Best budget planners in town? Look no further, this post will help you decide to pick the best budget planners in the market out there.

Have you ever wondered how sometimes money slips swiftly through your fingers?

When we don’t keep track of our finances, we forget to set aside money for priorities. It could end up spending on unnecessary stuff, which could also place us in a tight position when we find out our spending is more lavish than our take-home pay.

Not to mention not being able to spare a dime for your savings account.

So, if you want to change this lifestyle and switch to a budget-friendly one wherein you can track and trace your finances, then the first step you can take is to get your customized budget planner.

It’s a starter to help you and your wallet get back on track by organizing and managing your finances smoothly.

Today we’re going to look at the best budget planners available, their best features, what qualifies are under the “best” budget planners, and monthly budget apps, too, for those who prefer using their smartphones for digital budgeting.

So, buckle up as we delve into the exciting world of adulting: budgeting!

Related reads: How to Budget and Save Money to Transform your Finances.

What is a Budget Planner?

Like a typical planner that helps you organize dates and lists special events—a budget planner does the same. Only, it tracks all your financial-related data.

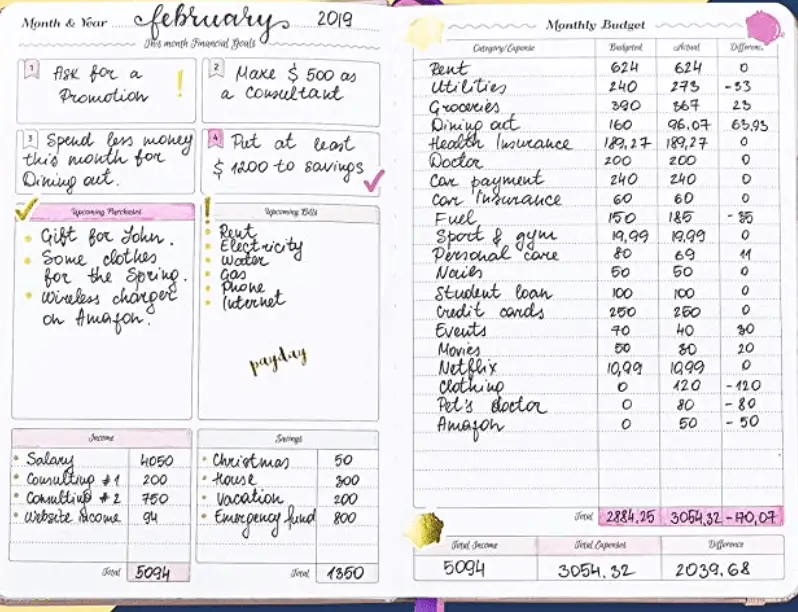

You can use budget planners to organize monthly bills and subscriptions, track receivable cash, and plot the collectible date.

Moreover, you can trace outstanding debts plus record the balances left, and record monthly savings made. Lastly, you can jot down special notes on anything related to your personal finance with your budget planner.

In this manner, you can track all cash inflows and outflows daily, monthly, and yearly for your convenience (ease of access to your financial data). Then, of course, you could manage your finances knowing every penny that comes in and out of your pocket.

Why do I need a Budget Planner?

Keeping track of your finances might be difficult without a planner since there’d be too much information to remember, which could lead to you forgetting about them, especially the relevant ones.

It’s much convenient and safer to know what expense should be set aside first in their order of priority.

That way, you won’t miss your payables and receivables and will make your life a lot easier and have fewer worries to think about.

This means that you’d already know which money would go to your savings account, for your monthly bills, and the money that would go to yourself because you plan ahead (that’s the perk when you’re thinking forward.)

Furthermore, you have complete control over where your money is going. Besides, there’s nothing wrong if you’re a control freak, of course, when it comes to your finances.

Most significantly, if you are meticulous (like me), planning generally leaves you worry-free and keeps that financial security and peace because you have the big and complete picture of everything under your finances.

What goes in a budget planner?

