How to open a Roth IRA account?

Opening a savings account is one step towards the world of adulting. However, starting your investment account is taking your finances to the next level.

If investing scares you, well, you shouldn’t be. But, unfortunately, fear is the main reason holding many of us back from investing. But weren’t you scared when you first started college, but you figured it out and did it anyway.

How about your first job? Weren’t you scared when you started, but you managed to find your way along the way?

Investing isn’t any different. Fear is not a valid excuse not to do something. It’s just an indication of something unfamiliar.

Therefore, lower the fear barrier to investing by starting your retirement investing account- the Roth IRA. To open a Roth IRA is as easy as opening a checking account.

This post will tell you how to open a Roth IRA account easy peasy, why you should have one, and discuss other investment accounts you can take part in.

So without further ado, let’s get started!

Related: How to Start Investing Your Money Like a Pro- the beginner’s guide.

What is a Roth IRA?

Roth IRA is a type of retirement account, basically standard accounts but has different rules on taxes, contribution, and withdrawal.

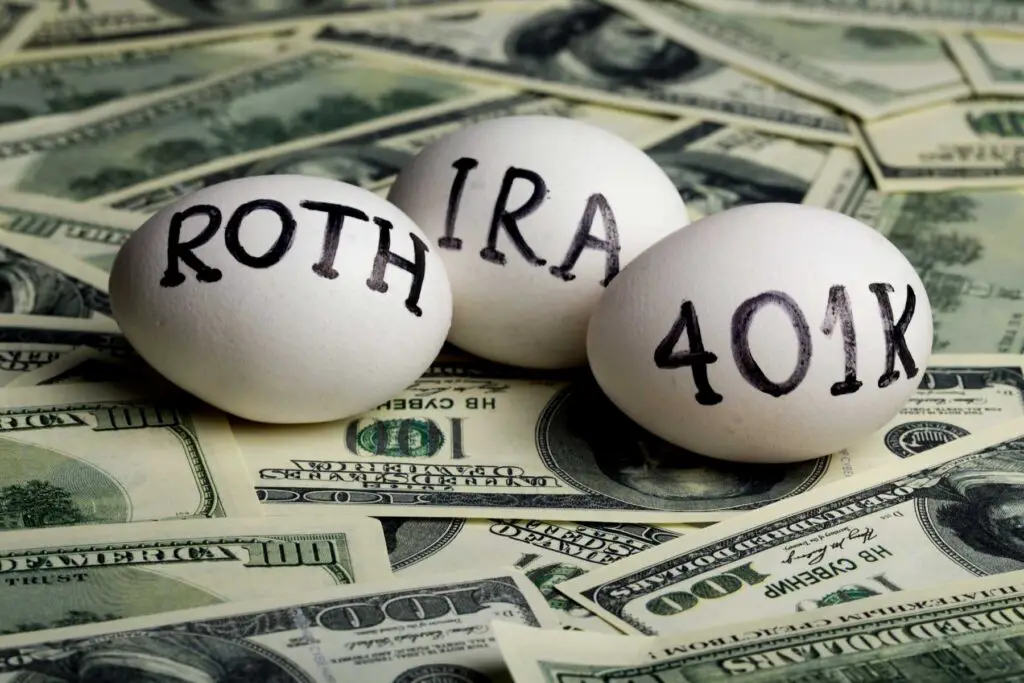

IRA stands for an individual retirement account, and aside from Roth IRA, you probably also heard about 401(k), 403(b), and Traditional IRA. We will share some key points about each of these later on.

So a Roth IRA is a retirement account funded with after-tax money. It means that you won’t pay any taxes on the money you take out in retirement once you hit age 59 1/2. This is because you invest in a Roth IRA with after-tax money, meaning you’ve already paid taxes on it. Moreover, you can withdraw money anytime without penalty.

However, all IRA contributions have a combined contribution limit of $6,000. So if you’re 50 or older and want to keep up, you can add an extra $1,000 for a total of $7,000. Furthermore, for the year 2021, you can open accounts with a single filer if the modified adjusted income is less than $125,000 and $198,000 for married couples.

Why open a Roth IRA account?

Roth IRA is an excellent retirement investment account that you can access in the future, especially if you don’t have any retirement account for now or your employer doesn’t offer 401(k).

When saving for retirement from your 20s, the thought of not being able to access your money for 30+years is a little bit discouraging.

But with Roth IRA, at least you know all your contributions are accessible even though you may not ever have to touch it. So, you see, it’s just a psychological thing, but it works.

Related reads: Investing For Beginners With Little Money- 13 Easy Ways To Invest

How to open a Roth IRA account?

As mentioned earlier, opening a Roth IRA account is as simple as opening a checking account.

Let’s walk you through the process of opening your first investment account. (If Roth IRA is your first one or if you are interested in adding it to your investment portfolio)

First, you must ask yourself and be familiar with what type of investment account you want to open? Of course, there are many to choose from, such as 401(k), Roth IRA, Traditional IRA, Standard Investment Account, to name a few.

