Being rich vs. wealthy: which one would you like better? Unknown to many, there’s a massive difference between being rich versus being wealthy.

You may probably hear about these two terms used interchangeably, and it’s acceptable. However, there is still a distinct difference between the two, and it isn’t hard to pinpoint that.

In his famous book, Rich Dad Poor Dad, Robert Kiyosaki emphasized the disparity between the two. He said that the rich have lots of money while the wealthy do not worry about money.

But, what exactly does it mean?

Apart from businesses, in 2019, there were 752,160 cases of personal bankruptcy filed nationwide in the United States.

What’s the reason behind it? Is it a good indication of managing personal finance? And more importantly, how to know whether you are rich or wealthy? Plus, how to become one?

In this article, we will answer all questions above and dig deeper between rich vs wealthy. Keep reading!

Don’t miss out: How to Build Generational Wealth that will last beyond your time.

Is rich the same as wealthy?

When I was young, I, too, thought that being rich is equals to being wealthy. Whenever I think of someone rich, I think of it as having tons of money, has a mansion, drives fancy cars, or eats at expensive restaurants.

Back then, I thought that being rich means you can buy and do anything you want, even going to planet mars.

But, when I encounter Mr. Kiyosaki’s notion of rich vs. wealthy, the wealthy do not worry about money; this got me thinking for a while.

Growing up, I live in a relatively financially stable family. We’re not rich, and we’re not poor either; we’re in the lower-middle-class status if you ask. My father works 9-5 while my mother stays at home and both, they work really hard for my education and manage to raise me well and healthy.

I don’t have siblings, so you may think that we lived a pretty well-off life, but no. It’s not always the case. There were days when we struggle financially due to reckless debts and poor money management.

I watched and felt how my parents struggle, and I promised myself that I don’t want to live a life like that. I want to be rich and wealthy.

Therefore, having not to worry about every single penny seems such a nice thing to have. Who wouldn’t want that? And, to answer the question, NO. Being rich does not mean the same as being wealthy. Here’s why.

What does being rich mean

You see before, I too mistook rich as synonymous with wealth. Besides, I was surprised to know that there is an actual difference between the two in financial jargon. With personal finance books and research aid, I was able to pick how to differentiate the two.

Being rich means having a lot of money in a definite time. In other words, you may be rich now, but only just at this moment or even today. For instance, whenever it’s payday week, I feel rich. Does it make sense?

Someone who is merely rich will only be rich in a short period. As soon as the money runs out, there’s zero, nada, zilch. You end up plain broke, and you don’t even have fallback money.

For sure, you may have heard of some famous actors, celebrities, professional athletes, among the few who live a fancy lifestyle. They live in huge houses, have nice cars, and wear branded expensive clothes.

However, there’s also the news about them filing for bankruptcy a year or a few after. Why is that? (more on this later)

What does being wealthy mean

On the other hand, a wealthy person has sustainable wealth. A wealthy person will always be wealthy and will always have money.

Besides, there are many rich people on the planet, but only one in a million who is truly wealthy.

Some people wear the mask of a rich person, but are they wealthy? There are fake rich or pretentious ones who don’t even have savings to begin with. A wealthy man doesn’t have to work too hard and exchange his time for money because he has more than enough to sustain his lifestyle and living conditions.

Being wealthy means making money work for you, and you don’t have to live paycheck to paycheck. When you’re wealthy, you are done and out of the rat race.

Which is better, being rich or being wealthy?

You may ask if being rich does not necessarily mean being wealthy, which is better then?

Obviously, being wealthy. If you are wealthy, you are set for life. Your second, third, and even the next after the next generation of you will live a comfortable life. Of course, it’s not easy to build wealth, and it may become a rough road down there, but it is attainable.

If you are wealthy, you are now cut off from the poverty cycle. I know there are many definitions of rich vs. wealthy that this blog post may not cover, but let me elaborate some more and give a few wealth descriptions.

You see, being wealthy is more than just the dollar amount you possessed or the properties you own. It’s also about how you view money in general, your confidence, and time exerts in doing your job.

Moreover, there’s plenty of reasons why it is better to be on the “what haves” side of the world and choose to be wealthy.

- You live longer– Studies have shown that wealthy people became confident in their financial life, eat healthy foods, and can afford better healthcare, thus allowing them to retire early and enjoy life.

- Pay lower taxes– Wealthy people are also smart people. They work hard for their money and ensure that they don’t easily part with it. They have entire systems set in place that prevent governments from taking a big cut as they do in lower-income individuals.

- Fewer worries about debts– If you’re wealthy, you know how to make money and make that money work for you; therefore, you know the consequences of bad debt and intend not to have one. In other words, you don’t worry about money.

- You can do more for the world– As a wealthy individual having more money than you actually need, you can make a difference and help other people as well. Not that you can’t help for now, that you’re not wealthy enough, but if you have more money, you can devote your time to causes and organizations that support your values or principles in life. You can afford to help someone because you can better take care of yourself.