Let’s peek at the features of the probable best budget planners.

| Features | Description |

| Expense Tracker | A good budget planner should include a space for you to track your monthly expenses- utilities, food, gas. etc. This is because it should give you a birds-eye view of your expenses and know which part of it might be adjusted in the future. |

| Income Tracker | To budget efficiently, you should know how much is coming into your bank account to manage your finances. |

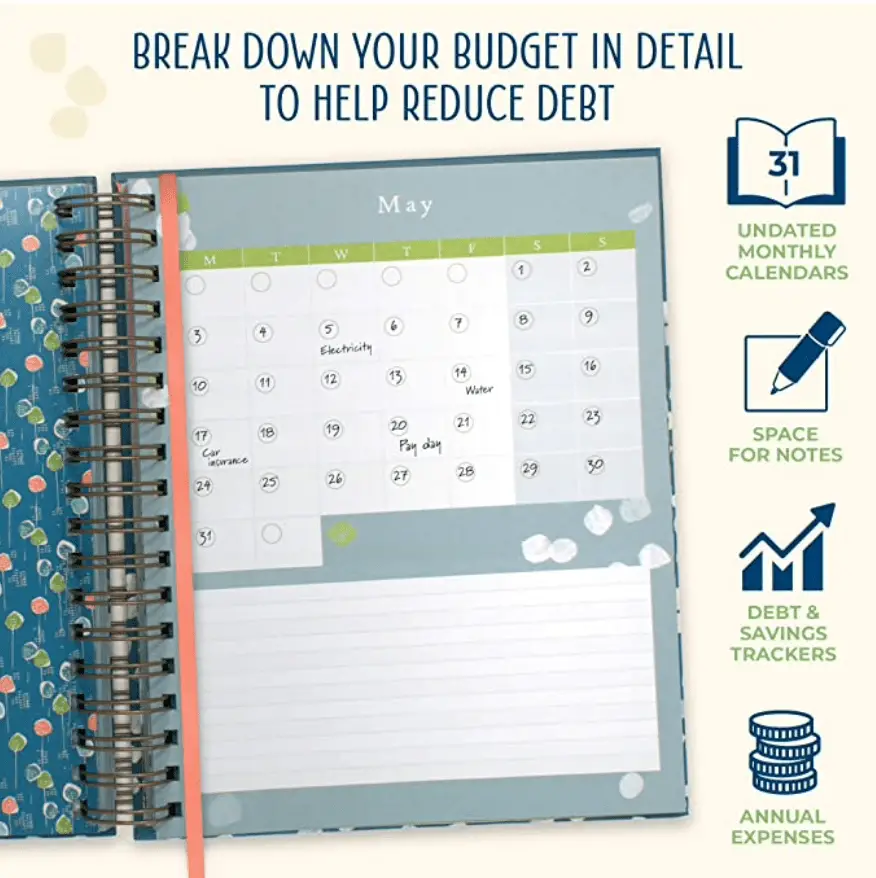

| Monthly Overview | This spot can be a calendar to mark your due dates so you wouldn’t forget any crucial reminders since going over your planner page by page might take some time. |

| Goal Page | A vital part of the planner; you can write down your goals weekly/monthly/yearly and go check on it if it has been fulfilled by the end of the date set. This will help you remember to budget since you have goals you want to achieve and commit to. |

| Receipt Pockets | Pockets are essential to keep notes, receipts, and other papers related to keeping your finances in check. One pocket would suffice, but it’s much to have a few more so your documents are organized. |

| Savings Checker | This spot will be your space for checking the total accumulated savings over the past months. |

| Debt Tracker | A space for you to track dents and balances left until they are fully paid will help you budget how much money you’re going to set aside for it monthly. This way, too, you can stay afloat. |

| Fits your Style | Who says budgeting can’t be in style? Pick the planner that suits your style to spark motivation as well! |

| Undated Planner | With the undated planner, you can start your budgeting any time you want. |

What’s the best budget planner?

Typically, any budget planner would work for everyone. But, whether you prefer the traditional pen and paper method, excel sheet, or digital app, it all boils down to serving its sole purpose- helping you to budget and keep tabs.

