Generational Wealth sounds like for the privileged and fortunate ones to abound financially. However, it's about more than how much money you have, though cash, of course, plays a crucial part.

When you heard the term generational wealth, what comes into mind? For me, at first, I thought about rich and powerful dynasty and powerful family corporations. A 20-something individual starting his career is the least bothered of the term.

But, I remember once, an English professor of mine shared with us that there are three things we should do in this finite lifetime.

- Plant a tree.

- Have children.

- Write a book.

Of all these three, where do you think generational wealth stands for?

Maybe you're a college student or a recent grad starting his career and never have thought about generational wealth or something similar. Your priorities might not be one of those right now but dig deeper. What mark or legacy would you like to leave behind in this world?

Aside from beautiful genes, what the future generation will take away from you?

You may probably think right now, what is all this seriousness and futuristic (boring) stuff? Well, think again.

In this post, we will share how you, a millennial, can build generational wealth that will transcend over your lifetime and share tips on how to ensure that the next in line will not sabotage or waste all your hard work.

Table of contents

- What is Generational Wealth

- Why Does Generational Wealth Matter?

- Where is the Wealth today, and Where will it be tomorrow

- How Can you start building Generational Wealth Today?

- How Millennials can Beat the Odds and Build Wealth

- Ways to Ensure Your Wealth is Not Squandered by Future Generations

- How to Pass on Generational Wealth

- Final thoughts

What is Generational Wealth

By definition, generational wealth is all assets or legacy passed down from one generation to the next. In simple words, a valuable inheritance. These assets can include real estate, stock market investments, a business, or anything else which contains a monetary value.

However, given the monetary value, generational wealth can also include your family's believes or supports' values and principles.

Those people who inherit generational wealth has a financial advantage compared to those who don't. Aside from the fact that they can live more comfortably and avoid costly debt, they already have the foundation to use those assets as an investment tool to make money for them.

Therefore, wealth begets further wealth.

On the other hand, you should not get distressed over this fact because you, too, can have the chance to build from the ground up your legacy. As a matter of fact, you may already have one.

Your education. Yes! To share with you, my parents always remind me that education is the key to our future, and this is the only wealth my parents can pass on that no one can steal from me.

Also, by the time the third generation comes, a staggering 90% of families lose their capital, not a good indication of building sustainable wealth that will last.

Why Does Generational Wealth Matter?

If you're a young adult professional, generational wealth may have never crossed your mind, not the least. Instead, you would enjoy your tea, work until your neck break, and retire to the coast.

Is that what you want? If you're thinking about having your own family someday, how about your future kids and grandchildren? What valuable inheritance will you pass down to them?

A burden of debt? A bad reputation? A financial strain? Well, I hope none of these!

But, generational wealth has been a hot topic as of now. It seems that many people are becoming interested in wealth preservation and building something next to their name.

It may sound too futuristic and all, but seriously, if you could give your next successor ample wealth, it will reduce the weight on their financial lives. Plus, it will also provide them with good education, financial security, and a promise of homeownership. At least, they will not live impoverished.

Moreover, talking more about generational wealth will help the future generation be financially literate, not squander their inherited wealth. Learning about it can help them appreciate it more and continue to support the causes their family holds and do philanthropic acts.

Lastly, generational wealth matters because it helps in keeping the legacy within families alive. It helps to sustain their lives and support other people, too, through their charitable acts.

Where is the Wealth today, and Where will it be tomorrow

There is a fine line between being rich and being wealthy. Most people think it's the same thing, but they're not.

If you have $1,000 today in your bank account, you're rich. You have the money, or even more; you can do whatever you want. But if you don't worry about money, you are wealthy. It means you have other investments or assets that are generating income for you.

You may have a lot of money and be rich, but you may also have high expenses like your mortgage or credit card debt. However, if you are wealthy, you are out of the rat race.

But more importantly, where is that wealth today, and how are wealth distribution among various age groups have shifted over the last few decades?

Racial Discrimination

US Senator Cory Booker states that the “racial wealth gap speaks to the fact that [we] still have a long way to go to achieve ideals of equality in [this] country.”

The racial wealth gap is the measure of black family vs. white family household wealth. The median white household wealth (savings plus assets minus debts) is $171,000. In comparison, the median black household's is $17,600. This net gap is still growing.

