallet in the free features and set up one budget category. This could be a bummer since the money lover app is easy to use, especially for beginners to budgeting.

Pop-up Ads

If you buy the money lover premium app, you get to enjoy a mobile wallet like never before. Say goodbye to those annoying ads everywhere!

Export transactions to Excel or CSV

Another cool thing that the money lover premium app gives its users is exporting data files to excel sheets or CSV. Therefore, if you like comprehensive reporting to be translated to an excel sheet, this is a significant plus point.

Aside from that, the paid version works across five devices and three platforms. Whether you like to budget via mobile or desktop, you can now do this and track your spending anytime, anywhere you go.

Getting Started: How Money Lover Works

At its core, money lover is an expense tracking app. You manually input your daily transactions, or you can choose to connect your checking and savings account to have an overview of your cash flow (linked wallets).

From there, you can now automatically update and get a picture of your current financial position.

1. Create your first wallet.

You can visit and try the desktop experience or download the mobile app.

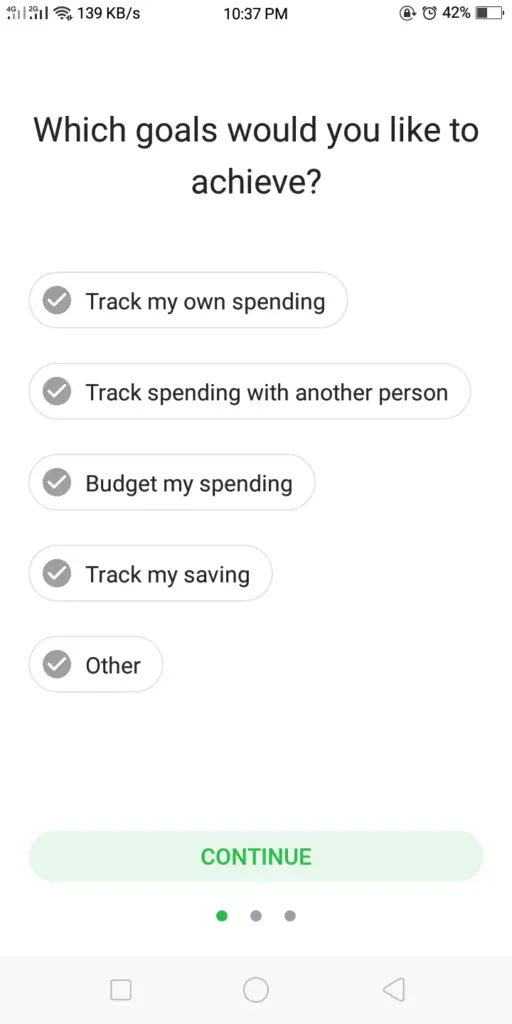

So, once you download the app, you will get asked about your specific goal in mind. You select which goals you would like to achieve, such as to track spending, to track spending with another person, to budget spending, to track saving, among the few.

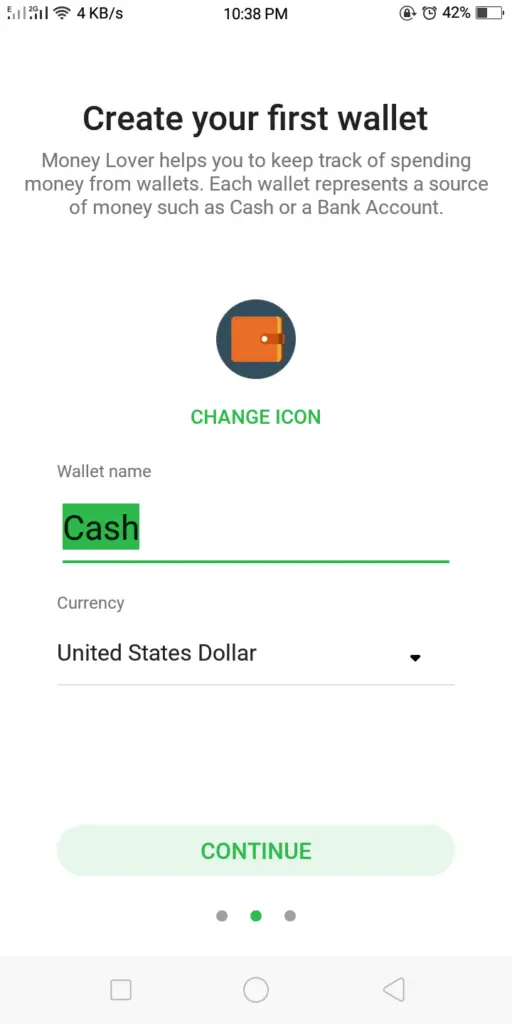

After you specify your desired goal, hoping to achieve it with the help of the money lover app, you can now create your first wallet.