However, if you have specific preferences or standards when choosing your budget planner, that would work too.

Therefore, the best budget planners, like personal finance, should also be on a personal level. Customized it if you want, DIY it yourself, or whatever you like it to appear. As long as it’s showing your personality and serving its full functionality, whether cheap or costly, that should work out as the best budget planners.

More importantly, budget planners should motivate you on managing and organizing your finances! So if you prefer the bright-colored ones or the ones with lots of pockets or the floral ones, then go ahead!

Remember, your budget planner is a personal tool to help you in your finances. You have a say as to which are the best budget planners out there that fit your style and taste.

So choose what sparks joy and inspiration to help you live the best life you deserve.

6 Handpicked Budget Planners for You

We handpicked the six best budget planners for you to help you kickstart your budgeting plans today.

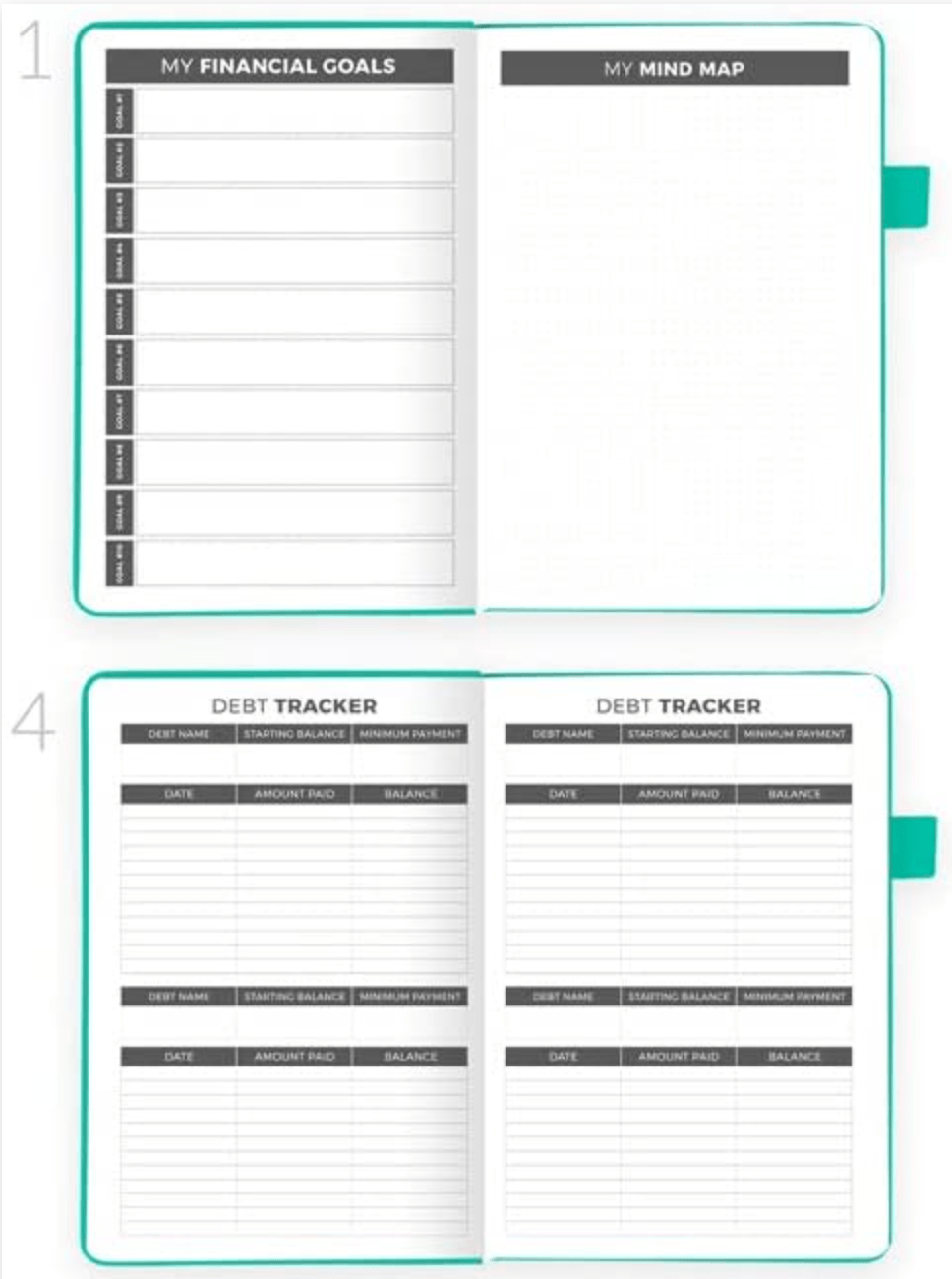

1. Clever Fox Budget Planner | Cost $19.99

PROS

- Undated planner + List your goals

