It’s payday again! But when you look at your paycheck, are you happy with the amount you received? Do you think it’s worth the blood, sweat, and tears of your long weeks and months of hard work?

Since 2014, the average U.S. household income (median) has been drastically decreasing. In 2018 it plummeted $64,324, then $68,703 in 2019. For the first three months of the last year, 2020, it falls to $49,764.

Well, of course, the numbers changed due to the effect of the global pandemic. But, since we’re climbing off to a better start in 2021, we expect that these stats will change soon. And as more and more cities are slowly opening back up and adapting to the new normal, the average salary range of $50k-$60k will be back soon.

However, comparing it to last years’ stats, $40,000 is a bit short. Does that mean you’re paid less compared to fellow Americans who earn more than $40k? Is $40000 a good salary?

And yet, here you are receiving, $40,000 for your annual salary, which is technically slightly below the average amount.

Is that all that there is? In this post, let’s find out if $40000 is a good salary enough to sustain and support your living.

$40k a year is how much per hour?

Let’s try to break down your $40000 annual salary to see if it is a good salary. That way, it’ll be easier for us to understand how much you’re getting paid per day, week, month, and hour.

It’s simple math, actually. If you want to know how much is your monthly earning from a $40,000 annual income, you simply divide it by 12 (months.) So, $40,000 ÷ 12 months = 3,333.-and that’s how much your monthly income is.

For a weekly payment, simply divide it by 52 (total # of weeks in a year), and you’ll get $769.23 per week. Let’s say you’re paycheck is biweekly, then you would divide it by 26 weeks, which equals $1,538.46.

Lastly, to know your hourly wage, divide $40,000 by 2080 (work hours in a year-40 hours work week * 52 weeks per year.) It goes like this.

| $19.23 per hour | ($40,000 ÷ 2080 work hours in a year) |

| $769.23 per week | ($40,000 ÷ 52 weeks) |

| $1538.46.biweekly | ($40,000 ÷ 26 weeks) |

| $3,333.33 per month | ($40,000 ÷ 12 months) |

However, take note that this is a computation based on gross income, meaning excluding taxes.

$40,000 a year is how much a month after taxes

Is $40,000 a good salary after taxes? Now, for this part, it will depend on which state you live in. Since each state has imposed different taxes, it may mean that you live in a state where the tax is higher than others.

Moreover, let’s not forget the cost of living in these areas. For example, cities like New York and Seattle, where business centers are, studio type apartment is expensive, among the few.

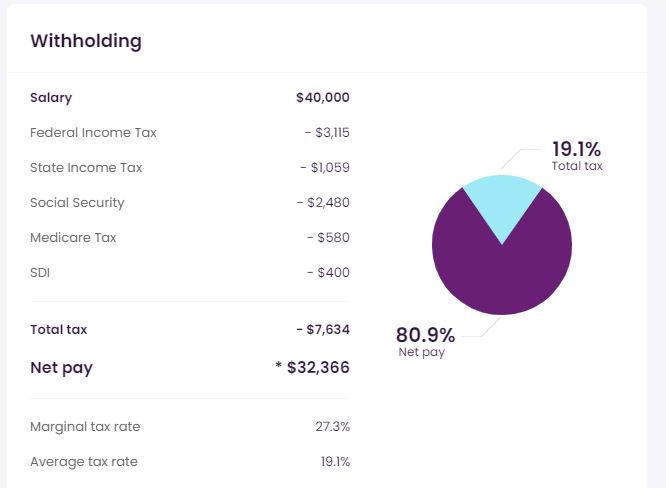

For instance, if you’re living in California with a $40,000 yearly income, your estimated net pay will be $32,366. That means you are taxed $7,634 – this accounts for federal and state income tax, social security, medicare tax, etc.

To know more about how much your salary is after tax, check out this online income tax calculator for free. Using it will also give you a comprehensive summary of how much your money is after deducting all those taxes, how much your employer matches, and pay its share for your tax, benefits, etc.

Furthermore, you can choose to select which cities you are from and view either yearly, monthly, hourly, or weekly pay right after tax.

How Much Rent can I afford on a $40k salary a year?

There’s a general rule of thumb which states that your monthly rent expenses should not exceed 30% of your gross monthly income. This 30% must also include utility expenses.

Hence, this means that if you’re making $40k, you can afford rent at $1,000, including utilities. However, it still depends on your geographical location and the type of apartment or property you’re eyeing.