Note that for free or basic features, you can only have one wallet.

On the other hand, money lover premium enjoys the flexibility of having more than one wallet.

Each wallet represents a source of money such as Cash or a Bank Account.

Once done, you’re all set. You can now add your first transaction; add any financial transactions you’ve had in the past, as long as you can remember. It’s okay if you can’t remember anything or want to get started.

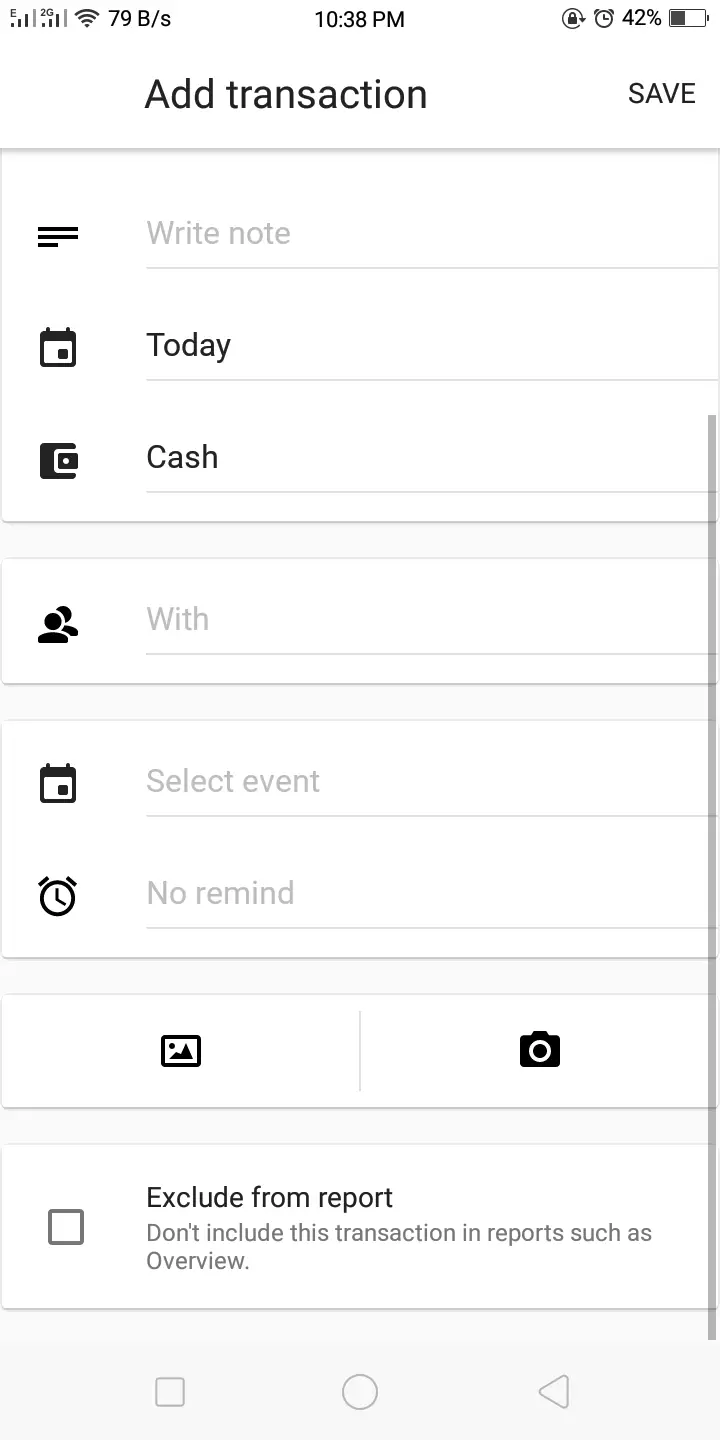

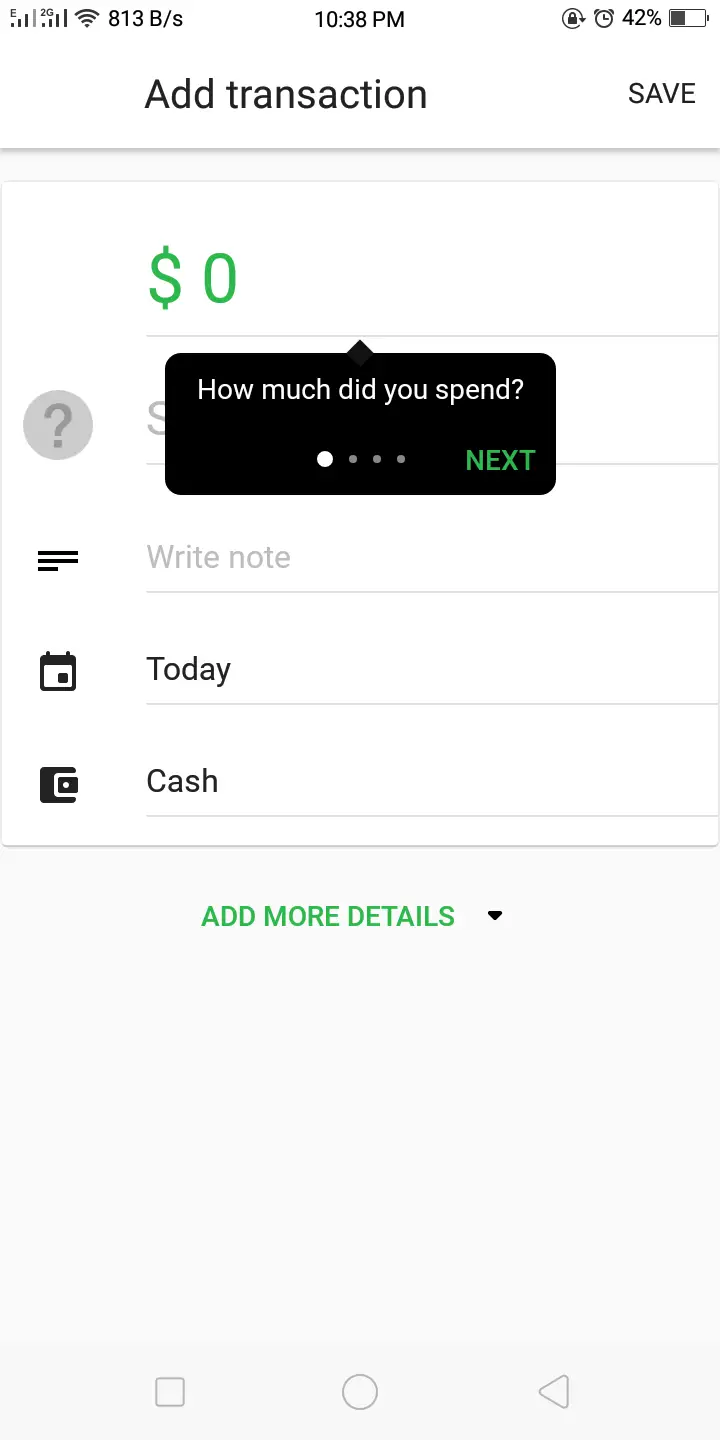

2. Add transactions.