- Compact + w/ Stickers + No bleed pape

- Pocket for receipts and bills + Pen loop

- Organizes monthly and yearly

CONS

- Lacks empty spaces for taking notes

- Relatively small (A5 Size)

The first best budgeting planners to make it into our list is the Clever Fox Budget Planner.

It features the necessary spots to help you organize your finances:

- monthly budget overview,

- strategies and tactics to manage your finances,

- trackers for both savings, debt, expense, financial goals,

- budget and tracker for special occasions like Christmas and yearly financial overview.

Aside from that, it has a calendar where you can note your monthly bills and receipts. Plus, there are pockets where you can tuck docs.

It’s compact, elegant, hard-covered, and comes along with 23 other colors to choose from.

This will suit those who prefer the classy yet straightforward type of planner.

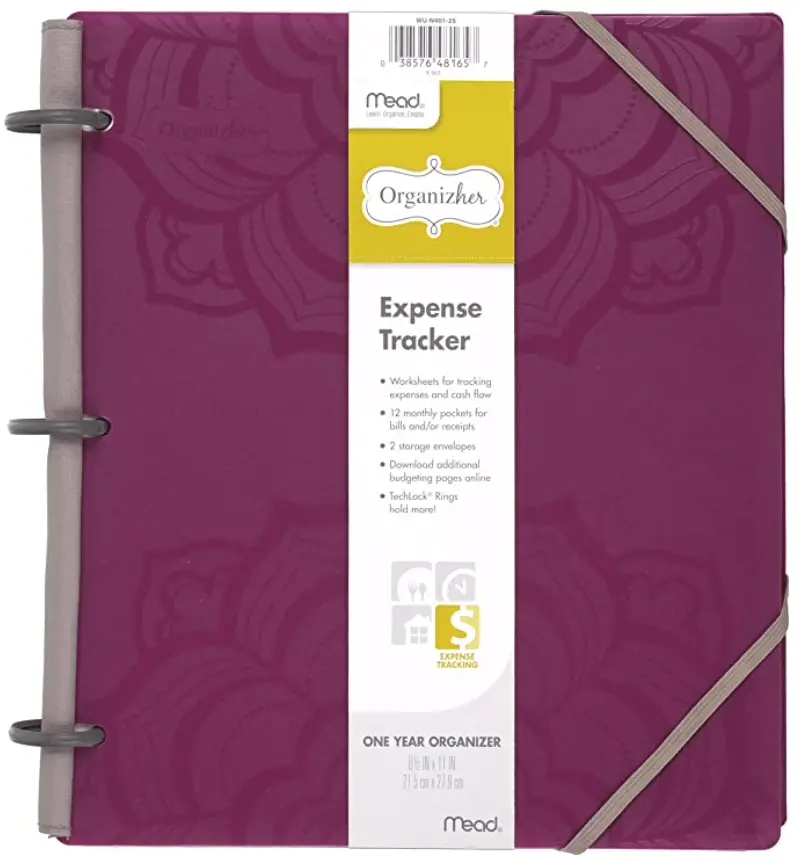

2. Mead Organizer Expense Tracker | Cost $14.99

If you prefer a more oversized planner spacious enough for notes, essential bills, and receipts, plus a cheaper alternative organizer, then this planner is for you.

