Since getting my first job out of college and earning a stable paycheck, I’ve continuously sought to make more money with my money. Investing was always the most common answer, but it seemed very complex at the start.

I understand first-hand how intimidating the concept of investing can be and created this guide for beginners with this in mind.

Investing simply involves using resources, typically money, for an undertaking with the expectation to make a profit. Here are some reasons why people invest:

- To be financially stable and never have to worry about money.

- Long-term wealth building for the future

- To retire early and spend your time doing things you really love

- Complete debt freedom

- To take advantage of compound interest over time.

So, how do you start investing your money like a pro to get the most return and value from it? Next slide, please…

Step 1: Decide What Type of Investor You Want to Be

Before you even think of how to invest your money, you need to decide what type of investor you are. It’s actually very easy.

Ask yourself; Do I want to make all my investment decisions on my own? That means you’ll research every asset you want to invest in before buying them.

Alternatively, maybe you’d rather have someone (or something) else do all the hard work for you while you enjoy the returns.

Investment Assets are physical or non-physical items an investor trades, based on perceived future value, to generate extra income. Examples of investment classes are stocks, bonds, real estate, and retirement savings accounts.

There are 3 approaches to investing that you can take

1. Do It Yourself (DIY) Investing

With this approach, you will find which assets to invest in, do thorough research, and monitor your investments closely by yourself.

While it is a time-consuming approach as you will have to do all the research yourself and keep track of your holdings regularly, it gives you full control of your investment portfolio.

Tools you’ll need to get started as a DIY investor:

A Brokerage

If you want to invest in individual stocks, look at Robinhood, which allows you to trade equities for free. It’s also a good brokerage to start with.

If you’d like to add index funds to your portfolio, E*Trade and TD Ameritrade allow you to trade ETFs and options as well at relatively low fees.

An Index fund is a portfolio of stocks or bonds that tracks and aims to perform like a particular market index. The S&P 500 is an example of a market index. Schwab S&P 500 Index Fund (SWPPX) is an index fund that tracks the S&P 500 index.

Stockpile is a great brokerage that allows you to buy fractional shares of a company’s stock.

For example, Amazon stock is currently at $3,125 per share. So, if you love Amazon and want to get shares in the company, typically, you’ll need to have at least $3,125 to invest in Amazon.

However, with a brokerage like Stockpile, you can invest with as little as $50, and you’ll get 1.6% of an Amazon stock.

Portfolio Analysis and Management Tools

To properly manage your assets, you need to analyze your portfolio for risk exposure and identify opportunities continuously.

You’ll be able to monitor your asset allocation, test different investing models, and calculate risk.

Personal Capital has a user-friendly asset management platform that helps you track all your assets with charts, plots, and calculators. It also provides recommendations and insights based on your portfolio and profile.

Also, check out portfolio visualizer, another free portfolio analysis tool.

Financial Portals for Market Research

Surely, you need financial data and information to conduct proper research for your assets. Financial portals provide you with all the information you need to choose, buy, or sell assets.

Some really good financial portals are MorningStar, FinViz, and Yahoo Finance.

Education

If you’re a beginner investor, you’re probably already feeling overwhelmed by how much you need to know. However, the great thing is that you don’t have to know everything at once.

Investing is a lifetime experience, and you learn more as you go. Investopedia Academy offers a great wealth of knowledge for both beginner and seasoned investors. Also, check out this free 3-day investing course by The College Investor.

2. Passive Investing

Whew! Finally, we can talk about an investment approach where you don’t have to do so much work. If qualitative research, using stock screeners, or reading quarterly earnings reports isn’t your jam, then this is for you.

Anyone who wants to start investing money and has no interest in making all investment decisions usually opts for a more passive investing approach.

That’s why it’s also called the set-it-and-forget-it approach. You can use a Robo-advisor or a human investment manager.

Cue in Robo-Advisors. A Robo-advisor is a digital platform that can build and manage a portfolio and offers financial advice using algorithms with little human supervision.

A robo-advisor can invest in various investment products like stocks, bonds, commodities, real estate, and more through exchange-traded funds (ETFs).

An exchange-traded fund (ETF) is a basket of securities (such as bonds and stocks) traded on an exchange.

If you don’t want to get into the details of investing, then a robo advisor is the right choice for you. A robo-advisor would typically ask you a series of questions to create an investment profile for you.

With the information you provide, the robo-advisor can assess your risk tolerance and automatically create a well-diversified portfolio accordingly.

