What do your golden years look like?

While most Americans are saving for retirement, only about 28% feel on track. More significantly, they are those in their early to middle and late 20s.

Although it’s a given, knowing that those in their 20s have far more years ahead of them, still, nothing beats when you start early plus consistently.

Moreover, it’s not enough that you save. What better way for you to boost your retirement savings is to put it in an investment account.

For instance, you can open an investment account today and start to invest in index funds for retirement.

Index funds aren’t just an effortless way to invest; they’re also more efficient and are proven to outperform active traders.

In this post, let’s talk about why you should invest in index funds for retirement. Are index funds good and a safe space for retirement?

Furthermore, are index funds for retirement better than 401k? What are the underlying pros and cons?

So without further ado, let’s get straight to the point.

Related Content: How to Open a Roth IRA Account? Simple and Easy Beginner's Guide

Are index funds good for retirement?

Generally, index funds are an ideal investment vehicle for retirement accounts. Due to its passive investing nature plus lower cost, investors’ risks are spread throughout their entire investment portfolio.

It is also safe to hold retirement accounts as more people are now investing in mutual funds, ETFs, Index Funds, and the like. Therefore, index funds are great even for beginner investors.

If you don't have time to study or research every individual stock, index funds are the easiest way to enter the market.

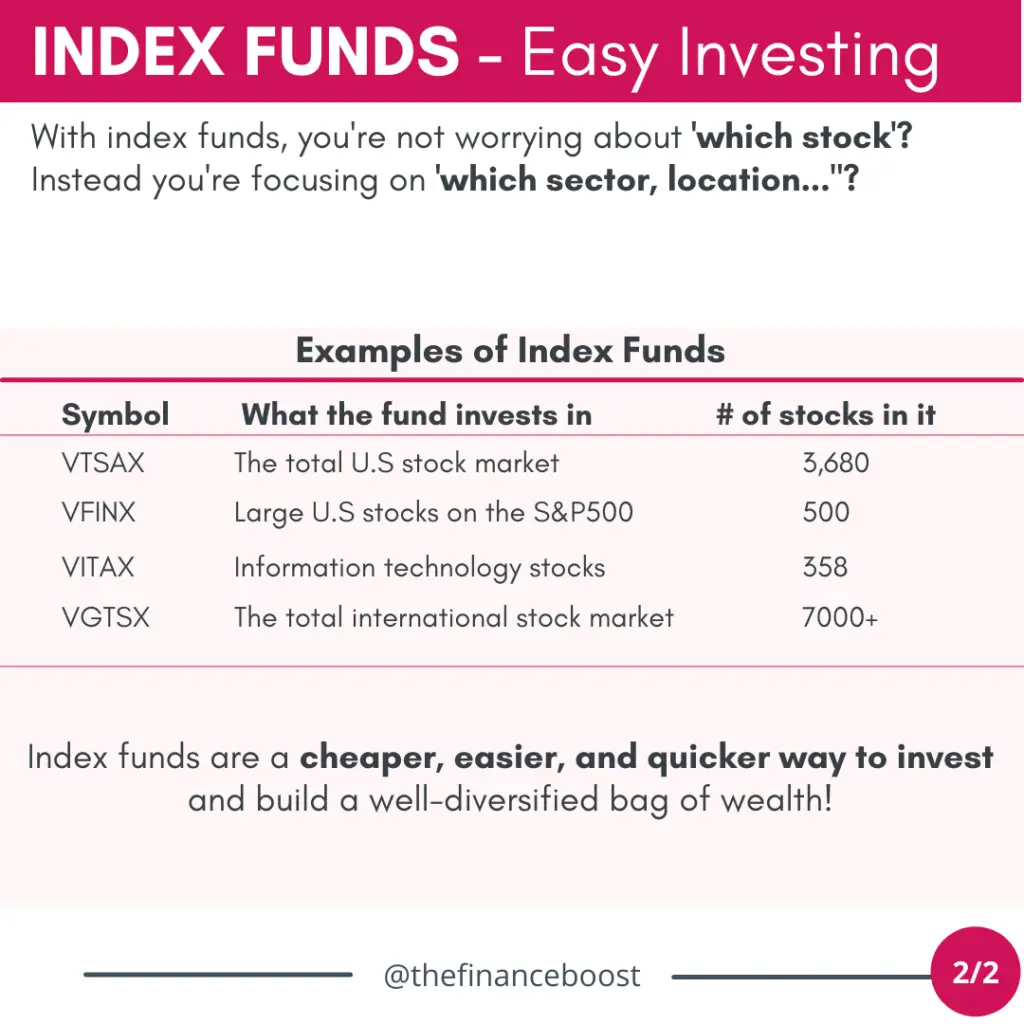

Instead of beating the market, index funds match the performance of the overall market. For example, the most common equity indices like the S&P 500 (Standard and Poor's 500) or simply the S&P 500.

