The history of investing is as old as human civilization itself.

Gone are the days when you want to buy a company’s share of stocks over the phone and to have the transaction via a human broker.

Then, after a couple of days, you receive by mail a physical certificate of stocks wherein you now own a piece of stock from that company.

Today, investing is more comfortable and accessible than it has ever been in the past.

Besides, the internet has made it easy for online brokers to do business, offering cheaper commission and trading fees than traditional banks and brokers.

On the other hand, have you heard about Robo-Advisors and the DIY investment approach?

Enter M1 Finance, an upcoming financial tech company that allows its users to customize and organize their portfolios. It takes the hassle out of investing!

Whether you’re a novice investor or an expert, M1 Finance is the Finance Super App you might be looking for.

However, since choosing the right investment platform can make a huge difference in your financial game, is M1 Finance safe? Let us find out.

Related reads: How to Start Investing Your Money Like a Pro – The beginner’s guide

What is M1 Finance?

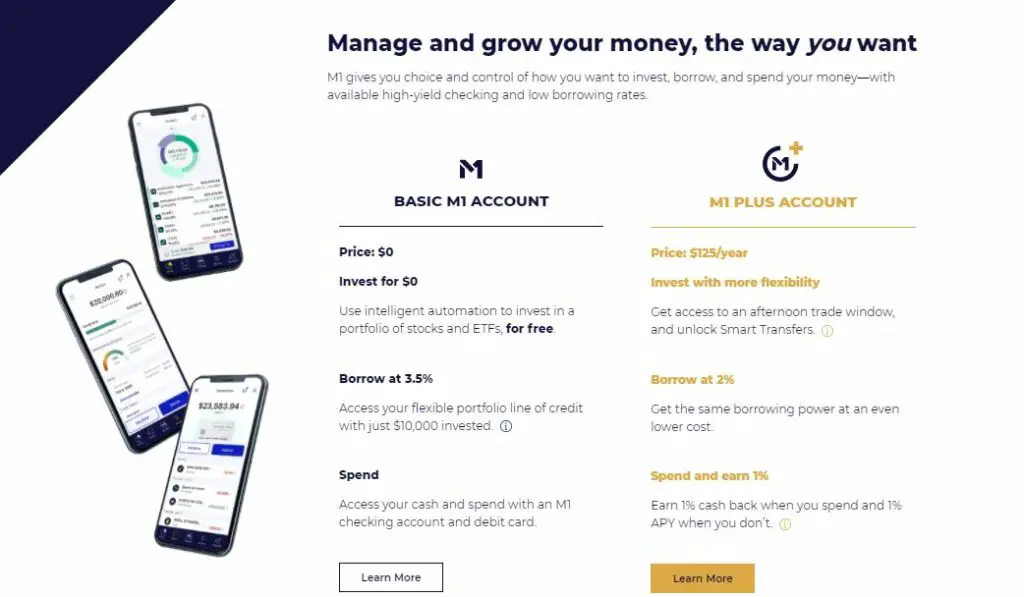

M1 Finance is a unique automated investing platform that gives you control over your portfolios and investing strategy. It’s free to use, plus no commission or management fees.

It takes the hassle out of having to manually input whether to buy or sell, the number of shares to transact, order type, and so on. You see, this makes managing a portfolio time-consuming and expensive.

With M1 Finance, you can make all deposits, withdrawals, or re-balances with a simple click of a button.

Additionally, what’s more, exciting about this super finance app is that it has fractional shares option through its “Pie Investing!” feature (We”ll cover more of that later)

M1 Finance

Account Minimum: $100 ($500 for retirement accounts)

Fee: 0%

M1 Finance was founded in Chicago, Illinois, in 2015 by CEO Brian Barnes. The M1 Finance business model was inspired by its CEO’s vision of having an investment tool to manage money easily.

You can start by opening an account with $100. However, if that is a bit of a stretch for you, you can deposit $50 first and then another $50 and then add it to your account.

If you’re opting for a retirement account, you will need $500 to get started.

Ultimately, M1 Finance offers a high-level of customization through its automated portfolio builder. Users can have portfolios that are tailored to their exact specifications. It made it possible through its “Pie Investing” feature.

What is that?