During the '90s, banks and politicians saw an opportunity to open up mortgage loans to the market. Unfortunately, it ended up for black Americans getting a high-risk subprime loan, and the black community lost 53% of their wealth.

The Federal Reserve Bank of St. Louis came up with a finding that white college graduates' wealth's increased dramatically. On the other side, black college graduates over the same period have their wealth decreased.

The reason why is how they spent money; An African-American college graduate is the most successful on their family network. That's why relatives ask them for help, and they give it. But, on the white college graduate case, they're like others in their network; that doesn't mean they are less charitable or not giving, though.

The huge gap between racial wealth has grown even higher, and it started since slavery times. These slaves didn't just represent wealth; they were wealth. The racial wealth gap is problematic and has deep historical roots that persist even today. I can't speak for its wholeness, but acknowledging that it exists and understanding just how much of a gap needs to be closed is an important starting point.

Generational Wealth Gap

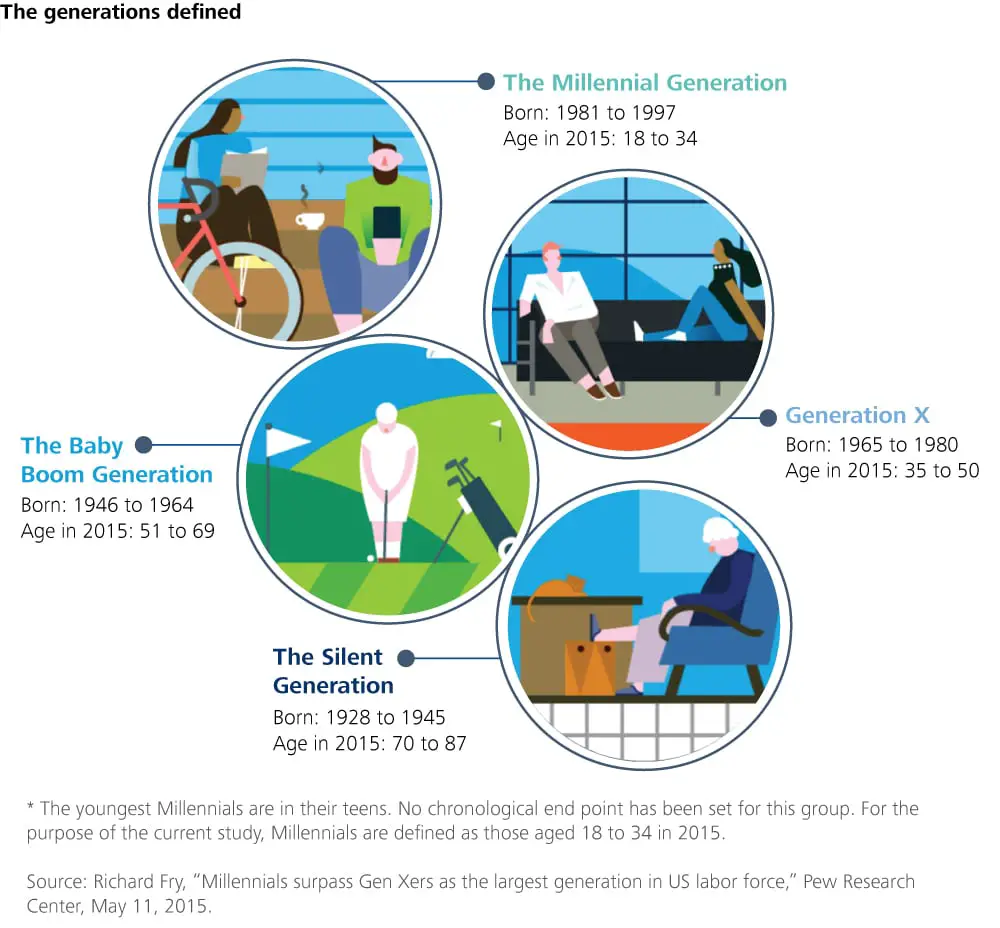

Wealth by generation also continues to soar.

Compared to baby boomers who owned about 21% of America's wealth, millennials are financially behind, with only 3% to share. Mostly because the millennial struggle with high living expenses, student debts, recession, etc.

