Many people fear investing. That is still a fact.

One reason they point out is the lack of funds. These people would typically say, “I don’t have a lot of money, so I can’t invest,” or “I’ll just wait until I have more.”

However, It doesn’t take much money to start investing.

If you can go each day without missing $10, then you have enough to invest.

What if I told you the wonders of investing in robo-advisors? One of them is Betterment.

Like most investing tools, Betterment will do all the legwork for you. Then, with a few taps from your mobile phone, you’re all set!

In this post, let’s talk about the process of investing in betterment. Moreover, let’s discover investing in Betterment, of which its strength lies, where it falls short, improvements, and more.

So, let’s dig in and find out!

Related: Money Investing For Beginners: The Right Way To Start Investing.

What is Betterment?

Betterment is an investment service provider and is one of the pioneers of an automated online financial advisor. It is more commonly known as an investment “robo-advisor.”

Essentially, Betterment uses computers and machine learning to invest money tailored to the user’s unique financial goals.

It also has a user-friendly interface to connect their bank accounts and automate their investments.

Founded in 2008, Betterment is one of the largest robo-advisor with over $33 billion in assets under management. Today, more than 700,000 customers are using the service.

Betterment is known for its core portfolio rebalancing, fractional stocks, and customized investing.

Moreover, it is available to download for free on iOs and Android devices. Betterment has a rating of 4.7 on the App store and 4.0 on the Play store.

How do Betterment works?

Investing in betterment is a no-brainer. The process works like this:

For Individuals

- Sign-up using your active email address. You can register and sign-up through their website or use their app.

- Betterment will start asking several questions and gather relevant data from you. These questions may include your investment goals, investing in betterment timeframe, and risk appetite.

- Based on your answers, Betterment will pull out a portfolio for you. Essentially, they use various ETFs to build your portfolio.

- The portfolio built for you may contain more bonds and fewer stocks (conservative) up to more stocks and fewer bonds or (aggresive) types.

- Once your portfolio is up and running, Betterment will fully manage it for you moving forward. Investing in betterment means you have the privileged of periodic portfolio rebalancing to keep each of your assets/securities aligned and consistent with the target investment percentage. It will also reinvest dividends for you (we’ll share more of their cool features later!)

For Employers

Are you an entrepreneur or a small business owner? Thankfully, investing in betterment has never been easier. Now, you can simplify your plan administration, making it easy for you to offer your employees a better 401(k) quickly and easily- all for a fraction of the cost.

Betterment provides full-service doing all the heavy work- onboarding, administration, reporting, and investment. They will also offer personalized advice that can help your employees earn better returns at various levels of risk.

In addition, you can use Betterment’s 401k rollover service. They will guide your employees in setting up a personalized retirement plan along with recommendations on how much to save and in which accounts.

Lastly, Betterment also offers payroll integrations. So if you want to get started getting a 401(k) plan for your company, check out investing in betterment for business.

For Advisors

Investing in betterment will help you streamline your business to offer a better client experience.

Betterment will provide services for advisors like you, such as paperless onboarding, account setup, automatic money movement and transactions, and billing.

Additionally, Betterment can be seamlessly integrated into other financial planning/advisor’s CRM tools like Right Capital, Wealthbox, Addepar, among the few.

Investing in Betterment: Features

Betterment Features: Summary | ||

Features | Rating | |

Core Features | Goal-based investing, fractional shares of stocks, portfolio rebalancing, automated investing from the get-go | |

Pricing and Fees | Digital- 0.25% (annual fee), Premium- 0.40% (annual fee) | |

Customer Support | Phone or email: (718) 400-6898 Monday through Friday, 9:00am-6:00pm (ET). | |

Platform Availability | Website, Mobile App | |

Account Syncing | Can add other external accounts to your Betterment account, Can also offer rollover 401k or IRA | |

Available Accounts | Taxable individual and joint brokerage accounts, Traditional, Roth, rollover, and SEP IRAs, Trusts and non-profit accounts, 401(k) plans. | |

Betterment Cash Reserve | No-fee cash savings account, 0 minimum balance with 0.10% APY | |

Checking Account | Mobile check deposit and also comes with Betterment Visa Debit Card that earns cash back on certain purchases. | |

Minimum Investment Required | $0 and Digital Investing Account (~$2.50/year for every $1K), Premium Investing Account $100,000 minimum balance ($400/year for every | |

Deposits and Withdrawals | 0 fees for Betterment Cash Reserve or Savings Account with unlimited withdrawals from your account | |

Download Now | ||

Investing in Betterment: The Goal-based investing

One unique feature of investing in Betterment is goal-based investing. There’s a reason why it’s called a goal-based investment platform.

