Is car an asset? This adage question has been a topic of debate over time in the financial world.

Just like determining whether a house is an asset or a liability, likewise, a car (vehicle) is what makes people’s opinions split.

Most people consider it an asset, while others see it as their liability.

However, what is the natural way to treat whether what you own or owe is an asset or a liability?

Today's post will give you answers to this question- is car an asset, and we will provide ways to make it one of your income-generating assets.

So, sit back, relax, and read.

Related reads: How to build assets? The secret to wealth revealed for young adults!

Is car an asset or liability?

Let's get straight to the point. Technically speaking, yes, a car is an asset- but a unique one in accounting terms.

Moreover, your assets and liabilities will make up your overall net worth. Like most companies and organizations update their monthly or quarterly balance statement, an individual also has his ways of assessing his overall net worth.

However, you should know first how to define whether something is an asset or a liability.

Asset vs. Liability

In accounting finance, an asset is anything that has value, can be easily liquidated into cash, and is producing more money for you, hence increasing your net worth.

For instance, cash, savings, investments, stocks, bonds- these are all your assets.

Furthermore, an asset can also mean something that can generate cash immediately, for example, when you sell your item (jewelry, antique collections, vintage or rare luxury brands, etc.)

However, it depends on how you view something as your asset.

Generally, suppose it brings economic value and resources to you, helping you to live a better life and well-being, plus increases your monetary worth. In that case, it can be considered an asset.

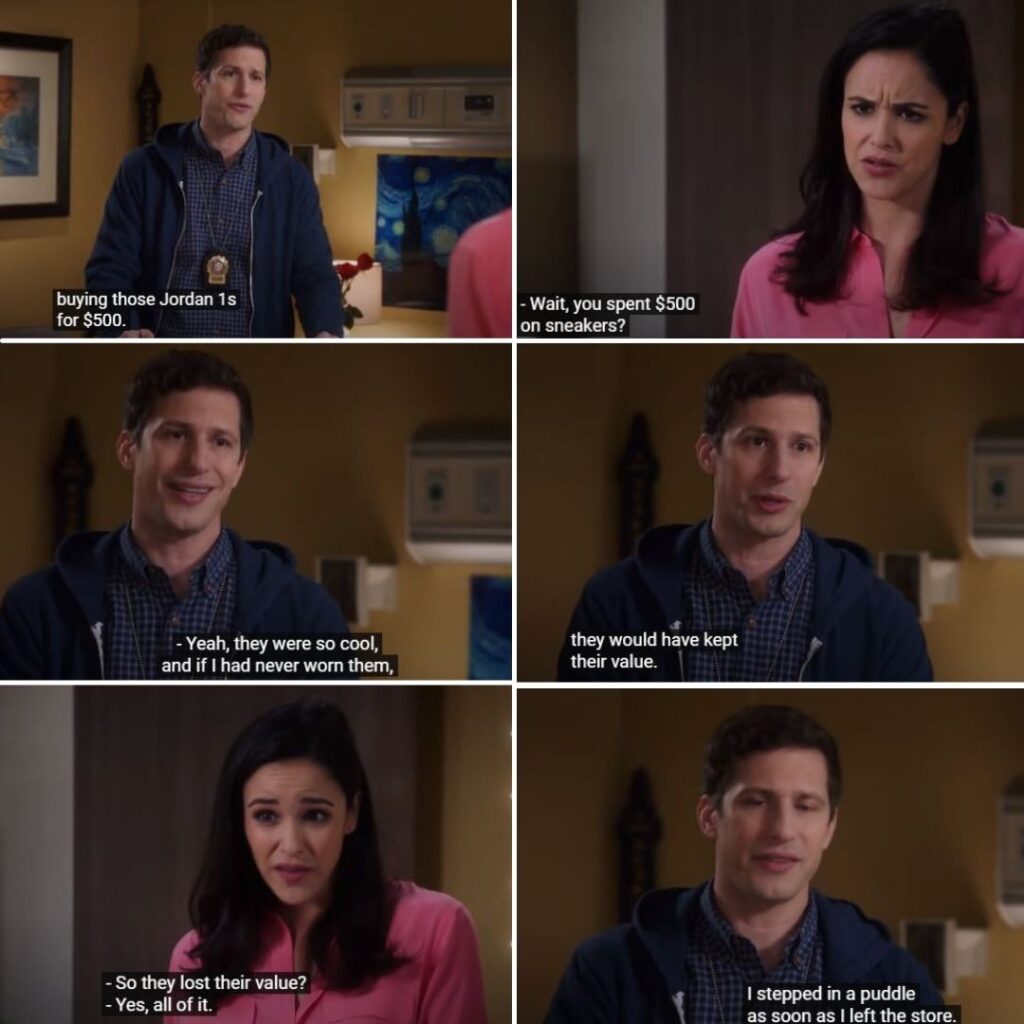

Therefore, is a car an asset? Yes, it is. But, it loses its value once you use it up. Hence, it is also called a depreciating asset.