Robo-advisors are a great low-cost investment solution to start investing your money. Fees are usually within 0.25% to 0.5% of the assets managed by the platform.

One of the best Robo-advisors is Wealthfront. It caters to beginner investors and a good platform to start investing your money. However, with Wealthfront, you can’t choose which assets to include in your portfolio.

M1 Finance, on the other hand, is a great Robo-advisor that allows you to choose customized portfolios to suit your risk tolerance. It also allows you to add individual stocks, choose responsible investing ETFs or choose any other pre-built portfolios to include in yours.

Learn More:

Is M1 Finance Safe? Learn More About The Finance Super App

A Robo advisor may limit your investment opportunities, which is why you can choose to find a trusted investment advisor. A human advisor will conduct research, make investment decisions for you. You can find a financial advisor that matches your interest in the Paladin Registry.

3. Hybrid Investing

The third style of investing is a hybrid of DIY and passive investing. You open a brokerage account and then hire the services of an expert.

You can get a personal financial advisor that would offer recommendations that you can then use to make your own investment decisions.

However, you can also have your passive investing accounts for which you don’t have to do much.

Step 2: Define Your Investment Budget

Not everyone likes to have a budget, but in reality, creating a budget can help set aside money that you would eventually invest with.

A budget can help you save up money for your needs, discretionary spending, and emergencies. After all these expenses are taken care of, it’s wise to use the rest of your money to invest.

There are several budgeting techniques and tools that can help you sort out your budget. You can go for the good old-fashioned pen and paper, use a spreadsheet, or use an app for your budget.

In fact, with money apps like Qapital, you can budget, save, and invest simultaneously. Acorns can also help you invest without thinking about it by rounding up your transactions and investing the change.

It’s a great idea to have a saving goal towards kickstarting your investment journey.

If you’re bothered about not having enough money to invest, check out this post on how you can invest with little money:

Investing For Beginners With Little Money- 13 Easy Ways To Invest

Step 3: Choose an Asset Mix that Suits Your Risk Tolerance/Profile

Whether you choose to invest through a robo-advisor or a brokerage firm, how you invest will depend on your risk tolerance.

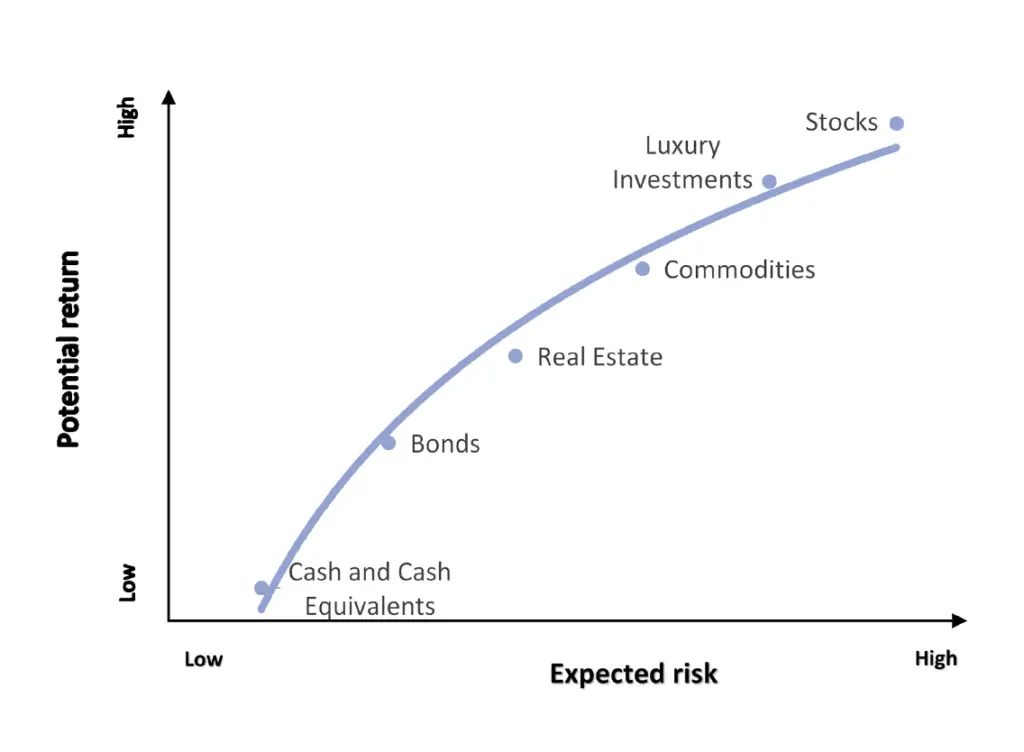

To put it plainly, it’s how comfortable you are with risking losing your money for the possibility of getting a higher return on your investment. As the saying goes – the higher the risk, the higher the return.