So what Betterment does is that it ensures that your funds are invested and properly aligned with your goals. Whether it could be for major purchases, retirement, education, general investment, or for an emergency fund (safety net), it makes sure it follows its portfolio that is pre-built for you.

More significantly, it mimics ETFs and bases its calculations and decisions on your risk tolerance, personal goals, and timeline.

In addition, you can set up separate accounts in investing in Betterment. So, if you have many different goals, Betterment will automate and take care of them.

Automated Investing

Investing in Betterment will make automated investments from your bank account and automate your invested money in the appropriate allocations you need based on your goals.

Moreover, it can automatically allocate your investment funds, and guess what? Automatically rebalance your investment portfolio for you.

So how does automatic rebalancing work?

For example, you are a conservative investor. Furthermore, you opt for a balance of 50 stocks and 50 bonds. However, due to the market’s volatility, you suddenly found your portfolio became 60 stocks 40 bonds share.

Therefore, Betterment will automatically buy low and sell high to rebalance your portfolio for you. Hence, making it come back to the original 50 stocks and 50 bonds allocation.

Tax-loss Harvesting

The tax loss harvesting allows you to sell some loss to offset your tax liability. So it means good money during tax season!

Investing in Betterment with Personalized Advised Packages

As mentioned earlier, Betterment is a robo-advisor that also offers online financial advisors. Most significantly, Robo-advisors are run by algorithm software, allowing them to automate the investing process.

It also means that there is little to no human interaction in most investment Robo-advisor apps. However, Betterment steps up the game because it allows its users to talk one on one with their team of professional and expert financial advisors.

This makes sense if you have further questions and seek experts’ opinions.

Hence, if you want to get access to speak to their financial professional, you must have a Betterment account. Then, all you have to do is schedule your call, prepare for your call, and start talking to the experts.

These financial planners and advisors will provide recommendations based on your personal financial goals and situation.

As this is part of their premium service, you can book the following packages.

- Getting Started Package– $299, 45-minute call with a certified professional that will provide a step-by-step tutorial on setting up and optimizing your Betterment account.

- Retirement Planning Package– $399, an hour of call with CFP (certified financial planner) to get you on track with your future retirement plans.

- Financial Check-up Package– $399, 60-minute call with CFP for current financial situation review plus investments.

- College Planning Package-$399, also with a 60-minute call to CFP for setting up a savings plan for higher education

- Marriage Planning Package– $399, with a 1-hour call with your loved one and a CFP professional to discuss financial goals and manage couple’s finances.

Account Syncing

Investing in Betterment allows you to sync your portfolio. For example, you can sync your 401(k) plan. However, this feature is only available for Premium plan accounts (minimum initial investment of $100,000 or more)

You can also make use of their in-app retirement calculator.

Betterment will ask for your retirement needs, and it will tell you exactly where you want to be and what you need to do for retirement.

Betterment Cash Reserve

You can also open a savings account with Betterment. It offers a generous 0.10% APY of interest on your cash balance, without minimum balance required and with 0 maintaining fees.

Plus, you can have unlimited withdrawals from your account.

Betterment Checking Account

Aside from that, Betterment offers a checking account. What’s great is that it offers no fees, no minimum balance, and your funds are FDIC-insured up to $250,000 through NBKC bank, an FDIC member.

Moreover, Betterment reimburses ATM fees and foreign transaction fees worldwide.

You should also not worry about overdraft fees!

Betterment’s checking account comes with a Betterment Visa Debit Card. It can earn cash back at thousands of your favorite brands such as Dunkin’, Sam’s Club, Adidas, Walmart, and more.