Adding transactions is straightforward; you can even include dates, upload a picture or scan a receipt for autoprocessing, and choose to exclude from the report overview.

But, again, you have to remember that in choosing which wallet the transaction occurs, you only have one for the free version but can select unlimited wallet if you paid for the money lover premium.

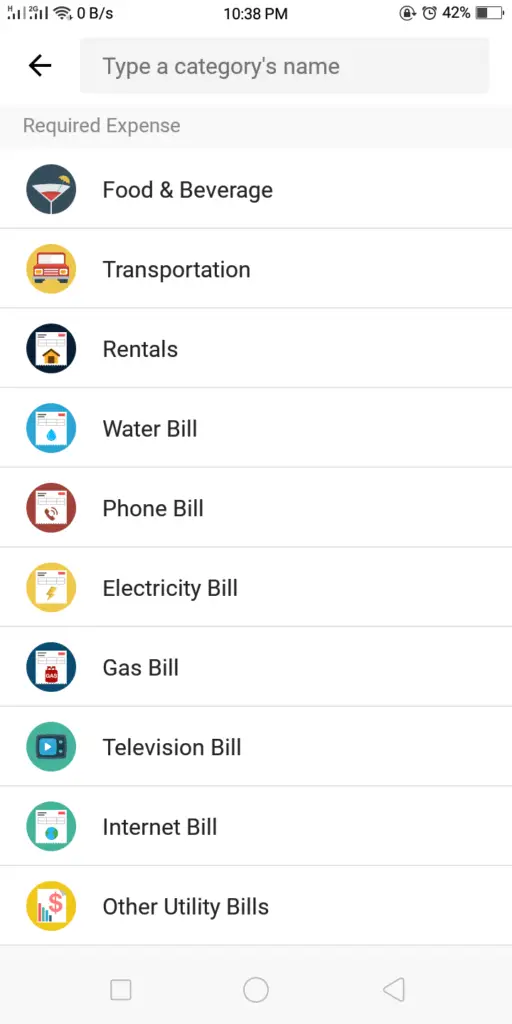

One of the coolest features of the money lover app is the category’s icon. It’s arranged from various spending tracks such as food and beverage, rentals, bills, and so much more. Not to mention the icons are pretty cute!

