Today, there are so many services vying for our attention. Sometimes we give in to them and sign up for a monthly subscription, but then it becomes hard to keep track of all of them. To make matters worse, you sign up for a free trial of a subscription and forget all about it until you’re getting charged month after month without your knowledge.

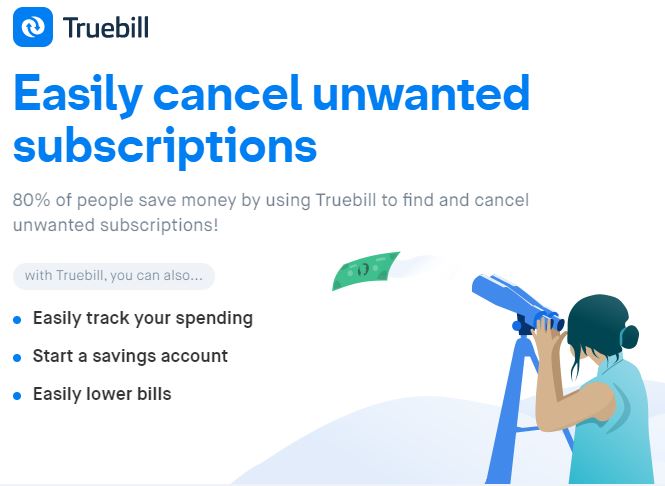

Not anymore, Truebill was built to solve this particular problem and can save you from wasting money on subscriptions you don’t need.

What is Truebill?

Truebill was created to help you save money by finding and canceling unwanted subscriptions for you. But beyond that, it’s also a money management app that allows you to create and monitor a budget and automatically save towards your savings goals.

Truebill was founded in 2015 by the Mokhtarzada brothers, Yahya and Haroon, after discovering a forgotten recurring $40 inflight WiFi bill.

To date, the company claims to have helped countless people save over $14 million by finding and canceling unwanted subscriptions, negotiating lower bills, and getting them refunds on fees and outages.

How Does Truebill Work?

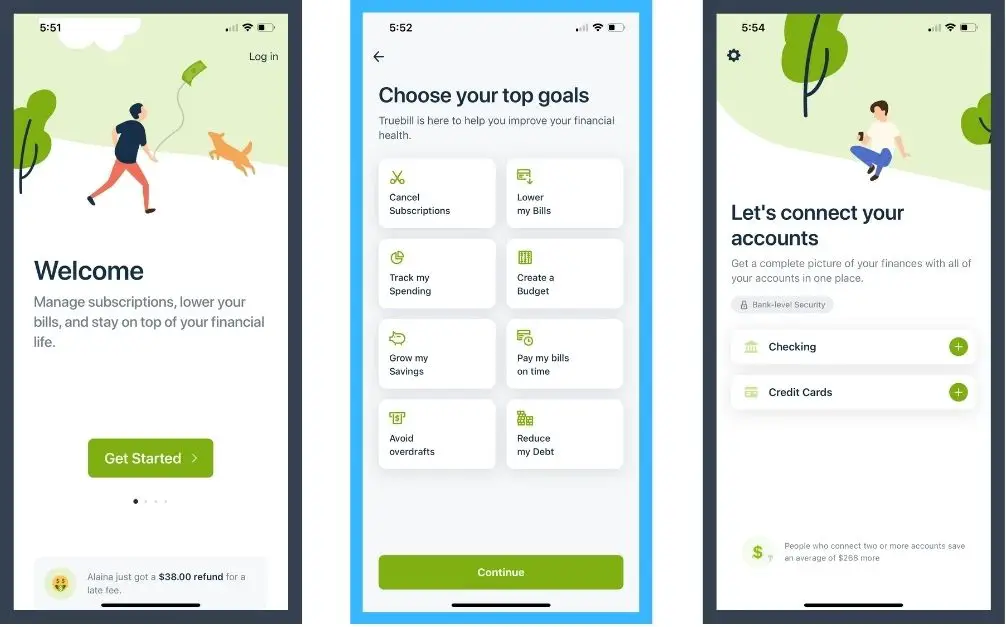

To better understand how Truebill works, I downloaded the app and created an account to get firsthand experience for this review.

After you download the app, go through the setup process of choosing your top goals and creating your account. The next step is to connect a checking account and/or a credit card account.

After successfully creating your account, you will be asked to pay what you think is fair for a premium account. Truebill makes a note there that “most people pick $7/mo”; however, the lowest monthly amount you can pick is $5, while the lowest annual amount you can choose is $5/mo.

There’s a 7-day free trial period, which you can use to try out Truebill’s premium features to see whether you want to stick around or not (More on this further in the Truebill review).