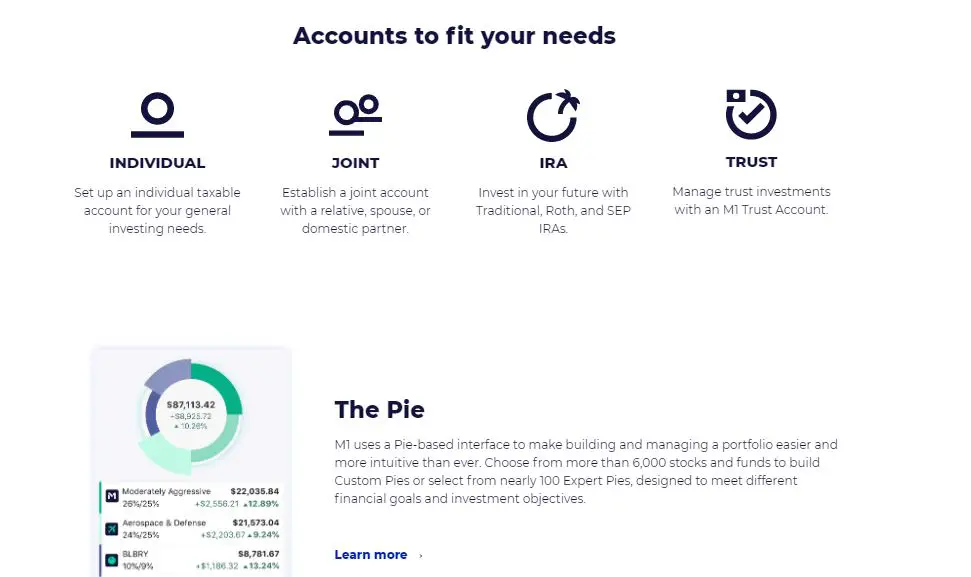

M1 lets its users build these “Pies,” which is a visual representation of their portfolio. Each pie consists of up to 100 “slices,” or investments, and each of these slices can be a stock, ETF (Exchange Traded Funds), or even another pie.

In other words, M1 Finance gets you fully invested with fractional shares. Woohoo exciting! You can now buy shares of stocks for as little as $1 and put all your other investments in different baskets, “Pies.”

How does M1 Finance work?

Signing up

Getting started is straightforward. You can choose to sign up on the website or download the app. Both iOS and Android devices are supported. Sign up using your email address and create a password then you’re good to go.

Once verified, you can select which type of accounts you want to have. From individual taxable accounts to joint, IRAs (Traditional and Roth), and Trust accounts.

***If you’re undecided and unsure, M1 offers an opportunity for you to test the platform before actually using it. From there, you will be allowed to create a portfolio and test M1 Finance before having to commit to funding an account.***

Creating Pie

At this point, you can custom-make your pie or choose a ready-made one consisting of ETFs or individual stocks. Take note that you can invest in more than 6,000 stocks and ETFs. Unlike other Robo-advisors, M1 Finance lets you choose individual stocks.

Then, you set the percentage for each slice. For instance, if you want 10% of your investment to be in Amazon, 10% of your Pie will be.

On the contrary, if you want the set-it-and-forget-it approach, you can choose from out of more than 80 portfolio allocations of M1 Finance through its Expert Pies (ready-made).

These Expert Pie portfolios are built around various themes or goals such as:

- General Investing – The portfolio is based on the investor’s risk tolerance.

- Retirement– Portfolio will adjust to your goals as you age.

- Responsible Investing– If you are concerned about a company’s social responsibility, this portfolio is built for you.

- Income Earners– For those focused on dividends and income returns, this portfolio caters to it.

- Hedge Fund Followers-Following the investment strategies of reputable hedge funds.

- Stocks & Bonds

Moreover, you can create multiple pies for different goals, and each additional pie appears as a slice of your overall pie.

Funding Your Account

When you add money to your account, M1 Finance will automatically buy shares of your investments according to the percentages you set.

For example, if you’ve set 10% of your Pie for Amazon and add $1000 to your portfolio, M1 would use $100 to allocate funds to purchase Amazon stocks.

Further, you can set automatic contributions in M1 Finance. M1 will withdraw the funds from your linked bank account and invest them accordingly.

Modify Your Pie

Once everything is set, M1 gives you the flexibility to modify your Pies further. You can add or remove shares of stocks or ETFs, depending on what suits you. M1 will automatically divide your funds between your investments.

Also, M1 will automatically re-balance your portfolio. Therefore, you don’t have to worry about trading and allocating your investments yourself. Then, you can make changes anytime.