In this instance, let’s discuss how to open a Roth IRA account.

To open a Roth IRA account, here are the basic steps.

- Pick a $0 trade fee broker like Vanguard, Charles Schwab, Fidelity, Ameritrade, etc.

- Select “Roth IRA” from the account options.

- Fill out personal info, including your name, social security number, and more.

That’s it!

What investments should be in your Roth IRA?

Now that you’ve set up your Roth IRA, what’s next?

You are free to input all different kinds of investments on your Roth IRA. However, remember that your Roth IRA is not an investment itself; it only holds your investment for you. Hence it is your retirement investment account.

A quick trivia: Let’s thank the late Delaware Sen. William Roth (where Roth IRA was named after), the purveyor of Roth IRA that became a savings option in 1998, followed by the 401(k) in 2006.

For starters, we recommend the following:

- Mutual Funds

- Blue-chip companies

- Stocks, ETFs, Index Funds

- Stocks that pay dividend income or equity income funds

- Growth funds

- International funds

How to open a Roth IRA Account- Key points

1. DIY investing

If you want more customization and can dedicate time to research and gaining investing knowledge, you might want to consider the DIY method of investing.

In DIY or Do-It-Yourself, you are the one responsible for every action you do with your investment portfolio. From opening a brokerage account or through your bank, you are the one who will monitor your investment growth, buy, sell, and hold.

Hence, you must have enough knowledge, skills, and practice when you want to invest independently. Know your appetite for risks and do your thorough research. Moreover, don’t let your emotions get the best of you.

2. Robo-Advisors

On the other hand, if you want the set-it-and-forget-it type of investing, there are Robo-advisors apps that cater to that need.

Essentially, your account has an automatic rebalancing, and you don’t have to think about it. Initially, you need to make some presets or select your investment type, then let the Robo-advisor app do the hard work for you.

In most cases, some Robo-advisors offer free investment guides and tutorials and even with a touch of humans through financial advisors or consultants available.

3. Automatic Contribution Transfer

Another thing to consider is the ease of transferring your fund. When choosing a broker, see if it caters to automatic contributions transfer from your checking account and if there’s a fee. That way, you don’t have to remember to set aside a specific amount of money to invest each month.

Furthermore, make it simple by dedicating 15-20% of your income to investing, and your contributions will automatically increase as your income does. You won’t break the bank doing that.

Then, be consistent with your investments forever; make it a lifestyle.

If 30 years seems like a long time to you, know that time will still pass whether you invest or not. So, start early and do it often!

| ANNUAL TAKE-HOME PAY | MONTHLY CONTRIBUTIONS | INVESTMENT BALANCE AT YEAR 30 |

| $30,000 | $375 | $855,122 |

| $40,000 | $500 | $1,140,163 |

| $50,000 | $625 | $1,425,203 |

| $60,000 | $750 | $1,710,244 |

| $70,000 | $875 | $1,995,285 |

| $80,000 | $1,000 | $2,280,325 |

| $90,000 | $1,125 | $2,565,366 |

| $100,000 | $1,250 | $2,850,407 |

Roth IRA vs. Traditional IRA vs. 401(k) and 403(b)

Retirement Accounts | ||

401(k), 403(b) | Traditional IRA* | Roth IRA* |

Employer-sponsored | Upfront Tax Break | Tax Break after withdrawal |

Tax-deductable | Early withdrawal penalty before age 59 1/2 | Contributions can be taken out anytime without penalty |

Early withdrawal penalty before age 59 1/2 | Contribution limit of $6,000/yr | Contribution limit of $6,000/yr |

Contribution limit of $19,500/yr | *Note: All IRA contribution has combined contribution limit of $6,000 | Can open accounts a single filer if modified adjusted income is <$125,000 |

About 56% of employers offer 401(k) plans to their employees. So if you haven’t set one up already, you may want to ask your employer about it.

A 401(k) retirement account allows you and your employer to contribute money towards your retirement. It’s primarily replaced pension plans (where your employer was the one responsible for how much you receive after retirement)

But note that not all employers match your contributions to a 401(k), and the match varies per employer. Still, it’s a great way to start saving for retirement early. It’s even better when the money is deducted from your paycheck before you see it.

For the Traditional IRA, it’s not complicated. Contributions are pre-tax, but you pay tax when you withdraw. There’s also an early withdrawal penalty before age 59 1/2, plus you can open a Traditional IRA with $0.

Wrapping Up

Creating a tax-free stream of income is a powerful retirement tool. Therefore, do one thing today.

Open your investment account!

It doesn’t matter if you don’t have a lot of $$$ to contribute; the goal is to start putting some money away, even if it’s $50 per month, and slowly build upward.

Why? Starting to invest ten years later will make you lose out on the two best things for any investment: Time and Compound Interest.

Therefore, whether you plan to retire 10, 20,30, or 40 years from now, there’s no other best or perfect time than NOW.

0 Comments