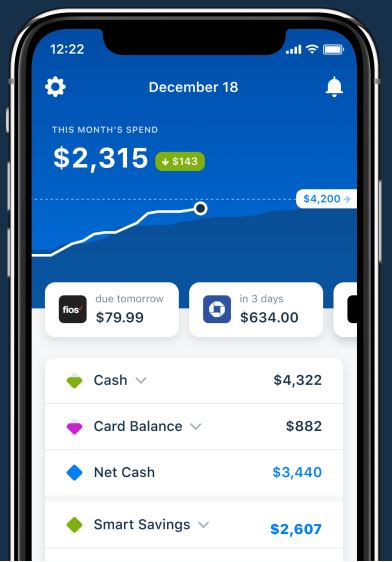

This first thing you’ll see once you’re in the app is a chart of your spending for that month, as well as your recent transactions and upcoming bills. There’s also a snapshot of your connected accounts.

Truebill Features

Monitor and cancel unwanted subscriptions

Yes, this is where you can find all the subscriptions you have linked with your connected accounts. Truebill searches through all your transactions from your linked accounts to find recurring bills and subscriptions.

By viewing the full list of subscriptions that Truebill finds, you can see which subscriptions you want to keep, which ones you’ve forgotten you had, and take action to unsubscribe from your unwanted subscriptions.

You can either cancel them yourself or have Truebill cancel them for you if you sign up for the premium service. Here’s a list of all subscriptions Truebill can cancel for you

While trying out Truebill for this review, I found a subscription with Crunch Fitness Club that I had canceled since June, charged me again in October and November. Frankly, I thought that there was no way this was accurate because I remember the trouble I went through having to cancel the subscription at a physical Crunch Fitness location.

You can try to imagine how livid I was when I actually checked my bank account and saw the charge there. Well, I went over to Crunch to request my refund. Now, that’s $49.90 (almost $300 in a year) I didn’t even know was missing, but, yay, I got it back!

Lower your bills

To reduce your bill, all you have to do is connect your bill to the app either by logging in with your provider or uploading a picture of your bill. Truebill will analyze it to find discounts and promo rates available to you and get you the best savings.

The next thing they do is to negotiate your bill on your behalf with your service provider. You can get a better rate for that bill or get a one-time credit applied to your account.

While Truebill is free to use, they expect to get compensated for their trouble in helping you lower your bills. If Truebill is successful and saves you money, they take a 40% cut of the negotiated savings.

Here’s the kicker, Truebill charges you 40% of the annual savings at one time. So if Truebill saves you $400 annually on an AT&T bill, Truebill charges you $160 at once. However, if Truebill doesn’t save you money on your bill, there’s no cost to you.

Truebill specializes in negotiating cell phone and cable bills with companies like Tmobile, AT&T, Sprint, and Cox up to a dozen providers. If you enable TrueProtect, Truebill will continuously monitor your accounts for new deals and potential savings, and they will automatically negotiate them.

Truebill claims to have an 85% success rate lowering and negotiating bills.

Outage Refunds

For any internet and cable service that you have connected to the app, Truebill will monitor these services for outages and request a refund from your service providers.

If they’re successful, they’ll split the refund with you and take 40% of it, but if not, there’s no cost to you.

Budgeting with Truebill

Often, budgeting gets a bad rap because most people find it challenging to create a budget and stick to it. With Truebill, you can create a budget very quickly.

First, confirm your income and recurring bills, which Truebill identifies and estimates based on your transactions on your linked accounts. Once you set your income and recurring monthly bills, you can proceed to allocate the amount remain to your other expenses.

You get to decide which spending categories you want to create. There are over a dozen categories you can choose from within the app.

Other Noteworthy Features

- Credit Score – Truebill lets you monitor your credit score by providing updates from Experian.

- Financial Snapshot – On your dashboard, you can see an overview of the balances on all your connected accounts, including your investment accounts. You can also track expenses, see how you spend and where you can save.

- Money Reports: It’s easy to monitor your financials with the different charts provided by Truebill, showing monthly-earned vs. spent amounts, bills paid, spending per category, frequent expenses, and largest purchases.

- Pay Advance up to $100 without interest – Truebill can loan you up to $100 ahead of payday without charging you any interest.

Truebill Premium Features

To enjoy more services from Truebill, you will need to pay a premium fee ranging from $3 to $12 monthly. Interestingly, you pay whatever amount you want from this range. Let me clarify; you can use the app for free to manage your subscriptions, lower your bills (except the 40% cut, of course), and create a budget. See the full list of Truebill’s premium features below:

- Subscription Cancellation Concierge

- Unlimited budgets and custom categories

- Full credit report and monitoring

- Smart savings – Automatically deposit money towards your savings goals with this feature. You can set the amount and frequency of deposits.

- Premium chat

- Sync Accounts

- Fee Refunds – Get bank overdraft fees refunded to you.

Are these services worth at least $3 monthly? Here’s my take:

First, several free apps allow you to create unlimited budgets and custom categories and even have a more robust budgeting platform (if you prefer detailed budgeting).

Second, you can get access to a full credit report for free from each of the credit bureaus every year – that’s 3 free full credit reports that you can request at different times within a year.

Next, many apps exist that automate your savings for free, and some even have many creative ways to encourage good saving habits; one such is Qapital.

Now, here’s where it might be worth it; they can help you cancel your subscriptions and save you the hassle of having to deal with customer service. They can also get you refunds on overdraft and late fees from your bank, which are usually at least $35.