Features

| Platform | Mobile App, Desktop Website |

| Fees | $20 Inactivity Fee, Miscellaneous Fees, $100 Fee for outgoing direct account transfers |

| Available Account Types | Taxable, Traditional, and ROTH IRA, Joint |

| Minimum Amount To Open Account | $100 for regular accounts, $500 (for retirement accounts) |

| Tradeable Assets | Stocks and ETFs only. |

| Key Features | M1 Invest, Spend, Borrow, Automatic Rebalancing, Dividend Reinvestment, Tax-efficient Investing |

| Paid Premium Account Feature | M1 Plus Subscription, Smart Transfers |

| Customer Support | Phone and Email, FAQs on the website, No Live Chat |

| Security | Military-Grade 4096-bit encryption, two-factor authentication, registered by SEC and member of FINRA (Financial Industry Regulatory Authority) and SIPC (Securities Investor Protection Corporation) |

M1 Invest

As mentioned earlier, M1 offers what it calls “Pie Investing.” It is made up of a circular chart with slices that represent each asset allocations and investments.

Plus, it allows you to pick individual stocks. Also, you can have passive investment opportunities in M1 with its partnership with Nuveen.

Apparently, there’s a limitation when it comes to trading within M1. For free app features, users can only trade once a day, starting every 9:00 AM EST.

So, for daily traders, this might be a little off-beat. But, if you’re a long-term investor, it shouldn’t be a problem. Besides, it’s free of various trading or transaction fees!

M1 Spend

One cool feature of this Super Finance App is its online banking account with no minimum balance required.

Say hello to M1 Spend! It comes with a free debit card plus cash backs on every purchase and is also FDIC insured up to $250,000.

M1 surely knows how to keep its users with its banking plus investment capabilities all in one place.

M1 Borrow

Another feature worth mentioning, a new feature of the app, allows you to borrow against your portfolio balance through this feature.

For accounts with over $10,000, you can borrow money up to 35% of your portfolio balance from your investments.

With this, you can reinvest and buy other shares (with margin trading, although risky too) or use it for non-investment purposes like a down payment for a house, buying furniture, or use it for your wedding.

There is a 3.5% interest charge for this loan service, and there’s no payment schedule. You can payback on your terms.

Additionally, you can get the loan instantly with no need for a credit check. However, the IRA account doesn’t qualify for this service.

With this feature, M1 allows you to get access to funds while staying invested. However, there’s still interest, so make sure to pay back as soon as possible.

Related reads: How to Start Saving for a House Hassle-Free

M1 Plus

It is the paid subscription service by M1 Finance. M1 Plus costs $125 annually, and it offers various discount perks. Some perks include:

- An additional second daily trading window (2:00 PM)

- Lower interest rates on M1 Borrow Loan (2% only)

- Higher interest rates on cash held in M1 Spend Account

- Smart Transfers – open for M1 Plus Accounts only, wherein you can specify the maximum amount you would like to hold in your Spend account, then set up rules for handling anything above that amount by transferring it into an M1 Invest Account.

The Smart Transfers you set will always be on and will continue working until you stop or change them. With this feature, you can now see how every dollar will work for you and allocate it in its proper place or invest the excess.

Dividend Reinvestment

Once your dividends reach a $10 mark, M1 Finance will automatically reinvest it. Now, it helps to increase your earnings. Your dividends will buy more shares, which will generate more returns.

Take note that dividends are reinvested back into the entire pie and not back into the specific stock. So, if you have $30 worth of dividends, it will be split up among all your investments.

Tax-efficient Investing

Although M1 Finance does not offer tax-loss harvesting, it does use tax depreciation so that you can keep more of your money when selling securities. It means losses that offset future gains will be sold first.

This is how M1 Finance will sell securities in order of priority, based on how they affect taxes:

- Losses are sold first, as this reduces your gains.

- Long-term gains, as they’re taxed at a lower rate.

- Lastly, short-term gains are sold last because these are taxed at the highest rate.

***Long-term investments held for more than a year has tax rates of 0%, 15%, or 20%, depending on the tax bracket. In contrast, investments held for less than a year are taxed at 37% or higher. That’s why short-term investments are only sold on last.***

$30 Referral Credit

M1 is currently running a promotion for referring others to the platform. You simply have to share the link with your friends or someone you know that might be interested in the app.

If your friend signs up and funds their account with $100 for an individual account or $500 for a retirement account within 30 days, you will receive a $30 referral bonus in your Payment Account, and your friend would also receive a $30 bonus within 14 days of your friend signing up and funding their M1 account.

Take note that a payment account cannot be a retirement account. A Payment Account must be an individual or joint taxable brokerage account (funding not required).