3. Make adjustments if necessary.

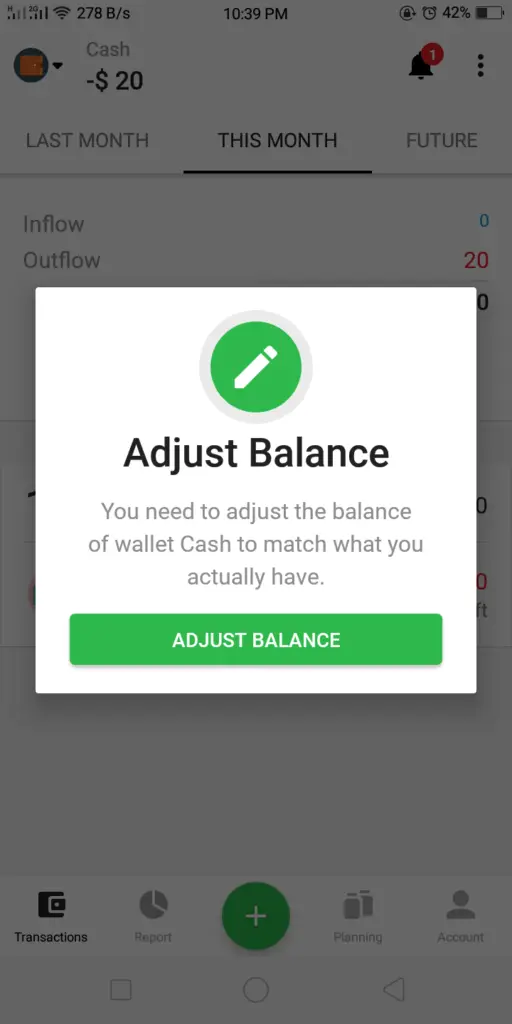

Furthermore, you can adjust your balance as you go along. If you are super meticulous like me, this is a bonus point since it will make sense to match what you actually have with what you have in the money lover app

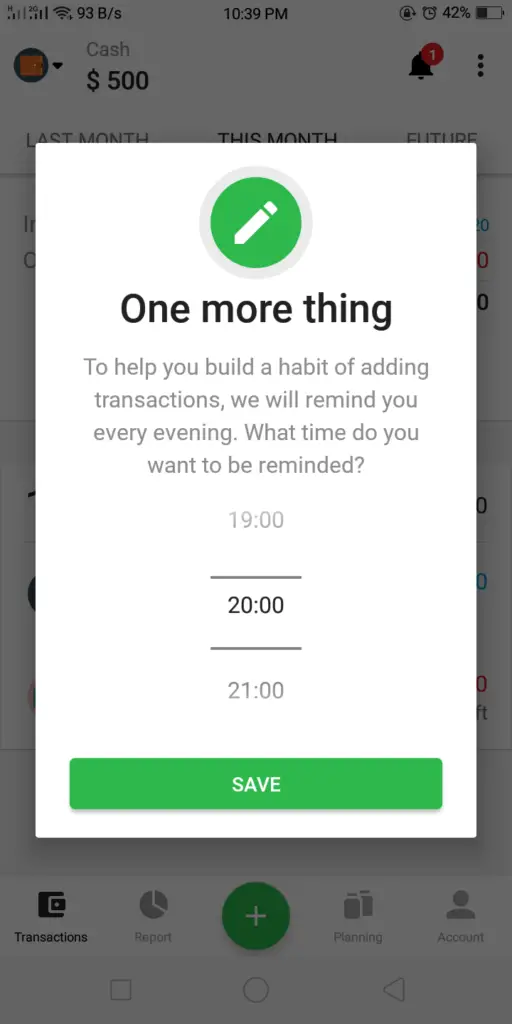

You can also set the app to remind you to budget and track every financial transaction you incur. That is if you would like to get notified.

How do you use Money Lover?