How to Sign Up with Truebill

First, download the app from the iOS App Store or Android Play Store. Then, create an account with your name and email address.

You will have to connect your bank account to the app. Also, you can add credit cards and investment accounts to the app. Truebill will extract all your transactions from your accounts and find the recurring bills and transactions.

You can choose to go for the premium service or continue with the free service into the app. Your dashboard will display your account balances. The recurring tab will show a bill calendar with your recurring and upcoming bills.

Now that you’re all set up, you can create a budget, cancel subscriptions, and start negotiating your bills with Truebill.

Truebill

Lower your bills, manage your subscriptions, track your spending, and create a budget to save money and stay on top of your finances.

Customer Support

For any questions or issues with the app, you can contact Truebill by submitting a ticket on their website. They will reach out to you through your email. You can contact them through the in-app chat, and a member of their team will respond and answer your questions.

They also have a help center site to find articles that address many questions about the service or the in-app chat. There’s currently no phone support by Truebill.

Frequently Asked Questions (FAQ)

How Much Does Truebill Cost?

Truebill has several free to use features to manage and cancel your subscriptions yourself, create and track a budget, and lower your bills. However, Truebill will take 40% of the annual savings of a negotiated bill.

Truebill has a premium service that costs from $3 to $12 monthly (you choose how much you want to pay). The premium service allows Truebill to cancel your subscriptions for you. You can also create savings goals and create custom budget categories.

Is Truebill Safe?

I get concerned too whenever I have to give any of my information to yet another app because it increases the risk of breaching my security.

Truebill assures that it takes its users’ personal data seriously and invests heavily in security. Truebil uses industry-standard security measures to make sure your financial and personal information is protected.

They make use of bank-level 256-bit encryption for storing your data and use a third-party service by a well known financial service, Plaid, to link securely to your online banking accounts. This way, your banking credentials never go through or get stored on Truebill’s servers.

Also, Truebill does not sell your information to any third party and only uses it to provide its services to you.

Finally, Truebill hosts its servers securely using Amazon Web Services (AWS), a service used by the Department of Defense, NASA, and other high-security dependent organizations. So you can rest assured your data is safe there too.

How Do I Cancel Truebill Premium?

- On the app, click on the settings icon and click on “Premium.”

- Scroll down till you see “Modify Subscription.”

- Slide the button to $0/month and hit cancel subscription.

- Truebill would “hate to see you go” and give you another chance to change your mind. Hit “I don’t want control of my money.”

- The next screen would ask why you’d like to cancel. Select an answer.

- Truebill will give you one more chance by offering a free month. If you still want to go, hit “No thanks, just cancel.”

PROS & CONS

| PROS | CONS |

|---|---|

| Saves you money on negotiated your bills | High commission (40% of negotiated savings) |

| Very easy to use | |

| Monitors subscriptions | |

| Gets refunds for outages | |

| Available on mobile and desktop |

Who is Truebill Best for?

If you don’t have subscriptions and don’t have time to track them individually, Truebill streamlines that process for you. If you also want to take advantage of deals and savings that internet and cable providers offer occasionally, you can easily do that with the TrueProtect feature.

Truebill also has an expense tracking feature that can prove very useful to monitor and improve your spending habit if you have a hard time doing that independently.

Start with the free version to get a feel for yourself and see how well it can benefit you. Who knows? You may even end up going for the premium service if you like it.

However, if you don’t really care about any of these features or are concerned about giving out personal information, then Truebill may not be right for you.

Alternatives to Truebill

Trim

Trim is Truebill’s main rival that offers the same services of canceling unwanted subscriptions and lowering your bills. However, Trim will cancel your subscriptions for you at no cost and charges a 33% commission compared to Truebill’s 40%.

Trim also takes care of medical bill negotiations and has a simple savings account that offers a 4% bonus on your first $2000.

Billshark

Billshark also helps manage bills and cancel unwanted subscriptions. The commission is the same as Truebill’s at 40% of savings. It also has other features like insurance reate comparison, rewards program and internet speed test.

Bobby

Bobby is mainly a subscription tracking app. It helps monitor all you fixed costs in the form of subscriptions and bills. You can track subscriptions like Spotify, Dropbox, iCloud, and even your rent.

You can see your fixed expenses by week or month and get notified whenever a bill is due. With the free version, you can add up to 5 subscriptions. To unlock the full app features, it’ll cost you $1.99.

Bottom Line

Truebill can help you save more money on both your needs and wants by negotiating your bills and monitoring your subscriptions. It’s also a great way to keep track of your finances if you don’t typically do. All this can be done with Truebill’s basic plan.

I’ve personally tried it, and I can honestly say I probably would not have found out about the monthly $24.95 gym membership fee until much later, if at all. So, I highly recommend this service.

Besides, you can try it out for free and keep using it for free for as long as you want. I think anyone can benefit from it, but you tell me.

Let me know your experiences with Truebill or if you think you might give it a shot. I would love you hear from you in the comment section below.

0 Comments