If you recall, on your accounting 101, there are many types of assets. There are fixed assets (plants, machinery, buildings) as well as current assets (cash, account receivables, marketable securities)

On the other hand, there is also a depreciating asset. It is where a car (vehicle) will fall into the asset type.

Because a car is susceptible to wear and tear, it will be worthless over time, thus losing its value. But when you sell it, it brings you cash- which is an asset.

So is car an asset? Here’s when a car is in its asset lifetime.

- You use it for your business transportation. Business helps generate revenue which is an asset, thus increasing your net worth.

- Using your car to make money for you.

- Your car gives you security, convenience, and peace of mind.

- You can sell it in the future through its depreciated price.

- Owning a loan-free car.

Therefore, this is when you will consider a car is more likely an asset to you.

On the other hand, when is a car a liability?

Car = Liabiliy

Let’s define what a liability is first.

Liabilities are the opposite of assets. If assets are what you own, liabilities are what you owe. Think of debts you need to pay or services to be rendered.

Student loans, credit card debts, mortgages, banknotes (loans), personal loans are a few examples of an individual’s liability.

Essentially, a liability decreases your net worth. It is because a liability (debts) reduces your money and is tied without any economic benefit.

When do you say a car is a mere liability?

Undeniably, many people view their cars and vehicles as something to be paid off.

Besides, as mentioned earlier, the moment you use your car is the time it starts to depreciate.

From the first year of using your car, it already loses 20% of its value. Then, it will generally lose 10%-30% more for the succeeding years, hence making it more expensive to own a car in the long run.

Here are other reasons why people think their car is a liability.

- Owning a car doesn’t end with the selling price. Over time you have to pay vehicle expenses such as maintenance and repair costs, mortgage/lease payment, car insurance, down to car parking, and toll fees. These are all included in the cost of owning a private vehicle.

- If you use your car to move, say for work purposes, which is fairly an asset type to consider since you use it to make money. Conversely, you can also use public transportation or commute instead.

- For improving social status without gaining any economic benefit at all, such as keeping up with the Joneses or showing off, then your car gains liability.

- If you owe money on the car loan, that loan is a liability.

- You can consider a car a liability once it causes accidents. For example, you hit someone with your vehicle, that is an expense on your part and a drawback since you have to pay for damage caused.

As you can see, there are various scenarios when a car is not an asset. The idea behind it is that your car loses value the moment you drive it off a lot and continues to lose value as time goes on.

But the most obvious reason for that is it feeds on car expenses that you should anticipate once you decide to purchase a car.

Perhaps you can consider buying a second-hand or refurbished vehicle- it’s less expensive, and there are many types of second-hand cars still in excellent condition. On the other hand, owning a brand new car can be costly.

Besides, location is a variable factor too. For instance, it is more costly to buy and own a car in California compared to Florida.

Still, you have to justify whether you need a car.

Moreover, it generally depends on how you treat it. For example, will you view it as your asset and add it to your balance statement, or will you treat it as another expense?

But, it will be much better if you can make your depreciating asset make extra money for you.

Why is car not an asset?

There could be a variety of reasons and circumstances when you can say that your car is not an asset.

However, it still depends on one’s perspective and unique life situation.

Most significantly, an asset should be a resource that generates income or money for you, thereby increasing your net worth. Liabilities are what you deduct from your assets, as these are your obligations or payables.

Think of it this way. Assets are the general inflow of money, while liabilities are responsible for the outflow.

You’re lucky if you run your numbers and you are left with a positive number. But, if you subtract your liabilities with your assets and the numbers are brimming red or negative, it’s time to assess your financial decisions and review your finances.

Lastly, a car or any vehicle isn’t an either-or type of asset vs. liability. Ultimately, it can be both. Depending on one’s view and life situation, a car may be an asset and can be a liability at the same time.

What is a vehicle asset?

A vehicle asset is one that you own outright and can use in your everyday business transaction.

Let's say, for example, you run a business. Your truck is a depreciating asset because it's a tool you use to earn money (moving goods, delivering items from one place to another, etc.) But at the same time, that same asset is also losing its value once you max its useful life.

