Wealth is the ability to experience life fully.

One thing that sets wealthy people apart from the rest of the world is their ability to grow their money.

Sure, you have savings and a cushion fund. But, wouldn’t you want it to multiply by twice or ten times? There ‘s a time in ones financial journey to take the next step to start building sustainable wealth.

It’s the mindset of letting your money grow and work for you. The easiest way to do this is through investing.

Probably, you have some preconceptions in your head right now, “Oh, I can’t invest, it’s going to take a lot of money,” “I don’t know where and how to start,” and so many reasons!

But, I tell you what, you can do a lot with a little if you have an investor mindset.

If you have $1,000, $500, or even just $10, you can start investing today!

Further reading: How to Start Investing Your Money Like a Pro – The beginner’s guide

Is it worth investing small amounts of money?

No investment is too small. If you understand the power of compound interest, dividend yields, etc., you’ll feel a lot more in tune with taking some risk and investing whatever little money you can. Besides, the most significant risk of all is not taking one.

However, invest the money you know you can afford to lose. The world of investing can be cold and hard, so you must know what you’re dealing with. Fortunately for you, you can invest as little as $25, and if you do this consistently over time, the power of compounding will grow your investment into large sums.

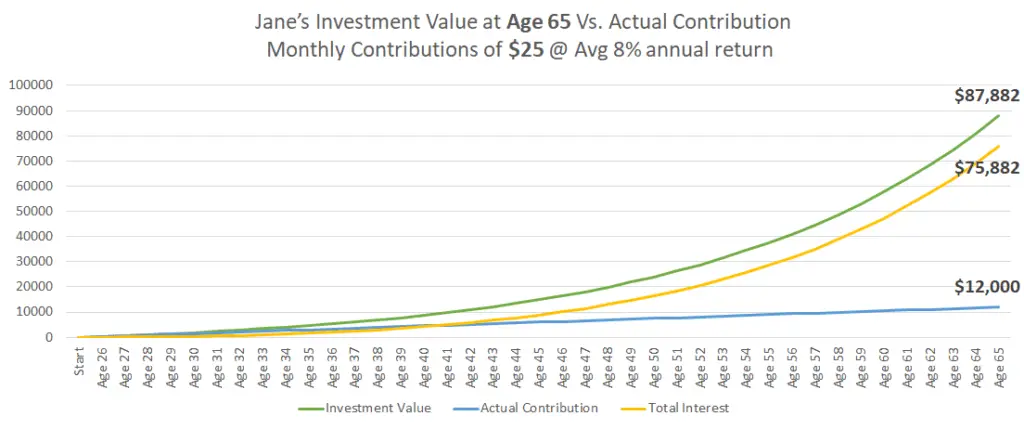

Let’s take a quick look at what that looks like: Assuming Jane starts investing $25 monthly with an average annual return on 8%, by age 65 that account will be at $87,882.

Mind you; if she had only saved that money in a regular savings account, the value would only be at $12,000. As for $75,882 you see in the chart? That right there is the POWER OF COMPOUNDING! All of that money is interests!

Overall, anyone can start with very little money. Over time, you’ll see your money grow and work for you.

Moreover, there’s a difference between saving and investing. When you save money, you let it sit for a while and wait for the right time to use it. While when you invest, you let the money work and make you more money, helping you build your wealth.

| Saving | Investing |

|---|---|

| Lower financial risk | Higher financial risk |

| Money sits safely | Can increase your net worth |

| Loses value with inflation | More likely to beat inflation |

| Great for short-term goals | Great for long-term goals |

How can I start investing with little money?

| 1. Drop any investing misconceptions. |

| 2. Start your pre-investment account. |

| 3. Determine your risk appetite. |

| 4. Research about any minimum deposit requirement. |

| 5. Take note of any fees and commissions. |

| 6. Choose a reliable broker. |

First, drop any investing misconceptions you have in your mind right now. There isn’t any law stating that you need thousands of dollars to invest. So, YES, you can start investing with little money, and it is possible.

Moreover, you also need to save money to invest first. What is recommended is at least 10-15% of your income dedicated to investing. But, it all depends on you on how much you want to call in.