If you’re living in a state where the cost of living is below central cities, rent may be cheaper, and you can tweak how much you dedicate to renting.

Let’s say, for example, instead of 30%, you can use 25% of your net pay as your maximum rent and utility amount. For instance, according to this paycheck calculator, a $40,000 salary in Las Vegas, NM, will bring about $2,683 monthly take-home pay.

Therefore, if we use the 25% maximum rent amount, it means that your monthly rent payment should work out to roughly $670.

If this is something that you think will work out for you, then great! You can adjust up to whatever amount you’re comfortable with, but don’t forget these guides. Moreover, if this will still pose a challenge, you might need a roommate to share rent expenses with or look for housing in a different area where you can use 25% of your take-home pay as your base guide.

Read more: How to save money on rent.

How to live well making $40k a year

Probably right now, you have an idea that whether earning $40k a year is a good salary depends on various factors, such as state you’re living in, lifestyle, how you handle money, expenses, among the few.

If you’re on the other side of the coin, here are some ways for you to live well, making $40k a year.

Live Well Within Your Means.

Living within your means is simply incorporating a frugal lifestyle. You should stop spending more than your earnings! Isn’t it disheartening to find out there’s nothing left in your wallet/pocket a few days after your payday?

And then here you go again struggling to make ends meet before the next payday. Why? Because you only save what is left. Counter it with: save as much as you can, and live on the excess.

Seriously, avoid those frivolous expenses eating into your money that you are unaware of. Stop keeping up with the Joneses! Breakaway from this rat race cycle, it’s not worth it. Moreover, YOU NEED A BUDGET.

Use a Budget to Maximize Your Money.

Speaking of a budget or spending plan, seriously, you need one now. A budget will not cripple your financial life nor deprive you of stuff you want to buy, eat, or do; instead, it will help you maximize your money.

A budget will show you where your money goes. It’s your first step to financial freedom!

Using a budget will help you live in peace with your money, stay disciplined, and you will have a clear picture of your overall financial well-being.

If you’re unsure how to do a budget or wondering where to begin, you can use the classic note and pen to write down all the nitty-gritty details of your expenses and money coming in from the last paycheck.

After you deduct all the expenses from your income, determine whether the net take-home pay is positive or negative. If there’s money left, congrats! You’re living within your means.

Otherwise, if it falls short, it’s time to make adjustments now.

Aside from that, there are many budgeting templates available that you can easily follow online. So, get converted now to a budgetary lifestyle!

Read more:

Pay off existing debt and avoid new ones.

While credit has indeed increased Americans’ purchasing power, allowing them to buy homes and other goods, it also opens the gate to normalized debt across the country. According to the most recent data from the Federal Reserve’s Survey of Consumer Finances, the average credit card debt is $6,270.

In January 2021, U.S. consumer debt decreased at an annual rate of 0.4% to slightly below $4.2 trillion. That’s after rising by 2.5% in December. Consumer debt had hit a record of over $4.2 trillion in February 2020, right before the pandemic and recession set in.

The Balance, Consumer Debt Statistics

I mean, there’s nothing wrong with having debt, but if it’s too much and mismanaged, that’s where the problem kicks in. Then, we begin the journey of crushing debt.

Some of the “excuses” people give that prevent them from saving money are associated with them having tons of debt that they want to settle first. But what if you can save money while paying off your debt?

First of all, there are two types of debt; revolving – mainly credit card debt, means it gets renewed every month as previous debt is paid. While non-revolving or installment debt- has a fixed schedule of when payments should be made until all the debt is paid off, e.g., student and auto loans.

There are also two types of strategies for you to pay off your debt faster; the snowball and avalanche method.

Aside from that, you must work out to settle your existing debts first. Here’s what to do:

- You can opt for a balance transfer at a low or no charge to a lower interest credit card.

- Pay off your credit card balance before the due date to avoid interest charges

- Don’t carry balances to the next month

- Keep your credit usage low (30% max).

- Remember, it’s not free money.

- Use it as a credit-building tool.

Afterward, avoid debt at all costs! That’s where having a buffer plays a significant role.

Track Your Spending and Improve your habits.

Like embracing the budgetarian life, you must keep track of money coming in and going out. That way, you’ll become aware of how much you’re letting go and saving.

You can make an informed decision about how you will spend your money while giving each dollar a job.

Another way for you to live well with a $40,000 salary is to improve your financial habits.- learn about personal financial literacy, stay consistent with your financial goals, and make saving money like second nature to you.