- Travel– It’s everybody’s dream to travel around the world. If you are wealthy enough, you can go around and explore the world, other cultures, and meet other people. But, not that you can’t do it now, of course, you can still travel with a sound financial travel budget plan. Unless you’re wealthy, traveling can give you peace of mind knowing more money is added to your bank account rather than depleting it by your reasonable expenses.

There’s a lot of benefits of being wealthy, and if you have all the money and time in the world, what can or will you do?

But, on the dark side, there’s no constant in this world other than change, and money and time are finite. That’s why, if you are rich today, you have to learn how to be wealthy tomorrow and have that peace of mind knowing you are financially stable.

Rich vs. Wealthy: The Difference Between The Two

Do you think it’s hard to know what sets rich people apart from the wealthy affluent ones? Well, in hindsight, I can tell which one is pretending and which is livin’ it low-key.

For instance, some rich people like to show off their money and all their possessions. Wealthy ones are not like that at all. They live the same way as before; they may afford to upgrade a lifestyle but they simply chose not to because they know their priorities, and having lots of money doesn’t get into their heads.

Let’s set an imaginary example.

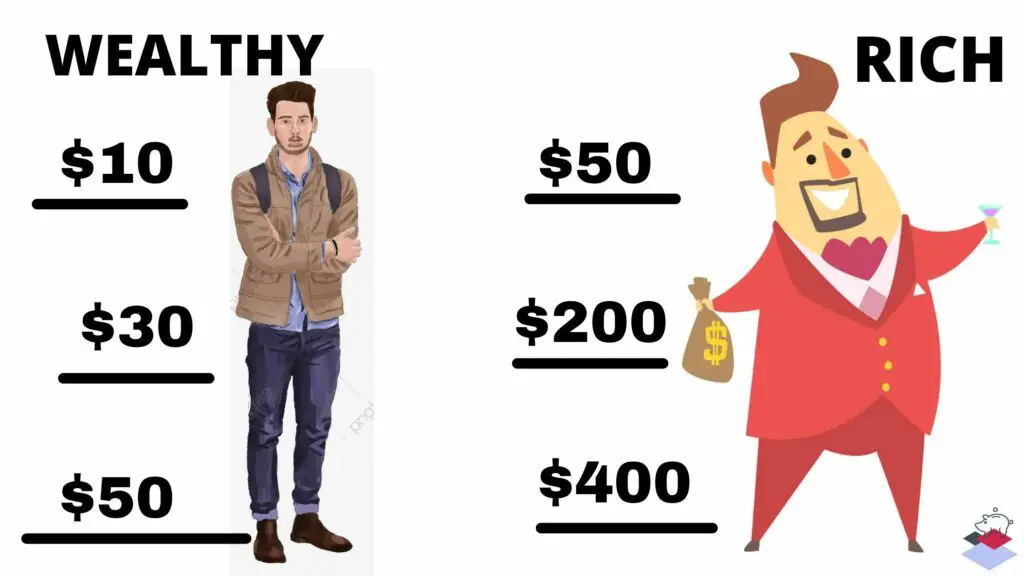

Jake is a doctor with an annual income of $310,000. Most of his money comes from work, with only 5% coming from investments. In the eyes of many, Jake is a rich man.

He lives in a big house in a nice neighborhood, and he also owns two luxury cars, one for him and the other for his wife, Amy. His children go to a private school, and he’s also a member of their local golf club.

Indeed, Jake has a lot of money at his disposal. However, he also has expenses like any other person.

Here’s a list of all Jake’s expenses:

- Mortgage to pay

- Transportation costs

- Household expenses

- Health insurance

- Taxes

- Set aside money for kid’s college education

- Annual family vacation

Plus, he has to buy another anniversary gift for his wife this year. When you deduct all these expenses from Jake’s annual income and removing all the savings and investments he makes, Jake is left with not much.

Overall, Jake spends about $21,500 every month on expenditures plus savings amounting to $43,500 in his bank account.

Since we define wealth as an individual status of financial resources to sustain a living for an extended time even if the individual stops working. In essence, this is money coming in consistently that can maintain your current standard of living for many years.

This means that should Jake lose his job today, together with the benefits he gets from it, he should be able to feed his family for only two months. After that, he should find another job or alternate ways to make money.

Jake is rich; however, he’s not wealthy.

Moving on, let’s see Charles. Charles Boyle is one of the business tycoons in America. He’s an investor, a philanthropist, and an author. Two years ago, his net worth was a mammoth of $95 billion. It’s estimated that every second, he earns about $130 or $78 in every minute.

Therefore, in an hour, Charles makes more money than Jake earns after a whole year of working, yet Jake is considered rich.

That’s why being wealthy essentially translates to being financially free. If you’re wealthy, you don’t necessarily need to make more money over a long time because you have enough money saved or passive income flowing in from your assets and investments to maintain your current lifestyle for the rest of your life.

Charles doesn’t actively work for the $135 that he made this second or the almost $78,000 he will earn after you read this entire blog.

It is a passive income that he gets in his sleep when he is playing golf or giving away $4 million annually to a charity he cares for and supports.

Wealth is a sustainable richness or a person who never runs out of money.