Furthermore, Betterment has a mobile check deposits feature. It means you can conveniently deposit your checks without leaving the comfort of your home. Plus, you can take care of all your checking accounts within the Betterment all-in-one dashboard.

Investing in Betterment: Deposit and Withdrawals

Betterment’s only allowing electronic transfers to and from your account and your checking account via the ACH network. Unfortunately, they do not accept personal checks.

They do not accept credit or debit cards as funding sources as well.

Then, they prefer wire transactions for large transfers (>$300,000). You can also transfer funds from external or third-party brokerage accounts using Automated Customer Account Transfer Service (ACATS). Moreover, with IRA rollovers, you can transfer retirement accounts.

It will take one or two business days for the transferred funds to reflect on your account and automatically get invested.

On the other hand, you can withdraw your money from Betterment at any time without additional fees. But it will generally take 4-5 business days to complete the process.

Note that there are no transaction fees, account closure fees, penalties, or even withdrawal limits.

When you initiate a withdrawal amount within the Betterment app, the estimated tax impact will appear, giving you access to a summary of the short- and long-term gains and losses expected to result from the sales/withdrawal.

Hence, if you withdraw 100% of your money before the end of a calendar quarter, Betterment will only assess a prorated fee for the total days your money was managed/invested. They do not charge fees for accounts with a $0 balance.

Investing in Betterment: Fees and Costs

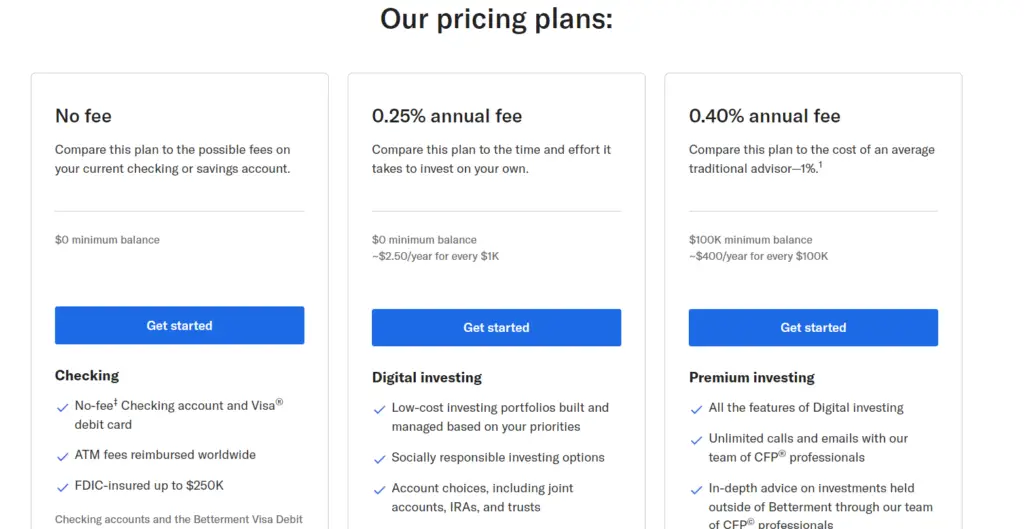

There is no minimum initial investment required. You can open an account with little to no money at all. From there, you can begin funding it with regular additional deposits afterward.

Hence, this allows you to buy fractional shares of stocks or stocks shares that are worth $1 or less.

The available accounts in investing in Betterment are taxable individual and joint brokerage accounts, Traditional, Roth, rollover, and SEP IRAs, Trusts and non-profit accounts, 401(k) plans.

Betterment offers two account plans: Digital Investing and Premium Investing.

The main difference is that only the Premium Investing plan offers certified financial advisors and financial planners access.

Moreover, the Premium plan requires a minimum balance of $100,000. However, if you hold a higher balance, say above $2M, you’ll receive a 0.10% discount.

So, you’ll pay just 0.15% on the Digital plan, and on the Premium plan, you’ll pay 0.30% annually.

