Are you looking for resources on how you can start investing in index funds for Roth IRA?

Welcome, you’ve come to the right place.

Today, let us walk you through the process of index investing. Plus, let us share with you the top index funds for Roth IRA.

Ready to paint a picture of your golden years?

Let’s get it on!

Read more: 5 Reasons Why Investing in Index Funds for Retirement is Worth It.

What is an index fund?

First of all, let us discuss what exactly an index fund is.

In simple words, an index fund is like a mutual fund which is a pool of selective securities or equities. Thus, it includes stocks, bonds, ETFs, etc.

Moreover, index investing is like what the word says; it simply means investing in index funds.

Then a Roth IRA is an individual retirement account that you must have right now. Furthermore, it is a retirement account funded with after-tax money. Then you can withdraw money anytime without penalty.

Essentially, index funds mimic the performance and behavior of the market fund it is based on. The most common index funds in the market are the S&P 500 or the Standard and Poor’s 500.

The S&P 500 is made up of the stocks of 500 large U.S companies. Imagine getting a piece of that every shard stock!

So should you invest in index funds for your Roth IRA? Definitely! But you have to keep in mind the overall expense ratio.

It is the fee that you will pay annually. For example, let’s play pretend.

Pretend that XYZA fund has a 0.02 percent expense ratio. That means in every $10,000 invested; it would cost $2 per annum.

Index investing is a form of passive investing.

Because most index funds are just a list of assets, e.g., stocks, that track the collective performance of the assets on the list.

So if you buy an index fund that mimics the S&P 500, that makes you a shareholder of those 500 companies too!

Now you don’t have to figure out which stock will perform well, and you don’t have to worry about finding the best 10 or 20 stocks to hold.

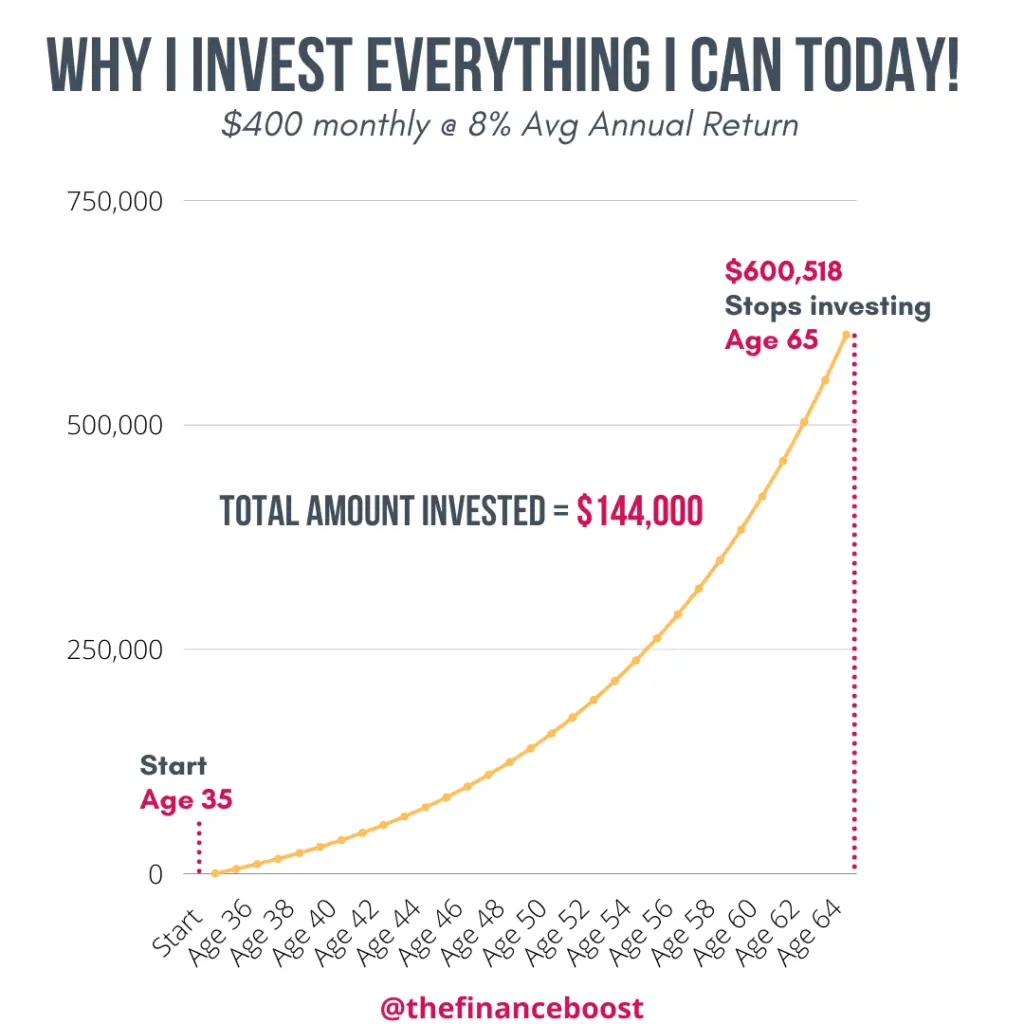

Why invest everything that you can today?

$261,000 is the difference between someone who starts investing at 25 and waits until ten years later in this example.

Furthermore, $96,000 is the difference in lifetime amount contributed/invested by the 25-year-old and the 35-year-old.

Hence, assuming a contribution is $400 monthly at an 8% average annual return.