The S&P 500 consists of 500 large companies listed on stock exchanges in the United States. It mirrors and tracks the performance of the listed stocks instead of trying to figure out which individual stocks will outlast or outperform each other.

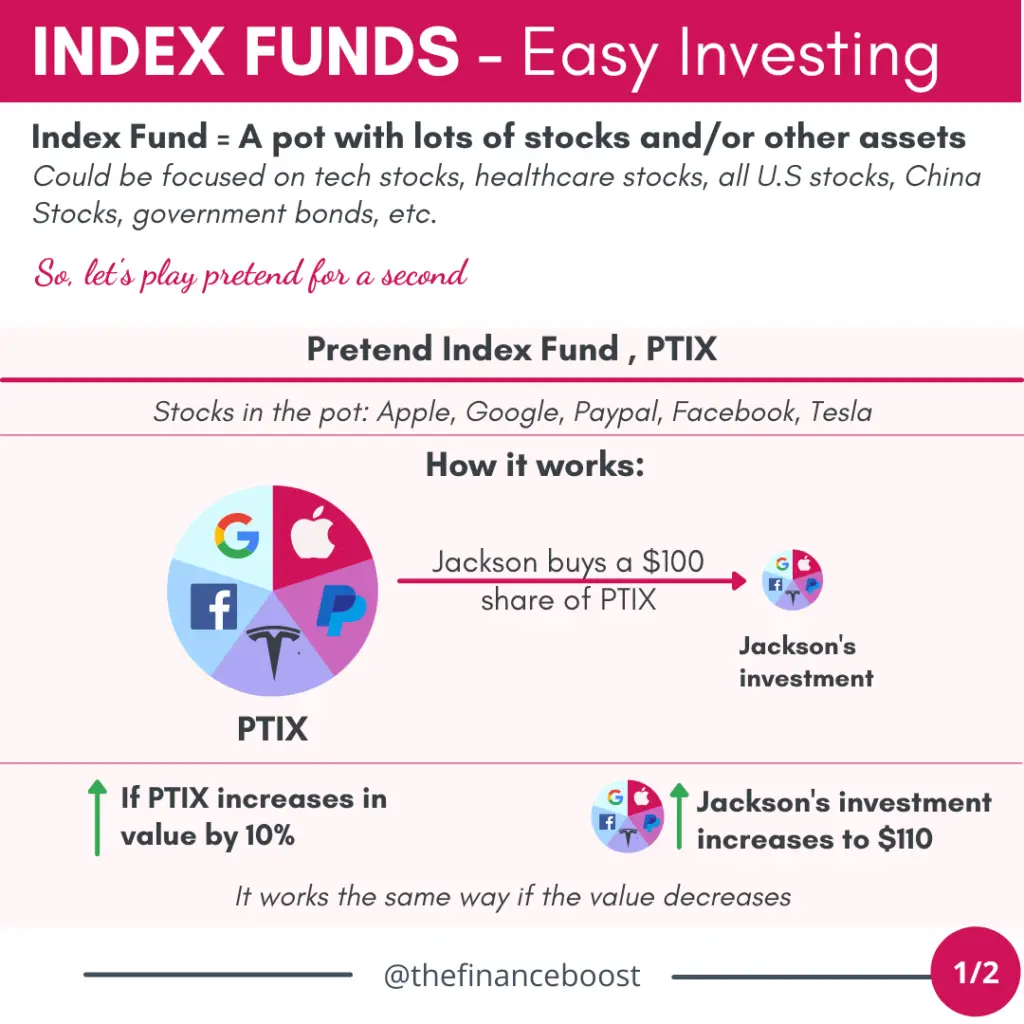

Moreover, index funds are simply a bundle of equities (stocks, bonds, funds) grouped per industry, sector, or location.

Hence, understand the following example.

For instance, the PTIX index fund consists of Apple, Google, Paypal, Facebook, and Tesla stocks. Assuming this particular fund is a pot of information technology stocks.

If you buy a $100 share of PTIX, you get a share in this fund on your investment portfolio.

Then if PTIX increases in value by 10%, your investment increases to $110.

Easy peasy, isn’t it?

Therefore that is why an index fund for retirement gives your portfolio a well-diversified position. Whenever one index goes up, your portfolio goes up too. However, it works the same way if the value decreases.