PROS

- Undated monthly planner

- Budget-friendly + Best for starters

- Spacious for other important notes

- Comprehensive Expense Tracker

- Twelve different pockets to store bills etc.

CONS

- Pages might be loose since it’s a binder

- Thin paper (might bleed)

The Mead Organizer features a monthly pocket for bills and other important receipts to store them according to the month they are due or paid. This then helps you organize your important papers and easily access them.

It comes with a monthly worksheet to help you monitor your monthly expenses, plus a calendar that can give you an overview of important events like due dates and when receivables are ready for collection.

In addition, there is a checklist that you can use for other important reminders which require detailed explanation on top of the overview calendar.

You can use ample space on the left for other important notes or reminders that you want to store in your planner, like directories and more.

Furthermore, it has three tech lock ring binders with a fabric gusset and two-strap locks to keep your planner in place. Finally, the planner features two colors to choose from: purple and pink.

3. Your Balanced Budget by Palmer, K. | Cost $7.99

PROS

- Straightforward and Simple

- Daily & Monthly Tracker

- Compact and lightweight

- Undated + Yearly Review

CONS

- Lacks pockets for bills etc.

- No space for other important notes

- Absence of monthly calendar to write reminders

- Lacks spot for financial goals

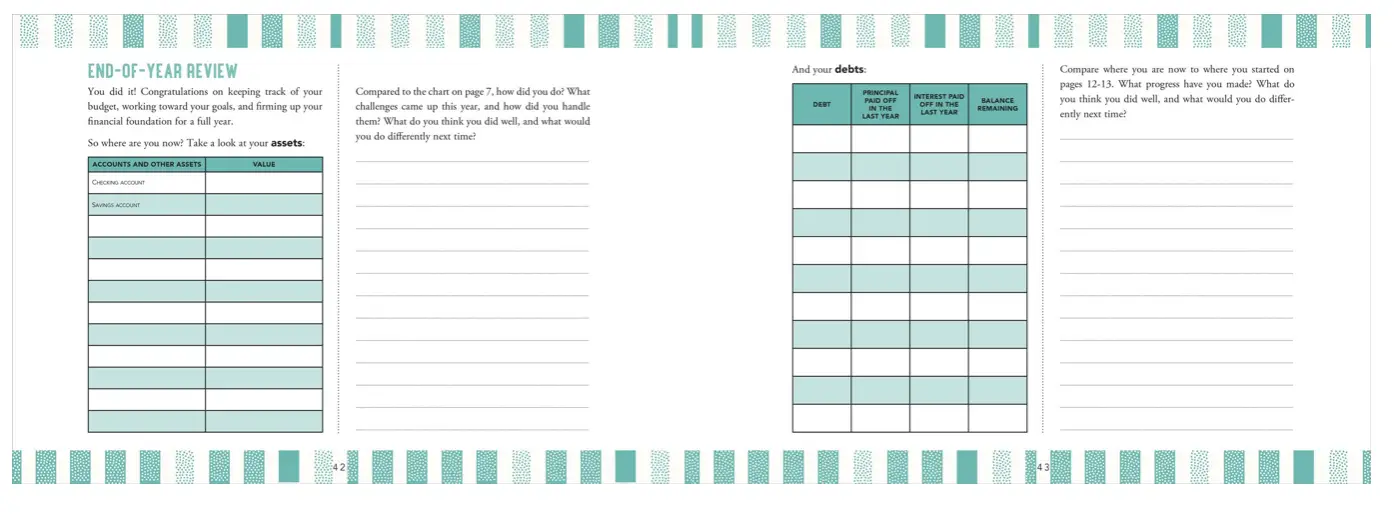

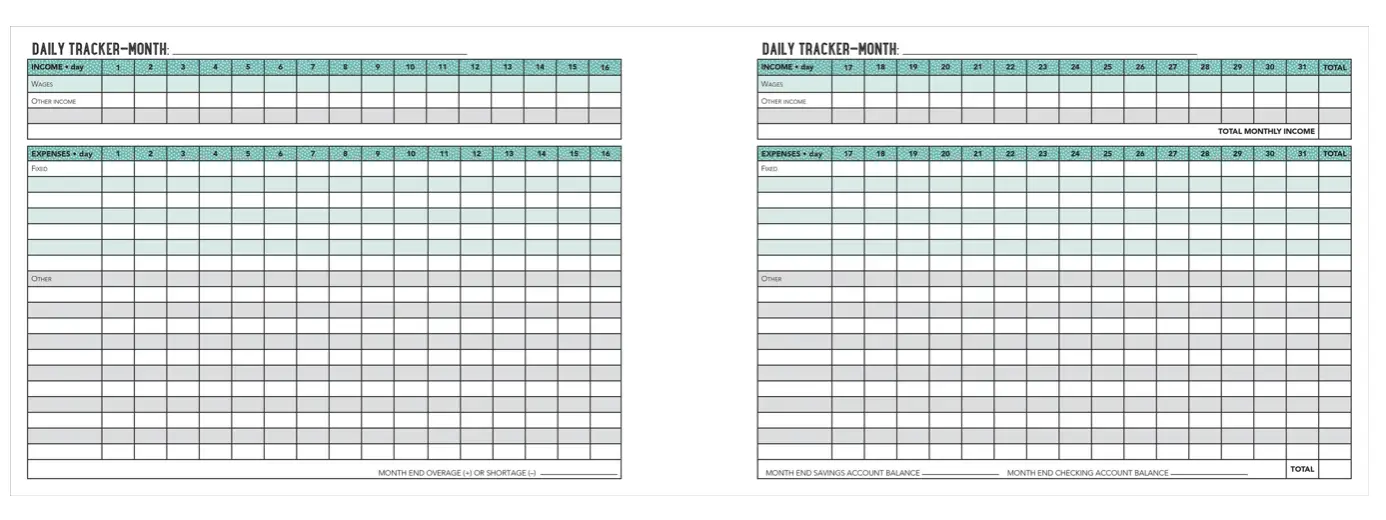

This particular budget planner is straightforward in organizing finances.

It features a daily to monthly expense tracker that separates your fixed expenses from other expenses.

Moreover, you can keep track of how much you’re earning daily from wages and your other source of income, i.e., small business or earnings from commissions.

Ultimately, this planner fits those who prefer to know the daily impact of their spending and control it to save more.