The 25-year-old only contributed to their investment for ten years, while the 35-year-old did for 30 years and still couldn’t meet up.

Therefore, TIME and COMPOUNDING INTEREST is what’s at play here.

So, this is why you should start investing as early and often as possible. Forget the excuses, the anxiety, and procrastination. It only takes 5 minutes to open an investment account.

Besides, 5 minutes can be the difference between reaching financial independence 20 years earlier than your peers.

Why invest your money in an index fund?

Still unconvinced of what investing in index funds for Roth IRA can do to your portfolio? Consider these solid reasons.

Diversification

Investing in index funds gives you instant diversification. It is because your investment is spread throughout different asset types.

Therefore, you get to have a piece of a share of these stocks.

Lower risk

Another benefit of investing in index funds for Roth IRA is that it minimizes your risk. But, there are also risks with index funds like in any other assets.

But index funds lower it because other assets in the fund can pull the slack if one fails.

It then gives you a well-balanced and even diversified portfolio that is easy to manage and follow.

Low cost

Aside from that, index funds tend to be less costly, unlike when you’re buying individual stocks. In addition, due to its passive investing nature, there is less management within the fund hence, a relatively low-risk way to invest.

However, there is only an expense ratio that you have to keep in mind. Plus, if your chosen broker has a buy and sells fee, other transactions fee, and the minimum amount required.

Promising Return

Finally, index funds provide attractive returns. Besides, some index funds like the S&P 500 do their stock-picking over time based on specific criteria. Hence, companies that fall short get booted off the index, while companies that rise to the occasion join the club.

So check this out.

The Top 10 companies in the S&P500 30 years ago vs. Today

| Year 1991 | Year 2021 |

| Exxon Mobil | Apple |

| Philip Morris | Microsoft |

| Wal-Mart Stores | Amazon |

| General Electric | |

| Merck | Alphabet Class A |

| Coca-Cola | Alphabet Class C |

| AT&T | Tesla |

| IBM | Berkshire Hathaway |

| Royal Dutch Petrol | Nvidia |

| Bristol-Myers Squibb | JP Morgan Chase |

None of the top 10 companies 30 years ago are top 10 today on the S&P500 in terms of market cap. Also, 917 companies have been added and removed from the index since its inception.

How to invest in index funds for Roth IRA?

So how do you want to get started in index investing? It’s as easy as 1-2-3! Follow these steps below.

1. Pick an index fund.

Your first step is to pick an index fund. So Aside from the most popular and commonly known index fund, the S&P 500, several index funds are available out there per industry sector and beyond U.S soil.

Remember with index funds, you are not worrying about which stocks to buy. Instead, you are focusing on which location, industry, and market opportunity.

For example, is the fund invested in environmentally friendly businesses or financing start-ups?

Therefore you may want to consider picking an index fund based on your preferences. Also, do your diligent research.

2. Choose a fund.

After you’ve picked an index fund to invest in, it’s time to decide which index funds to buy.

You can also look into factors that might affect your portfolios, such as the investing expenses, tax, accessibility convenience, and account minimum.

Investing expenses shouldn’t be overlooked. Moreover, the fund’s expenses are an essential factor that could make or cost you a lot more money when disregarded.

So factor in the expense ratio of the fund, taxes that you need to pay, and any other investment account you need to maintain once you start index investing.

In addition, take note of other investment accounts that allow fractional shares with zero trading fee and can be easily set up in just a few minutes with just a few dollars.

3. Buy shares through an online broker or investment app.

Now that you know how and what you would like to include in your portfolio, it’s finally time to buy a fund.

Plus, it’s the easiest part. In addition, you can directly buy through a broker or an investment app.

Even more, you can also directly buy from mutual fund companies.

The best index funds for Roth IRA

The best index funds for Roth IRA are low-cost, which is practically ideal for beginners.

Moreover, there are a few index funds for Roth IRA.

- Vanguard S&P 500 (VOO)

- Fidelity ZERO Large Cap Index (FNILX)

- Schwab S&P 500 Index Fund (SWPPX)

- Vanguard Total International Stock Index Fund (VGTSX)

- Vanguard 500 Index Fund (VFINX)

3 Broad Classification of Index Funds for Roth IRA

Growth Funds

A growth fund is all about capital appreciation. They are subject to higher rewards but are much riskier.

The growth fund aims to achieve a well-diversified portfolio focusing on long-term capital appreciation by investing in high-quality equities diversified across sectors.

Income Funds

It is for the income investors. Moreover, this type of fund offers exposure to stocks and investment-grade bonds. It typically consists of fixed income bonds, CDs, stocks that pay dividends, and other little-risk but with high and guaranteed returns.

Primarily, the fund’s goal here is to maximize current income while capitalizing on growth.

Target date funds

It is a personalized portfolio that contains a mix of stocks, bonds, and other investments that get adjusted the closer you get to retirement.

The fund will hold more risky assets initially, then slowly reduce risk as the target date nears.

Key Takeaway

So that’s it for index funds for Roth IRA. We suggest you do more research if needed and if you have any questions, feel free to ask us. We love to connect with you!

In the meantime, keep in mind that investing is not synonymous with “picking stocks.” You can be a great investor without picking any single stock.

Hence, enter index funds! Moreover, you can invest in index funds for Roth IRA. But, again, anybody that capitalizes on the future value and returns is an investor.

Don’t let anybody scare you into “investing.” It’sIt’s simple.

Best of luck to you, savvy investor!.

0 Comments