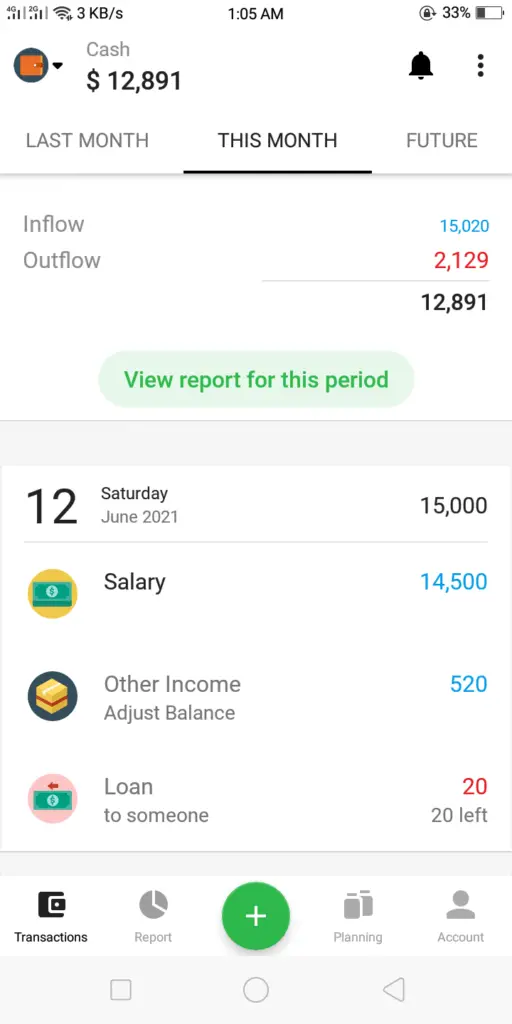

Transactions Tab

On the transactions tab, that is where all your financial transactions will occur. You will also see here your overall cash inflow and outflow that will help you monitor spending. If you press the green plus button, that is where you can manually input your financial transactions.

Moreover, this is where you can add various wallets and start categorizing each finance you have, such as cash-on-hand, money on the bank, and so on. You can also see here your transaction history.