But don’t worry, that doesn’t mean you can lose everything in an index fund. Most index funds available in the market today (and there are many!) have weathered many storms and are tested by time. Historically speaking, index funds going all the way down are highly unlikely as it only complements the equities it follows.

So even if one from the basket of funds decreases, the other investments will pull it up.

5 Reasons You Should Invest in Index Funds for Retirement

Now whether you're far or close to your retirement age, here are the practical reasons why you should invest in index funds for retirement.

1. It saves you time to do other financial empowering things.

As mentioned, investing in index funds for retirement is a form of passive investing. As opposed to active investing, which fund managers professionally manage.

Although fund managers also manage index funds, they are preset already and are more likely to follow the equities it represents.

Hence index funds don't require tons of financial research. You only pick, choose, and buy. Then, that's it; you're all set.

It’s like a set-it-and-forget-it approach to investing. But don’t forget to keep track every once in a while, though. Moreover, you may want to capitalize on more investment opportunities along the way.

2. Minimize risks

What’s excellent about index funds for retirement is the instant diversification that you will get. Moreover, it’s the easiest way to spread your risk.

Keep in mind that every asset has its own risk. But unlike individual stocks, which will put you in a higher risk position, it's less risky to invest with index funds.

Furthermore, this is because your investment is allocated into different shares of stocks and even if one goes down, the other can pull it back up. Thus, you can have more time to rebalance your investment portfolio.

But then again, know your comfortability when it comes to risk.

3. Ultra-low costs

Another notable reason index funds are perfect for your retirement is that you don’t have to pay as much to own them.

What does it mean? With index funds being a passive approach, there is less work for fund managers to keep track of the market. After all, index funds copy the market index they were based on.

However, consider the expense ratio or the fee that incurs per annum. It is for the overall maintenance of the fund. Usually, when it comes to index funds for retirement, they are very low.

For instance, you may pay none up to $1. But for larger funds, you may pay $3-$10 annually depending on how much amount you invested in.

For example, the Fidelity ZERO Large Cap Index (FNILX) has an expense ratio of 0 percent. That means every $10,000 invested would cost $0 annually.

Other funds such as the Schwab S&P 500 Index Fund (SWPPX) bear an expense ratio of 0.02 percent. Therefore every $10,000 invested would cost $2 annually.

4. Potential growth

Most index funds have better long-term performance. Plus, because you get to have a piece with every pie, there is undoubtedly growth potential.

However, since every asset type has its risk, remember that nothing is perfect too.

Like stocks, other funds may fluctuate. Hence, you have to know what your index fund is investing in.

Some funds invest in high-yield stocks while others seek growth or income. Above all else, you must thoroughly assess what the fund is investing in so you have at least an idea of what you own.

This is made easy as you can check the index's holdings to precisely see what's in the fund, and it is readily available online and with other resources.

5. Reduce your emotional barriers

More significantly, the gist in index funds for retirement is that instead of finding select ‘winning’ stocks, you buy the whole pot with the winners and losers.

Over time, the winners in the pot create tremendous value that overshadows the losses of the losers.

Therefore reducing your emotional attachment through investing is undoubted of importance!

Are index funds better than 401k?

401(k) is one of the most common investment accounts. It is an employer-sponsored retirement account that gives you a tax advantage.

Like index funds, 401(k) also offers benefits in a slightly different way. So whether you're wondering where to park your money better, well, we can say invest in both!

Here are the total pros and cons between index funds for retirement and 401(k).

Index Funds | 401(k) | |

PROS |

|

|

CONS |

|

|

Wrapping Up

Saving early is a surefire way to work toward a comfortable retirement. However, growing it yields a far better result.

It might be more appealing to tell yourself you've got to figure it out later, but in investing, time is the most significant resource you have to propel your wealth.

Waiting until a later date to start can literally cost you money. Today, many middle-aged and older folks say they worry a lot more about running out of money during retirement and wish they started early.

Well, you have the opportunity to start today, no matter how small you start with.

Remember whether you start today or 30 years from now, the time has still passed on.

We hope this post has given you an idea of what your golden years would look like. Or at least it gives you a clear picture of what you would like to do once you reach your retirement age.

Therefore, don’t just save; you must invest too. More significantly, invest in index funds for retirement. The younger you are, you have all the titles to take risks as you can recover your losses through far years ahead.

But even if you're close to retirement age and feel you can't keep track, index funds for retirement are still ideal as it provides a conservative and diversified investment portfolio.

Are you investing in index funds already? What is it for? Are you investing in index funds for retirement?

Or are you still looking for other ways to park your discretionary income? Tell us your story below!

0 Comments