Investing in Betterment: Pros and Cons

| The Good | The Bad (or a bit ugly) |

| 1. Low fees- offers meager fees, zero $$$ to get started within 5 minutes. | 1. Betterment is not for the DIY’ers or (Do-It-Yourself) type of person. Remember, in the Betterment app; you are investing in funds (pooled stocks, bonds. |

| 2. Cheap, easy, and convenient. | 2. Limited investments- offers only stocks and bonds. You can’t invest in other securities such as REITs. |

| 3. Pick the funds for you and recommend asset allocation. | 3. No access to a personal financial advisor for the basic account. |

| 4. Largest independent online financial advisor. | |

| 5. Automatic investing and portfolio rebalancing. | |

| 6. Simple asset allocation. You know where your money is going or invested, and it’s easier to keep track. |

Alternatives

Can Betterment be trusted?

In terms of security, investing in Betterment automatically protects your account with coverage from the SIPC or (Securities Investors Protection Corporation).

It is up to $500,000 in cash and securities, including $250,000 in claims for cash. With their cash management products, FDIC is in-charge in insuring your money.

Moreover, Betterment keeps your money safe by setting up two-factor authentication to access your account. This is an added layer of protection to your Betterment account.

What is the average return on Betterment?

You must know that investing in Betterment means your funds are invested in a basket of stocks and bonds, the ETF or (Exchange Traded Funds).

Most significantly, ETFs are similar to stocks brought and sold throughout the trading day.

Moreover, most ETFs mimic indexes like the S&P 500; they are, in a sense, a type of passive investment.

Of course, considering your age, other relevant personal information, risk tolerance, personal financial goals, and timeframe for that goals, will highly depend on these factors.

Through that, Betterment will automatically allocate your money with appropriate assets/securities to develop a portfolio suitable to your personal financial goals.

Aside from that, Betterment provides expert advice. Before, this is manually done, especially meeting with financial advisor physically. Through investing in Betterment, you can shoot all your questions and concerns at the comfort of your home to your financial advisor.

In terms of numbers, there’s no solid average return, especially with most robo-advisors like Betterment. But if we’re following historical portfolio composition and market performance, we must not remove into the equation the volatility and fluctuating prices in the market.

Also, don’t forget factors like time of the initial investment, amount and frequency of contributions, etc. All these are not indicative of future results.

Betterment’s built-in portfolio templates may perform better or worse. But right now, the Betterment portfolio is currently comprised of 12 ETFs (six stocks and six bonds)

Read here to learn more.

Can I lose money on Betterment?

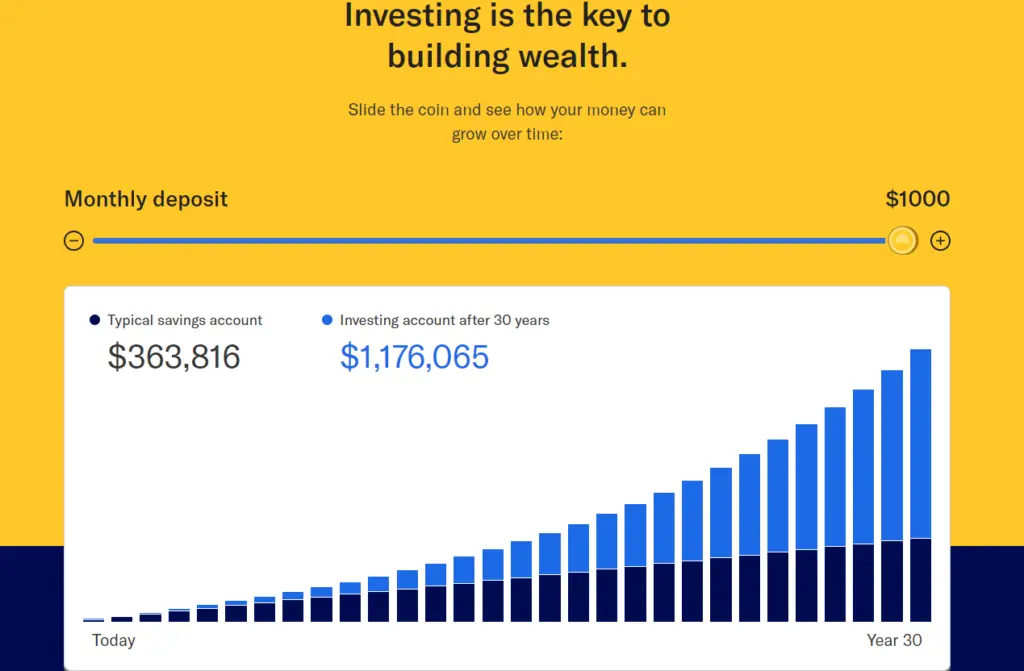

Like any other type of investment, yes, you may lose your money when investing in Betterment. But, likewise, there’s no guarantee of gains.