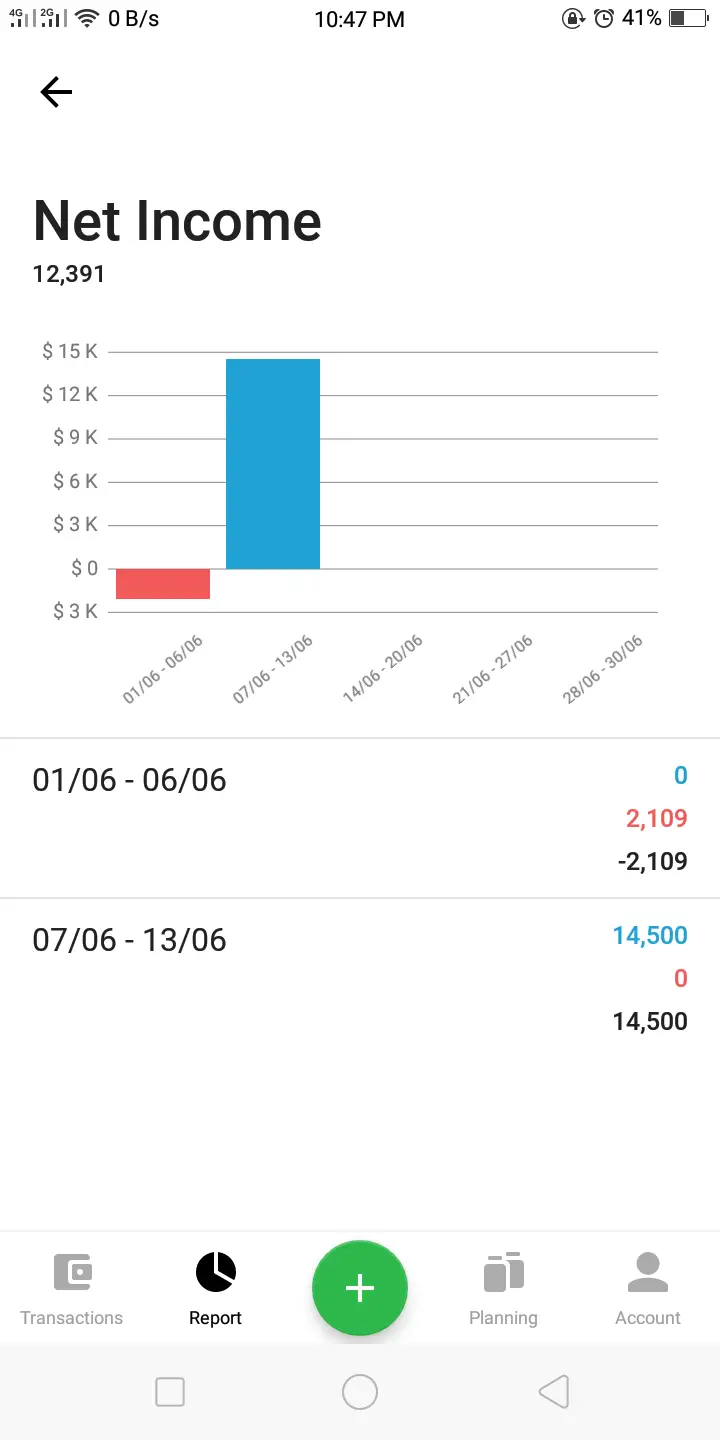

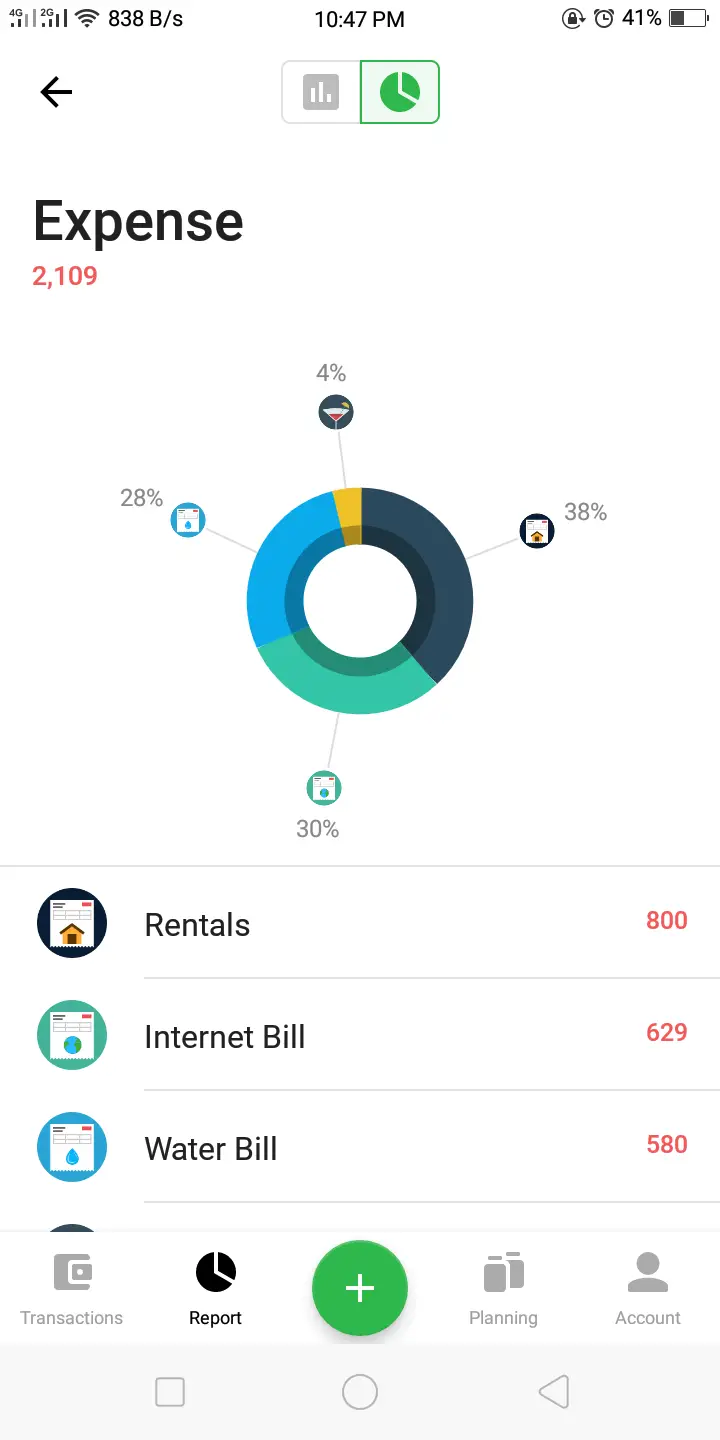

Report Tab

Meanwhile, the pie and line chart will represent your overall spending plus net income on the report tab. It will show you which budget category you are most likely spending money on and will also show you if you’re over budgeting.

The chart itself is interactive and easy to understand. You will find that the numbers stated therein are making sense, and will start talking to you.

Moreover, you can select a time range of which budget and expense report you want to tackle. Either by day, week, month, quarter, or year, it’s all in there!