Using this planner will give you an overview of how your everyday decisions can affect your finances and what measures you can take to change any bad habits or impractical purchases.

Furthermore, It also features a yearly review page where you can assess your financial management performance at the end of the year and whether or not you have improved on managing it effectively.

However, it doesn’t have space for other important stuff like pockets for tucking bills in one place, a calendar for reminders, as well as a monthly reminder on important events.

So, if you prefer keeping all necessary documents relating to your budgeting/financing, then check out the planners available above with those features.

Despite its lacking features, it still serves its purpose of helping you budget effectively. On top of that, it’s less expensive than most of the planners available in the market, considering its features.

4. Boxclever Press Large Budget Planner | Cost $19.99

| PROS | CONS |

| Undated (start anytime!) | Spiral-type; pages might tear/not intact |

| Daily and monthly tracker + reflection page | Large; difficult to carry around anywhere |

| Monthly calendar + bill tracker | 1 line space only per date (for trackers etc.) |

| 13 robust pockets for keeping bills | |

| Yearly overview + list future goals |

Another one of the best budget planners, plus high-rated on Amazon!

This all-in-one planner features a monthly tracker for income, savings, and budgeting, as well as a monthly calendar for an overview of your monthly financing activities.

The monthly calendar has enough space for a wide variety of notes that you might need to jot down on specific months.

It features a bill tracker to track substantial payment due dates and large monthly pockets to store those bills with colorful designs per pocket.

Aside from that, it has a daily tracker that can help you identify bad spending habits and improve out of them.