Pros and Cons

M1 Finance offers a lot of control and flexibility for most investors. But, it also has its strong points and drawbacks. Let’s figure them out one by one.

| PROS | CONS |

| No commission fees | No risk assessment questionnaire. |

| Fractional shares make you fully invested; no idle cash | No financial advisor. |

| You can choose your own investment. | Not many investment options. |

| Automatic rebalancing | No research and statistics tools. |

| You can borrow against your own portfolio balance. | No mutual funds investment. |

| Pre-made portfolios or custom-made | Premium Account fee is high, M1 Plus at $125/yearly. |

Is M1 Finance Secure?

It is safe to say that the online investment service, M1 Finance, is secure since it is registered with the Securities and Exchange Commission, a member of FINRA (Financial Industry Regulatory Authority) and SIPC (Security Investor Protection Corporation).

If brokers like M1 go bankrupt, your securities are protected up to $500,000 per account. However, SIPC does NOT protect you from losing money through investing.

The app also uses military-grade encryption level, PIN Code, Facial Recognition, and Two-factor authentication to secure its users’ account log-in information.

Does M1 Finance have fees?

M1 Finance is almost free to use except for its paid premium account subscription, which offers more discount perks and lower charges on some critical features like M1 Borrow.

For instance, M1 does not charge you account opening fees, trade fees, management fees, and no deposit or withdrawal fees to/from your linked bank.

M1 lives up to its core goal of removing the barriers for better investing. Although there are miscellaneous fees like:

- $20 for the inactivity of an account for more than 90 days,

- $100 fee for outgoing direct account transfers

- $125/yearly for M1 Plus Premium Subscription

- $100 termination fee

All of these may be a drop in the bucket, but it sure does add up, so think and plan carefully about the expenses of using apps like M1.

Is M1 Finance safe for ROTH IRA?

The Individual Retirement Account (IRA) falls into two types: Roth and Traditional IRAs. A Roth IRA is an individual retirement account that allows you to make after-tax contributions.

Traditional IRAs are individual retirement accounts that offer a tax-advantaged way for individuals to save for retirement.

With M1 Finance, you can steer clear of commissions or management fees; you never have to worry about hidden fees eating into your returns again. You can also start investing in your IRA for free and enjoy simple, secure, and free investing.

Indeed, The M1 Finance Roth IRA is just as good as any Roth IRA being offered elsewhere.

***But, it would be best if you did your research first. Learn about ROTH IRA’s rules, how to open an account, whether through a broker, a robo-advisor, or a financial institution. See about the fees and customer support available***

How does M1 Finance make money?

If you’re wondering how a company like M1 Finance makes money with the tons of fee-free features it offers, here’s a list of how they make a profit and still operate as a business.

- Fees from the M1 Plus membership

- When users make purchases on the M1 Spend debit card

- Interest on loans from M1 Borrow

- Lending shares (to short-sellers to earn a small profit from this)

- Gaining interest from the uninvested cash in your account (instead of giving the interest to you).

Is M1 Finance suitable for beginners?

With the high-level of customization that M1 offers to its customers, it’s clear to say that M1 is good for someone who has thorough experience in investing.

If you’re someone who understands how investments go, this is good for you. And, if you want to be in control and manage your money better, M1 is perfect for you. Moreover, M1 is for long-term investors since it has a limitation with the trading window unless you’re an M1 Plus member.

However, if you’re a newbie and are continuously learning, M1 might be a promising start for you too. With the help of its educational resources and your own research study, you will eventually get the hang out of it.

Alternatives

Of course, M1 is not the only investment app that you can try today. Check out other options that offer almost the same features as M1 but cater to different users depending on the purpose of their investments. You might check on:

Final Thoughts

Overall, M1 does bridge the gap between Robo-advisors and DIY investing. Although M1 has no real financial advisor to help you with your investment decisions, you must know what you were dealing with when choosing to use M1.

Ultimately, the app is best for DIY investors, semi-experienced, and long-term investors.

The fact that it offers retirement savings options is a big plus for someone looking for this opportunity.

The mobile app is as good as the full functionality of the desktop web version too.

Another aesthetically pleasing aspect is its “Pie” representation of shares. It is great, especially for those visual people who want to see all their money at a glance. With M1, you can make buy or sell orders on an individual slice of pie in dollar amounts.

Remember, every type of investment asset has a risk, so be equipped and know how you will enter the game.

When deciding to invest, it could be time-consuming to find a broker, but M1 Finance, an online investment service plus a bank all in one, will help you make smarter financial decisions. It’s a bank -(borrow) – broker investment account on the go.

What do you think of M1 Finance? Share your thoughts below.

If you have been using the app for a while, how has your experience been with it? Tell us. We love to hear from you!

0 Comments