You absolutely need to practice this one money habit: keeping your expenses lower than your income. Remember the formula: INCOME – EXPENSES = SOMETHING LEFT. This is what you want.

Related reads: Save Money Live Better: 21 Practical Saving Tips For Millennials

Find Ways to Save on every expense.

If you are still finding it hard to live within your means and had done every money-saving ritual you’ve ever known existed, perhaps you’re overlooking something.

It’s not enough to save money; you should also find ways to save on every expense. Perhaps you can switch a cable network or cellphone provider for a cheaper and more affordable cost?

How about that gym membership you barely use? Cut it out! Try to work out at home instead; you’ll save your money.

More often than not, little things matter, and sometimes all we need to do is let go of that stuff that isn’t serving you good.

Build up an emergency fund.

Now more than ever, having an emergency fund or contingency fund is essential to your financial health and wealth creation. The recommended amount is around three to six months’ worth of your monthly expenses.

The purpose of an emergency fund is to finance you when life throws lemons at you, e.g., sudden job loss, dent in the car, death of a loved one, and more.

Therefore, for anyone starting to save, work on building your emergency fund first. That way, you’ll have money to support yourself and your loved ones whenever life takes an unexpected turn.

If you have an emergency fund, you won’t need to go into debt because you have a stash of your own hard-earned money to sustain you. Also, you will start to approach financial freedom and independence.

Invest Regularly to grow your wealth.

Wanna know the secret to why wealthy people stay wealthy? It’s because they’ve learned the secret formula to multiplying wealth!

And that is tied up with only six letters: I-N-V-E-S-T.

By investing your money, you are allowing it to produce more money for you. With investing, time is your best friend. Keep in mind that it’s not a get-rich-quick scheme where you just pick a few winning stocks and flip $100 to $10000 in two months.

Investing isn’t hard nor too complicated a subject that only the elite can learn. Everyone has to learn how to invest their money and we all have free access to investing. Talkin’ ’bout Robo-investing apps out there!

Did you know that investing $10 per day for 20 years will get you $141,120.53 at 6% interest?

More importantly, invest regularly. If you want to get started with investing, download our free PDF guide or head over to our investing section to read more investing-related posts we can share with you.

Related reads: How to Start Investing Your Money Like a Pro – The beginner’s guide

10 Best U.S Cities To Live Comfortably on a $40,000 salary

Is $40000 a good salary based on my city? To give you a reference on which places you can move and start packing right now, below is the list of Top 10 most affordable U.S cities to live in.

Well, do not take our word for immediately moving in right now, but know that these cities on the list are based upon several factors like the median rent, household income, cost of living index, average commute time, and more.

For instance, the Cost of Living indexes (COLI) is a way to compare the overall price of goods and services between different areas of the United States. A COLI of 100 is like the benchmark for an average cost of living.

A city with a higher COLI means it’s more expensive than the country’s average, while a lower COLI means it’s cheaper.

The places on this list are relatively large, dynamic, with growing cultural diversity, improving economy, among the few. Still, it’s best to see if it’s worth the try.

Median Household Income/Cost of Living indexes (COLI) | Median Rent | |

Memphis, Tennessee | $39,108 / 76 | $825 |

Indianapolis, Indiana | $42,076 / 83.5 | $902 |

Omaha, Nebraska | $59,266 / 89.3 | $920 |

Columbus, Ohio | $52,971 / 85.5 | $959 |

Las Vegas, Nevada | $53,575 / 102.6 | $1,107 |

Salt Lake City, Utah | $73,730 / 118.9 | $1,235 |

San Antonio, Texas | $46,317 / 89.7 | $1,049 |

Birmingham, Alabama | $37,375 / 74.1 | $968 |

Des Moines, Iowa | $52,251 / 81.2 | $906 |

Buffalo, New York | $37,359 / 79.5 | $1,070 |

Source: Is $40000 a good salary- Top 10 Most Affordable U.S. Cities to Live In

10 Most Expensive U.S Cities that make a living on $40,000 salary hard

On the other hand, let’s take a look at cities where the cost of living will probably make $40,000 a bit of a stretch.

If you want to compare, you can use this COLI Index comparison calculator to see and compare your current cities to the list below and learn about factors contributing to the rankings.