While a higher return might tempt you to invest in riskier assets, you will be better off building an investment portfolio based on a variety of asset classes to diversify your risk.

An asset class is a group of similar investments that behave similarly in the marketplace. The 4 main asset classes; Equities (stocks), Debt and Fixed income (bonds), Money market/Cash equivalent, and Real Estate/Tangible assets

A well-diversified portfolio can better handle the ups and downs of the financial market. You can achieve this by having investments in all the different asset classes instead of just one.

A mutual fund, having a wide array of individual stocks across different industries (like financial institutions, healthcare, retail, transportation, and oil & gas) and having few real estate properties on rent outs, is an example of a diversified portfolio.

Asset Classes by Risk

The older you get, the lesser risk you should take on. That’s because the more time you have till retirement, the more time your investments have to recover if there’s a market downturn.

A 30-year old investor can consider investing 70% in stocks and 30% in bonds, while a 60-year old investor may be better off having only around 45% in stocks and the rest in bonds and cash.

Take a look at the different asset classes based on their respective risk level:

1. Cash

Cash and cash equivalents (like money market accounts) are in this class. Retaining value even after accounting for inflation makes cash the safest investment.

However, there’s very little return. Cash under your pillow might even lose some value because of the time value of money.

If you want your cash reserves to grow, check out high-interest saving accounts like with Chime and Axos bank.

2. Bonds

Sometimes when a government or a company needs to borrow money, they issue bonds and pay interest in return. Bonds are also known as debt or fixed income.

For example, debt securities such as Treasury bonds or T-bonds have maturities spanning up to 20 years and are issued by the U.S. Federal government. However, the returns on bonds are also small.

To put things in perspective, the US 10-Year Government Bond Interest Rate is 0.68% for Sep 2020. That means that in 1 year, you’ll earn $6.8 in interest on your investment.

3. Real Estate

Real estate is the top investment pick for 35% of Americans and is a very lucrative investment. Generally, many know that property almost always appreciates over time.

However, there are some risks due to the housing market’s unpredictability, high maintenance costs, and negative cash flow. Thankfully, with proper research and due diligence before investing, you can limit many of these risks.

You can own a whole property or invest in a Real Estate Investment Trust (REIT) to own a property portion. Real Estate is a good investment, but you should keep in mind that it requires commitment for a long time.

4. Commodities, Precious Metals, and Other Alternative Investments

Commodities (such as oil, pork bellies) and precious metals (such as gold, silver), just like real estate, are like owning physical items.

A futures contract is a legally binding agreement that obliges the parties involved to buy and sell an asset, such as gold, at a preset price and future date.

Although you don’t really have to actually own them physically, you can easily trade them. Investing in ETF or futures contracts are some of the ways you can trade in commodities.

The more wealthy investors also look into alternative investments like gold and cryptocurrencies and luxury goods like art.

5. Stocks

A stock, also known as equity, is a type of security that represents a fraction of ownership in a company. The owner of stock becomes entitled to a share in the company’s assets and earnings. Units of stock are called “shares.”

The level of risk each stock carries is based on the company. Normally young companies are considered riskier than well-established companies. Although well-established companies also carry the risk of bankruptcy owing to sudden lawsuits or unexpected changes.

Step 4: Choose an Investment Goal and Set a Timeframe

Hopefully, now you have a clear picture of the different types of asset classes you can invest in. Moving forward, it is time for you to set a timeframe and choose an investing goal.

What are you saving and investing for? How much will you need? If you’re saving for a retirement plan, you’ll need a different amount than if you’re saving for your dream wedding.

Short-term investing

Your investing strategy will be short-term if you need money a few years down the line. Short-term investments are for goals like a dream wedding, down-payment for a house, a car purchase, and such.

High-yield savings accounts and peer-to-peer lending are some good investment strategies for short-term lending.

Pros

- High Liquidity – It is straightforward to access your money, which is good considering you would need it soon.

- Lower Risk – Usually, short-term investing is considered low risk because sudden dips in interest rates or the financial market rarely impact it.