If Jake quits his job today, he’ll be stressed and most likely to bump into the middle-class. But, if Charles decided to retire today, he could maintain his lifestyle for the next 200 years.

See the difference between the two?

As long as you have income flowing in that you’re not directly working for, such that if you were to stop working today, but you can still maintain your current standard of living, then welcome to the wealthy club!

Can you go bankrupt even if you are rich?

Usually, when you think of a rich person, you think of someone who can buy both their needs and wants.

Beach house, sports car, $3,000, among the few. Just because someone exhibits these “rich behaviors” doesn’t mean their financial affairs are in order. Sometimes, these people live paycheck to paycheck or drowning in a pool of debt, thus going bankrupt.

Many people who say, “I want to be rich,” aren’t actually looking for financial security. What they want is the social status and prestige associated with the million dollars club.

Of course, there are also more reasons why the one day millionaire can go broke. Mismanaging money, high expenses, lifestyle inflation, financial illiteracy are among a few.

Are millionaires considered rich or wealthy?

To be considered “rich,” Americans say you need a net worth of at least $2.3 million. Today, a millionaire’s general definition is a person whose net worth is more significant than USD 1 million. Under this classification, the number of millionaires globally has multiplied dramatically over the past century.

There’s what we called the young self-made millionaires too, and they’re increasing in number.

However, keep in mind that there are also people who may be technically millionaires on paper. Still, if you take the what you own minus what you owe formula, these people may not have a considerable amount of cash in the bank.

When considering whether a person is a millionaire, it’s most likely that you’d look at the individual’s balance sheet. This will help you see if they are worth at least $1 million after considering their wealth and debts.

7 Tips To Become Wealthy

They say that if you are rich, you are also wealthy, and if you’re wealthy, you live a comfortable life; however, that alone is not always true. You may be rich in the paper but poor in money management, time, or other intangible debts.

A wealth handed to you at a speed of light may also vanish in a blink of an eye.

In creating and preserving wealth, there are habits and practical ways you can start today. The point is, you can create wealth next to nothing.

- Earn all you can– You have a day job, congratulations! It definitely pays the bill. But, how about your dream house, your vacation, retirement plan, and your kid’s future? It’s good that you have a job, but it’s even better if you can have multiple sources of income. Not because you’re greedy or what, but because you have dreams and priorities in life. In fact, this pandemic taught us that it’s not enough that we only have one income. Your thinking should be how to make extra money to sustain your living. Remember, you can produce wealth.

- Save all you can– Now, if you have passive income or a side-hustle that pays well, you should save more. Be frugal and don’t fall into lifestyle inflation. The problem is not the money, but the person who’s spending the money. Therefore, develop not just a good money mindset but also a saving habit.

- Invest all you can– There will come a time when you will eventually retire in your working days. When that happens, you no longer can earn all you can, and you may not be saving as much as you can. Hence, while young, invest all you can. There will be a moment you will no longer earn money, but you won’t stop spending. That is why having a passive income will help. That means, even if you stop working, your sources of income will never stop.

- Create a financial plan– It is the most significant step you can ever make. Set your financial priorities in order and develop short-term and long-term financial goals. You can start with paying off debts, building an emergency fund, or taking personal finance courses.

- Cultivate an abundance money mindset– Do you believe in the law of attraction? Well, where your attention goes, your energy flows. Subscribe to a healthier and abundant money mindset but also, don’t forget to take action. You have to not only desire financial freedom and be willing to work toward financial success; you have to believe you can become rich and that you deserve it.

- Expand yourself– Have a growth mindset and remember, the sky is the limit. Invest in yourself as well. Take financial courses, read books, and test yourself. Share your knowledge and apply it to your life. Remember, learning does not only take place in the four corners of a classroom. Wealthy people are continually challenging themselves to learn new things. They’re continually expanding themselves by absorbing further information and gaining knowledge, experience, and insight.

- Take risks and think big– Learn to step out of your comfort bubble and recognize that the path to success is through uncertainty. Traditional approaches, like having a steady job and a fixed check, are safer, but wealth often comes through taking calculated risks. Don’t let fear and those self-limiting beliefs hold you back. Always push yourself to keep dreaming and accept that failure is part of the learning process, embrace and own it, and own your successes too.

Final thoughts

At first, rich vs. wealthy is like pronouncing tomato, /tomahto/ or /tomayto/ for some, it means the same way, and it’s acceptable whatever pronunciation you adhere to. However, we now know that there is a difference between rich vs. wealthy.

We all define wealth differently. You can be wealthy in life in the form of money, love, work, etc. It’s also true that being rich can be fleeting when managing your money wrong. But, most importantly, strive for a full life, not only a rich life.

Learn to be generous and give all you can. Take note, the more you give, the more you can receive. Wealth isn’t only measured in terms of monetary and time value but also the legacy or impact you leave behind.

Have you learned about the difference between being rich vs. wealthy? Tell us your thoughts about this topic and comment down below.

For weekly financial tips and topics, subscribe to TheFinanceBoost and, altogether, discover the mystery in unlocking your full potential in managing your finances.

0 Comments