It is called a pre-investment account. You can fund this through payroll deductions or set aside money allocated for investment, no matter what amount.

Next, determine what kind of investor you are and what your risk appetite is. Which type of investor are you?

- High-risk, high-gain investor (AGGRESSIVE)

- Low-risk, low-gain investor (CONSERVATIVE)

- Balanced investor (mix of bonds and stocks)

- Multi-Asset investor

Lastly, be mindful of charges or fees associated with your broker and investing strategy. You should also have a long-term mindset and let your money build up.

How can I invest less than $100?

Here are ways for you to start investing even with a little money.

Robo-advisor

Nowadays, you can easily invest with as little as $5! With the help of many Robo-advisors out there and investment apps like M1 Finance and Wealthfront (I use them both), you can buy stocks with little money. You can get a fractional share of stock with the likes of Amazon, Facebook, or Google.

These Robo-advisors make it possible to invest even with little money using your smartphone. Most of them offer fee-free commission and zero trading fees. However, make sure to check out fees applied in terms of premium subscription and service.

Learn More:

Is M1 Finance Safe? Learn More About The Finance Super App

Robinhood App Review 2021- Is It The Right Investment App For You?

High-yield savings account

Where else can you put your money? For beginners, you can start by opening an account in a high-yield savings account. Afterward, you can choose to invest it further in stocks or ETFs.

High-yield savings accounts are also used to save money for short term use.

Real estate (crowdfunding)

Did you know that you can invest in real estate without much money? With crowdfunded real estate, you can now invest as little as $500.

So how does it work? Typically, you team up with other real estate investors, pool your money, and buy some real estate. You then become part-owner of the property.

You get your part from any profit made from selling the property or earning an income from rental fees.

Apps like Fundrise make it easy to invest in real estate through crowdfunding.

Mutual Funds and Exchange Traded Funds (ETFs)

When you choose to invest in a mutual fund or an ETF with a low minimum amount, you get to maximize your pool of investments.

Mutual funds are professionally managed. Some funds are available with low or even with no minimums. These are money market mutual funds, which pay a low-interest rate in exchange for safety and carry a shallow risk of loss.

ETFs tend to mimic an index like the S&P 500 . What that means is an if you invest in an ETF that tracks the S&P 500 (which contains the top performing 500 companies in the US) then you’re automatically investing in about 500 companies by buying just one share of an ETF. It’s easy, affordable and gives you a diversified portfolio instantly.

Treasury Securities

Treasury Securities, also known as Savings Bond, can be a stable venue to place your money and earn interest. You can buy these through the U.S. Treasury’s online savings bond portal called Treasury Direct.

The good news? Bonds can cost as little as $100! But, keep in mind that these treasury securities or bonds won’t generate a significant investment return. It’s good for safekeeping your money at low cost and low risk.

Employer Retirement Plan 401 (K)

Contributing to your 401 (k) is one of the best personal finance choices you can make. It’s essentially FREE money from your employer!

Even if money is tight, you should contribute up to the amount that your employer matches to your 401 (k). What that means is if your employer will match up to 6% of your paycheck, and that 6% is $100 per month, your employer will also contribute $100 to your 401(k).

You can choose the amount you want to contribute, so if you can only do $5 per paycheck, that’s a good start.

However, strive to contribute as much as you can to get as much free money from your employer as you can.

You should know that your employer matches your contribution up to a certain percentage, and many 401(k)s are invested in mutual funds so your money can grow with the market as you earn.

ROTH IRA

On the other hand, if your employer doesn’t offer a sponsored retirement plan, you can do it independently.

A Roth IRA is a type of retirement account that allows you to contribute after-tax dollars that get invested. Note that you cannot touch this money until you’re 65 years old without paying a penalty.

You can start depositing money to your IRA account (Individual Retirement Account) at a bank or through a stockbroker, and even through a Robo-advisor like Wealthfront. which is the one I use.

The maximum contribution this 2021 is $6,000. You don’t get a tax break now, but you can claim it after your retire when you withdraw the money.