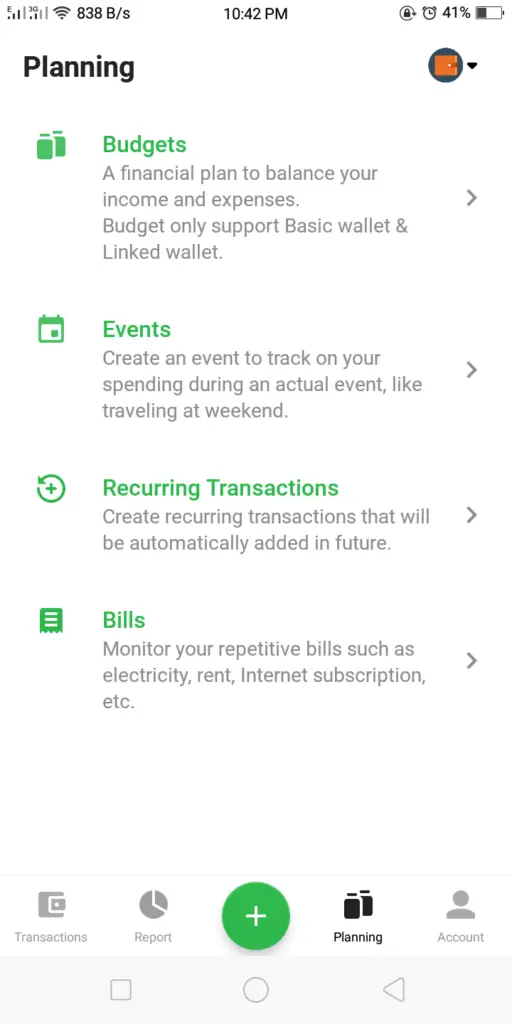

Planning Tab

You’ll see the budget, events, recurring transactions, and bill options on the planning tab.

Essentially, the planning tab lets you set a budget, create an event to track your spending during traveling periods or when you’re out of town. (You know it’s easy to forget money matters when you’re on vacay or holiday, so use your mobile money lover app to keep on track!)

And then, you can also have the option for creating repeated transactions and bills manager. This can be automatically added in the future.

Recurring transactions would account for subscriptions or multiple billing transactions which you expense or repeat daily, weekly, monthly, or yearly.

You can see your balance and your upcoming bills for the rest of the month in the Bills section. You can set a reminder to pay your bill on time, and then the app will help you never forget your bills.

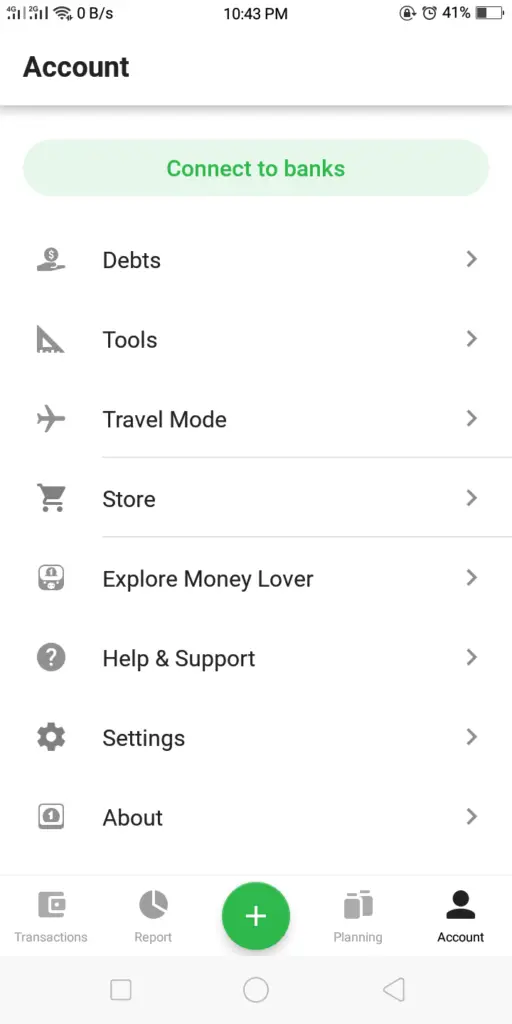

Account Tab

Lastly, you can see tools that can help you get the most out of the money lover app on the account tab. From there, you can also manage the ff:

- payable and receivable

- tool for currency exchange converter

- loans and mortgage calculator

- exclusive built-in app for shoppers

- export file to CSV or excel

- ATM and Bank finder

- Interest rate

Currency converter, loans and mortgage calculator, and the shopper app are on beta type for now. But isn’t it exciting once the app launches its updated features? I can’t wait to explore more of it.

The money lover app can help you stay on track with your finances with its travel mode feature if you travel.

Aside from that, the account tab will also show you a help and support guide, settings, and a brief company background about the money lover app, plus a video walkthrough.

Is the money lover app safe?

Money Lover App Review: Security

The user’s login username and password are stored in a secure and isolated multi-layered database as per the money lover app. All of the information is encrypted both in the database and the user’s bank account. Furthermore, the app only stores the data needed to sync and update transactions automatically.

The linked wallet feature, which allows you to connect your bank account to the money lover app, is safe. With the linked wallet feature, you can create as many wallets to connect with as many banks as you want to, without the extra fees. Additionally, different bank accounts will be associated with separated wallets.