Cons

- Low Returns – Since money is invested for a short period of time, you will likely get a small return on your investment.

- Higher Tax – You may have to pay more taxes compared to the investment in a longer-term account.

Long-term Investing

If you invest for your retirement or to build wealth, this is the most suitable investment method for such goals. It’s also known as the buy-and-hold investment.

Some long-term investment strategies include stocks, real estate, mutual funds, and investing in a term deposit.

Pros

- Less Risky – When you invest for a long period of time, you have time to recover from abrupt dips in the financial market.

- Less Stressful – Long-term investments typically don’t require you to follow the market very closely daily; hence it is less stressful.

Cons

- Requires Patience – If you are looking for quick results, then long-term investing is not for you as it usually takes a long time to see good returns. Without patience, you may also get out of the market at the wrong time due to fear. Long-term investments demand that you be patient.

- Less Control – You will have less control over your money since it is invested for a longer period of time. It may also be more illiquid, and you cannot easily access it, especially in the case of IRAs.

Step 5: Understand and Limit Fees to Maximize Returns

As a beginner investor, it is important to know about the different fees you will have to pay, also called investment expenses.

They can take a big chunk out of your earnings, so you have to pay attention to these fees when choosing which investment platform or service to go with.

There are many ways to avoid them or at least reduce them to a certain extent.

Although every investment type carries its own set of fees, here are some of the most common fees you’ll see:

1. Account Maintenance Fees

This fee is usually less than $100, and to avoid it, you will have to meet the account’s minimum balance requirement. Once you meet that requirement, your fees will be waived.

2. Commissions

It is a flat-fee that you’re charged per trade or a flat-fee plus a percentage per trade. It typically depends on your broker and the funds you invest in.

3. Mutual Fund Loads

It is the commission paid by an investor to compensate the financial planner or fund manager who does research and makes the investment decisions.

This fee can be charged up-front when the shares are bought or charged when the shares are sold. It can sometimes be waived based on some qualifying circumstances. You can check with the broker.

4. Management or Advisor Fees

This is the fee you will pay to the advisor that will manage your investment account. It can be up to thousands of dollars per year, but all of it can be avoided if you decide to manage your account yourself.

There are several investment services in the market that have free management. For example, Wealthfront, a robo-advisor, is free for accounts of up to $5,000 in investments. This makes it one of the great platforms to get started with.

An increase in competition among stockbrokers is making them slash their fees to zero. If you’re looking for a fee-free stockbroker, you’re in luck.

M1 Finance is a great investing platform that never charges commissions or markups on any trades and doesn’t charge any fees for using the platform or to deposit or withdraw from your connected bank

Robinhood is one of the pioneers of no-fee brokerage services, but even old favorites like Firstrade are now fee-free.

Public.com is another broker to check out, especially if you want to add a social element to your investing.

Step 6: Keep Track of Your Investments

Another key ingredient to have for a successful investment strategy is your tracking system. In recent years, lots of new platforms have sprung up to tackle this.

While some platforms offer both investing and tracking services, others offer tools and educational options.

Personal Capital is a personal favorite because they have a robust investment portfolio management platform. The performance of your investment is visualized in the form of charts and graphs. To track your portfolio’s performance history, it compares the stock market index with your investment performance.

And guess what? It’s free!

Final Thoughts

You may be thinking that the current atmosphere due to the pandemic may not be the best time to start investing. However, think long-term and take a futuristic approach to investing.

There’s no perfect time to start investing your money; all you have to do is start and take advantage of compound interest in the long run.

Recommended Reading:

18 Unique Ways To Create Passive Income and Boost your Cash Flow

Investing For Beginners With Little Money- 13 Easy Ways To Invest

Investing in any kind of asset class is possible, but practicality is high, I cant escape from the challenge of investing in any kind of asset class The only requirement is that I have a high level of confidence in my judgement and worth, I can withstand the odds and still make money, no matter what I do, I have no ambition to become a successful entrepreneur, just want to make money and be happy with it A lot of people think that they can get themselves rich doing what they want to do, but theyll have to work very hard to get that dream job doing something they really enjoy doing right now, for free

Hello Mosun, Thanks for sharing this article, its Is very educative, I can only imagine how much time you put into this. Investment is something I hear all the time, I have listened to wealthy men, even read books, they are always about Investing yet it really is not as easy as it sounds. After reading this article I have a better understanding of ways to get started.

Awesome. I’m glad to hear that