Skills

Ever heard the famous quote, “An investment in knowledge pays the best interest.”? Well, it still rings true today.

This year, maybe one of your goals is to start investing in your skills and knowledge. There are numerous resources out there and online courses for free.

With your newly acquired skills, you increase your value as a professional.

Opportunities for promotion at work may arise, or you can even discover yourself and your exceptional capabilities as well.

Learn More:

9 High-Income Skills That Will Boost Your Financial Life

Business

Do you have that creative idea you’ve been holding off for a while? It’s now time to invest in your idea and put it into reality.

Many businesses don’t cost much to start up; you can build your online store or business for free or with little to no money at all.

Create your website or blog and learn to monetize it. You can also do a home-based job.

Learn more:

21 Best And Most Successful Businesses To Start With Little Money

DRIPS (Dividend Reinvestment Plans)

Commonly known as DRIPS, will allow you to invest small amounts of money into stocks of companies that pay dividends.

Many large companies or corporations offer DRIPS, so if you want to invest directly in them and trust the companies’ reputation and value their business, you can invest in those companies without paying any upfront investment fees.

DRIPS can also be an excellent way to dollar cost average your investment portfolio. When you earn dividends, the money will automatically be reinvested for you to buy more company stock.

Time Deposit

Another safe way to invest with little money, to begin with, is a time deposit, also known as Certificate of Deposits or CDs.

It works similar to a savings account, but you can earn higher interest rates with CDs by leaving the money alone for a certain period or “term.”

It’s typically three or five years. Usually, the longer the term, the higher the interest rates gained.

Be sure to invest only the money you can afford to lose and won’t use for the next five years or more. If you need the money before the CD’s term matures, you have to pay a fee and lose your earnings from the interest.

The downside of a CD is that it offers lower returns than other investment types, but on the bright side, the risk is much lower if you’re the conservative type.

Stocks Options

Many people get lost about what a stock option is. To put it simply, think of it this way. You are buying the right to purchase or sell something at a set price (strike) by a specific date. That’s it.

Robinhood offers options trading, and although it may look complicated, it can be a valuable investment if played right.

You can buy “calls” or “puts.” If you buy a call, you are betting that the stock is going up. And, if you buy a put, you are betting that the stock is going down.

Small investors should thoroughly research and widen their financial knowledge first before investing in or trading options.

Gold and other precious metals

Golds and other precious metals are suitable investments since they have a defined value and are tangible and physical products. (I remember how my mother used to get so addicted to pieces of jewelry and lock them for a long time because she hoped the value would increase and there will be someone interested in purchasing the appraised piece of gold/metal value.)

Although you don’t get a monetary dividend value from these metals, investing in them is valuable depending on the demand.

Related reads: 18 Unique Ways To Create Passive Income and Boost Your Cash Flow

What is the best investment for beginners?

For beginners, the best investments are

- retirement plans, either employer-sponsored or an IRA,

- total market Exchange-traded funds (ETFs)

- a target-date mutual fund,

- fractional shares through Robo-advisors and mobile investment apps.

The historical average stock market return is 10%. As you can see, there are many small investment ideas to park your money tino; some are high risk while others are low risk.

Many also offer zero fees. Of all the investment ideas, I think stocks are still the best and most lucrative due to the dividends they provide and the ability to grow your net worth.

Final Thoughts

Your road to financial security is summed up in the three steps below.

- Learn to save.

- Invest your savings well.

- Be Consistent.

To be successful on your investing journey, keep the following in mind:

- Invest for the long term – Set up long term investments for your long term goals.

- Invest in Quality at a Reasonable Price – Leverage your research resources and personal finance knowledge.

- Diversify investments – Spread your investment across companies, industries, and asset classes. Remember, “Do not put all your eggs in one basket.”

- Invest regularly using a plan and rebalance – Use investment apps or tools to automate your investment goals with lesser costs.

I hope this article helps you learn how to invest even with little money. Don’t worry; nobody started as a pro. Everyone takes the first step, the beginner level.

Here at TheFinanceBoost, we are always rooting for you, especially for your investment and all other financial journeys. Share one with us below! We love to hear from you!

0 Comments