You can set or change a PIN or password to access the app.

As of the moment, the app is currently enhancing its product features and improving security by working with banks.

What is the best free app for tracking expenses?

With several budgeting apps circulating the internet, it’s not hard to pick one and test it yourself. However, you should check it out if it serves what you need.

Often, most budgeting and tracker apps come complete all-in-one, but you have to seek features that will ultimately make sense to you, and of course, an app that will value security. Among others, we should always prioritize the safety of our finances.

Other budgeting and expense tracker apps

Aside from Money Lover, there are also budget tracker apps that you can check out. Each of these apps can serve a different purpose depending on your financial needs. There are apps for tracking alone, for investing, and for saving.

For instance, here are other budgeting and expense tracker apps you might try as well.

Which is the best money manager app?

Deciding which is the best money manager app should be a personal call. If you look at it, most of these money manager apps are almost the same. They differ in a few features, UI graphics, subscription fees, among the few.

But, the best money manager app should be easy to use, help you achieve your financial goals, and be affordable. It would be best to list a set of features that you value in an app and see if one is served in the market.

Money Lover App Review: Pros and Cons

| PROS | CONS |

| 1. User-friendly and mobile intuitive. | 1. Limited features for the free version app. |

| 2. Great app for budgeting beginners. | 2. $34 for premium features |

| 3. Interactive mobile app for budget and expense tracking, saving plans, debt/ loan. | 3. Sudden app crashing or glitch and difficulty in contacting the support team. |

| 4. Bill reminders & schedule for recurring transactions plus a travel mode feature for tourists. | 4. Limited bank connections |

| 5. Easy to use and available both in android and iOs phones, can even access via their website. | 5. Web-based access has still a lot more to improve |

| 6. The app never gives nor shares the info with a third party. It uses SSL encryption on both free and premium accounts. Plus, it uses google cloud services for hosting. | 6. Too many ads |

| 7. Can get a premium lifetime subscription | 7. Can’t import data from previous apps used. |

| 8. No credit card and crypto options |

Money Lover App Review

Money Lover App Review (s) from Google Playstore

I’ve used this app for about three years and still counting! My expenses, bills, debts, loans were tracked and helped me so much since then. Very helpful apps! — Georgy Fabrian

I have been using Money Lover for a couple of years and really enjoy the budget functions. It’s easy enough to use to log everything, so daily finances are a breeze. — Barbara Verduzco

It would be ok, except for the fact that after paying for the premium, I realized that I couldn’t use the same categories for all wallets, which is annoying. — Laura M.

The app is okay and is quite useful. The only downside is; only one wallet can be made for the free users. Wish it had a limit of at least two for the free users. — Naveen Senanayake

I downloaded this app today and immediately bought the premium. Loved the piechart! Looking forward to the updates for the desktop version. It will be nice to sync the bills. This app has a lot of potential. — Kristine Naz

Features | Rating |

User-interface | |

Security | |

Accesibility | |

Core functionality | |

Fees |

Money Lover App Review: Final thoughts

I must say that this personal finance app is up-and-coming for my final thoughts here at the money lover app review. So, for the question, if it would help you never to overspend again yes it is!

Back in 2015, when I first used the app, I think it was freshly-launched back then; I was able to create more than one wallet, and it was all for free. But, seeing now how it has improved from back then, I am glad I have discovered this app (for now, I am using it back again and trying to catch up with my finances)

However, it may be difficult to link your bank financial data from an application if you are concerned about security. Know that the financial technology industry is thriving, and an app like money lover is such a good place to start.

Budget tracker wise, money lover is worth the premium lifetime subscription. But, according to some reviews I gathered, you still had to pay for icons, which doesn’t make sense since you’ve already purchased the app, right?

As of writing for the money lover app review, they put the cryptocurrency feature to a halt. No further announcement has been made as to current updates.

Above all, the app is user-friendly; you’ll get to start loving it already. Aside from that, I noticed how slightly confusing it is to research the money lover app. There were blogs all over the place, but most are outdated. However, its website manages to offer all the details that a user needs.

Money Lover App Review: Updates

A quick update for the money lover app review: they offer a discount if you purchased the money lover premium. From $34, now it’s only $15. Did I mention that it’s already a lifetime premium membership? Meaning, you don’t have to worry about recurring charges since the app is all yours, forever! (even if they do updates)

Ultimately, if you want to become financially savvy and control your finances, the money lover app can help you. I highly recommend the app for beginners who want to simplify their financial life.

What do you think of this money lover app review? Have you been using it? if so, tell us your experience with the app? In case I missed any other feature, please visit their website or comment it down below.

Therefore, if you have any questions or thoughts, feel free to comment. Let’s talk about our love of money!

0 Comments