On the other hand, if you purchase that vehicle out of a loan, your liability is the money you need to pay off. Once you debit the amount you owe to the amount you own, that is your asset.

How to make money with your car?

Now that you have an idea of whether a car is an asset, fully knowing that it is a type of fast depreciating asset, it makes sense to use it for your good.

For instance, instead of using your car for sole personal purposes only, why not let it earn money for you?

Since we’ve established that an asset is anything that generates cash for you plus economic benefit, you can start to make your car a money-maker asset.

1. Drive for Uber or Lyft and do delivery gigs

Nowadays, ride-sharing services and delivery gigs are among the most popular ways to turn your car into a money-maker asset. This type of venture business ensures that it will give you money back and turn your vehicle into an effective asset.

If you have a clean driving record and can spare even a part-time job, then you can try becoming a driver for Uber or Lyft.

You can also do some delivery gigs for Instacart, DoorDash, and Postmates.

Most of these companies require any vehicle, even bikes, or you can also deliver on foot if you prefer. You can earn a fixed rate plus generous tips from customers as you become an independent contractor and can work anytime and anywhere you want.

Read more:

- DoorDash vs Grubhub vs UberEats-Which is the best delivery gig?

- How Much Do Postmates Drivers Make- Will it make a good full-time job?

2. Wrap your car

Companies like Wrapify and Carvertise allow you to generate income using your car.

Whether traveling or simply going out for your errand, you can earn a decent amount of money by making your car a suitable advertising place for various businesses' geo-marketing promotional campaigns.

If you are comfortable wrapping your car with decals and advertising stickers, then this gig is for you.

Related content:

- Wrapify Review: How to earn passive income by driving your car?

- Carvertise Review- How Much Can You Get Paid To Wrap Your Car?

- SellMax Review: How To Make Money Selling Used or Damaged Cars

3. Rent or lease your car

If you can’t drive for a while, instead of letting your car be stagnant for the following days and be there parked doing nothing for you (gaining dust and not making money for you), why not list it for rental?

This is an excellent opportunity for travelers or tourists who will be staying in your area.

Besides, you can set your rental rate. Head over to Turo and try leasing your car for a few days per month, and you could rack up a fairly decent amount enough for the insurance and other car ownership costs.

4. Do errands

What’s good about this errand gig is that you can do it while doing your stuff at the same time.

For example, you can deliver parcels while fetching your kids to school or run other errands for others in exchange for a service fee.

Check out TaskRabbit for available odd tasks you can earn money for today.

5. Sell to a trusted dealer or trade-in privately.

Finally, if you think that your vehicle costs outweigh the value it is supposed to give you, it's probably time to consider selling it.

However, you have to do your research first. There are a couple of ways to sell your car. First, you can reach out to legit car dealers who will do the work of finding a customer for you and selling your vehicle.

If you choose the dealership’s service, you might not get the best price because most dealers will spend money enhancing the car, remodeling it, making some repairs, and selling it for a higher or even better price outside.

But then, since it’s already a depreciated car value, at least you make money out of it even for a half or quarter price. Most sellers are also willing to take less money due to the convenience.

The other way is to trade privately. For example, you can post your car on online websites or marketplace and deal with the trade-in yourself.

Of course, you must also know your car's value. One way to know your car's worth is to check the Kelly Blue Book.

Apart from that, if you know someone buying and selling new and used cars, you can also seek help from them and ask related questions.

Furthermore, you can check what other people are saying on Craiglist, eBay Motors, CarGurus, AutoTrader, and NADA.

Final thoughts

So is car an asset? Well, depending on how you would see it. But know that there are creative ways for you to turn it into a money-making tool to grow and increase your net worth and assets.

Everything you own has its costs. Likewise, owning and using a car can lead to an expensive outlay, but that doesn’t mean that it is not a worthy investment overall.

Nevertheless, be smart about where to put your money or what you will invest in. You must carefully evaluate whether a car will fulfill your need or your mind is tricking you into just a fancy status and symbol.

Finally, mindset is everything. As long as your car serves its purpose and gives you all the benefits you deserve (convenience, safety, business purpose, etc.), you are free to treat it as your asset or liability. Besides, there is tons of potential for you to make money out of it.

What are your thoughts about this? Is your car an asset, or do you treat it as a liability? We would love to hear from you!

For more related content, subscribe to The Finance Boost and receive daily financial tips and tricks that will ultimately liberate you and empower you towards acing the money game!

0 Comments