The wealth gap between older households and younger households has nearly doubled in the past 20 years. However, millennials can catch up financially through a baby-boomer inheritance, low unemployment rates, and good budgeting and savings habits.

How Can you start building Generational Wealth Today?

Now that you know the importance of building wealth and the difference between rich vs. wealthy, are you ready now to roll up your sleeves?

Wooh! You might think, but I'm not even starting my own savings yet!

It might be overwhelming, but the overall concept is easy to grasp yet tricky in actuality.

First of all, you need to nail down first your finances in order. Save up enough money and invest those you do not use in retirement. Once you have a handle on your current finances to fund your golden years, then it is time to start saving beyond that. Then, acquire assets worthy of passing along to your children when you pass away.

Here are some of the best ways to start preparing to leave a legacy of wealth behind for your children and grandchildren.

- Homeownership

- Business

- Life insurance

- Investments

- Values

- Gifts

- Philanthropy

Homeownership and Properties

Without a doubt, homeownership is the first step towards building wealth. With the potential passive income it can generate, owning a piece of land gives you many opportunities.

It can be a way to transition wealth from one generation to the next. You don't need to build a real estate empire, although that would be cool too. By purchasing your own home, it can be a good start.

Ensure that your home appreciates over time and you have the necessary money to cover expenses and maintenance to keep it long enough to pass its value down to your children.

Build a business

Being an employee will not make you wealthy nor will it guarantee success. Having a business will do. If you have that entrepreneurial skills and mindset, put them into practice.

Running a small business or a start-up will allow you to earn more money and be your own boss. And if you grow and expand it, you can pass it along to your children as they get older.

The most significant part of America's wealth lies with family-owned businesses. According to the US Census Bureau, family firms comprise 90 percent of all business enterprises in North America. Who knows, your family business could be the next multi-million dollar business!

Related reads: 21 Best and Most Successful Businesses to Start with Little Money

Life Insurance

You might think you don't need it now since you're young and healthy, but life insurance is like giving a treasure to your loved ones.

An affordable term life insurance policy can help protect your family from unexpected financial fallout, and the value of your life insurance policy can become part of your children's inheritance.

It may take you 20 years or more to save $250,000 or $500,000. Still, if you buy a term life insurance policy with the same face amount coverage, then your beneficiaries would get that payout if something happens to you. They won't be left stressed about finding money to bury and give a decent funeral to you.

Investments

Saving money is vital for building a better financial future. However, savings are at the mercy of inflation. Although your savings might have the same balance five or ten years from now, it would have less purchasing power than before.

Therefore, investing will be able to make your money grow over time and keep the powers of inflation at bay. Investing in the stock market, for example, could provide returns for your savings around 6% to 7%, with inflation factored in. Those returns would allow your savings to grow dramatically over time.

You can make money from stocks through capital appreciation and income from dividends. To maximize capital appreciation, you follow the tried-and-true investing advice of buying low and selling high. or buying high, selling higher. For the latter, you earn these passively and choose to reinvest or stay in your account.

Besides, you don't need thousands of dollars to invest in the stock market.

Related reads:

- Investing For Beginners With Little Money- 13 Easy Ways To Invest

- How to Start Investing your Money like a Pro- The beginner's guide

You can also start to invest in your children's college education; that way, they'll be less burdened by student debts. As they say, “Knowledge in itself is wealth.” Teach your kids to save and help them in opening up and funding their savings account. Help them with their homework, and eventually, they'll learn how to apply for scholarships when they go to college.

You should also invest and contribute more towards your retirement account if you want to be financially independent and retire early.

Values

As I mentioned earlier, generational wealth is more than just monetary and tangible things. You can also pass on individual family values and principles you uphold—for example, kindness, diligence, compassion, and generosity.

Anything important to your family, your family's rich history, can also be shared with the next generation.

If you value financial success, you can train your child to learn how to budget, save money, and grow money. Teach them and engaged them in personal finance lessons, savings challenges, and an abundance mindset. Set them up towards financial independence and security.

Gifts

Generational wealth doesn't need to be passed down when nearing your death bed. You can still give money or any amount of gift while you're still alive.

You can help your children buy their first home, pay off their debts, and assist them in their financial journey.