COLI Cost of Living indexes (COLI) are a way to compare the overall price of goods and services between different areas of the United States. | |

New York, NY | 278 |

San Francisco, CA | 228 |

Washington, D.C. | 202 |

Los Angeles, CA | 194 |

Boston, MA | 193 |

Seattle, WA | 189 |

Honolulu, HI | 189 |

San Diego, CA | 189 |

Miami, Florida | 184 |

Denver, Colorado | 181 |

Source: Is $40000 a good salary- 10 Most Expensive Cities in the U.S

Is $40k a year a good salary for a single person

All the single ladies and gents out there, put your hands up! Ah! the glory of single life. If you’re asking, “is $40000 a good salary for a single individual,” meaning no dependents and no responsibilities in life except to live and survive? yes, it is decent enough.

However, depending on the city you live in, living on a $40k salary might carry weight and put you at a disadvantage. There are some cases where insurance is cheaper for married persons, mind you.

Families can save money by buying in bulk, but for a single person, this is impractical. Another thing, having a partner that can share expenses and the cost of living together, but if you don’t have any of that, traveling alone is expensive, and you don’t have someone to share financial setbacks or help you at times when money is hard.

Above all, the most important thing is that, yes, as a single person without children, you can live with $40k provided that you live within your means and stay within a budget.

Nonetheless, don’t forget factors such as location and lifestyle (for example, living rent-free with your parents) when accounting for whether $40k is enough to get by.

How to increase your income beyond a $40,000 salary

If you’ve done your homework and found out that you can barely get by on a $40,000 yearly, don’t worry, there are a few things you can do to maximize it and boost your finances!

1. Pick up a side hustle or two.

The economy gig is flourishing, and you should totally take part! Boost your $40k income by becoming a part-time delivery driver at Uber or Lyft.

You can also try earning additional money through data entry and typing words based on audio you hear (transcription). Besides that, it gives you the benefit of working as much as you want and whenever, wherever you are.

For instance, did you know that you can make money by becoming a virtual friend?

The sky is the limit! And there is no shortage of outsourcing either local or international talents around the world. So come on and take your part! Pick up a lucrative side hustle now!

2. Offer Your skills as a freelancer.

Freelancer is also another way for you to tap into your skills and leverage them to boost your income.

If you know how to write compelling words, you can become a copywriter. A virtual assistant is the most in-demand freelance skill nowadays. But have you ever heard of a Pinterest manager?

Working as a freelancer also gives you the freedom to work anytime and anywhere you are in the world. As a freelancer, you are an independent contractor meaning you have flexibility in your work schedule but must manage your own taxes.

3. Ask for a raise at your job.

If you think jumping into the freelancing and side-hustling world is not to your liking, you can first ask for a raise at your current job.

Don’t be shy and speak up! Relay in good terms to your boss all the good work you’ve done, how you’ve grown since you started and learned a lot, and are now ready to take the next level. Of course, you should do this when you’ve acquired enough experience or years at your job and not when you’re just a newly hired employee.

Communicate well with your boss and learn the art of negotiation to fulfill your reasonable demand. Learn how to tell your manager about how you think you deserve a raise pleasantly and professionally.

4. Create a business

Lastly, building a business is a surefire way to boost your $40k salary and generate multiple income streams, which will lead to wealth.

You may already have something you love doing or are learning about, which can be turned into a business. However, this is not necessary.

You can work backward with a proven profitable business model and emulate it. There are so many of these available.

Maybe you think you have to start big or do nothing. You couldn’t be any more wrong. Many big businesses today – Microsoft, Apple, Skyscanner (which started as a simple spreadsheet) all began with little or no money.

So, take your chance. Share with the rest of the world your talent, gifts, and unique business ideas, products, and services that will help people solve their problems or make life better.

Wrapping Up

If you’re a fresh college graduate wondering whether to take that $40,000 offer, I hope we helped clarify to you to make an informed choice before you accept your job offer.

Maybe you’re a career shifter wondering if $40000 is a good salary. Regardless, you must assess whether your pay is worth it and can sustain or support your lifestyle in the long-term.

Ultimately, there’s nothing to be ashamed of if you are earning $40,000. For some, it may not be enough to sustain their lifestyle, but for others, it could be more than enough.

After all, it still all depends on how you are using that money.

I hope we answered all your questions in mind, especially the question, is $40000 a good salary? If you have any comments about this post, don’t hesitate to ring us! We love to hear from you and would gladly help you with any money-related questions you may have.

Cheers to an abundant financial life!

0 Comments