There are also pages to track expenses for special occasions available to know the total spending you’ve made on these occasions so that you can set a sinking fund budget for these events. Besides, there are allotted special pockets for special or specific occasions to avoid getting lost.

This planner is equipped with all the important features needed for a budget planner to help you properly organize and manage your finances.

It has a page for yearly review to look back and see what you’ve achieved during the year and a page for future goals.

More significantly, the planner is beautifully crafted with a stunning pattern and has a page marker to navigate quickly to where you left off.

This budget planner suits those who prefer large spaces for notes and other important stuff while keeping organization for finances intact.

5. GoGirl Budget Planner | Cost $16.99

Best budget planners, you might ask? GoGirl Budget Planner is the answer!

A very compact all-around all-in-one planner that organizes finances and notes in one page, allowing you quick access to your important stuff with just one flick of a page.

| PROS | CONS |

| Compact and Portable + small yet spacious enough for an important note | Smaller than a regular A5 planner |

| Creatively plan w/ free stickers | |

| Income, savings, expenses tracker | |

| Monthly review of financial performance | |

| Different colors + budget-friendly | |

| It comes with a pen loop + two ribbon page markers | |

| Has pockets for bills + bleed-resistant paper |

GoGirl Budget Planner features a monthly budget page to list and sum up your expenses and review and check on areas that need curbing.

It has a monthly page allocated for essential reminders, goals, and a summary of your expenses, such as your purchases and incoming bills.

Moreover, it also comes with a monthly tracker for your income, savings, and expenses plus spending for special occasions like Christmas, allowing a smooth and organized flow for your finances, not leaving a critical detail behind.

The planner is undated to start anytime; plus, it comes with a user manual to assist you in using the planner and bonus stickers to help you creatively plan your finances.

One incredible perk of this planner is that it’s compact and portable, enough to carry it anywhere you want. Apart from that, there are twelve varieties of colors to choose from.

This planner is perfect for those people on the go, who frequently travel, or for college students. This one is ideal for you with the chic and girly vibe, small but compact, and well-organized.

6. Undated Budget Planner by Limitless | Cost $16.69

| PROS | CONS |

| Undated + comprehensively organized | No empty calendar |

| Cash envelope system (w tracker) | Lacks extra spaces for notes |

| Stylus-pen + pen loop + elastic closure | Spiral-type (Pages might fold) |

| Goal tracker + stickers | |

| Quickly monitor progress + cost-friendly |

This budget planner is one of Amazon’s best choices as it features the cash envelope system, unlike any other planners.

As we all know, the cash envelope system organizes your bills according to their specified category, whether for expenses, savings, debt, and special occasions, to not mix them up with each other.

The budgeting planner features spending, savings, debt, bill, income, review, and goal tracker, which is pretty much all the possible tracking organizers for your finances and monitor your progress.

Aside from that, it comes with three cash envelopes to track your monthly budget by category. Hence, a dual functionality.

It also comes with a stylus pen which you can use in your journal and devices, a pen-loop to hold pens in place, inner pockets to store bills, cash envelopes, and stickers for all-in-one budget planning.

The planner is crafted with PU leather hardcover in elegant black color with two pockets front and back.

Ultimately, this would suit those on-the-go people who prefer having a compact all-around-planner that is comprehensively organized with a stylish look.

What is the best monthly budget app?

If you prefer organizing your finances through a mobile app (on which you already have), then various budgeting software and apps exist.

These applications are often free to use and are pretty handy since you carry your phone, tablet, or laptop anywhere. This means you have your budgeting tool available with you anytime and anywhere you go.

Essentially, these apps work like budget planners, only it’s digital and backed with automation.

Here are a few of the best of the best out there!

1. MoneyLover

It is a simple money tracker perfect for your budget needs. In addition, you can further customize each budget category.

The app is available both on iOs and Android devices.

PROS:

- Interactive mobile app for budget and expense tracking, saving plans, debt/ loan.

- User-friendly and mobile intuitive.

- Bill reminders & schedule for recurring transactions plus a travel mode feature for tourists.