However, remember that you should save enough money first before holding off on making annual gifts to your children. Take advantage now as the federal tax levied up to $15,000 exclusion to gift taxes.

Philanthropy

Not necessarily a way to build generational wealth, but one way to pass it is through philanthropic acts. Of course, this is if you have lots of money and want to support organizations or programs that align with your values and principles in life.

Donating or supporting charities is an excellent way of ensuring that your money goes towards a good cause.

It is also one way for those people who don't have children and wonder what to do with their assets; to help others.

How Millennials can Beat the Odds and Build Wealth

As shared earlier, millennials seem to be on the side of a wealth deficit. How can we turn the tables upside down and prove that we can also make and own wealth?

Well, first off we need a stable source of income. We need money to support our financial goals, and not only that, we must learn to diversify them.

Pick up a side-hustle today and learn about passive income.

As early as now, we should learn how to invest and accumulate assets that will pay us back after some time. And not just earn, but get wisely.

In three words, we can sum it up to EARN, MAKE, GROW.

Earn more money, make money, and grow more money. It's a long way down there, but it isn't impossible.

Ways to Ensure Your Wealth is Not Squandered by Future Generations

They say it works like a cycle. The first generation till the soil and lay the groundwork. Then, the second generation reaps the fruits and eat with a silver spoon. The next thing you knew, the third generation is left with nothing. (But we want to avoid that at all costs)

That is why, as early as now, you should make plans to save and ensure that your future generation will keep the wealth within your family.

- Communicate with each family member – Crystal clear communication goes a long way. If you can, disclose your assets and net worth to them, share what you are planning to do, and gather insights. Youngbloods might have a fresh perspective, that way family feud or misunderstandings will be avoided, plus you get to bond with them.

- Develop a family briefing system – If necessary, you can hire a financial expert that will act as your family's facilitator and ally. Make sure it is someone trustworthy, though.

- Teach your child the value of sound finances and wealth preservation – Terrified that your kids might blow off the family business or your family legacy? As early as this time, train them every financial knowledge and know-how, they should learn. Please don't be too hard, though but appreciate them and teach them the value of hard work and gratitude. But, don't spoil them too much also.

We've seen it in movies, and it has been written in books, future offspring ruining the family's wealth. Some kids are ungrateful and don't even want to be in that position. Others were spoiled brats and lavished the money their ancestors have worked hard for.

You can mitigate all these family feuds and conflicts (dramas) if you know how to manage and distribute your asset. Be kind but firm. Learn from Crazy Rich Asians how they deal with rich people's problems.

How to Pass on Generational Wealth

Aside from philanthropy, there are other ways to pass on generational wealth legally.

- Write a will testament – I'm sure you're familiar with it. The will should include your exact wishes. Make it specific so you can articulate better what your vision is for the family. Without a will, things could go ugly; of course, you've seen it in movies. Family wars, and all because of just a piece of land! Envy and greed mix it all. So, create transparent guidelines in your will and state specifically what you want to do and share, up to what amount or reason you would grant it to such a person. You can also include an estate plan.

- Create a custodial account – Custodial accounts are investment accounts that you can manage and control for your children until they are no longer minors. In most states, they receive control of the account at age 18. However, in some states, they accepted it until they turn 21. By creating this account, you can fund it for your child's future financial needs, such as a college education or buying their first home.

- Name and update your beneficiaries – Make sure you have updated your beneficiaries' names and contact details. Outdated ones can cause conflicts. If you pass away, the beneficiary will receive the funds.

Final thoughts

Generational wealth can either go the right and bright way or the bumpy one, especially when deciding to share and pass it on to the future generation.

It can be stressful to preserve it and at the same time ensure that each family member is aligned with the family's core values and legacy. But with transparency and training, your family wealth can stay alive.

In addition to that, millennials alike may be financially behind the wealth-building generation. Still, II believe that we can rise above that and build wealth more than statistics and surveys can measure.

Above all else, a generational wealth of values and right conduct matters the most; since it is the foundation of financial well-being. Again, if you know how to make, grow, and earn more money, generational wealth will have a spot on your priority list.

Soon, you'll be concerned about wealth protection, wealth accumulation, and wealth succession.

Let's all get wealthy!

What are your thoughts about generational wealth? Tell us more about it in the comments down below. We love to hear from you!

0 Comments