That’s why it’s vital to check in on your financial goals continually. Moreover, long-term investing always wins.

Therefore, learn to invest using your head. Do your research, invest in quality assets or think of it this way. Buying stocks or bonds (assets/securities) is like supporting a cause or an organization you are passionate about or company products you use every day and believe will outlive the market.

Don’t ride with your emotions. Use science and facts. Invest with a long-term mindset and don’t overreact to short-term losses.

It’s all part of the process. You can further and consistently educate yourself, be disciplined, and build a system that will work for you.

Investing is a long-term game. You may make mistakes here and there, but as long as you’re learning and investing early and consistently, you are beating inflation!

Can you buy stocks on Betterment?

No, you can’t buy individual stocks on Betterment. The Betterment app only allows users to buy ETFs or a basket of pooled stocks and funds that mirror the indexes in the market like the S&P 500.

However, Betterment’s best because they offer many tailor-made portfolios for every unique individual with better financial goals.

For example, suppose you advocate promoting gender diversity or minority empowerment. In that case, you can choose how your money will make an impact through its SRI or Socially Responsible Investing Portfolios.

Socially Responsible Investing helps you make an impact without sacrificing your performance goals. It will help you align with causes and organizations you support that match your values and principles while investing in low-cost ETFs.

They also have an option if you’re a supporter of climate change awareness. Climate Impact includes climate-conscious ETFs that support companies with lower carbon emissions and help fund green projects.

Aside from that, they also have BlackRock Target Income Portfolios. These are for investors looking for investment income (bond income rather than market returns) while minimizing capital losses.

So you can choose from Betterment’s socially responsible investing portfolios, or for a lower-risk approach, you can try an all-cash or all-bond option.

And if you’re looking for more control over your portfolio, Flexible Portfolio options can adjust only the allocations in your asset classes based on your own personal preferences and risk tolerance.

Is Betterment for you?

Betterment is ideal for beginner investors and even for the average ones. It’s because it’s a simple platform with competitive pricing.

Generally, Betterment will be deemed worthy for beginner investors up to intermediate and even expert or seasoned investors. But, ultimately, it depends on one’s net worth.

The perks of having a personal financial consultant are a plus. Before, it was very difficult to find a certified financial consultant or advisor, and if you do, they are expensive. They won’t even talk to you if you have less than a thousand dollars.

So it’s a plus point that help and support are now affordable for the masses. It makes investing available for anyone the way it should be.

Nonetheless, Betterment will let you have all your finances in one place.

Investing in Betterment is not for you if you want to control your asset and pick individual ETFs or index funds.

This is not for someone who wants to play around with their own investments.

Simply put, investing in Betterment is hands-off!

Investing in Betterment: Final thoughts

There you have it! This post covers a Betterment Review 2022 and all you need to know in investing in Betterment.

Remember that many investing platforms exist today, and it’s up to you which provider to use. Just make sure that it’s easy to get started, the fees are reasonable, and it will help you achieve your financial goals.

So, just like money, these are valuable tools that will be your partner for financial growth and achieving your goals. It would be best if you used them to your advantage.

Furthermore, what’s good is that investing in Betterment is a set it and forget it, passive investing approach. If you’re new to investing, investing in the best 500 companies is a good place to start. The S&P 500 gives you instant diversification into these companies.

Perfect because Betterment offers you just that!

Above all, Betterment is one of the best robo-advisor online investing platforms/apps today suited for newbie investors and those busy individuals that got less time analyzing each investment strategy but still want to put their money elsewhere.

There is no minimum investment requirement, small fees, and almost anyone can get started and open an account.

The bad? Maybe just limited securities offered. While the ugly? There’s none!

All you have to do is get started today.

Happy investing!

0 Comments