CONS

- Limited features for the free version app.

- Can’t import data from previous apps used.

Read more: Money Lover App Review: Will it help you never overspend again?

2. Qapital

An app built based on how human psychology influences money habits, Qapital offers a little bit of everything for your money management process, with its ultimate goal to supercharge your savings.

Need help saving, budgeting, and investing? Qapital takes off the work from you and helps you do all these and more.

Qapital is a mobile money app that helps you save money based on the rules you set, your spending habits and automatically saves and invests money towards your savings goals or expenses you plan for.

Furthermore, it takes the stress of micromanaging your money off you by allowing you to set rules once and doing the rest for you.

PROS

- Provides the opportunity to save often and regularly by tying saving triggers to routine activities

- It makes budgeting stress free for laid back budgeters

- Zero Transfer fees

- No minimum amount to open an account

- It comes with a Visa debit card

CONS

- Charges a fee for International transactions

- You can only reach customer service through email or message in the app. No phone support.

- No web or PC version of the app can only use on a mobile phone

To learn more, read our Qapital full review below.

3. Clarity Money

A simple management app for all of your financial well-being.

From budgeting to expense tracking, savings, subscription cancellation (yes, it does this too!), and credit score tracking, Clarity Money can do all these for you.

Ultimately, the Clarity Money app is a personal finance app to help you see all your finances in one place and keep tabs on your spending habits.

PROS

- Free to use and readily available.

- Creating accounts takes less than a minute.

- The app makes you aware of how much you’re spending each month and makes it easy to reduce your expenses by allowing you to contact providers to cancel your subscriptions.

- The app enables you to sign up for monthly updates on your Experian credit score.

CONS

- Less customization, unlike other budgeting apps.

- Although Clarity Money has 9,000 U.S.- based financial institutions to work with, there will be times when the app doesn’t support your bank, so this may be one downfall.

Full review: Clarity Money Review 2020: Best Budgeting App For Beginners

4. Tiller Money

Do you love excel or spreadsheet stuff? Tiller Money is your automatic spreadsheet on the go.

If you’re using spreadsheets to track your cash flow, Tiller money can cut all the tedious tasks like labeling, putting data, and downloading your bank statements for you.

Moreover, you can link up to five spreadsheets at a time if you want to consolidate all your budgeting sheets for expenses, freelance income, even tracking your net worth.

PROS

- Custom budget spreadsheet

- Automatic updates

- Free templates

CONS

- Skill level for persons not familiar with spreadsheet

- No investment monitoring option

Full review: Tiller Money Review- How to use the Automated Budgeting Spreadsheet

Manual Planner or Automatic App?

Budgeting Planner | Mobile App | |

|

| |

|

|

Ultimately, I think it all depends on your personal preference whether or not you’re settling on mobile apps or desires a tangible planner.

As long as it achieves the goal of helping you organize, track and budget your finances, then the method used doesn’t matter anymore.

However, the tangible budgeting planner could encourage motivation to properly managing your finances as it helps reduce screen time since we’re already too caught up with our electronic devices.

It’s nice to spend some time jotting down essential reminders in your tangible planner (more likely to remember stuff when writing it down), tucking bills, and setting financial goals—you’d find it more fulfilling and encouraging.

The decision is up to you as long as it helps you achieve your financial goal and makes your life easier.

Final thoughts

There are many tools to help you start your budgeting plans today, and it all goes down to which method works for you and makes your life easier.

Remember, these are just “tools” to help you budget effectively and efficiently. But the determination and discipline needed to plan and budget your finances all effectively depend on you.

These are a few of the best budget planners. Either physical or virtual would help you kickstart your budgeting plans today!

You have to choose which one works perfectly for you. Personally, I prefer the classic pen and paper method with binders. Most significantly, mini size to keep it light; besides, I’m in love with every budget planner design.

Have you tried these best budget planners? If not, which of the best budget planners mentioned above would you be willing to try?

Share your thoughts below; we can’t wait to talk with you!

0 Comments